Trump's 100-Day Plan & Bitcoin: A Price Prediction Analysis

Table of Contents

Trump's 100-Day Plan: Key Economic Policies and Their Potential Effects on Bitcoin

Trump's 100-day plan encompassed significant changes across various economic sectors. Understanding these changes is crucial for predicting their impact on Bitcoin.

Fiscal Policy Changes: A Double-Edged Sword for Bitcoin

Trump's plan included substantial tax cuts and increased infrastructure spending, a form of fiscal stimulus. These policies had the potential to create both opportunities and challenges for Bitcoin.

- Increased Inflation: Increased government spending could lead to inflation, potentially devaluing the US dollar and driving investors towards alternative assets like Bitcoin as a hedge against inflation.

- Market Volatility: The sheer scale of the fiscal changes could introduce significant market volatility, impacting Bitcoin's price both positively and negatively depending on investor sentiment.

- Impact on Investor Confidence: If the policies boosted economic growth and investor confidence, it could indirectly benefit Bitcoin by increasing overall market optimism. However, the opposite is also true.

- Flight to Safe Haven Assets: During periods of economic uncertainty, investors often flock to safe haven assets like gold. Whether Bitcoin would be considered a safe haven asset during this period is debatable and would depend on various factors. Keywords: fiscal stimulus, inflation rate, Bitcoin investment, regulatory uncertainty.

Trade Policies and Their Impact: Navigating the Trade Wars

Trump's protectionist trade policies, including tariffs and trade wars, created a significant amount of global economic uncertainty.

- Market Uncertainty: Trade wars increase uncertainty for businesses and investors worldwide, leading to potentially volatile market reactions that could impact Bitcoin's price.

- Potential for Capital Flight: Uncertainty surrounding trade relations can cause capital flight, potentially pushing investors towards Bitcoin as a less regulated and more globally accessible asset.

- Impact on Global Economic Growth: Slowed global economic growth, a potential consequence of trade wars, could negatively impact Bitcoin's price.

- Effects on Bitcoin as a Global Asset: Bitcoin's position as a global asset means it's susceptible to global economic shifts caused by protectionist trade policies. Keywords: trade wars, protectionism, global economic outlook, Bitcoin volatility.

Regulatory Uncertainty and Bitcoin: A Balancing Act

The regulatory landscape surrounding cryptocurrency remained a key area of uncertainty during Trump's presidency.

- Increased Scrutiny on Crypto Exchanges: Increased regulatory scrutiny could lead to tighter controls on crypto exchanges, potentially impacting Bitcoin's liquidity and trading volume.

- Potential for Stricter Regulations: The potential for stricter regulations on cryptocurrencies could dampen investor enthusiasm and negatively impact Bitcoin's price.

- Impact on Investor Sentiment: Uncertainty about future regulations could create negative investor sentiment, leading to price drops.

- Effect on Bitcoin Adoption: Conversely, clear and favorable regulatory frameworks could boost Bitcoin adoption and increase its price. Keywords: cryptocurrency regulation, SEC regulations, Bitcoin legality, regulatory compliance.

