Trump Tax Plan Unveiled: Key Details From House Republicans

Table of Contents

Individual Income Tax Changes

The Trump Tax Plan proposes significant changes to the individual income tax system, aiming for simplification and lower rates.

Proposed Changes to Tax Brackets

The plan aimed to simplify the tax code by reducing the number of tax brackets and lowering overall rates. While the exact numbers fluctuated during the legislative process, the general goal was a significant reduction.

- Proposed Bracket Changes: Initial proposals suggested a reduction from seven to three tax brackets. This simplification aimed to make tax filing easier and more accessible for individuals. However, the final version of the legislation may have differed slightly.

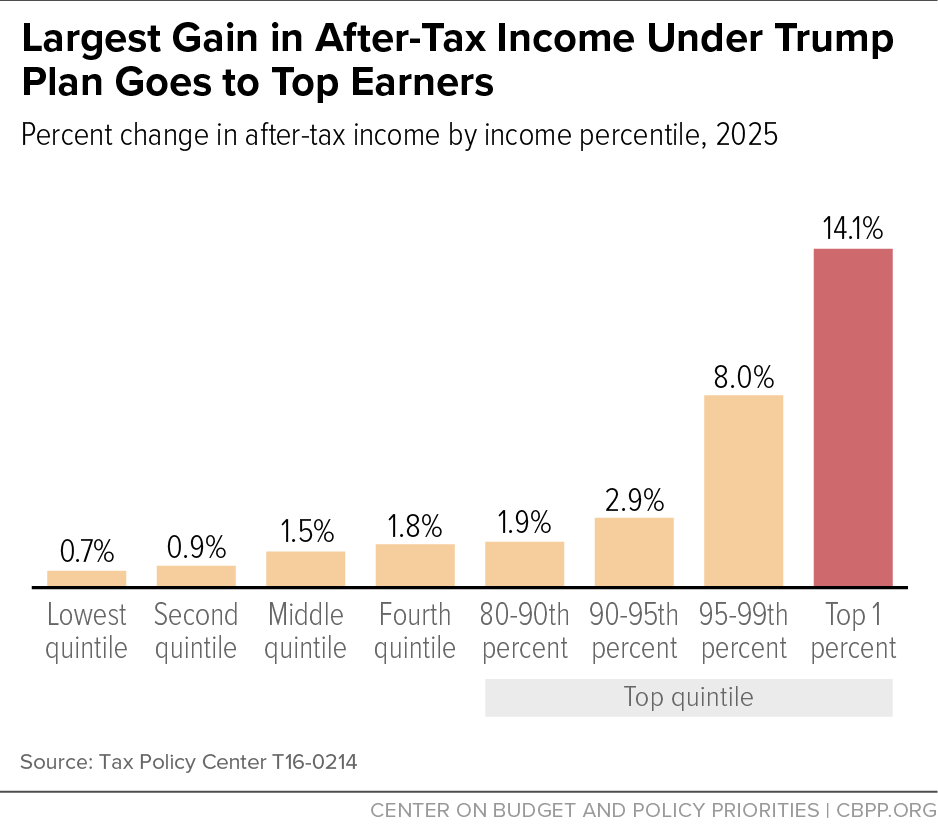

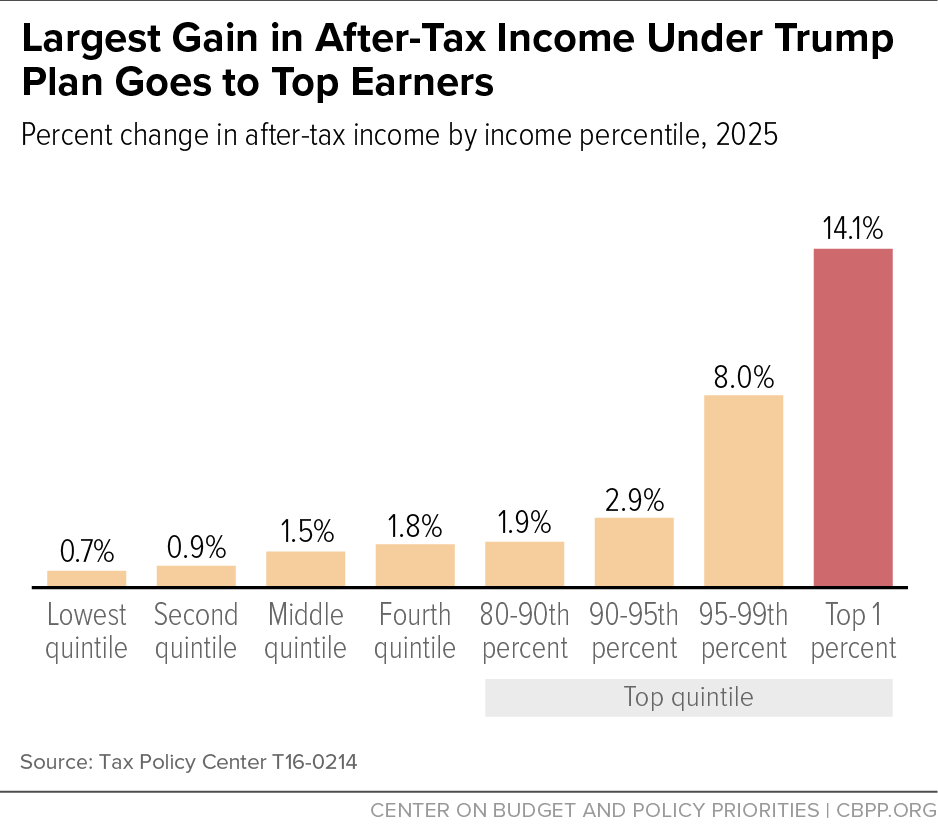

- Impact on Income Levels: Lowering the number of brackets and rates would generally result in tax savings for most taxpayers, with higher-income earners potentially benefiting more proportionally. However, the impact varied significantly based on individual circumstances and deductions.

