U.S. Federal Reserve Holds Steady: Rate Pause Amidst Growing Economic Pressures

Table of Contents

The Rationale Behind the Rate Pause

The Federal Reserve's decision to pause interest rate hikes reflects a careful balancing act between combating inflation and mitigating the risk of a recession. Several key factors contributed to this strategic shift.

Inflationary Pressures Easing

While inflation remains a concern, recent data suggests inflationary pressures are easing. The Consumer Price Index (CPI) and Producer Price Index (PPI), key indicators of inflation, have shown signs of slowing down.

- Declining Energy Prices: A decrease in global energy prices has contributed to lower inflation across various sectors.

- Easing Supply Chain Bottlenecks: Improved supply chain efficiency, though not completely resolved, has reduced inflationary pressures stemming from shortages.

- Impact of Previous Rate Hikes: The cumulative effect of previous interest rate increases is starting to manifest in slower economic growth, which in turn is impacting inflation. The lag effect of monetary policy is a crucial factor to consider in assessing the impact of past rate hikes on the current inflation rate.

The reduction in the inflation rate, while still above the Fed's target, indicates a potential for price stability in the coming months, supporting the decision to pause rate hikes.

Growing Recessionary Fears

Despite the easing of inflation, the risk of a recession remains significant. Several economic indicators point towards a potential economic slowdown.

- GDP Growth Slowdown: Recent GDP growth figures have been weaker than expected, signaling a potential contraction in the near future.

- Rising Unemployment Claims: An increase in unemployment claims suggests a weakening labor market, a typical precursor to a recession.

- Decreased Consumer Confidence: Consumer confidence has fallen, indicating reduced consumer spending, a major driver of economic growth.

High interest rates, while effective in curbing inflation, can stifle business investment and consumer spending, potentially triggering a recession. The Fed is carefully weighing the risks of further rate increases against the possibility of triggering a severe economic downturn.

Balancing Act: Growth vs. Inflation

The Federal Reserve faces the difficult challenge of balancing its dual mandate: maintaining price stability and promoting maximum employment. This necessitates a delicate balancing act between controlling inflation and fostering sustainable economic growth.

- The Pursuit of a "Soft Landing": The Fed aims for a "soft landing," a scenario where inflation is brought under control without causing a significant economic recession. This is a challenging goal, and the likelihood of success depends on several unpredictable factors.

- Understanding the Fed's Dual Mandate: The Fed's actions are guided by its dual mandate, requiring it to consider both price stability and full employment when setting monetary policy. The current situation presents a complex trade-off between these two objectives.

Market Reactions and Future Outlook

The Federal Reserve's rate pause has had a mixed impact on financial markets and spurred diverse forecasts about the future economic trajectory.

Stock Market Response

The stock market's reaction to the rate pause has been largely positive, with initial gains attributed to the reduced likelihood of further aggressive rate hikes. However, the market remains volatile, reflecting the uncertainty surrounding future economic conditions.

- Investor Sentiment: Investor sentiment is cautiously optimistic, with investors closely watching upcoming economic data releases to gauge the Fed’s next move. Significant volatility remains as investors grapple with the uncertain economic outlook.

- Bond Yields: Bond yields have fluctuated in response to the rate pause, reflecting the changing expectations for future interest rate movements and the overall economic climate.

Economic Forecasts and Predictions

Economists hold diverse views regarding the future course of the U.S. economy. Some predict a mild recession, while others anticipate a "soft landing," with continued economic growth albeit at a slower pace.

- GDP Growth Projections: Projections for future GDP growth vary widely, depending on the assumptions made regarding inflation, consumer spending, and business investment.

- Inflation Outlook: The outlook for inflation remains uncertain, with differing predictions regarding the speed and extent of its decline.

- Interest Rate Predictions: Forecasts regarding future interest rate movements are similarly divergent, with some economists anticipating further rate hikes while others predict rate cuts in the future.

The Fed's Forward Guidance

The Fed's communication regarding future policy decisions, commonly referred to as forward guidance, remains crucial for market participants. While the current pause suggests a more data-dependent approach, the Fed hasn't completely ruled out future rate increases.

- Data Dependence: The Fed’s future decisions will heavily depend on the incoming economic data, particularly inflation and employment figures. This data-driven approach suggests flexibility in policy adjustments.

- Conditions for Future Rate Adjustments: The Fed will likely adjust its policy based on the observed trajectory of inflation, economic growth, and other key economic indicators. The possibility of rate hikes remains open, contingent upon these data points.

Conclusion

The Federal Reserve's decision to pause interest rate hikes reflects a complex interplay of factors, including easing inflationary pressures and escalating concerns about a potential recession. This rate pause represents a significant shift in monetary policy, and its long-term implications for the U.S. economy are still unfolding. Market reactions have been mixed, underscoring the uncertainty surrounding the future economic outlook. Understanding the intricacies of the Federal Reserve's monetary policy and its impact on the U.S. economy is crucial for informed decision-making.

