Trump's Claim: Does The US Really Need Canada's Goods? Expert Analysis

Table of Contents

The Scope of US-Canada Trade: A Deep Dive

The economic relationship between the US and Canada is far more intricate than a simple buyer-seller dynamic; it's a deeply intertwined partnership built on decades of integrated supply chains and shared economic interests. Understanding the scope of US-Canada trade is crucial to evaluating the validity of claims suggesting its dispensability.

Bilateral Trade Volume and Importance

The sheer volume of bilateral trade between the US and Canada is staggering. In 2022, bilateral trade exceeded $700 billion, making Canada the US's largest trading partner. This massive exchange encompasses numerous sectors, with significant flows in energy, automotive manufacturing, agriculture, and lumber.

- Energy: The US relies heavily on Canadian energy resources, particularly oil and natural gas, especially in border states. Disruptions here would severely impact energy prices and availability.

- Automotive: The North American auto industry is profoundly integrated, with cross-border supply chains crucial for vehicle production. Severing this link would cripple the industry on both sides of the border.

- Agriculture: Canada is a significant supplier of agricultural products to the US market, including grains, livestock, and dairy. Reducing this trade would lead to shortages and price hikes.

- Lumber: Canadian lumber is a key component of the US construction industry. Reduced access would increase costs for homebuilders and consumers.

The economic impact of even minor disruptions to this trade flow is substantial, affecting jobs, consumer prices, and overall economic growth in both nations. A complete severing of ties would have catastrophic repercussions.

Key Sectors and Interdependencies

The interdependence between the US and Canadian economies is most evident in specific sectors:

- Energy: Many US states, especially those bordering Canada, are heavily reliant on Canadian oil and gas imports. A sudden cut in supply would lead to immediate energy price spikes and potential shortages.

- Automotive: The integrated nature of the North American auto industry is undeniable. Parts and components frequently cross the border multiple times during the manufacturing process. Disrupting this flow would cause significant production delays and losses for both US and Canadian automakers.

- Agriculture: The US benefits significantly from access to Canadian agricultural products. Restricting these imports would lead to higher food prices and reduced availability for American consumers. Canadian farmers would also suffer from reduced market access.

- Lumber: The US construction industry utilizes vast quantities of Canadian lumber. Any reduction in this supply would directly translate to higher construction costs and potential delays in building projects.

Economic Consequences of Reduced Trade

Reducing or disrupting US-Canada trade would have severe and far-reaching negative consequences for the US economy.

Price Increases for Consumers

Reduced access to Canadian goods would inevitably lead to higher prices for American consumers.

- Energy: Decreased Canadian oil and gas imports would immediately impact gasoline and heating costs.

- Food: Reduced imports of Canadian agricultural products would lead to higher grocery bills.

- Building materials: Less Canadian lumber would make homes and other construction projects more expensive.

These price increases would contribute to higher inflation, eroding consumer purchasing power and impacting overall economic well-being.

Negative Impacts on US Businesses

Many US businesses rely directly or indirectly on Canadian goods and services. Reduced trade would significantly impact their operations.

- Automotive manufacturers: US automakers would face production disruptions due to supply chain issues.

- Construction companies: Higher lumber costs would impact profitability and project timelines.

- Retailers: Higher prices for imported goods would reduce consumer demand.

These impacts could translate into job losses, reduced economic output, and overall stagnation.

Geopolitical Implications

Disrupting US-Canada trade would have significant geopolitical ramifications, potentially damaging the US's relationship with a key ally and undermining international trade norms established under agreements like the USMCA (formerly NAFTA). This could also affect US trade relations with other countries, as it would create uncertainty and distrust.

Expert Opinions and Counterarguments

While some may argue about the specific degree of dependence, experts overwhelmingly agree that US-Canada trade is mutually beneficial and deeply ingrained in both economies. Economists consistently highlight the significant negative consequences of severing or significantly reducing this trade relationship. Many counterarguments to the claim that the US doesn't need Canadian goods lack robust economic data and fail to consider the complex interdependencies involved.

Conclusion

Our analysis clearly demonstrates the crucial role Canadian goods play in the US economy. Severing or significantly reducing this vital trade relationship would lead to substantial negative consequences, including higher consumer prices, reduced economic growth, and significant job losses. The economic interdependence between the US and Canada is undeniable. Reducing trade would harm both nations. Understanding the intricacies of US-Canada trade is crucial for informed decision-making; continue learning about the vital relationship between these two North American economies. Further research into government reports and academic papers on US-Canada trade is recommended to gain a deeper understanding of this complex and crucial relationship.

