Trump's Shift In Tone Triggers Gold Price Rally

Table of Contents

Understanding the Gold-Political Uncertainty Correlation

Gold's value is intrinsically linked to global political stability. Historically, there's an inverse relationship between political stability and gold prices; when political uncertainty rises, so does the demand for gold. This is primarily because gold is considered a safe haven asset. Investors see gold as a reliable store of value during times of economic or political turmoil. Unlike stocks or bonds, which can lose value rapidly during crises, gold generally holds its value, providing a degree of protection against market volatility.

- Gold as a Safe Haven: Gold's inherent value and limited supply make it a desirable asset during uncertain times. Its resistance to inflation and its tangible nature further enhance its appeal as a safe haven.

- Past Examples: Previous periods of significant geopolitical risk, such as the 2008 financial crisis and the height of the European debt crisis, saw substantial increases in gold prices as investors sought refuge from market instability. The precious metals market responded predictably in these situations.

- Political Risk and Gold Investment: The inherent risk associated with political instability often drives investors towards gold as a hedge against potential losses in other asset classes. This increased demand often translates to higher gold prices.

Trump's Previous Rhetoric and its Market Impact

Trump's past presidency was characterized by unpredictable statements and actions, often causing market instability. His aggressive trade policies, challenges to international alliances, and unpredictable tweets frequently created uncertainty, impacting market confidence and influencing gold prices.

- Examples: For instance, periods of heightened trade tensions with China were often accompanied by a rise in gold prices. Data shows a clear correlation between periods of increased uncertainty surrounding Trump’s policies and corresponding increases in gold futures and trading volumes in the precious metals market.

- Market Instability: This unpredictability led to significant market volatility, increasing the demand for gold as a defensive investment strategy. The gold trading market reacted swiftly to these swings in market sentiment.

The Recent Shift in Trump's Tone

Recently, a noticeable shift has occurred in Trump's public demeanor and rhetoric. He has adopted a more conciliatory approach in certain areas, leading to a perceptible change in market sentiment. While specifics vary depending on the news source, many analysts point to a reduction in aggressive rhetoric on key policy areas as the main driver of this change.

- Specific Examples: Reports cite a decrease in inflammatory tweets and public statements as contributing factors. Reliable news outlets highlight instances of more diplomatic engagement, which may have contributed to this change in market perception.

- Impact on Market Sentiment: This perceptible change in tone is seen as a reduction in political risk, triggering a corresponding shift in investor confidence. The resulting increase in optimism seemingly reduced the demand for gold as a safe haven asset – at least temporarily.

Analyzing the Gold Price Rally's Mechanics

The market's immediate reaction to Trump's altered tone was a notable decrease in gold prices, as some investors interpreted this as a decrease in political risk and therefore a decreased need for a safe haven. However, this initial reaction was relatively short-lived.