- Middle-Class vs. High-Income Earners: While the plan aimed for broad-based tax cuts, the extent of tax savings varied. Some analyses suggested that higher-income earners would receive a larger percentage reduction in their tax liability compared to middle-class families.

Changes to Standard Deduction and Itemized Deductions

The Trump Tax Plan proposed significant adjustments to deductions, potentially altering the overall tax liability for many taxpayers.

- Increased Standard Deduction: A substantial increase in the standard deduction was a key feature. This change aimed to benefit a larger number of taxpayers by simplifying their tax filings and reducing the number of people who itemize.

- Itemized Deduction Modifications: The plan included provisions that impacted itemized deductions. Key changes included the limitation or elimination of deductions for state and local taxes (SALT), which significantly affected taxpayers in high-tax states.

- Itemizers vs. Standard Deduction Claimants: The changes to the standard deduction and itemized deductions had a significant impact on which method would be more beneficial for individual taxpayers. Many taxpayers who previously itemized found it more advantageous to use the standard deduction after the changes.

Corporate Tax Rate Reduction

A core element of the Trump Tax Plan was a substantial reduction in the corporate tax rate.

Impact on Business Investment and Growth

The proposed cut in the corporate tax rate aimed to stimulate business investment, job creation, and overall economic growth.

- Increased Global Competitiveness: Proponents argued that a lower corporate tax rate would make US businesses more competitive in the global marketplace, attracting investment and encouraging expansion.

- Potential Downsides: Critics raised concerns about potential downsides, including increased income inequality and a possible surge in the national debt due to reduced tax revenue.

- International Comparisons: The proposed rate was compared to corporate tax rates in other developed nations, highlighting its potential to attract foreign investment and create a more favorable business environment in the United States.

Repatriation of Overseas Profits

The plan included provisions to encourage the repatriation of corporate profits held overseas.

- Tax Rate for Repatriated Funds: A lower tax rate was proposed for companies to bring their overseas profits back to the US. This aimed to incentivize investment and economic activity within the country.

- Impact on the US Economy: Increased repatriation of funds could boost economic activity through investment in new projects, job creation, and increased domestic spending.

- Incentives for Repatriation: The lower tax rate served as a key incentive for companies to bring their foreign earnings back to the US, injecting capital into the domestic economy.

Potential Economic Impacts of the Trump Tax Plan

The Trump Tax Plan's economic consequences, both short-term and long-term, are complex and subject to ongoing debate.

Short-Term vs. Long-Term Effects

Predicting the precise economic impact required considering both short-term and long-term effects.

- National Debt Impact: Concerns were raised regarding the potential increase in the national debt due to lower tax revenue from reduced tax rates.

- Inflation and Interest Rates: The tax cuts could potentially stimulate inflation and lead to higher interest rates.

- Economic Growth or Stagnation: Proponents argued that the plan would spur economic growth, while critics expressed concerns about potential economic stagnation or even recession.

Impact on Income Inequality

The Trump Tax Plan's potential impact on income inequality was a major point of contention.

- Distribution of Tax Benefits: Analysis focused on how the tax benefits would be distributed across different income levels, with concerns raised about potential exacerbation of existing inequalities.

- Comparison to Other Tax Reform Proposals: The plan's impact on income inequality was compared to other tax reform proposals, highlighting the varying effects on different segments of the population.

- Social and Political Consequences: The potential social and political consequences of increased income inequality stemming from the plan were considered a significant aspect of the debate.

Conclusion

The Trump Tax Plan, as proposed by House Republicans, represented a significant overhaul of the US tax system. While it aimed to simplify the code and boost economic growth through lower tax rates for individuals and corporations, its potential long-term effects on the national debt, income inequality, and overall economic stability remained a subject of ongoing debate. Understanding the key details of the Trump Tax Plan is vital for all citizens. Further research and careful consideration are essential before forming a definitive opinion. Stay informed about the latest developments and potential revisions to the Trump Tax Plan to make informed financial decisions. Understanding the implications of the Trump tax plan and its various components is crucial for navigating the evolving tax landscape.

Featured Posts

-

Alex Ovechkins Historic Goal Ties Wayne Gretzkys Nhl Record

May 15, 2025

Alex Ovechkins Historic Goal Ties Wayne Gretzkys Nhl Record

May 15, 2025 -

Earthquakes Cant Solve Zach Steffens Problems Loss To Rapids Highlights Goalkeeping Woes

May 15, 2025

Earthquakes Cant Solve Zach Steffens Problems Loss To Rapids Highlights Goalkeeping Woes

May 15, 2025 -

Chinas Xi Taps Top Advisors For Crucial Us Deal

May 15, 2025

Chinas Xi Taps Top Advisors For Crucial Us Deal

May 15, 2025 -

Andor Season 2 Release Date What To Remember Before Watching

May 15, 2025

Andor Season 2 Release Date What To Remember Before Watching

May 15, 2025 -

The Unrealized Kevin Durant Trade How A Deal With The Celtics Could Have Changed Everything

May 15, 2025

The Unrealized Kevin Durant Trade How A Deal With The Celtics Could Have Changed Everything

May 15, 2025