U.S.-China Tariff Reductions: A Comprehensive Economic Analysis

Table of Contents

Historical Context of U.S.-China Tariffs

The history of U.S.-China tariffs is complex, marked by periods of cooperation and intense conflict. The relationship, often characterized by a delicate balance of cooperation and competition, has experienced several major shifts impacting global trade. Understanding this history is key to interpreting the current implications of tariff reductions.

-

The Trump administration's imposition of tariffs (2018-2020): This period saw a significant escalation of the trade war, with both countries imposing tariffs on hundreds of billions of dollars worth of goods. Keywords like trade war and protectionism dominated headlines as bilateral trade suffered. This protectionist approach aimed to address concerns over trade imbalances and intellectual property theft.

-

Subsequent trade negotiations and agreements: The initial wave of tariffs led to intense negotiations, resulting in the "Phase One" trade deal in 2020. This agreement involved some tariff reductions and Chinese commitments to purchase more American goods. However, many tariffs remained in place.

-

The Biden administration's approach to tariffs: The Biden administration has maintained some of the tariffs imposed by the Trump administration while also engaging in further negotiations with China. The focus has shifted towards addressing structural issues, such as intellectual property rights and forced technology transfer, rather than solely focusing on tariff levels. This nuanced approach aims for a more sustainable and balanced trade relationship.

The initial economic consequences of the tariff increases included increased inflation, particularly impacting consumer goods, and significant disruptions to global supply chains. Businesses faced increased costs and uncertainty, leading to reduced investment and slower economic growth in some sectors.

Impact of Tariff Reductions on Specific Sectors

The effects of U.S.-China tariff reductions vary significantly across different sectors. Analyzing these impacts requires a nuanced understanding of each industry's unique position in the global supply chain.

-

Agriculture (soybeans, pork): U.S. farmers, particularly soybean and pork producers, experienced significant losses during the tariff dispute. Reductions in tariffs have led to increased exports to China, boosting farm incomes and benefiting Chinese consumers through lower prices.

-

Manufacturing (electronics, textiles): The tariff war disrupted global manufacturing supply chains, leading to higher production costs and uncertainty. Tariff reductions can lead to a re-shuffling of production locations, as businesses reassess the cost-benefit of sourcing from China versus other regions. Keywords like import tariffs and export tariffs are crucial in understanding these shifts.

-

Technology (semiconductors, telecommunications): The technology sector has been significantly affected by the trade tensions, with implications for technological innovation and competition. Tariff reductions could ease some of the pressures on companies, but geopolitical considerations regarding technology dominance remain a significant factor. Supply chain resilience has become a crucial consideration in this sector.

The overall impact on manufacturing highlights the interconnected nature of global trade and the ripple effect of tariff adjustments.

Macroeconomic Consequences of U.S.-China Tariff Reductions

Reduced tariffs have broad macroeconomic implications for both the U.S. and China, affecting various aspects of their economies.

-

Inflationary pressures: Tariff reductions can help mitigate inflationary pressures by lowering the cost of imported goods. However, other factors, such as supply chain bottlenecks and energy prices, also influence inflation.

-

Economic growth: Reduced trade barriers can stimulate economic growth by increasing trade volumes and promoting efficiency. However, the magnitude of this effect depends on various factors, including the extent of the tariff reductions and the overall global economic environment. Analyzing GDP growth is crucial for assessing the impact.

-

Investment flows: Tariff reductions can lead to increased foreign direct investment (FDI) and portfolio investment as businesses gain greater confidence in the stability of the trading relationship. Monitoring foreign investment trends is a key indicator of the economic effects.

Analyzing these macroeconomic indicators provides a holistic view of the overall impact of tariff adjustments on both national economies.

Geopolitical Implications of Reduced Tensions

The U.S.-China trade relationship extends far beyond simple economic considerations. It has significant geopolitical implications, influencing global stability and the balance of power.

-

Impact on global trade agreements and multilateral institutions (WTO): The trade war raised concerns about the future of the World Trade Organization (WTO) and other multilateral trade agreements. Reduced tensions can help restore confidence in these institutions and promote a rules-based trading system.

-

Influence on the relationship between the two superpowers: The trade relationship is closely intertwined with broader geopolitical competition between the U.S. and China. Tariff reductions can contribute to de-escalation and potentially improve overall bilateral relations. Improved bilateral relations contribute to geopolitical stability.

-

Potential effects on other countries involved in global trade: The U.S.-China trade relationship has significant spillover effects on other countries. Changes in tariffs can impact global supply chains, investment flows, and competitiveness. Analyzing the impact on global trade relations and international trade agreements is crucial.

Conclusion

U.S.-China tariff reductions have had varied and complex impacts on different sectors and the global economy. While reductions can ease inflationary pressures, stimulate economic growth, and improve geopolitical stability, the full consequences are still unfolding. Positive effects include increased trade volume and reduced costs for consumers in both countries. Negative consequences could involve disruptions to established supply chains and challenges to certain domestic industries.

Further research and monitoring of U.S.-China trade relations are crucial for understanding the ongoing implications of tariff reductions and predicting future trends. Stay informed on developments in U.S.-China tariff reductions and their impact on the global economic landscape. Continuously analyze the effects of these adjustments on various sectors to make informed business decisions. Understanding the nuances of these adjustments is critical for navigating the complexities of global trade and ensuring economic prosperity.

Featured Posts

-

Romska Glasba V Prekmurju Tradicija Muzikantov

May 13, 2025

Romska Glasba V Prekmurju Tradicija Muzikantov

May 13, 2025 -

Federal Judge Allows Irs Data Use To Track Undocumented Immigrants

May 13, 2025

Federal Judge Allows Irs Data Use To Track Undocumented Immigrants

May 13, 2025 -

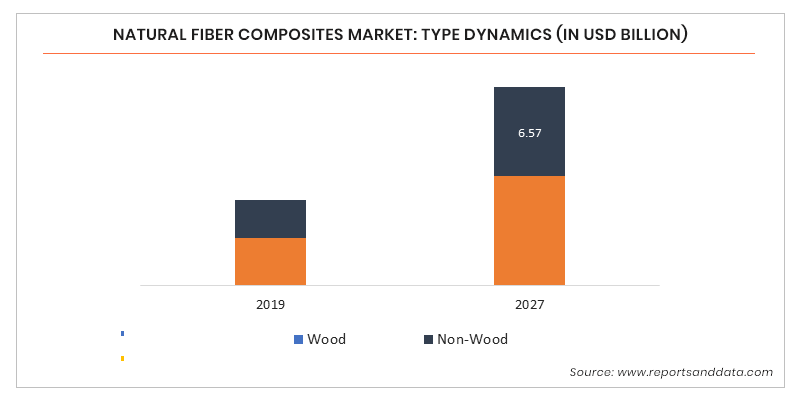

2029 Natural Fiber Composites Market Outlook Drivers Challenges And Future Trends

May 13, 2025

2029 Natural Fiber Composites Market Outlook Drivers Challenges And Future Trends

May 13, 2025 -

The Nightmare In Gaza Families Of Hostages Endure Prolonged Suffering

May 13, 2025

The Nightmare In Gaza Families Of Hostages Endure Prolonged Suffering

May 13, 2025 -

Create Your Own Doom Themed Waiting Room Playlist A Guide For Dark Ages Fans

May 13, 2025

Create Your Own Doom Themed Waiting Room Playlist A Guide For Dark Ages Fans

May 13, 2025