Trump's Tariff Halt Sends Euronext Amsterdam Stocks Up 8%

Table of Contents

The Trump Tariff Impact on Euronext Amsterdam

The Trump administration's trade policies, particularly the imposition of tariffs on various goods, significantly impacted companies listed on Euronext Amsterdam. These policies created considerable market volatility and uncertainty. The specific tariffs imposed varied, targeting sectors heavily reliant on international trade.

- Specific Tariffs: Previous tariffs targeted a range of goods, including steel, aluminum, and agricultural products, impacting numerous companies listed on Euronext Amsterdam. For example, manufacturers heavily reliant on imported materials faced increased production costs, while agricultural exporters suffered from reduced market access.

- Most Affected Sectors: The manufacturing and agricultural sectors were among the hardest hit. Companies in these sectors experienced reduced profitability and constrained growth due to increased input costs and decreased demand. The automotive industry, for example, faced challenges from tariffs on steel and other components.

- Negative Market Sentiment: Before the tariff halt, market sentiment surrounding Euronext Amsterdam was largely negative. Investor confidence was low due to the uncertainty surrounding trade relations and the potential for further tariff escalations. This led to a period of decreased stock prices and suppressed investment activity.

- Statistical Evidence: Data from Q[Insert relevant Quarter] [Insert Year] showed a [Insert Percentage]% decline in the Euronext Amsterdam index compared to the previous year. This decline was directly correlated with the implementation of Trump-era tariffs and the resulting economic uncertainty.

Analysis of the 8% Stock Market Surge

The news of the Trump tariff halt triggered an immediate and dramatic positive reaction in the Euronext Amsterdam market. The 8% surge reflects a significant shift in investor sentiment and a renewed confidence in the market’s future.

- Immediate Market Reaction: Within hours of the announcement, stock prices across Euronext Amsterdam began to climb. The initial reaction was swift and substantial, indicating the pent-up demand for positive news and the significant weight of the tariff uncertainty on the market.

- Biggest Gainers: Companies in the manufacturing, agricultural, and automotive sectors experienced some of the most significant gains, reflecting the direct impact of the lifted tariffs on their profitability and competitiveness.

- Investor Confidence and Speculation: The price increase was largely fueled by a surge in investor confidence. The removal of the tariffs reduced uncertainty, encouraging investors to reinvest and speculate on future growth. This created a positive feedback loop, driving further price increases.

- Illustrative Charts/Graphs: [Insert Chart or Graph showing the dramatic 8% increase in stock prices following the tariff halt].

Long-Term Implications for Euronext Amsterdam

While the 8% surge is a significant positive development, the long-term implications for Euronext Amsterdam require further analysis. The tariff halt represents a significant step towards greater economic stability, but several challenges remain.

- Continued Growth Potential: The removal of tariffs creates the potential for sustained growth by reducing production costs and increasing market access for many businesses listed on the Euronext Amsterdam exchange.

- Remaining Challenges and Uncertainties: Geopolitical risks and global economic uncertainty could still impact market performance. Furthermore, the long-term effects of the previous tariffs may linger, requiring time for a full recovery.

- Risks and Opportunities for Investors: While the outlook is improved, investors need to carefully assess the risks and opportunities associated with the market’s recovery. Diversification and a thorough understanding of the sector-specific impacts of the tariff changes are crucial.

- Future Predictions: Expert opinions suggest a cautiously optimistic outlook for Euronext Amsterdam, with potential for continued growth, but also a need for ongoing monitoring of global economic conditions and trade policies.

Global Market Reactions and Comparisons

The halt of Trump-era tariffs had ripple effects across global markets, though the impact varied depending on the specific economic ties and trade relationships.

- Comparison to Other Markets: While Euronext Amsterdam experienced a substantial 8% increase, other European stock markets also saw positive gains, reflecting the broader positive impact of the tariff reversal. However, the magnitude of the increase varied depending on each market's exposure to the affected sectors.

- Global Trade and Economic Relations: The decision highlights the interconnectedness of global markets and the significant impact of trade policy decisions on international economic relations. The reversal signifies a potential shift towards more cooperative trade policies, although uncertainties remain.

- Ripple Effects: Sectors outside of those directly impacted by the tariffs also experienced indirect benefits, such as increased consumer confidence and improved business sentiment.

Conclusion

The unexpected halt in Trump-era tariffs has had a dramatic impact on Euronext Amsterdam, leading to an impressive 8% surge in stock prices. This surge reflects a significant shift in investor sentiment, driven by reduced uncertainty and increased confidence in the market's future. While the long-term implications remain to be fully realized, the removal of tariffs represents a significant positive development for many companies listed on the exchange.

Call to Action: Stay informed about the evolving situation and its impact on Euronext Amsterdam stocks. Incorporate these insights into your investment strategies and continue monitoring the effects of this significant trade policy shift. Learn more about managing your portfolio effectively in light of fluctuating trade policies and potential future changes to Trump-era tariff impacts.

Featured Posts

-

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025 -

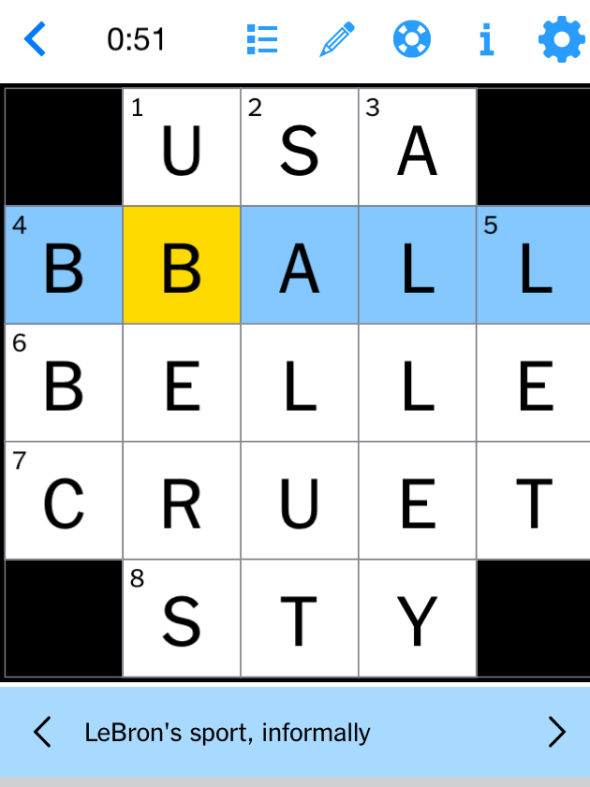

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 24, 2025

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Europe And Bangladesh A Focus On Collaborative Growth Strategies

May 24, 2025

Europe And Bangladesh A Focus On Collaborative Growth Strategies

May 24, 2025 -

A Guide To Escaping To The Country Budget Friendly Options And Considerations

May 24, 2025

A Guide To Escaping To The Country Budget Friendly Options And Considerations

May 24, 2025

Latest Posts

-

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025 -

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025 -

Discover The Countrys Top New Business Locations A Geographic Overview

May 24, 2025

Discover The Countrys Top New Business Locations A Geographic Overview

May 24, 2025 -

New Business Hotspots Across The Country An Interactive Map And Analysis

May 24, 2025

New Business Hotspots Across The Country An Interactive Map And Analysis

May 24, 2025