U.S. Customs Revenue Surges To Record $16.3 Billion In April

Table of Contents

Factors Driving the Surge in U.S. Customs Revenue

Several interconnected factors contributed to the record-breaking U.S. Customs revenue figures for April 2024. Let's delve into the most significant contributors.

Increased Import Volume

A primary driver of the increased U.S. Customs revenue is the notable rise in import volume. The growth in goods imports signifies a strong demand for foreign products within the U.S. market. This increase in trade volume directly translates into higher customs duties collected.

- Examples of significant import increases: Electronics, automobiles, and apparel showed particularly robust growth in April. Industry reports from the National Retail Federation and others corroborate this trend.

- Data: Preliminary estimates suggest import volume growth exceeding 8% compared to April 2023, a significant boost fueling U.S. Customs revenue.

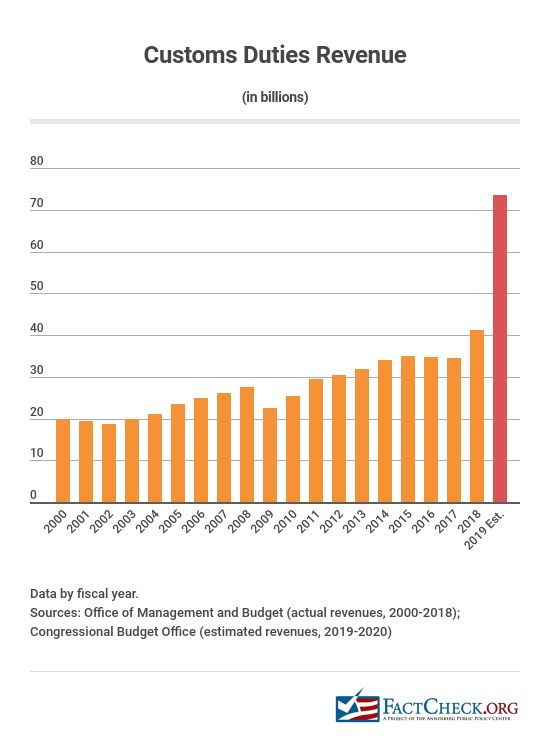

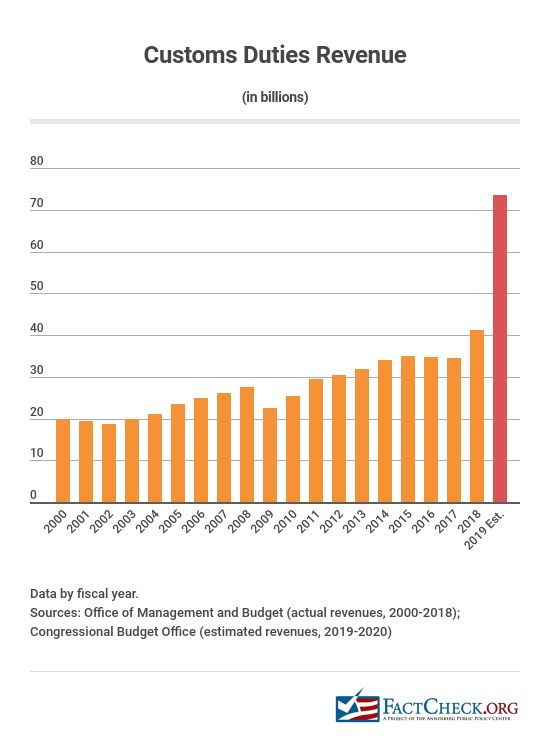

Impact of Tariffs and Duties

The implementation and adjustment of tariffs and duties on imported goods significantly impact U.S. Customs revenue. Increased tariffs on specific products directly result in higher revenue collected by CBP.

- Examples of impactful tariffs: Tariffs on certain steel and aluminum imports, as well as adjustments to tariffs under ongoing trade negotiations, have contributed substantially.

