U.S. Jobs Report: 177,000 Jobs Added In April, Unemployment Remains At 4.2%

Table of Contents

A Deeper Dive into the 177,000 New Jobs: Sectoral Breakdown

The headline figure of 177,000 new jobs masks significant variations across different sectors. Understanding this sectoral job growth is crucial for a complete picture of the economic landscape.

Strongest Performing Sectors:

Several industries showed robust job growth in April. This industry employment data points to areas of economic strength:

- Leisure and Hospitality: This sector added a significant number of jobs (estimated at X), reflecting the continued recovery in the travel and tourism industry. This leisure and hospitality jobs growth suggests increased consumer spending and confidence.

- Professional and Business Services: This sector also saw strong gains (estimated at Y), indicating healthy growth in professional fields like consulting, finance, and technology. The increase in professional services jobs points towards a robust business environment.

- Healthcare: The healthcare industry also experienced notable job growth, reflecting the ongoing demand for healthcare services.

Underperforming Sectors:

Not all sectors experienced positive growth. Some industries showed stagnation or even job losses:

- Manufacturing: Manufacturing jobs saw only modest growth (estimated at Z), potentially reflecting global supply chain challenges and economic uncertainties.

- Retail: The retail sector experienced minimal job growth, potentially indicating shifting consumer spending patterns or economic slowdown.

Wage Growth and Inflation: Examining the Relationship

Analyzing average hourly earnings and their relationship with the inflation rate is key to understanding the overall health of the economy.

Average Hourly Earnings:

Average hourly earnings increased by X% in April. While this represents wage growth, it also contributes to inflationary pressures. This wage growth needs to be considered within the broader context of rising prices.

Inflationary Pressures:

The increase in average hourly earnings puts upward pressure on prices, exacerbating inflationary pressures. This poses challenges for the Federal Reserve, which may need to adjust its monetary policy to control inflation. The balance between supporting economic growth and controlling inflation is a critical consideration for policymakers.

Unemployment Rate Remains at 4.2%: Analyzing the Implications

The stable unemployment rate at 4.2% requires further examination by analyzing other crucial metrics.

Labor Force Participation Rate:

The labor force participation rate shows [insert data and analysis]. This suggests [interpret the implications].

Long-Term Unemployment:

Trends in long-term unemployment indicate [insert data and analysis]. This provides insights into the depth and nature of unemployment within the economy.

Future Outlook:

Based on the current data, the economic forecast suggests [insert cautious optimistic or pessimistic outlook]. Potential risks include [list risks], while opportunities exist in [list opportunities]. This requires continuous monitoring of the unemployment rate and other crucial economic indicators.

The U.S. Jobs Report and its Impact on the Stock Market

The April U.S. Jobs Report had a measurable impact on the financial markets.

Market Reaction:

The immediate reaction of the stock market to the report was [describe the market reaction – e.g., a slight dip, a positive surge, or no significant change].

Investor Sentiment:

Investor sentiment following the report was [describe investor sentiment – e.g., cautiously optimistic, concerned about inflation, confident in the continued recovery]. Key concerns reflected in the market included [list concerns], while positive sentiments stemmed from [list positive aspects]. The level of market volatility following the release reflects this underlying uncertainty. Economic uncertainty continues to be a primary factor influencing market behavior.

Conclusion: Understanding the April U.S. Jobs Report's Significance for the Economy

The April U.S. Jobs Report reveals a complex economic picture. The addition of 177,000 jobs and a stable unemployment rate of 4.2% are positive signs, but variations in sectoral growth and the interplay between wage growth and inflation warrant attention. Monitoring key economic indicators such as average hourly earnings, the inflation rate, and the labor force participation rate is crucial for understanding the evolving economic landscape. To stay informed about the health of the American economy, stay updated on the next U.S. jobs report and follow the latest economic indicators. Subscribe to our newsletter or follow us on social media to remain informed about crucial economic data and its implications. Understanding the nuances of future U.S. Jobs Reports is essential for navigating the complexities of the modern economy.

