U.S. Dollar Performance: A Troubling First 100 Days Compared To Nixon Era

Table of Contents

The Nixon Shock and its Long-Term Impact on U.S. Dollar Performance

The Nixon Shock, referring to President Richard Nixon's August 15, 1971, decision to unilaterally suspend the convertibility of the U.S. dollar to gold, remains a landmark event in economic history. This action effectively ended the Bretton Woods system, a post-World War II monetary management system that pegged the value of most currencies to the dollar, which in turn was backed by gold.

The 1971 Gold Standard Suspension:

Nixon's decision, driven by concerns about unsustainable U.S. trade deficits and inflation, sent shockwaves through the global financial system. The immediate consequences were dramatic:

- Weakening of the dollar's value relative to other currencies: The dollar's value plummeted against major currencies like the German mark and the Japanese yen.

- Increased inflation and economic uncertainty: The decoupling from gold led to increased uncertainty and fueled inflationary pressures globally.

- Long-term shift to a fiat currency system: The Nixon Shock marked a transition to a global system based on fiat currencies—currencies whose value is not backed by a physical commodity like gold.

- Creation of the floating exchange rate system: The fixed exchange rate system was abandoned, leading to the current system of floating exchange rates, where currency values are determined by supply and demand in the foreign exchange market.

Long-Term Effects of the Nixon Shock on the Global Economy:

The Nixon Shock's legacy extends far beyond the immediate aftermath. It fundamentally reshaped the international monetary system, ushering in an era of increased volatility and complexity in currency markets. The floating exchange rate system, while offering greater flexibility, also introduced new risks and challenges for policymakers. The event highlighted the limitations of fixed exchange rate systems and the inherent risks associated with managing national currencies. The subsequent decades witnessed periods of both significant growth and instability, shaped in no small part by the changes introduced by the Nixon Shock. Understanding this historical context is crucial to analyzing current trends in U.S. dollar performance.

Comparing the First 100 Days of [Current Year/Period] to the Nixon Era

Analyzing the first 100 days of [Current Year/Period] reveals striking parallels with the economic climate preceding the Nixon Shock.

Key Economic Indicators:

