Trump's Plan To Track Undocumented Immigrants Via IRS Data Approved By Judge

Table of Contents

The Trump Administration's Proposal

The Trump administration's proposal aimed to leverage IRS data to identify and potentially deport undocumented immigrants. The core idea was to cross-reference tax information with immigration records to pinpoint individuals who may have evaded detection.

- Rationale: The administration argued this was a necessary measure to strengthen national security and enforce immigration laws, claiming it would help identify and remove those who were unlawfully residing in the country.

- Data Used: The proposed plan involved accessing various IRS data points, potentially including individual taxpayer identification numbers (ITINs), addresses, and income information. The exact scope of data access remains a point of contention.

- Identification Process: The intended process involved comparing the IRS data with existing immigration databases to flag individuals for further investigation and potential deportation proceedings. This process raised immediate concerns about the accuracy and fairness of targeting individuals.

The Judge's Ruling and its Implications

A Texas judge recently ruled in favor of the plan, allowing the government to access IRS data for immigration enforcement purposes. The judge's reasoning largely centered on the government's assertion of its authority to enforce immigration laws and the availability of appropriate safeguards.

- Legal Arguments: Proponents argued the government has a legitimate interest in identifying and removing undocumented immigrants. Opponents countered with concerns about due process, potential for abuse, and the violation of taxpayer privacy rights. The legal battle highlights the conflict between national security interests and individual liberties.

- Impact on Undocumented Immigrants: This decision has created widespread fear among undocumented immigrants, potentially leading to a reluctance to engage with government services, including essential healthcare and tax filing. This chilling effect could have far-reaching social and economic consequences.

- Potential for Misuse: Critics fear the potential for misuse or discriminatory application of the data, leading to the targeting of specific communities or individuals based on factors unrelated to their immigration status. Robust oversight mechanisms are crucial to mitigate this risk.

Privacy Concerns and Data Security

The use of IRS data to track undocumented immigrants raises significant privacy concerns. Civil rights groups and privacy advocates argue that this action violates the fundamental right to privacy guaranteed by the Constitution.

- Data Breaches: The risk of data breaches and unauthorized access to sensitive personal information is substantial. A breach could expose millions of taxpayers' data to malicious actors, leading to identity theft and other serious consequences.

- Erosion of Trust: This plan could severely erode public trust in government agencies, particularly the IRS, which is responsible for handling highly sensitive financial information. The damage to public confidence could have long-term implications.

- Violation of Existing Laws: Opponents argue that the plan may violate existing laws and regulations protecting taxpayer privacy and data security, including the Internal Revenue Code and various privacy acts. The legal challenges will likely focus on these alleged violations.

Ongoing Legal Challenges and Public Response

The judge's ruling is not the final word; ongoing legal challenges and appeals are expected. The plan faces significant opposition from various quarters.

- Lawsuits and Appeals: Numerous lawsuits and appeals are anticipated, focusing on the legality and constitutionality of accessing IRS data for immigration enforcement. These legal challenges will shape the future of this controversial policy.

