Trump's Trade War: Wall Street Bets On A Brighter Future

Table of Contents

The Initial Shockwaves of Trump's Trade Policies

The imposition of tariffs under Trump's trade policies sent immediate shockwaves through the global economy, creating significant uncertainty for businesses and investors alike.

Market Volatility and Uncertainty

The abrupt introduction of tariffs led to considerable market volatility.

- Stock market dips: Major indices like the Dow Jones Industrial Average and the S&P 500 experienced significant drops in response to escalating trade tensions. For example, the Dow saw a percentage drop of X% in [Month, Year] following a particular tariff announcement. (Note: Replace X% and [Month, Year] with accurate data).

- Increased uncertainty for businesses: Businesses faced challenges in forecasting future costs and planning for investments due to unpredictable tariff changes, impacting production schedules and profitability.

- Impact on specific sectors: Sectors heavily reliant on international trade, such as agriculture and manufacturing, were disproportionately affected. The agricultural sector, for instance, faced significant losses due to retaliatory tariffs imposed by China.

The Flight to Safety

The uncertainty generated by Trump's trade war triggered a "flight to safety" among investors.

- Decreased risk appetite: Investors shifted their investments away from riskier assets like stocks and into safer havens such as government bonds. This reduced capital available for investment in growth sectors.

- Capital flight: Some capital flowed out of the US and into other countries perceived as less vulnerable to trade disputes.

- Impact on international trade relations: Trump's trade war strained relationships with major trading partners, leading to decreased global trade volumes and a slowdown in economic growth worldwide.

Emerging Signs of Resilience and Adaptation

Despite the initial negative impacts, the US economy and businesses demonstrated remarkable resilience and adaptability.

Corporate Restructuring and Innovation

Companies responded to the challenges of Trump's trade war by restructuring their operations and embracing innovation.

- Examples of companies successfully adapting: Many firms diversified their supply chains, sourcing materials from multiple countries to mitigate the risk of tariff disruptions. [Insert specific company examples and how they adapted].

- Technological advancements: The need to navigate trade restrictions spurred investment in automation and technology to enhance efficiency and reduce reliance on specific suppliers.

- Increased domestic investment: Some companies chose to "reshoring," bringing manufacturing and production back to the US, creating new jobs and boosting domestic investment.

Government Intervention and Support

Government interventions played a role in mitigating some of the negative effects of the trade war.

- Specific examples of government programs: The government implemented various support programs aimed at assisting affected industries, including financial aid and tax incentives. [Insert details on specific programs].

- Effectiveness of these interventions: The effectiveness of these programs varied, with some proving more successful than others in shielding industries from the worst impacts of the trade war.

Wall Street's Optimistic Outlook

Despite the initial challenges, several factors contribute to Wall Street's increasingly optimistic outlook.

Long-Term Economic Growth Projections

Positive economic indicators are bolstering investor confidence.

- GDP growth predictions: Economists have projected [Insert percentage]% GDP growth for [Year], indicating a robust economic recovery. (Note: Replace with accurate data).

- Consumer confidence data: Consumer confidence has shown a steady upward trend, suggesting strong domestic demand.

- Job market trends: The job market has remained relatively strong, contributing to positive economic sentiment.

Sector-Specific Opportunities

Specific sectors are poised to benefit from the post-trade war environment.

- Tech: The technology sector is expected to continue its strong growth trajectory, driven by innovation and increasing demand for digital services.

- Renewable energy: Investments in renewable energy are expected to surge, driven by government policies and growing environmental concerns.

- Infrastructure: Increased government spending on infrastructure projects is anticipated to create significant economic opportunities.

Investment Strategies and Opportunities

Wall Street is adopting specific investment strategies to capitalize on future growth.

- Examples of investment vehicles: Investors are focusing on sectors demonstrating strong growth potential, including ETFs focused on technology and renewable energy.

- Specific sectors gaining investor interest: Sectors perceived as less sensitive to trade disruptions are attracting significant investor interest.

Conclusion

Trump's trade war initially dealt a significant blow to Wall Street, causing market volatility and prompting a flight to safety. However, the US economy demonstrated resilience, with businesses adapting to the new landscape through restructuring and innovation. Government interventions also played a role in mitigating some negative impacts. Consequently, Wall Street is increasingly optimistic about the long-term economic outlook, anticipating growth in specific sectors and employing strategies to capitalize on post-trade war opportunities. Understanding the lasting impact of Trump's trade war is crucial for navigating the complexities of today's market. Stay informed, analyze the data, and make informed investment decisions to capitalize on the opportunities emerging from this period of economic transition. Analyzing the effects of Trump’s trade policies and the post-trade war economy requires careful consideration of all factors involved.