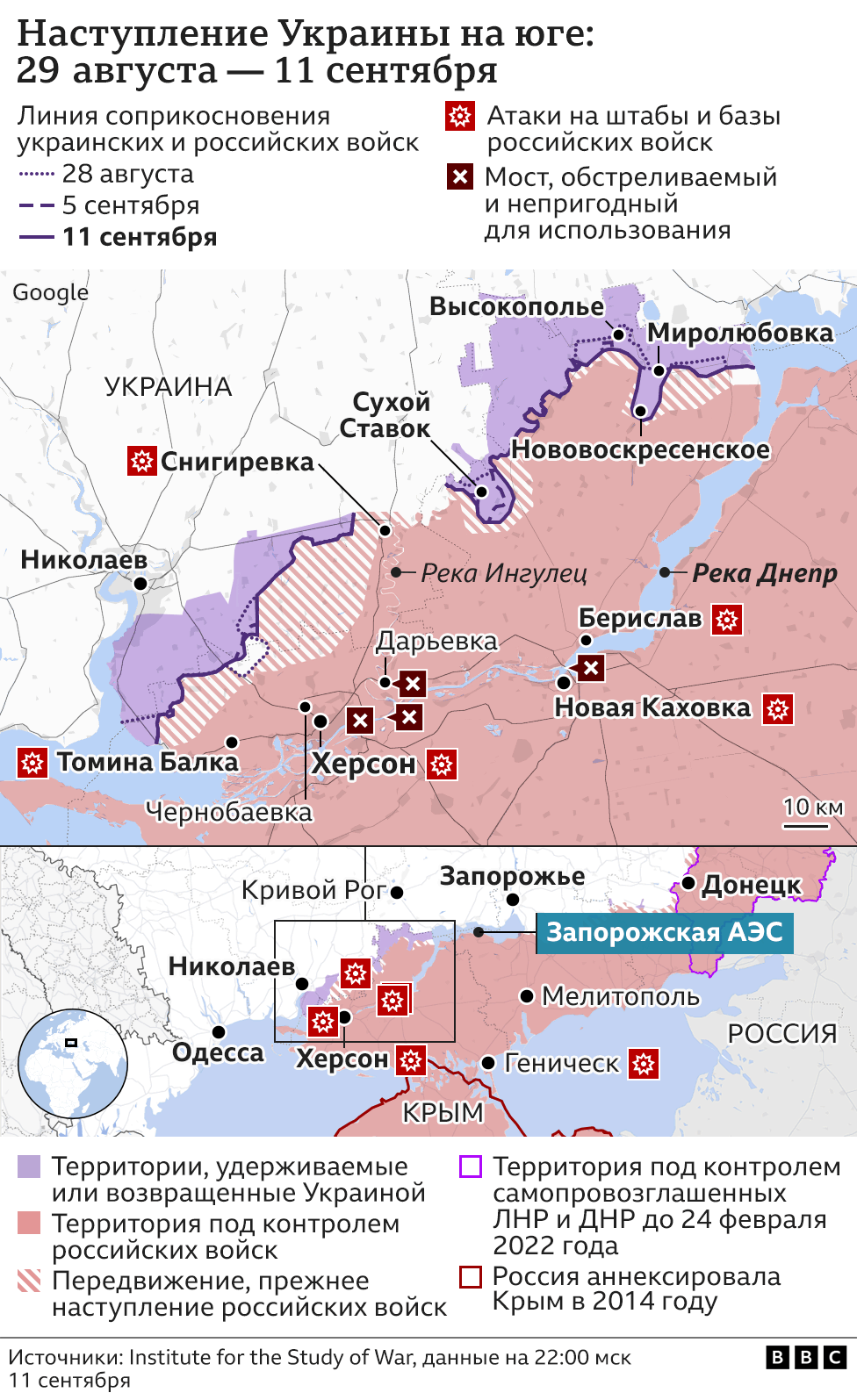

- Price Movements: Although charts and graphs would provide a more visual representation, reports indicate a significant drop followed by a steady climb in gold prices following the initial reaction.

- Other Contributing Factors: Other factors, such as dollar fluctuations and global economic conditions, might have contributed to the gold price rally, either amplifying or counteracting the impact of Trump’s changed rhetoric. The currency exchange rates, for example, played a crucial role.

Investor Sentiment and Market Behavior

The shift in Trump's tone led to an observable improvement in investor sentiment. The reduced perceived political risk decreased the demand for gold as a safe haven investment, initially leading to the drop in price. However, this initial shift was temporary, and the gold price soon began to climb again. Speculation and investor behavior shifted as events continued to unfold.

- Increased Demand (Later Stage): As other economic factors came into play, the demand for gold as a hedge against inflation or other economic uncertainties began to rise again, driving the gold price upwards.

- Trading Volumes and Volatility: During this period, trading volumes reflected the fluctuating investor sentiment, with periods of increased activity corresponding to significant shifts in Trump's pronouncements and market reactions.

Role of Other Economic Indicators

While Trump's actions were a significant catalyst, other economic indicators played a role in shaping the gold price. Inflationary pressures, for example, can increase demand for gold as investors seek protection against the erosion of purchasing power.

- Inflation Concerns: Rising inflation might increase gold's appeal as an inflation hedge, supplementing the impact of Trump's changed tone.

- Interest Rates: Interest rate changes influence the opportunity cost of holding gold, which might impact the overall demand.

Implications and Future Outlook

The long-term implications of Trump's altered rhetoric on gold prices remain uncertain. The sustainability of the rally depends on various factors, including the consistency of his changed approach and the evolving global economic landscape.

- Gold Price Forecast: Predicting future gold prices is inherently challenging, given the multitude of interacting factors. However, sustained political stability, coupled with ongoing economic uncertainty, could support higher gold prices in the long term.

- Long-Term Investment: Gold often serves as a component of diversified investment portfolios. Investors should carefully evaluate gold’s place in their overall investment strategy based on their risk tolerance and financial goals.

Conclusion

Trump's shift in tone has undeniably impacted gold prices, highlighting the strong correlation between political uncertainty and investor confidence in the gold market. The initial drop and subsequent rise reflect the complex interplay of market psychology, economic indicators, and the perception of political risk. The price movements in gold have demonstrated the impact of Trump's actions and words on precious metals market behavior.

Understanding this correlation is crucial for making informed investment decisions. Stay informed about Trump's actions and their potential impact on the gold price to make well-informed choices. Consider diversifying your portfolio with gold investments to mitigate political risk and protect your assets during times of uncertainty. Careful monitoring of the gold price chart, along with other economic indicators, is crucial for prudent investment in the precious metals market.

Featured Posts

-

The Dallas Cowboys And Ashton Jeanty A Necessary Union

Apr 25, 2025

The Dallas Cowboys And Ashton Jeanty A Necessary Union

Apr 25, 2025 -

Anzac Day Disrespect Aussie War Veteran Speaks Out On Schools Actions And National Decline

Apr 25, 2025

Anzac Day Disrespect Aussie War Veteran Speaks Out On Schools Actions And National Decline

Apr 25, 2025 -

Izmenenie Pozitsii Trampa Po Voyne V Ukraine

Apr 25, 2025

Izmenenie Pozitsii Trampa Po Voyne V Ukraine

Apr 25, 2025 -

American Lung Association Receives Over 230 000 From 2025 Scale The Strat

Apr 25, 2025

American Lung Association Receives Over 230 000 From 2025 Scale The Strat

Apr 25, 2025 -

Increased Rent In La After Fires A Look At Price Gouging Claims

Apr 25, 2025

Increased Rent In La After Fires A Look At Price Gouging Claims

Apr 25, 2025

Latest Posts

-

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 30, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 30, 2025 -

2024 Open Ai Developer Event New Tools For Voice Assistant Creation

Apr 30, 2025

2024 Open Ai Developer Event New Tools For Voice Assistant Creation

Apr 30, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Showcase

Apr 30, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Showcase

Apr 30, 2025 -

Podcast Production Revolution Ais Power To Process Repetitive Scatological Documents

Apr 30, 2025

Podcast Production Revolution Ais Power To Process Repetitive Scatological Documents

Apr 30, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Informative Podcasts

Apr 30, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Informative Podcasts

Apr 30, 2025