Trump's Tariffs And Their Effect On Norway's Investment Strategies (Nicolai Tangen)

Table of Contents

The Impact of Trump's Tariffs on Global Markets

The introduction of Trump tariffs created a ripple effect across global markets, impacting investment strategies worldwide. This section details the significant consequences.

Increased Market Volatility

The uncertainty surrounding the Trump tariffs led to significant market volatility. Investors struggled to predict the long-term consequences of these trade restrictions, leading to:

- Increased market fluctuations: Daily market swings became more pronounced as investors reacted to news and announcements concerning new tariffs or trade negotiations.

- Unpredictable trade relations: The unpredictable nature of the trade war made it difficult for businesses to plan for the future, impacting investment decisions and potentially slowing economic growth.

- Impact on commodity prices: The tariffs had a significant impact on commodity prices, particularly affecting Norway's oil and gas sector, a cornerstone of its economy. The fluctuating prices introduced substantial risk into the Norway investment landscape.

- Ripple effect across sectors: The effects weren't confined to directly targeted sectors. The uncertainty and disruption spread through global supply chains, affecting diverse industries and creating a climate of widespread risk.

Disruption of Supply Chains

Trump tariffs significantly disrupted established global supply chains, forcing businesses to adapt and increasing production costs. This resulted in:

- Increased production costs: Companies faced higher costs for imported goods, leading to increased prices for consumers and reduced profit margins.

- Relocation of manufacturing: Businesses sought to relocate their manufacturing operations to avoid tariffs, leading to a shift in global production patterns.

- Impact on global trade flows: The tariffs significantly altered the flow of goods across borders, impacting global trade volumes and creating new trade relationships.

- Impact on Norwegian businesses: Norwegian businesses relying on global supply chains were affected, impacting their profitability and requiring them to adjust their strategies. This, in turn, directly influenced the investments held by NBIM.

Nicolai Tangen's Response and NBIM's Strategic Adjustments

Nicolai Tangen, as CEO of Norges Bank Investment Management (NBIM), the manager of Norway's sovereign wealth fund, had to respond to the challenges posed by Trump tariffs. His strategies prioritized mitigation and adaptation.

Portfolio Diversification Strategies

In response to the increased market risk generated by the trade war, NBIM implemented several portfolio diversification strategies:

- Shifting investment focus: NBIM likely reduced its exposure to sectors heavily affected by the Trump tariffs, such as those directly involved in international trade.

- Increased investment in less trade-sensitive sectors: The focus likely shifted towards industries less exposed to international trade disputes, promoting resilience within the portfolio.

- Geographical diversification of investments: NBIM likely expanded its investments into regions less impacted by the trade war, reducing overall reliance on specific geographic markets. While specific details of NBIM's internal strategies aren't publicly available, these adjustments are logical responses to the situation.

Enhanced Risk Management Protocols

The volatility caused by the Trump tariffs prompted NBIM to enhance its risk management protocols:

- Implementation of new risk models: NBIM likely refined its models to better account for geopolitical risks, including those stemming from trade disputes.

- Increased due diligence on investments: A more thorough assessment of potential risks associated with individual investments became crucial in this turbulent environment.

- Proactive monitoring of geopolitical risks: NBIM likely increased its monitoring of global events and their potential impact on its investment portfolio, incorporating geopolitical analysis more deeply into its decision-making process. This involved predicting and preemptively mitigating potential long-term effects of trade conflicts.

Long-Term Effects on Norway's Economy and Investment Approach

The Trump tariffs had lasting implications on Norway's economy and its long-term investment strategy.

Re-evaluation of Global Trade Dependence

The experience prompted a re-evaluation of Norway's reliance on global trade:

- Increased focus on domestic growth: Norway likely increased its focus on strengthening its domestic economy to lessen dependence on fluctuating global markets.

- Strengthening of regional partnerships: Collaboration with neighboring countries and within regional trade blocs became more important to diversify trade relations.

- Exploration of new trade agreements: Norway may have actively sought new trade partnerships to reduce its reliance on countries involved in trade disputes.

Shift in Investment Philosophy

The Trump tariffs may have influenced a long-term shift in NBIM's investment philosophy:

- Increased emphasis on sustainability and ESG factors: A growing focus on Environmental, Social, and Governance (ESG) factors in investment decisions might have emerged as a way to mitigate risk and invest in more resilient sectors.

- Prioritization of long-term value creation: A longer-term perspective prioritizing sustainable value creation over short-term gains may have been adopted.

- Greater consideration of geopolitical factors: Geopolitical risks, including the potential for future trade disputes, are now likely factored more prominently into investment decisions.

Conclusion

The Trump tariffs significantly impacted Norway's investment strategies under Nicolai Tangen's leadership. NBIM responded by diversifying its portfolio, enhancing risk management protocols, and potentially shifting towards a long-term investment philosophy that prioritizes sustainability and resilience. This experience highlights the crucial importance of adapting to global economic shifts and the need for proactive risk management in a world increasingly shaped by geopolitical factors. Further research into the ongoing effects of trade policies on global investment strategies is encouraged. Learn more about the impact of Trump's tariffs and how they continue to shape investment decisions today.

