Two Days Of Crypto Chaos: A Wild Party Report

Table of Contents

The Trigger: A Flash Crash and its Ripple Effects

The crypto chaos began with a sudden and dramatic flash crash, primarily impacting Bitcoin and Ethereum. This unexpected downturn triggered a wave of panic selling across the entire market. The initial event, a significant sell-off by a large institutional investor (rumored, but unconfirmed), sent shockwaves through the cryptocurrency landscape.

- Specific details of the crash: Bitcoin plummeted by 15% within an hour, dragging Ethereum down by 12%. Many altcoins experienced even steeper declines.

- Immediate market reactions: Trading volume surged as panicked investors rushed to liquidate their holdings. The sell-off created a cascading effect, further amplifying the price drops.

- Initial impact on investor sentiment and confidence: The sudden crypto market crash significantly dampened investor sentiment and confidence. Fear and uncertainty spread quickly throughout the community. Many questioned the long-term stability of the crypto market.

The Rollercoaster Continues: A Day of Whiplash

The following day brought little respite. The crypto market continued its volatile trajectory, exhibiting significant price swings throughout the day. While some recovery was seen in the early hours, further sell-offs in the afternoon wiped out much of the initial gains. This extreme crypto volatility made it incredibly difficult for traders to predict market direction.

- Highs and lows of key cryptocurrencies: Bitcoin experienced a 10% recovery, only to see another 5% drop later in the day. Ethereum followed a similar pattern.

- News and announcements that influenced price movements: A rumored regulatory crackdown on stablecoins contributed to the negative sentiment and further price drops. Conversely, news of positive developments in the DeFi space (Decentralized Finance) briefly spurred a modest rally.

- Analysis of trading volume and market capitalization changes: Trading volume remained exceptionally high, indicating continued uncertainty and active participation in the market. Market capitalization saw significant fluctuations, reflecting the extreme price swings.

Winners and Losers: Who Benefited (or Suffered) Most?

The crypto chaos produced both winners and losers. While Bitcoin and Ethereum suffered significantly, some altcoins demonstrated surprising resilience, while others experienced catastrophic losses. This highlights the inherent risk and diverse nature of the cryptocurrency market.

- Performance analysis of specific cryptocurrencies: Bitcoin and Ethereum were among the biggest losers. However, certain privacy coins and meme coins saw unexpected gains, fueled by speculation and increased community interest.

- Reasons for their performance: The performance of individual cryptocurrencies was influenced by a complex interplay of factors, including project-specific developments, technological advancements, and broader market sentiment. Regulatory uncertainty significantly impacted many projects.

- Impact on different investor groups: Day traders experienced significant losses due to the sudden and unpredictable price swings. Long-term holders, on the other hand, demonstrated greater resilience, though still experienced significant paper losses.

The Altcoin Aftermath: How Smaller Cryptos Fared

The altcoin market was particularly hard hit during the crypto chaos. Many smaller cryptocurrencies experienced dramatic price drops, some exceeding 50% within a 24-hour period. This was amplified by the general bearish sentiment following the initial Bitcoin and Ethereum downturn.

- Examples of altcoins with significant price changes: Several DeFi tokens and gaming-related cryptocurrencies saw extreme losses, reflecting the increased risk associated with less established projects.

- Reasons behind their price movements: Many altcoins suffered disproportionately due to their higher volatility and susceptibility to market sentiment shifts. Lack of liquidity also exacerbated the price drops.

Analyzing the Chaos: Potential Causes and Future Implications

The recent "Crypto Chaos" can be attributed to a combination of factors:

- Whale activity and large trades: Large institutional investors (often termed "whales") can significantly influence price movements with large, coordinated trades.

- Regulatory uncertainty and news: Uncertainties surrounding cryptocurrency regulations and potential government crackdowns played a significant role in investor sentiment.

- Technical issues affecting exchanges or blockchain networks: While not directly causing the initial crash, temporary technical glitches on exchanges further exacerbated the situation, adding to the overall panic.

- Market sentiment and speculation: Fear, uncertainty, and doubt (FUD) heavily influenced market sentiment, prompting widespread sell-offs and amplifying the volatility.

Analyzing these factors provides clues for predicting future crypto market movements and navigating potential future instances of crypto chaos. Predicting the future of crypto is difficult, but understanding these driving forces is crucial for informed decision-making.

Conclusion

The past two days have showcased the extreme volatility inherent in the cryptocurrency market. This period of "Crypto Chaos" highlighted the impact of large trades, regulatory uncertainty, and overall market sentiment on crypto prices. Bitcoin and Ethereum suffered, but some altcoins saw unexpected gains, showcasing the complex and dynamic nature of the space. Understanding the interplay of these factors is crucial for navigating future periods of market instability.

Stay informed about the latest developments in the crypto market to navigate future periods of Crypto Chaos. Follow us for insightful analysis and up-to-the-minute reports on cryptocurrency price movements and market trends.

Featured Posts

-

Child Predator Sentenced Interagency Effort Brings Justice

May 04, 2025

Child Predator Sentenced Interagency Effort Brings Justice

May 04, 2025 -

Buduschee Frantsii Reformy I Predstoyaschiy Referendum

May 04, 2025

Buduschee Frantsii Reformy I Predstoyaschiy Referendum

May 04, 2025 -

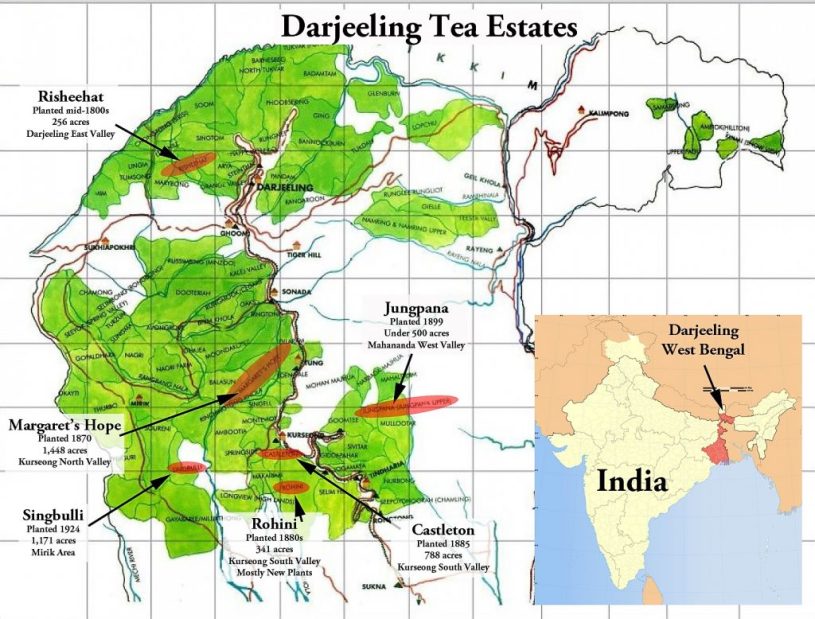

Darjeeling Tea Production Growing Concerns

May 04, 2025

Darjeeling Tea Production Growing Concerns

May 04, 2025 -

Confira A Tabela Oficial Do Brasileirao Serie A 2024 Cbf

May 04, 2025

Confira A Tabela Oficial Do Brasileirao Serie A 2024 Cbf

May 04, 2025 -

Canelo Vs Crawford Al Haymon To Announce Promoter And Platform On May 3rd

May 04, 2025

Canelo Vs Crawford Al Haymon To Announce Promoter And Platform On May 3rd

May 04, 2025