Trump's Tax Bill: Republican Opposition And Potential Blockades

Table of Contents

Conservative Concerns within the Republican Party

The opposition to Trump's Tax Bill wasn't solely from Democrats; significant resistance came from within the Republican party itself. Conservative factions harbored deep concerns about several key aspects of the proposed legislation.

Fiscal Responsibility Concerns

Many Republicans expressed serious reservations about the long-term fiscal impact of Trump's Tax Bill. The substantial tax cuts, they argued, would exacerbate the national debt and lead to unsustainable budget deficits.

- Example: The bill's projected increase in the national debt over ten years was a major point of contention.

- Quote: Senator [Insert Name of Republican Senator who opposed the bill due to fiscal concerns] famously stated, "[Insert quote expressing concern about the bill's fiscal impact]."

- Specific Tax Cut Criticized: The significant reduction in the corporate tax rate was widely criticized for its potential to disproportionately benefit large corporations at the expense of long-term fiscal stability.

Tax Cuts for the Wealthy

Another major source of Republican opposition stemmed from concerns that the tax cuts disproportionately benefited the wealthy, contradicting the party's public commitment to middle-class tax relief. Critics argued that the bill lacked sufficient provisions to directly aid the middle class.

- Statistical Data: Analysis showed that the top 1% of earners received a significantly larger percentage of the tax cuts than the middle class.

- Quote: [Insert quote from a Republican critic highlighting the inequitable distribution of tax benefits].

- Tax Loophole: The elimination or reduction of certain deductions disproportionately impacted middle and lower-income taxpayers, while loopholes benefiting the wealthy remained largely untouched.

Lack of Transparency and Hasty Passage

The rushed legislative process and lack of transparency surrounding the bill's drafting and negotiation fueled further opposition within the Republican party. Many felt the bill was pushed through too quickly, without adequate consideration of its long-term consequences.

- Speed of Legislative Process: The bill was passed with unusual speed, limiting opportunities for thorough review and debate.

- Insufficient Public Debate: Critics argued that there wasn't enough time for public input and meaningful discussion on the implications of the proposed tax changes.

- Quote: [Insert quote from a Republican who opposed the bill due to the lack of transparency and rushed process].

Potential Blockades and Legislative Hurdles

Beyond internal Republican opposition, several legislative hurdles threatened to block Trump's Tax Bill.

Senate Filibuster and Required Votes

The Senate's filibuster rule presented a significant challenge. The Republicans needed a supermajority to overcome a potential filibuster and pass the bill. This requirement increased the pressure on Republican Senators to maintain party unity.

- Senate Filibuster Rules: A filibuster allows a minority of Senators to delay or block a vote on a bill.

- Republican Majority in the Senate: While Republicans held a majority, the margin wasn't large enough to guarantee passage without potential defections.

- Potential Defections: The threat of Republican Senators voting against the bill was a real possibility, given the significant internal opposition.

Internal Republican Divisions and Factionalism

Deep-seated ideological and regional differences within the Republican party significantly contributed to the opposition. Conservative, moderate, and libertarian factions held conflicting views on the bill's merits.

- Factional Divisions: Conservative Republicans prioritized fiscal responsibility, while more moderate Republicans focused on broader economic growth.

- Prominent Republican Opponents: Several high-profile Republican Senators and Representatives publicly voiced their opposition.

- Geographical Distribution of Opposition: Opposition wasn't evenly distributed geographically; some regions showed stronger resistance than others.

Lobbying and Interest Group Influence

Powerful lobbying groups played a significant role in shaping Republican lawmakers' stances. Some groups actively lobbied against certain provisions, while others supported the bill.

- Key Interest Groups: [Mention specific interest groups and their lobbying efforts].

- Influence on Lawmakers: These lobbying efforts exerted considerable pressure on Republican lawmakers, influencing their votes.

- Contribution to Opposition: The success of lobbying efforts by groups opposing specific aspects of the bill contributed significantly to the overall opposition.

The Fallout from Opposition to Trump's Tax Bill

The internal Republican opposition to Trump's Tax Bill revealed deep fissures within the party, raising serious questions about its future unity and its ability to effectively govern. The challenges faced in passing the bill highlighted the difficulties in navigating conflicting ideological viewpoints within the Republican party. The bill's passage, despite the opposition, left a lasting impact on the party's internal dynamics and its legislative agenda. The long-term consequences remain to be seen, but the episode underscored the fragility of party unity and the power of internal dissent in shaping legislative outcomes.