Featured Posts

-

Aritzia And Trump Tariffs How The Retailer Plans To Adapt

May 05, 2025

Aritzia And Trump Tariffs How The Retailer Plans To Adapt

May 05, 2025 -

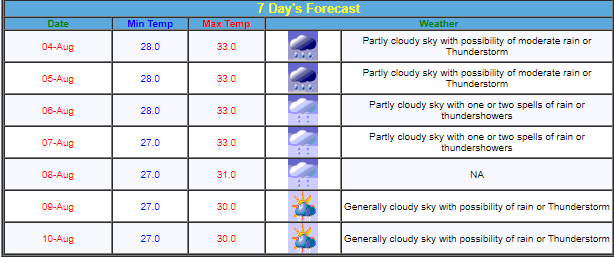

Me T Department Forecasts Thunderstorms In Kolkata And Surrounding Areas

May 05, 2025

Me T Department Forecasts Thunderstorms In Kolkata And Surrounding Areas

May 05, 2025 -

Analyzing Blake Lively And Anna Kendricks Interactions Body Language Reveals All

May 05, 2025

Analyzing Blake Lively And Anna Kendricks Interactions Body Language Reveals All

May 05, 2025 -

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 05, 2025

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 05, 2025 -

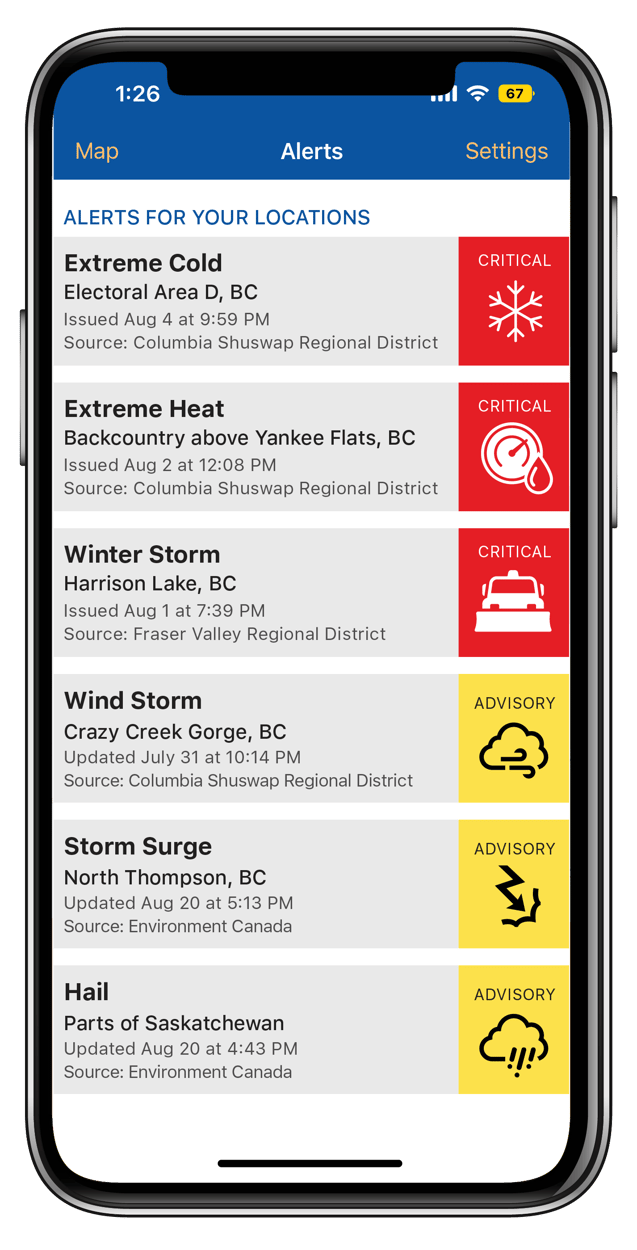

Severe Weather Alert Nyc Faces Potential Impacts Monday

May 05, 2025

Severe Weather Alert Nyc Faces Potential Impacts Monday

May 05, 2025

Latest Posts

-

Emma Stoun Minispidnitsya Yak Golovniy Aktsent Na Premiyi Shou Biznes

May 05, 2025

Emma Stoun Minispidnitsya Yak Golovniy Aktsent Na Premiyi Shou Biznes

May 05, 2025 -

Emma Stones Snl 50th Anniversary Dress Photos And Details

May 05, 2025

Emma Stones Snl 50th Anniversary Dress Photos And Details

May 05, 2025 -

Premiya Shou Biznes Emma Stoun U Yaskraviy Minispidnitsi

May 05, 2025

Premiya Shou Biznes Emma Stoun U Yaskraviy Minispidnitsi

May 05, 2025 -

Emma Stones Popcorn Dress A Showstopper At Snls 50th Anniversary

May 05, 2025

Emma Stones Popcorn Dress A Showstopper At Snls 50th Anniversary

May 05, 2025 -

Emma Stoun Ta Yiyi Efektniy Obraz Na Premiyi Shou Biznes Minispidnitsya

May 05, 2025

Emma Stoun Ta Yiyi Efektniy Obraz Na Premiyi Shou Biznes Minispidnitsya

May 05, 2025