Featured Posts

-

Inter Rent Reit Acquisition Details Of The Offer From Executive Chair And Sovereign Wealth Fund

May 29, 2025

Inter Rent Reit Acquisition Details Of The Offer From Executive Chair And Sovereign Wealth Fund

May 29, 2025 -

Did Bryan Cranstons X Files Role Influence Breaking Bad

May 29, 2025

Did Bryan Cranstons X Files Role Influence Breaking Bad

May 29, 2025 -

Winning With Probopass A Pokemon Tcg Pocket Deck Guide

May 29, 2025

Winning With Probopass A Pokemon Tcg Pocket Deck Guide

May 29, 2025 -

Pcc Rokita Analiza Decyzji Dotyczacej Dywidendy

May 29, 2025

Pcc Rokita Analiza Decyzji Dotyczacej Dywidendy

May 29, 2025 -

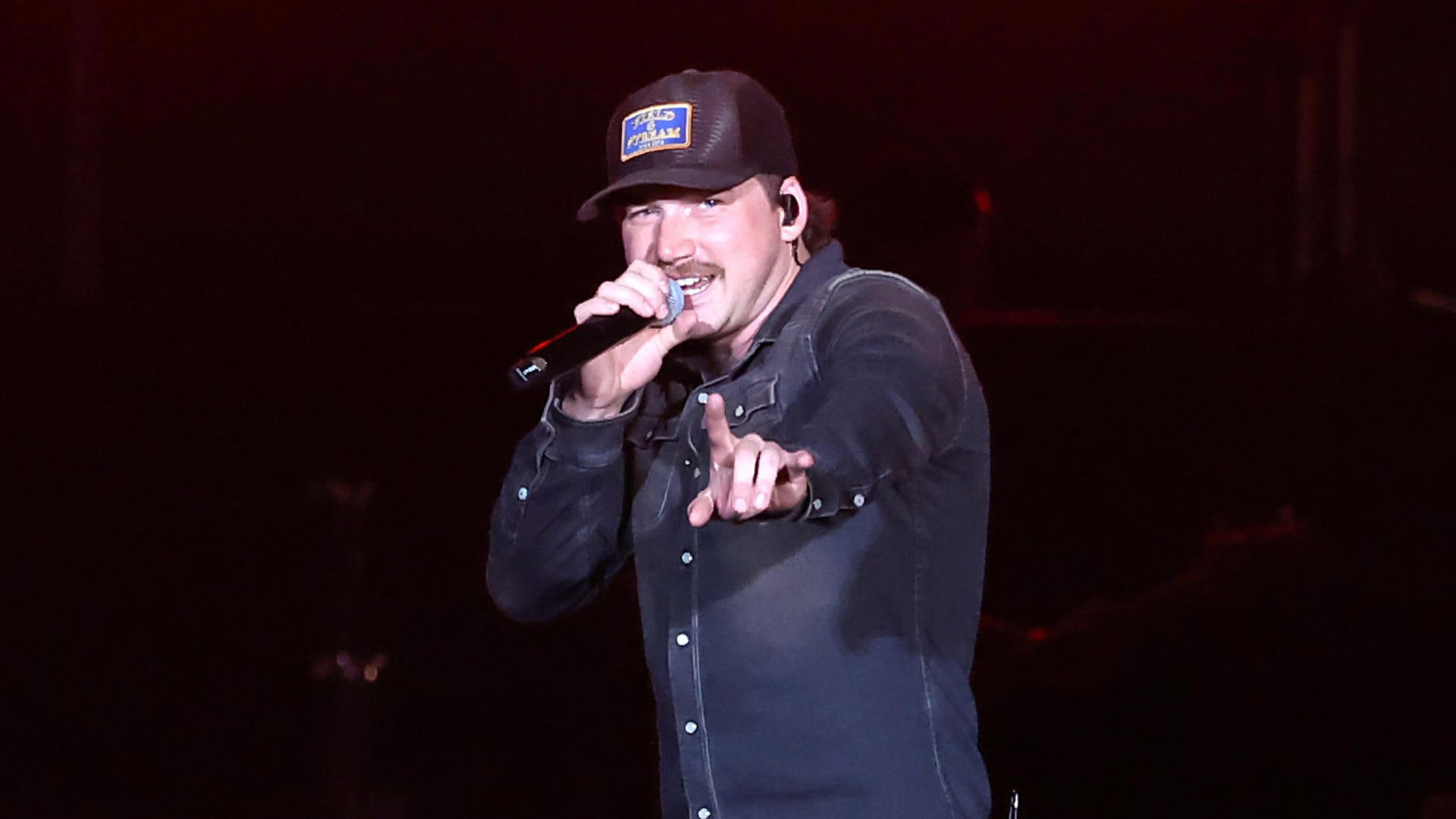

Record Label Sells 200 Million Stake In Morgan Wallens Catalog

May 29, 2025

Record Label Sells 200 Million Stake In Morgan Wallens Catalog

May 29, 2025

Latest Posts

-

Canelo Vs Golovkin Where To Watch Live Results And Play By Play

May 31, 2025

Canelo Vs Golovkin Where To Watch Live Results And Play By Play

May 31, 2025 -

Horoscope May 27 2025 Christine Haas Astrological Insights

May 31, 2025

Horoscope May 27 2025 Christine Haas Astrological Insights

May 31, 2025 -

Munguia Denies Doping Claims After Positive Test Result

May 31, 2025

Munguia Denies Doping Claims After Positive Test Result

May 31, 2025 -

Munguia Denies Doping After Positive Test Result

May 31, 2025

Munguia Denies Doping After Positive Test Result

May 31, 2025 -

Live Stream Canelo Vs Golovkin Fight Results And Play By Play Updates

May 31, 2025

Live Stream Canelo Vs Golovkin Fight Results And Play By Play Updates

May 31, 2025