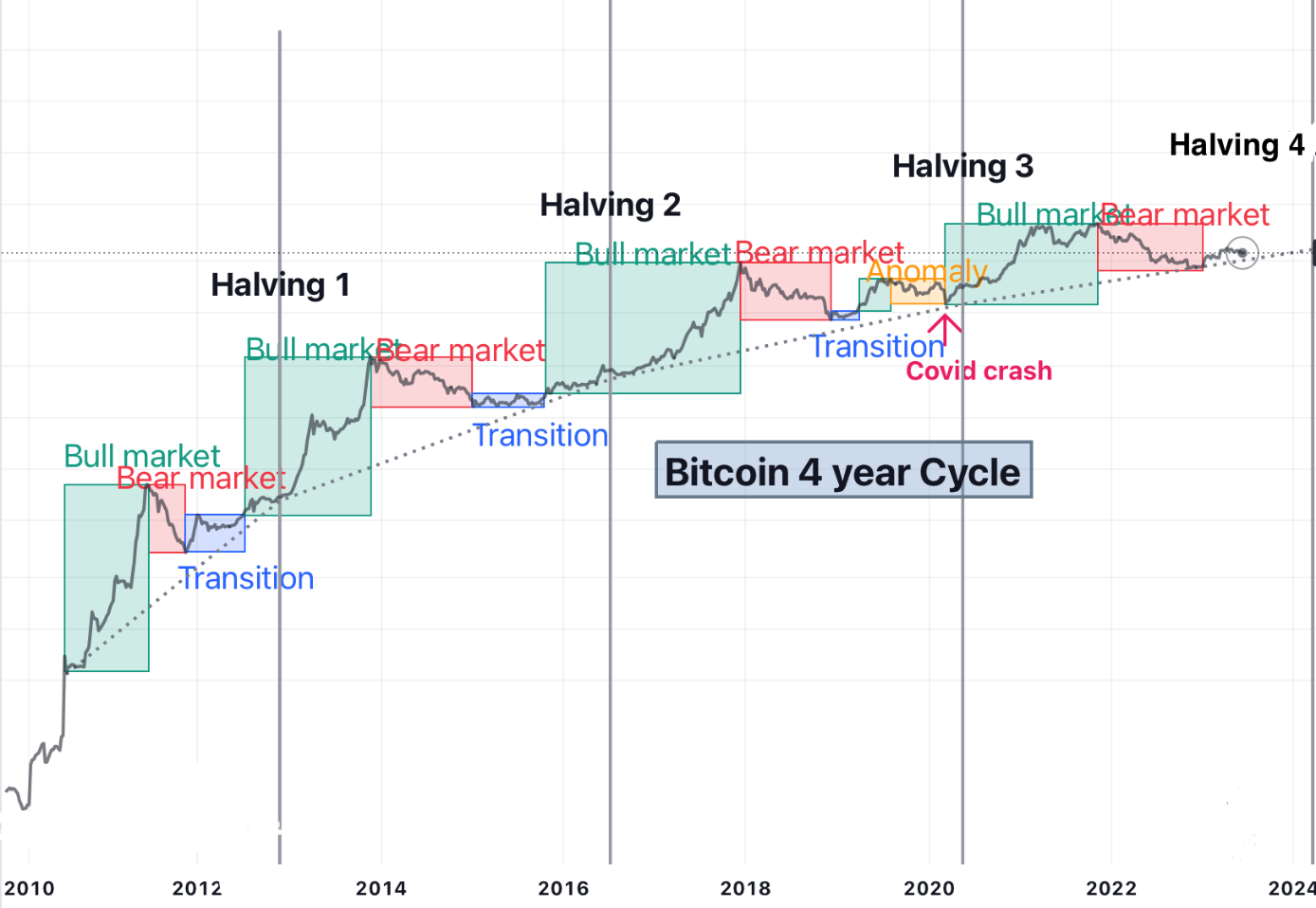

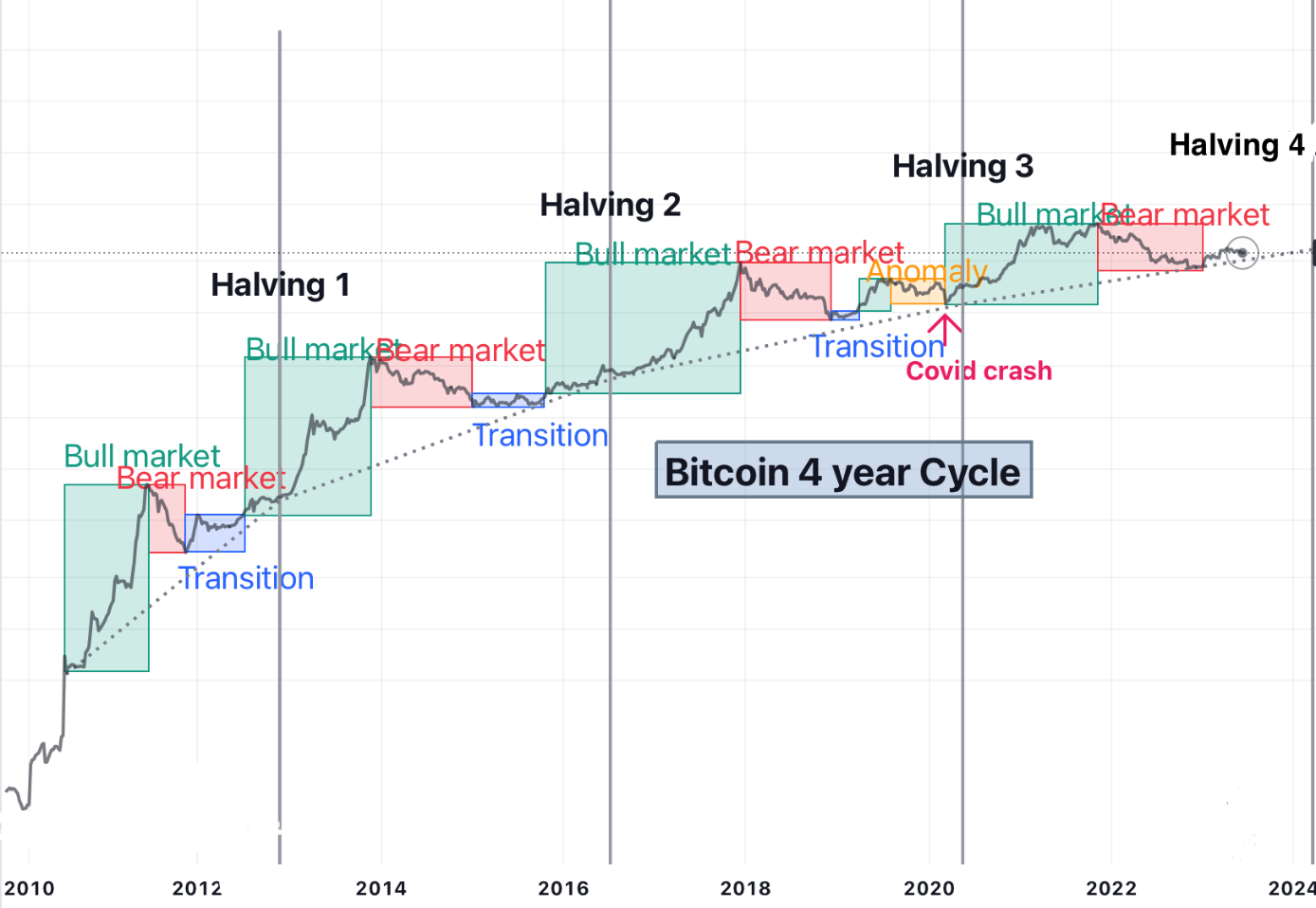

Historical Bitcoin Price Behavior During Periods of Economic Uncertainty

Examining Bitcoin's historical price movements during periods of economic uncertainty can provide valuable insights. For example, Bitcoin's price often saw increased volatility during periods of global financial instability, sometimes rising and sometimes falling sharply. Analyzing data from periods such as the 2008 financial crisis or the European debt crisis can show correlations between market uncertainty and Bitcoin's price movements. Charts illustrating these correlations would provide strong visual evidence. Keywords: Bitcoin historical data, economic shocks, market volatility analysis, Bitcoin price charts.

Predicting Bitcoin's Price Based on Trump's 100-Day Plan: Scenarios and Analysis

Predicting Bitcoin's price with certainty is impossible. However, we can explore different scenarios based on the potential outcomes of Trump's 100-day plan:

- Scenario 1 (Successful Plan): If the plan successfully stimulated economic growth and reduced regulatory uncertainty, Bitcoin's price could experience a bullish trend, potentially driven by increased investor confidence and adoption.

- Scenario 2 (Partially Successful Plan): A mixed outcome could result in a more neutral price movement, with periods of both gains and losses.

- Scenario 3 (Unsuccessful Plan): If the plan led to increased economic instability or negative investor sentiment, Bitcoin's price could experience a bearish trend, potentially driven by a flight to safer assets. Keywords: Bitcoin price prediction 2024, Trump's economic impact, cryptocurrency market forecast, Bitcoin price analysis. Specific price predictions should be avoided due to their inherent uncertainty and to maintain credibility.

Conclusion: Understanding the Interplay Between Trump's Policies and Bitcoin's Future

