Trump's Preferred Oil Price Range: Insights From Goldman Sachs' Social Media Review

Table of Contents

Goldman Sachs' Methodology: Analyzing Social Media for Economic Insights

Goldman Sachs, known for its sophisticated economic analysis, employed an unconventional approach to understand former President Trump's views on oil prices: social media analysis. This methodology presents both opportunities and challenges in extracting meaningful economic insights.

Data Sources: Mining the Digital Landscape

The analysis likely encompassed a range of social media platforms, primarily focusing on Trump's prolific use of Twitter. Other platforms, such as Facebook and potentially even more informal channels, might have been considered, depending on the scope of Goldman Sachs' research. The sheer volume of data generated by these platforms presents both an opportunity and a challenge for researchers.

Data Analysis Techniques: Deciphering the Digital Signals

Goldman Sachs likely employed sophisticated data analysis techniques to extract relevant information. Sentiment analysis, a common method in social media analytics, would have been crucial for gauging Trump's attitude towards fluctuating oil prices. Keyword frequency analysis, focusing on terms like "oil prices," "energy independence," and "OPEC," could reveal the relative importance he placed on these issues.

- Limitations: This methodology has inherent limitations. Social media posts may not always reflect a person's fully considered views; they can be subject to emotional biases, impulsive statements, or even deliberate misdirection. Incomplete data, due to deleted tweets or private communications, also poses a significant challenge to complete analysis.

- Novelty and Strengths: The use of social media data for economic analysis is relatively novel and offers a unique perspective. It taps into a real-time, unfiltered stream of information, providing a potentially valuable insight into the thinking of influential figures.

- Accuracy and Reliability: The accuracy and reliability depend heavily on the sophistication of the data analysis techniques employed and the robustness of the methodology used to account for biases and incomplete data. The findings should be interpreted cautiously and in conjunction with other available information.

Interpreting Trump's Statements on Oil Prices: A Range of Opinions

Extracting a precise "preferred oil price range" from Trump's often-unpredictable statements requires careful analysis. His public pronouncements contained a blend of explicit opinions and implicit signals.

Identifying Key Statements: Sifting Through the Tweets and Speeches

Numerous instances exist where Trump publicly commented on oil prices. These ranged from tweets expressing dissatisfaction with high prices, to speeches celebrating the supposed benefits of energy independence achieved through increased domestic production, potentially influencing lower prices. Analyzing these statements, while potentially revealing a preferred range, will necessarily require careful attention to context and nuances.

Defining the "Preferred Range": A Matter of Interpretation

Determining Trump's favored oil price range is challenging due to the ambiguity inherent in his public comments. His statements often reflect short-term political considerations rather than a long-term economic strategy. One interpretation might suggest a preference for lower oil prices to boost consumer confidence and economic growth. Conversely, his emphasis on energy independence could indicate a tolerance, or even preference, for a range that supports domestic producers, even if somewhat higher.

- Specific Quotes: Identifying specific quotes that directly or indirectly address preferred price levels is crucial. These should be examined in their original context.

- Contextual Factors: External factors like geopolitical events (e.g., tensions in the Middle East) and domestic economic indicators (e.g., inflation) greatly influence a politician's views on oil price levels.

- Interpretational Ambiguity: The ambiguity in Trump’s statements needs to be highlighted, acknowledging the limitations in drawing definitive conclusions from his social media activity.

Economic and Geopolitical Implications of Trump's Preferred Oil Price Range

The oil price range favored by a political leader carries significant economic and geopolitical consequences.

Impact on the US Economy: A Balancing Act

Different oil price ranges exert varying impacts on the US economy. Lower prices typically benefit consumers and stimulate economic growth but could hurt domestic oil producers and lead to job losses in the energy sector. Higher prices can fuel inflation, dampen economic activity, and hurt lower-income households more severely, but are favorable for energy companies. Understanding Trump's preferred range allows for a better understanding of the trade-offs he may have been willing to accept.

International Relations: Global Implications

Trump's views on oil prices significantly influence US foreign policy and its relationships with oil-producing nations. A preference for lower prices could put pressure on OPEC and other producers, potentially leading to strained diplomatic ties. Conversely, a preference for a higher range that supports domestic producers might result in less reliance on foreign oil and a more assertive stance in international energy negotiations.

- Positive and Negative Consequences: Careful examination of both positive and negative consequences of high versus low oil prices is necessary for a comprehensive picture.