Understanding the complexities of Trump's Tax Bill and the challenges it faced requires further investigation. Continue your research to fully grasp the political dynamics and lasting impact of this controversial legislation. Explore resources on the Congressional Budget Office’s analysis of the bill, read statements from key Republican figures involved in the debate, and delve deeper into the influence of various lobbying groups.

Featured Posts

-

Chinas Huawei Unveils New Ai Chip Aiming For Nvidia Parity

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Aiming For Nvidia Parity

Apr 29, 2025 -

Harvard University And The Trump Administration A Legal Battle Over Federal Funding

Apr 29, 2025

Harvard University And The Trump Administration A Legal Battle Over Federal Funding

Apr 29, 2025 -

Cocaine Found At White House Secret Service Investigation Complete

Apr 29, 2025

Cocaine Found At White House Secret Service Investigation Complete

Apr 29, 2025 -

Canada Election Carneys Campaign Faces Headwinds In Final Days

Apr 29, 2025

Canada Election Carneys Campaign Faces Headwinds In Final Days

Apr 29, 2025 -

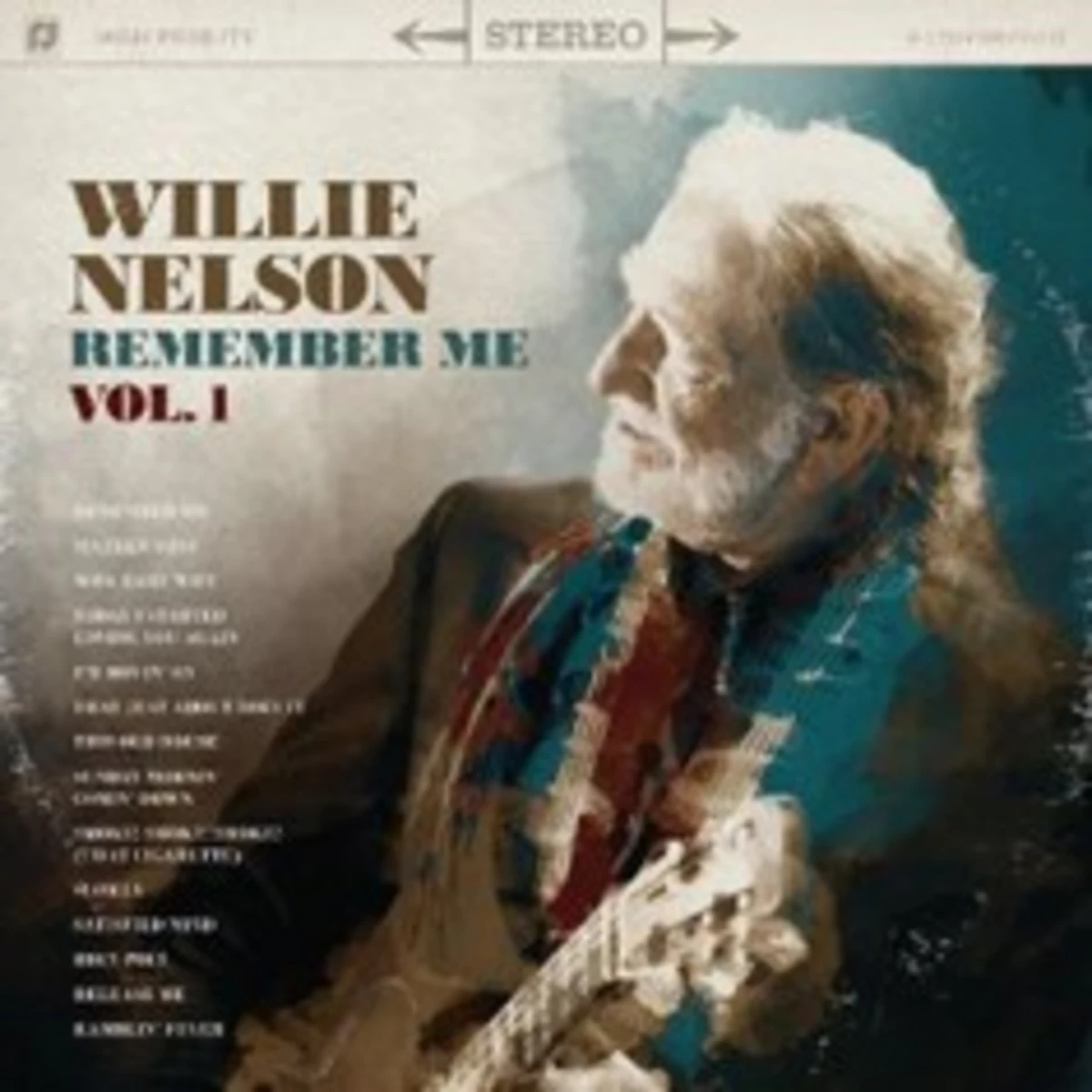

Willie Nelson New Album Release And Family Controversy

Apr 29, 2025

Willie Nelson New Album Release And Family Controversy

Apr 29, 2025

Latest Posts

-

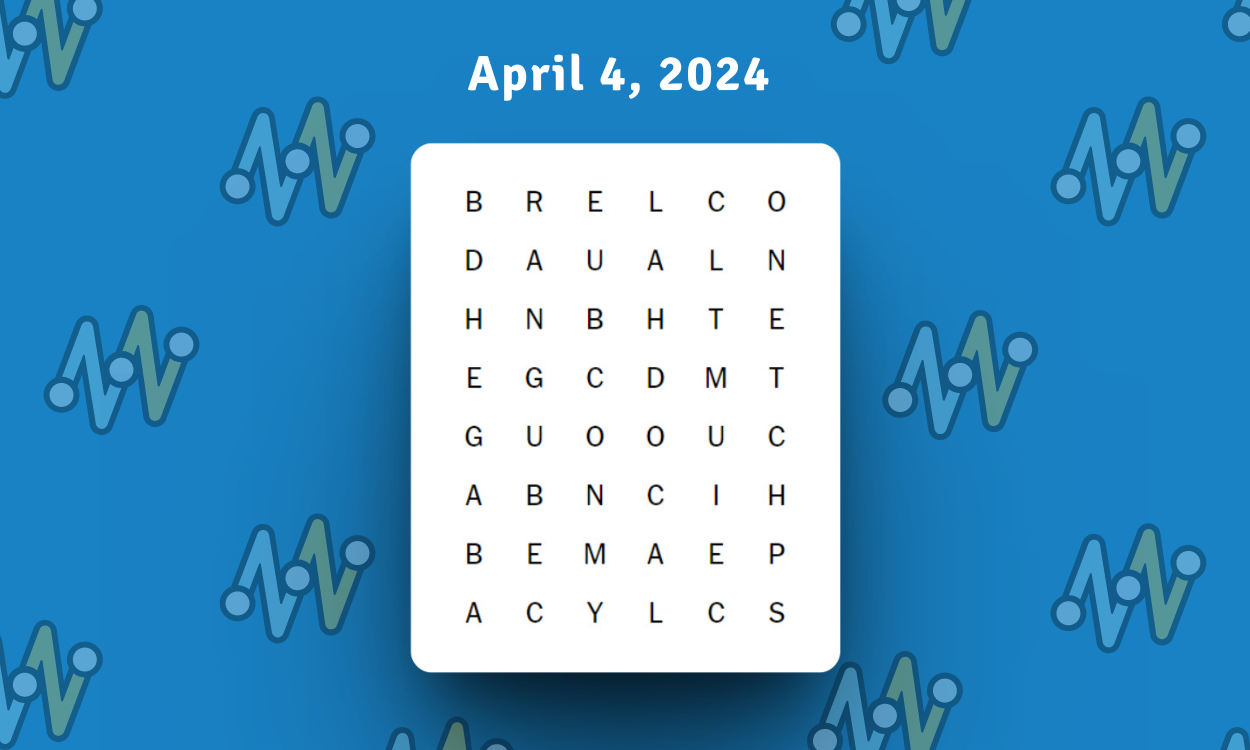

Nyt Strands February 28 2025 Solutions And Spangram

Apr 29, 2025

Nyt Strands February 28 2025 Solutions And Spangram

Apr 29, 2025 -

Nyt Strands Solutions Hints And Answers For March 3 2025

Apr 29, 2025

Nyt Strands Solutions Hints And Answers For March 3 2025

Apr 29, 2025 -

Tuesday April 29th Nyt Strands Answers Game 422

Apr 29, 2025

Tuesday April 29th Nyt Strands Answers Game 422

Apr 29, 2025 -

Nyt Spelling Bee February 25 2025 Hints Answers And The Pangram

Apr 29, 2025

Nyt Spelling Bee February 25 2025 Hints Answers And The Pangram

Apr 29, 2025 -

Solve Nyt Strands Game 422 April 29th Hints And Answers

Apr 29, 2025

Solve Nyt Strands Game 422 April 29th Hints And Answers

Apr 29, 2025