U.S. Dollar's First 100 Days Under [President's Name]: A Troubling Trend?

![U.S. Dollar's First 100 Days Under [President's Name]: A Troubling Trend? U.S. Dollar's First 100 Days Under [President's Name]: A Troubling Trend?](https://ideatankforkids.com/image/u-s-dollars-first-100-days-under-presidents-name-a-troubling-trend.jpeg)

Table of Contents

Main Points:

Inflation and the U.S. Dollar's Value:

Rising Inflationary Pressures:

Inflation significantly impacts the U.S. dollar's purchasing power, both domestically and internationally. A weakening dollar reduces its ability to buy goods and services globally, diminishing its value relative to other currencies.

- Consumer Price Index (CPI): The CPI saw a substantial increase in the first 100 days, indicating a rise in the cost of goods and services for consumers.

- Producer Price Index (PPI): Similarly, the PPI reflected increased costs for producers, potentially leading to further price hikes for consumers.

- Impact on Consumer Spending: Rising inflation erodes consumer purchasing power, potentially slowing economic growth. Consumers may postpone purchases or reduce spending on discretionary items.

- Potential for Wage Increases: While wage increases can help offset inflation, they can also fuel a wage-price spiral, leading to further inflation and potentially weakening the dollar.

Federal Reserve Response:

The Federal Reserve's response to inflation is crucial in determining the dollar's strength. Their actions influence interest rates, impacting investor confidence and capital flows.

- Interest Rate Hikes: The Fed initiated a series of interest rate hikes to curb inflation. Higher interest rates can attract foreign investment, increasing demand for the dollar.

- Quantitative Easing (QE): While QE was largely phased out before this period, the potential for future QE measures could weaken the dollar by increasing the money supply.

- Communication Strategy: The clarity and effectiveness of the Fed's communication regarding its monetary policy significantly influence market expectations and the dollar's value.

International Comparison:

Comparing U.S. inflation rates with other major economies reveals the relative strength of the dollar.

- Exchange Rate Fluctuations against the Euro: The dollar's exchange rate against the Euro fluctuated based on the relative performance of the U.S. and Eurozone economies.

- Exchange Rate Fluctuations against the Yen: Similarly, the dollar's value relative to the Japanese Yen reflected the economic conditions in both countries.

- Exchange Rate Fluctuations against the Pound: Fluctuations against the British Pound were also influenced by Brexit-related uncertainties and economic conditions in the UK.

Impact of President Biden's Economic Policies:

Fiscal Policy Changes:

President Biden's fiscal policies, including spending initiatives and tax policies, significantly impact the U.S. economy and the dollar's value.

- American Rescue Plan: This significant spending package aimed to stimulate the economy but also raised concerns about potential inflationary pressures.

- Infrastructure Investment and Jobs Act: This long-term infrastructure plan could boost economic growth but also increase the national debt, potentially affecting the dollar's value.

- Tax Policies: Changes to tax rates and deductions can affect consumer spending and business investment, influencing economic growth and the dollar's strength.

Trade Policies and International Relations:

Trade policies and international relations play a significant role in shaping investor confidence and influencing the dollar's value.

- Trade Agreements: Negotiations and revisions of existing trade agreements can affect the balance of trade, impacting the dollar's demand.

- Tariffs: The imposition of tariffs on imported goods can lead to retaliatory measures from other countries, negatively impacting trade relations and potentially weakening the dollar.

- International Relations: Positive international relations and strong alliances generally contribute to a stronger dollar, while geopolitical tensions can lead to uncertainty and a weakening dollar.

Geopolitical Factors:

Geopolitical events influence investor confidence and global capital flows, thus affecting the dollar's value.

- International Conflicts: Escalating conflicts can create uncertainty and lead to a "flight to safety," potentially boosting the dollar's value as a safe haven asset.

- Political Instability: Political instability in other countries can lead to capital flows into the U.S., strengthening the dollar.

Market Sentiment and Investor Confidence:

Investor Reactions:

Investor reactions to economic policies and overall economic climate directly influence the dollar's value.

- Stock Market Performance: A strong stock market generally reflects positive investor sentiment and can contribute to a stronger dollar.

- Bond Yields: Changes in bond yields reflect investor expectations of future interest rates and inflation, influencing the dollar's value.

- Flight to Safety: During times of uncertainty, investors often seek safe haven assets like the U.S. dollar, increasing its demand.

- Capital Flows: Capital flows into and out of the U.S. significantly impact the supply and demand for the dollar.