The analysis shows a complex interplay between Trump's 100-day plan and Bitcoin's price. The plan's impact on inflation, investor confidence, and regulatory uncertainty significantly influenced Bitcoin's market behavior. The historical analysis reinforces the sensitivity of Bitcoin to macroeconomic shifts. While predicting the exact price is impossible, understanding the potential scenarios helps navigate the complexities of this relationship. Continued monitoring of economic indicators and their impact on the cryptocurrency market is crucial. To gain a deeper understanding of the intricate relationship between Trump's 100-day plan and Bitcoin, further research is encouraged, allowing you to stay informed about future market movements and effectively navigate the cryptocurrency landscape.

Featured Posts

-

A Good Boy Indeed Kryptos Appearance In New Superman Footage

May 08, 2025

A Good Boy Indeed Kryptos Appearance In New Superman Footage

May 08, 2025 -

Lahwr Myn Py Ays Ayl Trafy Ka Shandar Astqbal

May 08, 2025

Lahwr Myn Py Ays Ayl Trafy Ka Shandar Astqbal

May 08, 2025 -

The Art Of Breaking Bread With Scholars Navigating Academic Networking

May 08, 2025

The Art Of Breaking Bread With Scholars Navigating Academic Networking

May 08, 2025 -

Sharpest Hkd Usd Fall Since 2008 Impact Of Recent Intervention

May 08, 2025

Sharpest Hkd Usd Fall Since 2008 Impact Of Recent Intervention

May 08, 2025 -

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025

Latest Posts

-

Universal Credit Claiming Past Payments You May Be Entitled To

May 08, 2025

Universal Credit Claiming Past Payments You May Be Entitled To

May 08, 2025 -

Jayson Tatum On Steph Curry An Honest All Star Game Reflection

May 08, 2025

Jayson Tatum On Steph Curry An Honest All Star Game Reflection

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025 -

Could You Be Owed Money From Universal Credit

May 08, 2025

Could You Be Owed Money From Universal Credit

May 08, 2025 -

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025