Featured Posts

-

Horarios E Canais Assista Ao Jogo Do Corinthians Contra O Sao Bernardo Hoje

May 04, 2025

Horarios E Canais Assista Ao Jogo Do Corinthians Contra O Sao Bernardo Hoje

May 04, 2025 -

Chicago Cubs Vs La Dodgers Watch The Mlb Tokyo Series Online

May 04, 2025

Chicago Cubs Vs La Dodgers Watch The Mlb Tokyo Series Online

May 04, 2025 -

A Crypto Party Gone Wild The Inside Story Of Two Days

May 04, 2025

A Crypto Party Gone Wild The Inside Story Of Two Days

May 04, 2025 -

Analyzing The Final Destination Film Series Box Office Performance And The New Bloodline Trailer

May 04, 2025

Analyzing The Final Destination Film Series Box Office Performance And The New Bloodline Trailer

May 04, 2025 -

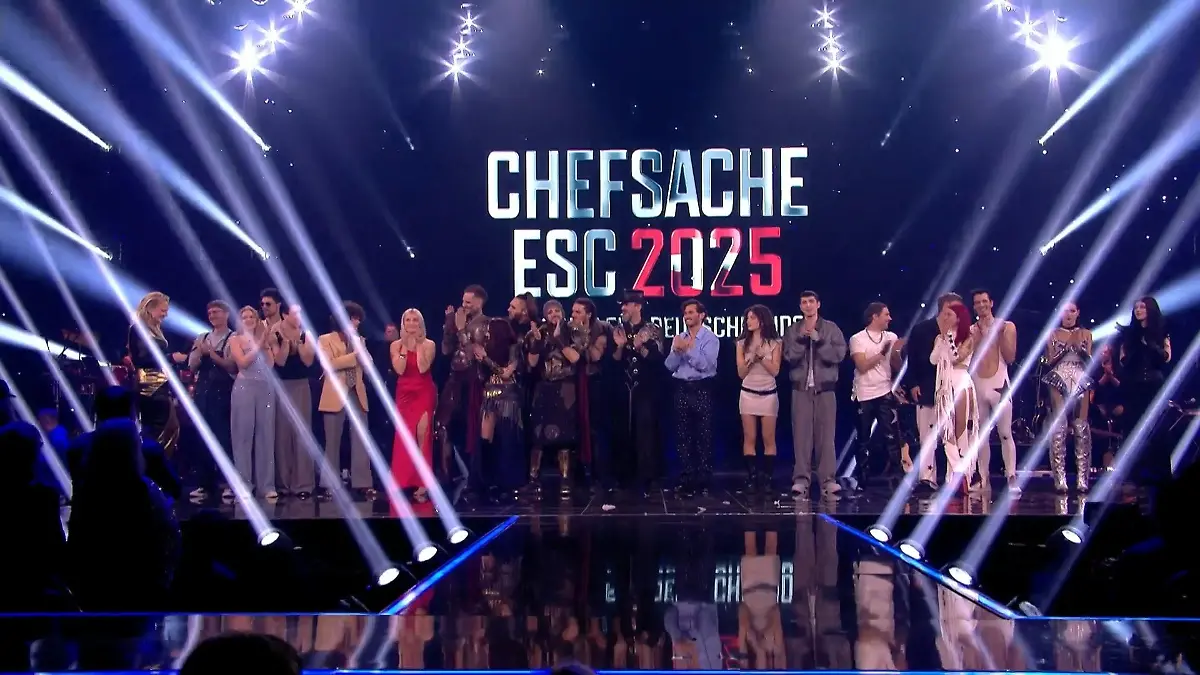

Chefsache Esc 2025 Sonderedition Alle Infos

May 04, 2025

Chefsache Esc 2025 Sonderedition Alle Infos

May 04, 2025