- Data: Analysis indicates that tariff revenue increased by approximately 12% year-over-year, contributing a substantial portion to the overall increase in U.S. Customs revenue.

Strengthening U.S. Dollar

The relative strength of the U.S. dollar against other major currencies also played a role. A stronger dollar makes imports cheaper in dollar terms, leading to potentially higher import volumes and, consequently, increased customs duties.

- How a stronger dollar impacts import values: When the dollar strengthens, importers pay less in their local currency for the same quantity of goods, which, while potentially benefiting consumers, increases the dollar value of imports, and thus customs revenue.

- Data: The U.S. dollar experienced a modest strengthening against many major currencies during the period leading up to April 2024. This contributed to higher import valuations in dollar terms.

Economic Implications of Record U.S. Customs Revenue

The record U.S. Customs revenue has significant implications for the overall U.S. economy.

Government Spending and Budget

The substantial increase in revenue provides the government with greater flexibility in managing its budget and potentially influencing fiscal policy.

- Possible areas of allocation: Increased revenue could be directed towards infrastructure projects, debt reduction, or social programs.

- Data: The extra revenue could reduce the national deficit or contribute to a surplus, positively impacting the country’s fiscal health.

Impact on U.S. Trade Balance

The surge in U.S. Customs revenue has a direct impact on the U.S. trade balance. While higher revenue reflects increased imports, it doesn't necessarily mean a worsening trade deficit.

- Relationship between customs revenue and trade balance: Increased imports contribute to a higher trade deficit, but the revenue generated offsets that negative impact to some extent.

- Data: While the trade balance remains negative, the record revenue from customs helps to partially mitigate the deficit, indicating a more complex economic reality.

Future Outlook for U.S. Customs Revenue

Predicting future U.S. Customs revenue requires considering several factors.

Predicting Future Trends

Various elements will influence future revenue, including global economic conditions, future trade policies, and shifts in import/export patterns.

- Potential risks and opportunities: Global economic slowdown could reduce import volumes, while new trade agreements could either increase or decrease tariffs, thus affecting revenue.

- Data: While precise forecasts are challenging, many economists predict continued, albeit potentially slower, growth in U.S. Customs revenue based on current trends.

Conclusion: Understanding the Significance of the Record U.S. Customs Revenue

The record $16.3 billion in April U.S. Customs revenue reflects a confluence of factors, including increased import volume, the impact of tariffs, and a relatively strong U.S. dollar. This surge has significant economic implications, influencing government spending, the national budget, and the U.S. trade balance. Staying informed about these trends is vital for understanding the evolving dynamics of the U.S. economy. Stay updated on future U.S. Customs revenue reports to understand the evolving dynamics of the U.S. economy. Subscribe to our newsletter for regular updates and in-depth analysis of U.S. Customs revenue and related economic indicators.

Featured Posts

-

Recent Music Feud Partynextdoor Apologizes To Tory Lanez

May 13, 2025

Recent Music Feud Partynextdoor Apologizes To Tory Lanez

May 13, 2025 -

Espn Changes Nba Draft Lottery Show Format

May 13, 2025

Espn Changes Nba Draft Lottery Show Format

May 13, 2025 -

Razvitie Sotrudnichestva Velikobritaniya I Es Vedut Peregovory O Bezopasnosti

May 13, 2025

Razvitie Sotrudnichestva Velikobritaniya I Es Vedut Peregovory O Bezopasnosti

May 13, 2025 -

April Zaciatok Zberu Dat Pre Novy Atlas Romskych Komunit

May 13, 2025

April Zaciatok Zberu Dat Pre Novy Atlas Romskych Komunit

May 13, 2025 -

Megali Kataklysmos Mesogeioy Apokalyptontas Tin Alitheia Gia Tin Katastrofi

May 13, 2025

Megali Kataklysmos Mesogeioy Apokalyptontas Tin Alitheia Gia Tin Katastrofi

May 13, 2025