Currency Market Volatility:

High volatility in the foreign exchange market reflects uncertainty and risk aversion, which can negatively impact the dollar.

- Daily/Weekly Fluctuations: The magnitude of daily and weekly fluctuations in the dollar's value indicates the level of uncertainty in the market.

Expert Opinions:

Analyzing expert opinions from reputable economic analysts provides valuable insights into the future trajectory of the dollar.

- Consensus Forecasts: Summarizing the consensus forecasts from leading economic institutions and analysts offers a valuable perspective.

- Divergent Views: Highlighting differing perspectives from experts helps to paint a comprehensive picture of market sentiment.

Conclusion: The U.S. Dollar's Future Under President Biden – A Call to Action

The first 100 days of President Biden's administration presented a mixed bag for the U.S. dollar. While the initial decrease against major currencies raises concerns, the impact of rising inflation, evolving economic policies, and fluctuating market sentiment remains complex and requires continuous monitoring. Whether this represents a "troubling trend" depends on the ongoing interplay of these factors. The Federal Reserve's response to inflation and the implementation of President Biden's economic agenda will be crucial in shaping the dollar's future trajectory. Stay informed about the U.S. dollar's performance during President Biden's presidency by following reputable financial news sources and continuing to analyze the economic indicators discussed in this article. Understanding these intricate dynamics is vital for informed decision-making in the ever-evolving global financial landscape.

![U.S. Dollar's First 100 Days Under [President's Name]: A Troubling Trend? U.S. Dollar's First 100 Days Under [President's Name]: A Troubling Trend?](https://ideatankforkids.com/image/u-s-dollars-first-100-days-under-presidents-name-a-troubling-trend.jpeg)

Featured Posts

-

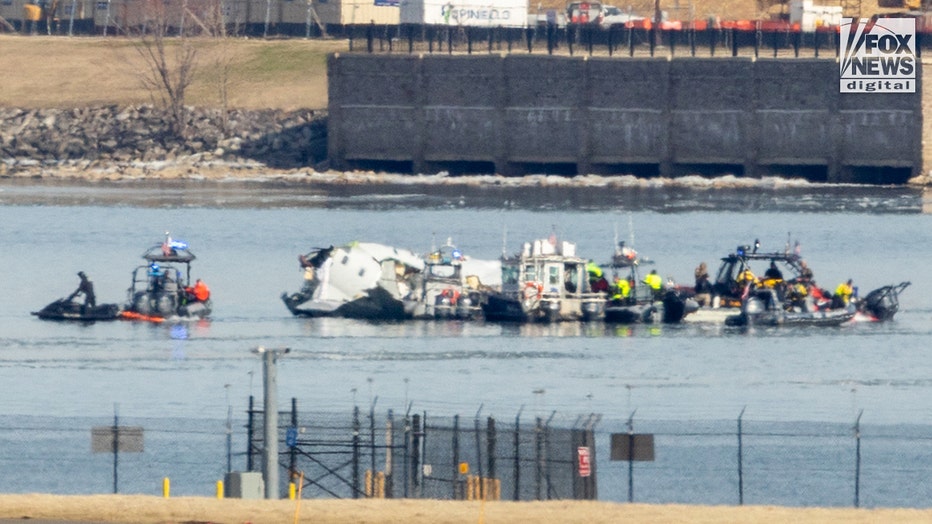

The Dangers Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025

The Dangers Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025 -

Legal Showdown Us Attorney General And Minnesota Clash Over Transgender Athlete Policy

Apr 29, 2025

Legal Showdown Us Attorney General And Minnesota Clash Over Transgender Athlete Policy

Apr 29, 2025 -

Bob Dylan Billy Strings Join Willie Nelsons Outlaw Music Festival In Portland This Spring

Apr 29, 2025

Bob Dylan Billy Strings Join Willie Nelsons Outlaw Music Festival In Portland This Spring

Apr 29, 2025 -

Alan Cummings Favorite Scottish Childhood Pastime Revealed By Cnn

Apr 29, 2025

Alan Cummings Favorite Scottish Childhood Pastime Revealed By Cnn

Apr 29, 2025 -

The Mets Rotation Debate Is Pitchers Name The Answer

Apr 29, 2025

The Mets Rotation Debate Is Pitchers Name The Answer

Apr 29, 2025

Latest Posts

-

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025 -

Trump To Issue Full Pardon For Rose Latest Updates

Apr 29, 2025

Trump To Issue Full Pardon For Rose Latest Updates

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025 -

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025 -

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025