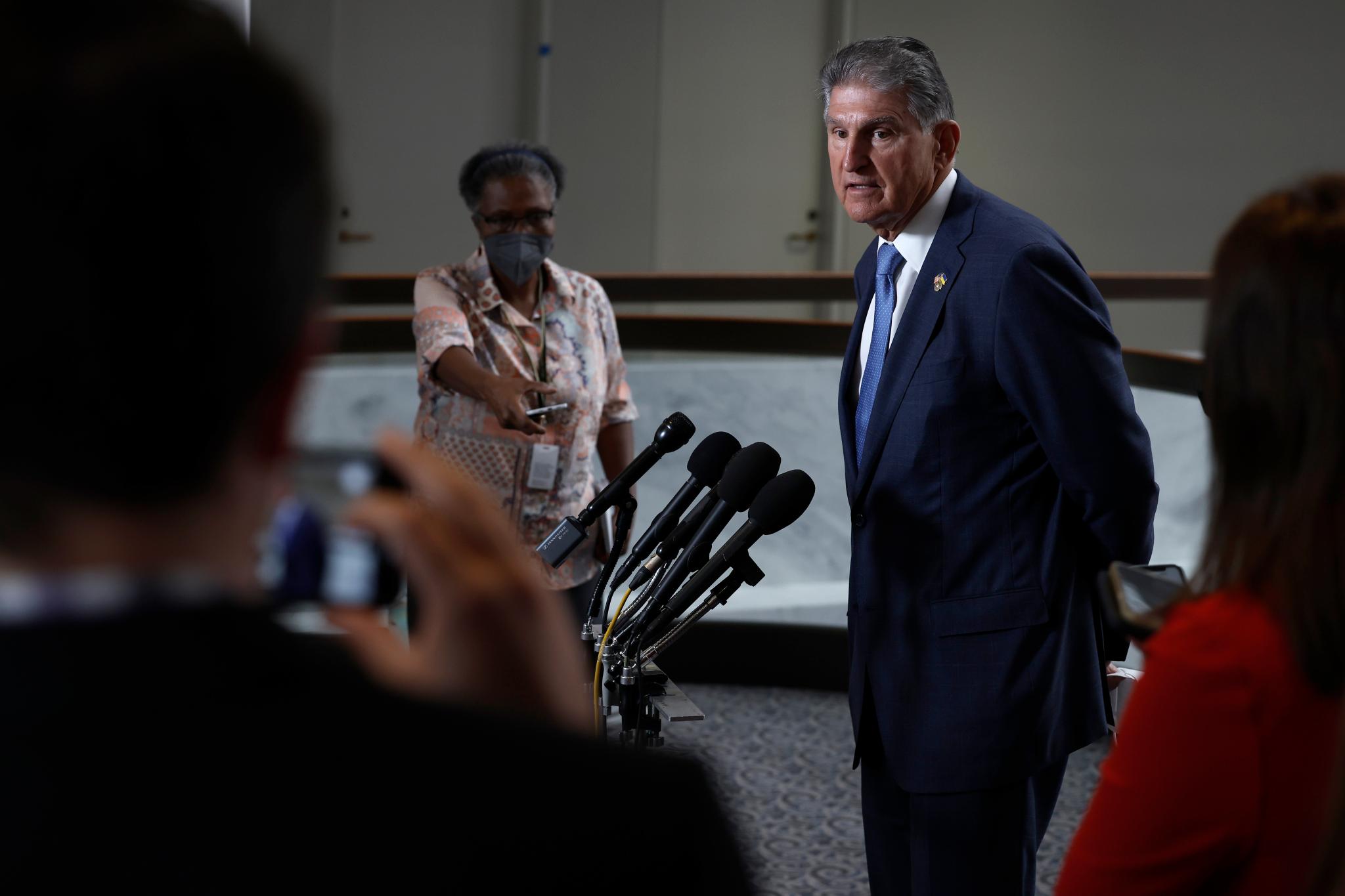

- Public Reaction: Public reaction has been largely negative, with widespread protests and condemnation from various civil rights organizations and advocacy groups. Politicians on both sides of the aisle have also voiced strong opinions, reflecting the deeply divisive nature of this issue.

- Long-Term Effects: The long-term effects on the relationship between the IRS and taxpayers remain to be seen. The controversy could damage public trust and potentially affect future tax compliance.

Conclusion

The judge's approval to use IRS data and undocumented immigrants is a momentous decision with far-reaching consequences. The original proposal, the legal arguments surrounding it, the inherent privacy concerns, and the ongoing legal battles all underscore the complexity of this issue. The potential ramifications for individuals and the political landscape are substantial, demanding careful consideration. Staying informed about developments in this critical legal battle involving the use of IRS data and undocumented immigrants is paramount. Continue to follow the news for updates on the ongoing legal challenges and the potential impact on immigration policy. Understanding the use of IRS data and undocumented immigrants is crucial for informed civic engagement.

Featured Posts

-

Budget Bill Includes Renewed Focus On Drug Middleman Price Reform

May 13, 2025

Budget Bill Includes Renewed Focus On Drug Middleman Price Reform

May 13, 2025 -

Exploring Doom The Dark Ages Gameplay Story And More

May 13, 2025

Exploring Doom The Dark Ages Gameplay Story And More

May 13, 2025 -

Myanmar Examining The Uk And Australias Selective Approach To Sanctions

May 13, 2025

Myanmar Examining The Uk And Australias Selective Approach To Sanctions

May 13, 2025 -

Nba Tankathon More Than Just A Game For Miami Heat Fans

May 13, 2025

Nba Tankathon More Than Just A Game For Miami Heat Fans

May 13, 2025 -

Uni A Roma Srbi E Trazhi Zashtitu Od Targetiranja Od Strane Marinike Tepi

May 13, 2025

Uni A Roma Srbi E Trazhi Zashtitu Od Targetiranja Od Strane Marinike Tepi

May 13, 2025