Featured Posts

-

Spoedberaad Geeist Bruins Wil Direct Over Leeflang Spreken Met Npo

May 15, 2025

Spoedberaad Geeist Bruins Wil Direct Over Leeflang Spreken Met Npo

May 15, 2025 -

Foot Locker Sale Nike Air Dunks Jordans And More Up To 40 Off

May 15, 2025

Foot Locker Sale Nike Air Dunks Jordans And More Up To 40 Off

May 15, 2025 -

Elon Musk Fathered Amber Heards Twins Examining The Evidence

May 15, 2025

Elon Musk Fathered Amber Heards Twins Examining The Evidence

May 15, 2025 -

Pley Off N Kh L Vashington S Ovechkinym Sygraet Protiv Monrealya Demidova

May 15, 2025

Pley Off N Kh L Vashington S Ovechkinym Sygraet Protiv Monrealya Demidova

May 15, 2025 -

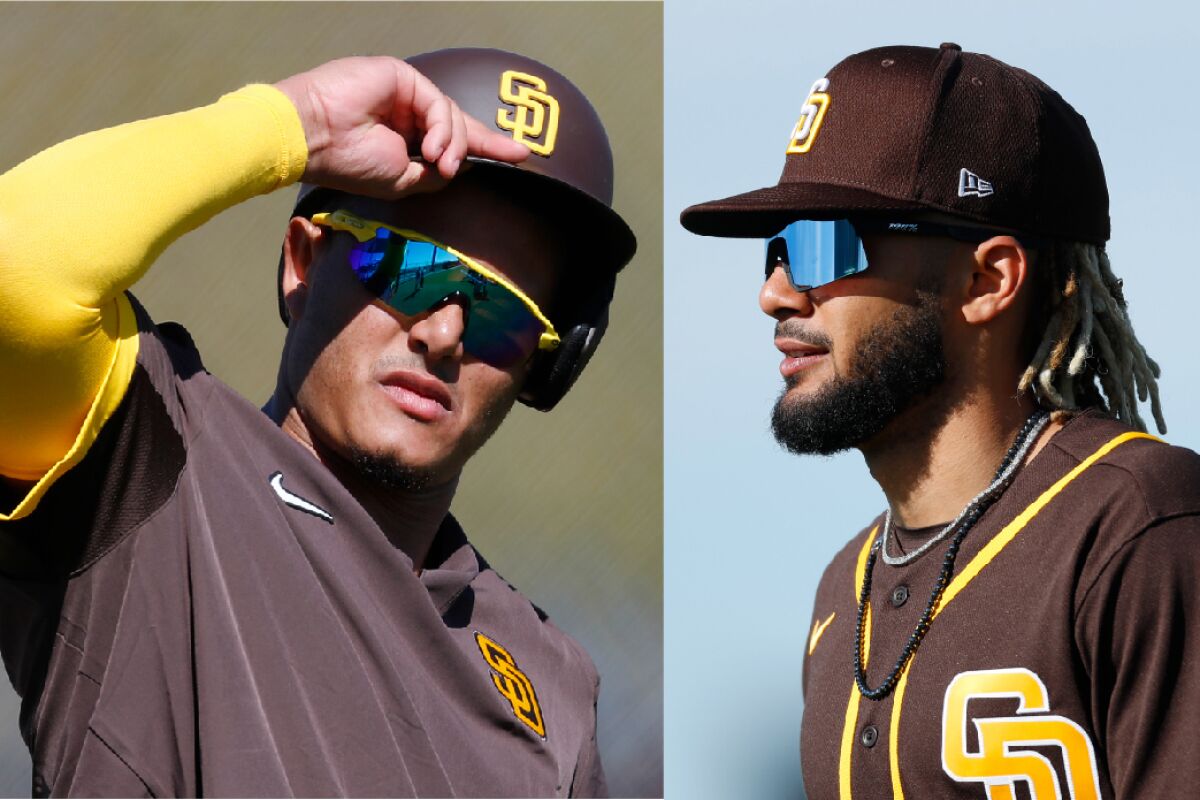

San Diego Padres Pregame Report Rain Tatis And Campusano

May 15, 2025

San Diego Padres Pregame Report Rain Tatis And Campusano

May 15, 2025