Call to Action: Stay informed about the evolving economic situation and the Federal Reserve's future decisions regarding interest rates. Monitoring the Federal Reserve's announcements and economic indicators is essential for navigating the current economic climate and adapting your financial strategies accordingly. Learn more about the intricacies of the Federal Reserve's monetary policy and its influence on the U.S. economy to make informed financial decisions. Understanding the Federal Reserve's actions is vital for navigating this period of economic uncertainty.

Featured Posts

-

Is Us Taxpayer Money Funding Transgender Mouse Research A Detailed Look

May 10, 2025

Is Us Taxpayer Money Funding Transgender Mouse Research A Detailed Look

May 10, 2025 -

Difficultes D Epicure La Cite De La Gastronomie Et La Ville De Dijon

May 10, 2025

Difficultes D Epicure La Cite De La Gastronomie Et La Ville De Dijon

May 10, 2025 -

Trumps Greenland Gambit Increased Danish Influence And Greenlands Future

May 10, 2025

Trumps Greenland Gambit Increased Danish Influence And Greenlands Future

May 10, 2025 -

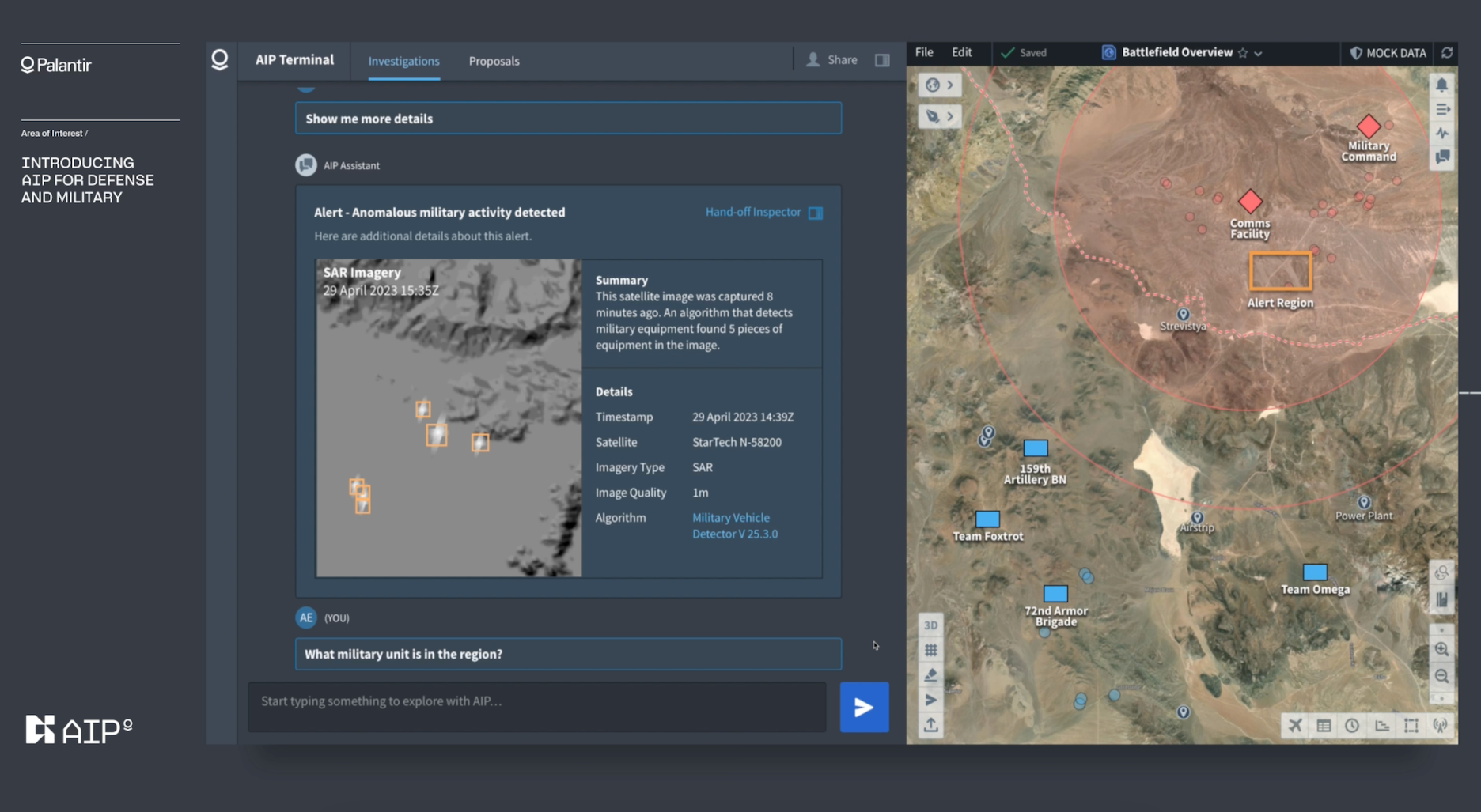

Predicting The Future Palantir Nato And The Transformation Of Public Sector Ai

May 10, 2025

Predicting The Future Palantir Nato And The Transformation Of Public Sector Ai

May 10, 2025 -

Land Your Dream Private Credit Role 5 Key Dos And Don Ts To Follow

May 10, 2025

Land Your Dream Private Credit Role 5 Key Dos And Don Ts To Follow

May 10, 2025