- Trade Relations and Geopolitical Strategy: Specific examples of how oil prices directly influence US trade relations and geopolitical strategy are essential to demonstrate the impact of Trump’s preferred oil price.

- Potential Conflicts of Interest: Examining potential conflicts of interest or policy inconsistencies stemming from Trump's preferred oil price range is crucial.

Comparing Trump's Stance with Other Key Figures and Expert Opinions

To fully understand the implications of Trump's preferred oil price range, it is essential to compare his views with those of other key figures and experts.

Alternative Perspectives: A Range of Expert Opinions

Economists, politicians, and energy industry experts hold varying views on ideal oil price ranges. Some favor a stable, moderate price, while others may advocate for higher prices to incentivize investment in renewable energy sources or lower prices to stimulate economic growth.

Contrasting Viewpoints: Divergent Economic Strategies

Comparing Trump's views with these alternative perspectives highlights significant differences in economic philosophies and priorities. His emphasis on energy independence and domestic production often contrasted with those advocating for a globalized energy market and a focus on climate change mitigation.

- Specific Individuals and Viewpoints: Mentioning specific individuals and their viewpoints on optimal oil prices lends credibility and provides a broader perspective.

- Points of Agreement and Disagreement: Highligting points of agreement and disagreement enhances the reader’s understanding and highlights critical debates.

- Implications for Policy and Economic Outcomes: Discussing the implications of differing opinions on policy and economic outcomes reinforces the significance of understanding perspectives on oil prices.

Conclusion: Understanding Trump's Preferred Oil Price Range: A Call to Action

Goldman Sachs' innovative use of social media analysis provides a unique, albeit imperfect, lens through which to understand Trump's preferred oil price range. The analysis, while offering intriguing insights, highlights the complexities of interpreting public statements to determine underlying economic preferences. The findings underscore the significant economic and geopolitical implications of such preferences. The impact on the US economy, its international relations, and the overall global energy market are all deeply intertwined with the political leader's views on oil price stability.

Key Takeaways: This analysis reveals the challenges and potential rewards of utilizing social media to gauge policy preferences and sheds light on the intricate interplay between oil prices, economic policy, and international relations. Understanding Trump's preferred price point allows for a more nuanced comprehension of his overall economic and foreign policy strategies.

Call to Action: Continue your research on Trump's economic policies and the influence of oil prices by exploring related articles and reports. Understanding Trump's preferred oil price range is crucial for comprehending his overall economic strategy and its lasting impact on the US and the global economy.

Featured Posts

-

Colorado Rockies Seek To End Losing Streak Vs Padres

May 15, 2025

Colorado Rockies Seek To End Losing Streak Vs Padres

May 15, 2025 -

Oakland Athletics Muncys Debut At Second Base

May 15, 2025

Oakland Athletics Muncys Debut At Second Base

May 15, 2025 -

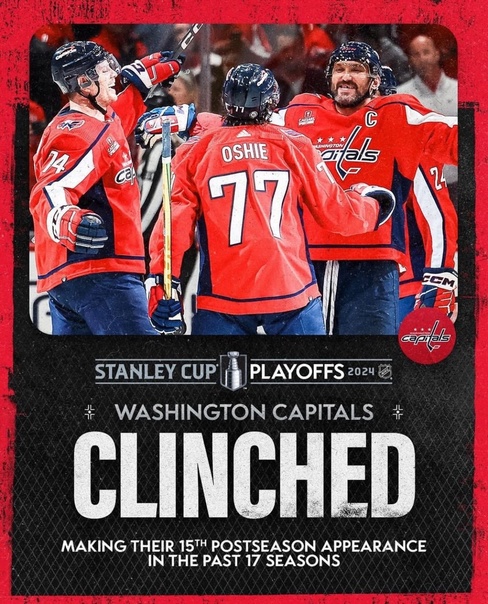

Kinopoisk Soski S Ovechkinym Podarok V Chest Istoricheskogo Rekorda N Kh L

May 15, 2025

Kinopoisk Soski S Ovechkinym Podarok V Chest Istoricheskogo Rekorda N Kh L

May 15, 2025 -

Pulaski Residents Urged To Boil Water Until Saturday

May 15, 2025

Pulaski Residents Urged To Boil Water Until Saturday

May 15, 2025 -

Kid Cudi Memorabilia Sells For Staggering Amounts At Auction

May 15, 2025

Kid Cudi Memorabilia Sells For Staggering Amounts At Auction

May 15, 2025