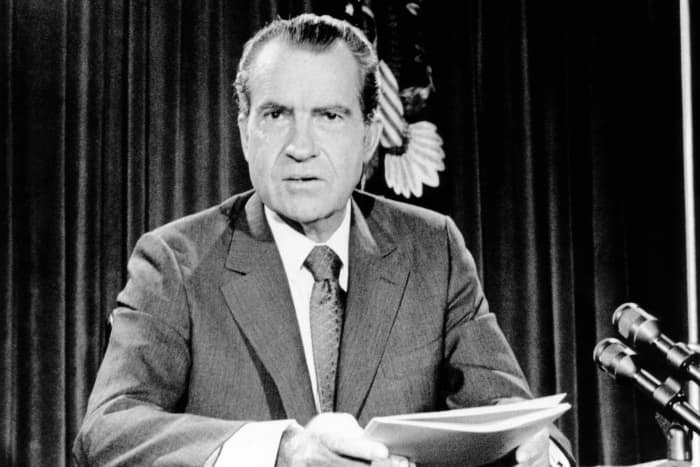

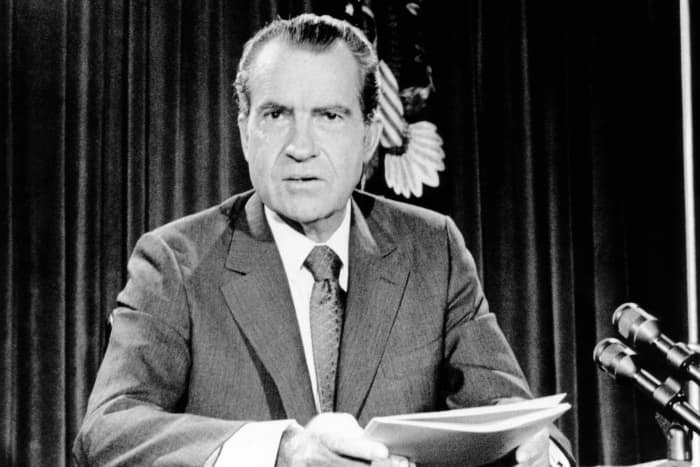

U.S. Dollar: Worst Start Since Nixon? Analyzing The First 100 Days

Table of Contents

The U.S. Dollar's Performance in the First 100 Days

Key Economic Indicators

The first 100 days have witnessed a mixed bag of economic indicators impacting the U.S. dollar's value. Several factors are at play, creating a complex picture.

- Inflation: The inflation rate stands at [insert current inflation rate]% (e.g., 3.2%), a [increase/decrease] compared to the previous year. This relatively high inflation erodes the purchasing power of the dollar, potentially weakening its value against other currencies.

- Interest Rates: The Federal Funds Rate currently sits at [insert current Federal Funds Rate]% (e.g., 5.0%), reflecting the Federal Reserve's efforts to curb inflation. Higher interest rates generally attract foreign investment, strengthening the dollar, but can also slow economic growth.

- GDP Growth: The U.S. GDP growth rate for the first quarter of [insert year] is reported at [insert current GDP growth rate]% (e.g., 2.0%), signaling [strong/weak] economic performance. Strong growth typically bolsters the dollar's value, while slower growth can weaken it.

- Economic Policies: The current administration's fiscal and monetary policies, including [mention specific policies and their potential impact on the dollar], significantly influence the dollar's trajectory. These policies' effectiveness in managing inflation and stimulating growth will directly impact the U.S. dollar’s strength.

Geopolitical Factors

Geopolitical events significantly impact investor confidence and the value of the U.S. dollar. Recent developments include:

- [Geopolitical Event 1]: The [brief description of event] has introduced [positive/negative] uncertainty into the global market, affecting investor sentiment toward the dollar.

- [Geopolitical Event 2]: Escalating tensions in [region] have increased risk aversion, potentially leading to a flight to safety and increased demand for the U.S. dollar as a safe-haven asset.

- [Geopolitical Event 3]: Changes in international trade relations and the potential for [trade wars/agreements] will impact the flow of capital and the overall strength of the dollar. These uncertainties can lead to increased volatility in the foreign exchange market.

Market Sentiment and Investor Behavior

Market sentiment toward the U.S. dollar is currently [optimistic/pessimistic/mixed]. Several factors contribute to this sentiment:

- Speculation: Currency speculation and hedging strategies significantly influence the dollar's daily fluctuations. Large institutional investors' actions can create significant short-term volatility.

- Foreign Exchange Reserves: Central banks around the world hold substantial U.S. dollar reserves, making it a crucial global currency. Shifts in these reserves can impact the dollar's value.

- Capital Flows: The flow of capital into and out of the United States directly influences the supply and demand for the U.S. dollar. Increased foreign investment strengthens the dollar, while capital outflows weaken it.

Comparing to the Post-Nixon Shock Era

Historical Context of the Nixon Shock

President Nixon's closure of the gold window in August 1971 ended the Bretton Woods system, a fixed exchange rate regime. This decision allowed the U.S. dollar to float freely against other currencies, leading to significant volatility and a period of considerable uncertainty. The dollar's value depreciated substantially in the following years.

Parallel Trends and Divergences

Comparing the current situation to the post-Nixon period reveals both similarities and differences:

- Similarities: Both periods feature significant global uncertainty, impacting investor confidence. In both cases, inflation and interest rate adjustments play a crucial role in shaping the dollar’s value.

- Differences: The global financial landscape has changed dramatically since 1971. The emergence of the Euro and the rise of China as a global economic power are key differences, altering the dynamics of the foreign exchange market. Furthermore, the tools available to central banks for managing currency exchange are more sophisticated today.

Lessons Learned from the Past

The post-Nixon shock era highlights the crucial role of effective monetary policy in maintaining the stability of the U.S. dollar. The experience underscores the potential risks of prolonged periods of high inflation and the importance of managing expectations in the foreign exchange market. This history offers valuable lessons for policymakers today regarding the need for transparency, coordination, and proactive management of the U.S. dollar in a volatile global environment.

Conclusion

The U.S. dollar's performance in its first 100 days under the current conditions presents a complex picture, with similarities and differences to the turbulent post-Nixon shock era. Economic indicators like inflation and interest rates, combined with geopolitical events and investor sentiment, continue to heavily influence the dollar's value. While not a direct parallel to the Nixon shock, the current volatility underscores the importance of carefully monitoring these interconnected factors. Stay updated on the latest U.S. dollar trends and monitor the U.S. dollar's performance closely to navigate this dynamic global market. Learn more about the factors affecting the U.S. dollar to make informed financial decisions.

Featured Posts

-

Key Factors Contributing To Tylor Megills Success With The New York Mets

Apr 29, 2025

Key Factors Contributing To Tylor Megills Success With The New York Mets

Apr 29, 2025 -

Nyt Spelling Bee February 12 2025 Answers Clues And Pangram

Apr 29, 2025

Nyt Spelling Bee February 12 2025 Answers Clues And Pangram

Apr 29, 2025 -

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Auto Brands

Apr 29, 2025

The China Factor Analyzing The Difficulties Faced By Premium Auto Brands

Apr 29, 2025 -

Australias Lynas Seeking Us Assistance For Texas Rare Earths Refinery

Apr 29, 2025

Australias Lynas Seeking Us Assistance For Texas Rare Earths Refinery

Apr 29, 2025

Latest Posts

-

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025 -

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers A Trend Analysis

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers A Trend Analysis

Apr 29, 2025 -

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025