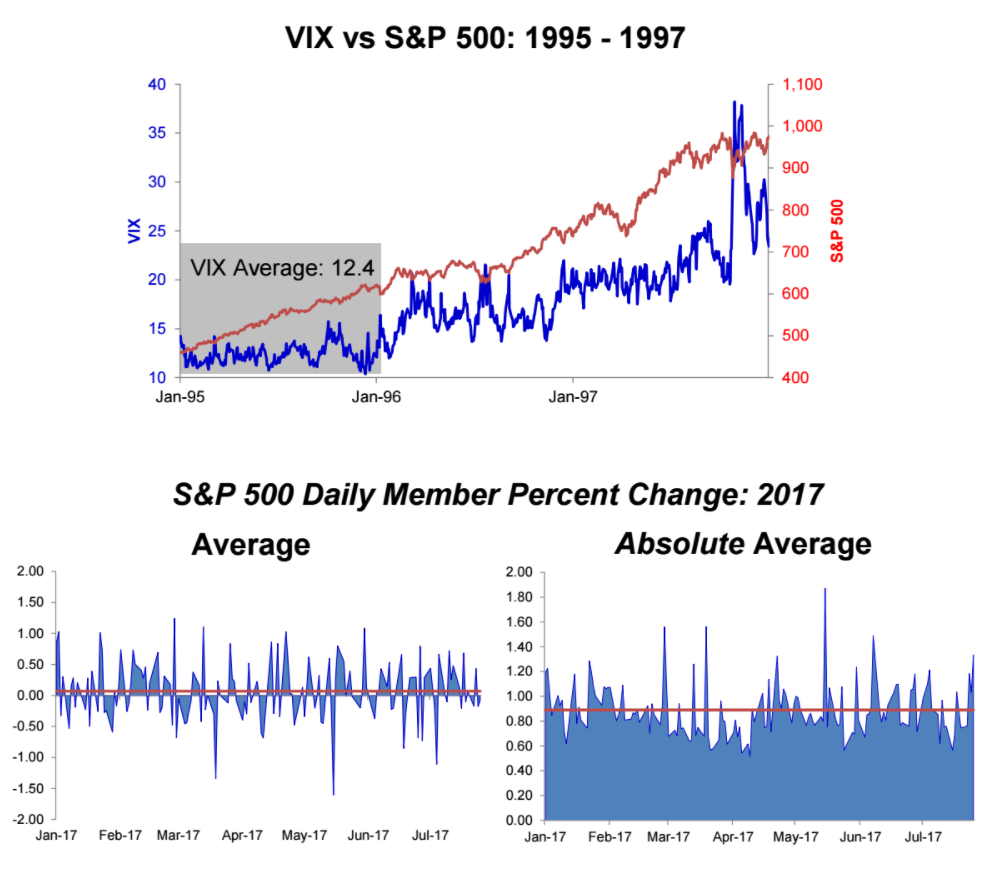

Several key economic indicators show a concerning resemblance between the two periods. [Insert comparative charts and graphs here showing inflation rates, interest rates, unemployment rates, and the value of the U.S. dollar for both periods]. For instance, both periods witnessed:

- Rising inflation: [Provide specific data comparing inflation rates in both periods].

- Declining dollar value: [Provide specific data comparing the dollar's value against major currencies].

- [Add other relevant parallel trends, supported by data].

Geopolitical Parallels:

Geopolitical factors also mirror the situation leading up to the Nixon Shock. [Current Year/Period] has seen [mention specific geopolitical events, e.g., rising tensions with major powers, trade wars, etc.], much like the period leading up to 1971 which featured [mention relevant geopolitical events from the Nixon era]. This global instability has contributed to the uncertainty surrounding U.S. dollar performance.

- Comparison of major global conflicts or tensions: [Detailed comparison of geopolitical situations].

- Analysis of international trade relationships and policies: [Discussion of trade agreements and their impacts].

- Impact of these factors on currency exchange rates: [Explain how geopolitical events influenced currency values].

Potential Future Scenarios for U.S. Dollar Performance

Understanding the historical parallels allows us to project potential future scenarios for U.S. dollar performance.

Risk Factors:

Several risk factors threaten the U.S. dollar's stability, echoing the challenges faced during the Nixon era:

- Ongoing inflation and rising interest rates: Persistently high inflation could erode the dollar's purchasing power and further weaken its value.

- Geopolitical instability and its impact on the global economy: Escalating international tensions could trigger capital flight and negatively impact the dollar's value.

- Potential shifts in international trade relations: Changes in global trade patterns could affect the demand for the U.S. dollar.

Mitigation Strategies:

Mitigating these risks requires a multi-pronged approach:

- Monetary policy adjustments by the Federal Reserve: The Federal Reserve could use monetary policy tools, such as interest rate adjustments, to control inflation and stabilize the dollar.

- Fiscal policy changes by the government: Government spending and taxation policies can influence economic growth and inflation, thereby indirectly affecting the dollar's value.

- International cooperation to stabilize global financial markets: Cooperation among major economies is crucial to manage global economic shocks and prevent currency crises.

Conclusion: Understanding the Troubling Trajectory of U.S. Dollar Performance

The parallels between the current economic climate and the period leading up to the Nixon Shock are striking. Rising inflation, geopolitical uncertainties, and weakening U.S. dollar performance all point towards a troubling trajectory. Understanding this historical context is crucial to anticipating and mitigating future economic risks. The lessons of the Nixon era underscore the importance of proactive policymaking and international cooperation in maintaining the stability of the U.S. dollar and the global financial system. Stay informed on the ever-changing landscape of U.S. dollar performance by following our blog for the latest updates and analysis.

Featured Posts

-

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025 -

Understanding The Volatility Of Gpu Prices

Apr 28, 2025

Understanding The Volatility Of Gpu Prices

Apr 28, 2025 -

The China Factor How Its Affecting Luxury Car Brands Like Bmw And Porsche

Apr 28, 2025

The China Factor How Its Affecting Luxury Car Brands Like Bmw And Porsche

Apr 28, 2025 -

The Overseas Highway A Historic Drive Through The Florida Keys

Apr 28, 2025

The Overseas Highway A Historic Drive Through The Florida Keys

Apr 28, 2025 -

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025

Latest Posts

-

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025