Trump's Tariffs And The Small Wine Importer: A Survival Guide

Table of Contents

Understanding the Impact of Trump's Tariffs on Wine Imports

Trump's tariffs on imported goods significantly impacted the wine industry. These tariffs took various forms, including retaliatory tariffs imposed in response to trade actions by other countries and Section 301 tariffs targeting specific goods deemed to violate US trade laws. These measures resulted in increased costs for small wine importers, squeezing profit margins and forcing difficult decisions.

- Increased costs per bottle: Tariffs directly added to the cost of each bottle imported, reducing profitability. The percentage increase varied based on the country of origin and the specific type of wine.

- Reduced profit margins: Higher import costs meant smaller profit margins, forcing importers to make tough choices about pricing and volume.

- Potential for price increases impacting consumer demand: To maintain profitability, many importers were forced to pass on increased costs to consumers, potentially reducing demand for imported wines.

- Difficulty competing with domestically produced wines: Higher prices for imported wines made them less competitive with domestically produced wines, impacting market share.

Specific examples include the significant tariffs imposed on wines from the European Union and China, severely impacting importers specializing in these regions. These tariffs varied depending on the wine's classification (still wine, sparkling wine, etc.) and often resulted in substantial price increases for consumers.

Strategies for Mitigating Tariff Impacts

Facing the challenges of Trump's tariffs required small wine importers to adopt proactive strategies to mitigate their impact. This involved diversifying sourcing, optimizing supply chain management, and adapting pricing and marketing strategies.

Diversifying Wine Sources

One of the most effective strategies was to diversify wine sources. This involved exploring countries not subject to high tariffs or finding alternative suppliers within previously utilized regions.

- Finding new suppliers: This required extensive research, networking within the industry, and potentially visiting wineries abroad to build relationships and evaluate quality.

- Establishing relationships: Building trust and strong relationships with new suppliers is crucial for consistent supply and favorable pricing.

- Due diligence: Thorough due diligence, including assessing the quality, consistency, and reliability of the new supplier, is essential.

Optimizing Supply Chain Management

Optimizing the supply chain was essential to minimize costs.

- Reducing shipping costs: Negotiating better rates with shipping companies and exploring alternative shipping routes could significantly reduce costs.

- Improving logistics efficiency: Streamlining the entire import process from customs clearance to warehousing could save time and money.

- Inventory management: Effective inventory management helps avoid holding excessive stock that incurs additional storage and potentially obsolescence costs.

Adapting Pricing and Marketing Strategies

Adapting pricing and marketing strategies was vital to maintaining sales despite higher costs.

- Adjusting pricing: Carefully adjusting prices to account for increased costs while remaining competitive required sophisticated market analysis.

- Marketing unique value propositions: Highlighting the unique quality, origin, and characteristics of imported wines helped to justify higher prices to consumers.

- Targeted digital marketing: Using digital marketing and targeted advertising to reach specific consumer segments who value quality and are willing to pay a premium allowed for greater market penetration.

Seeking Support and Resources

Small wine importers were not alone in facing these challenges. Several resources were available to help mitigate the impact of Trump's tariffs.

- Government resources: The Small Business Administration (SBA) and the Department of Commerce offer various programs and resources to support small businesses impacted by trade policies.

- Industry associations: Industry associations such as the Wine Institute and the National Association of Beverage Importers offered guidance and support to their members.

- Financial advisors and consultants: Seeking advice from financial advisors or business consultants specializing in international trade could prove invaluable.

Conclusion:

Trump's tariffs posed significant challenges to small wine importers, impacting profitability and market competitiveness. Understanding the financial implications, diversifying sourcing, optimizing supply chain management, and adapting pricing and marketing strategies are crucial for survival. By proactively implementing these strategies and seeking available support, small wine importers can navigate the complexities of international trade and ensure the continued success of their businesses. Remember to stay informed about trade policies and actively seek resources to mitigate the impact of future tariff changes or similar economic challenges. Don't let Trump's tariffs define your future – take control with a well-informed strategy. Navigating Trump's tariffs and understanding their impact on wine imports requires proactive planning and resourcefulness.

Featured Posts

-

Jacob Alons Fairy In A Bottle Todays Top Tune

May 31, 2025

Jacob Alons Fairy In A Bottle Todays Top Tune

May 31, 2025 -

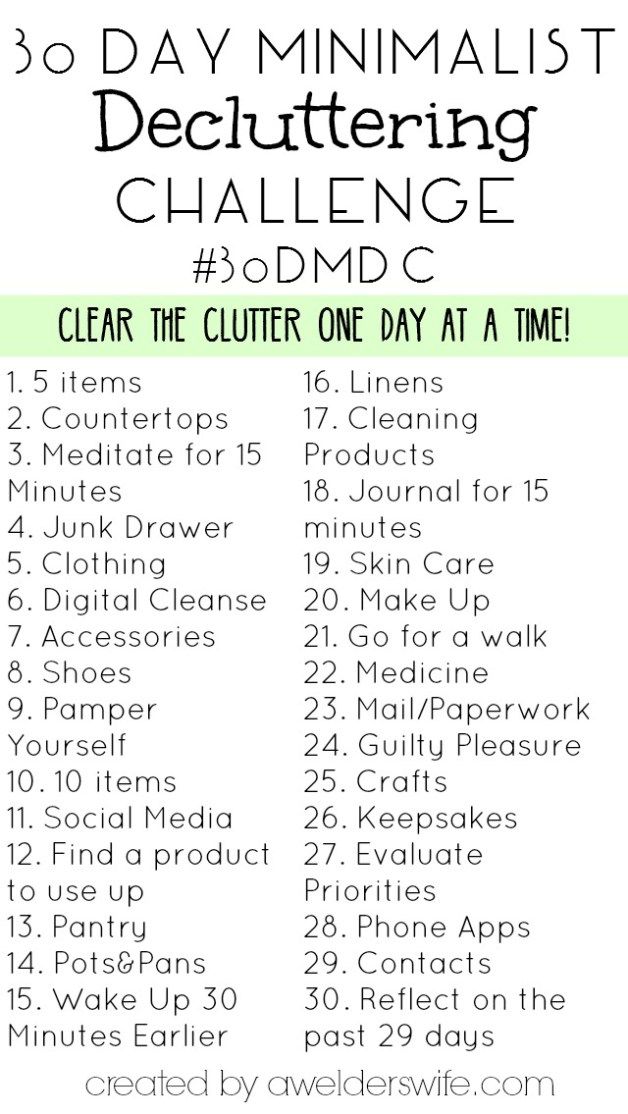

30 Days To Minimalism A Practical Guide To Decluttering

May 31, 2025

30 Days To Minimalism A Practical Guide To Decluttering

May 31, 2025 -

Fast Resale Glastonbury Tickets Gone In 30 Minutes

May 31, 2025

Fast Resale Glastonbury Tickets Gone In 30 Minutes

May 31, 2025 -

Samsung Galaxy Tab Undercuts I Pad 101 Bargain

May 31, 2025

Samsung Galaxy Tab Undercuts I Pad 101 Bargain

May 31, 2025 -

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

May 31, 2025

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

May 31, 2025