Uber Calls Off Foodpanda Taiwan Purchase Amidst Regulatory Challenges

Table of Contents

Regulatory Hurdles in Taiwan's Food Delivery Sector

Taiwan's regulatory environment for food delivery services is notoriously complex, presenting substantial challenges for both domestic and international players. Navigating this intricate web of rules and regulations proved too difficult for Uber to overcome in its pursuit of Foodpanda's Taiwanese operations. Specific regulations likely contributing to the acquisition's failure include stringent antitrust laws, demanding data privacy regulations, and potentially restrictive foreign investment policies.

- Antitrust Concerns: Taiwanese authorities may have expressed concerns about the potential monopolistic effects of a merger between two significant players in the food delivery market, particularly considering Foodpanda's already substantial market share. The potential for reduced competition and increased prices for consumers would likely trigger rigorous scrutiny.

- Data Privacy Regulations: The acquisition would have involved the transfer of vast amounts of user data, necessitating compliance with Taiwan's robust data privacy laws. Meeting these standards, particularly given the cross-border nature of the deal, might have proven to be an insurmountable obstacle.

- Foreign Investment Restrictions: Taiwan's regulations concerning foreign investment in certain sectors could have added another layer of complexity, potentially leading to delays and ultimately, the termination of the deal. Specific limitations on foreign ownership or control within the food delivery sector may have played a role.

- Examples: Past instances of fines levied against food delivery companies in Taiwan for violating data protection regulations or engaging in unfair competition practices illustrate the potential risks and regulatory scrutiny faced by operators in this market.

Financial Implications for Uber and Foodpanda

The cancellation of the acquisition carries substantial financial ramifications for both Uber and Foodpanda. For Uber, it represents a significant loss of potential market share in a rapidly growing Asian market and a substantial hit to its investment strategy. The financial investment already committed to the deal – which remains undisclosed – represents a sunk cost, further impacting Uber's bottom line.

- Uber's Loss: This failure significantly impacts Uber's broader Asian expansion plans, requiring a reassessment of its strategy in the region. The lost opportunity to gain a foothold in the lucrative Taiwanese food delivery market represents a considerable blow.

- Foodpanda's Challenges: Foodpanda, while retaining its operations in Taiwan, faces the challenge of navigating the competitive landscape without the added resources and strategic backing of Uber. Its future growth strategy in Taiwan will need to be recalibrated to address the absence of this anticipated partnership.

- Market Share Impact: The inability to consolidate market share through acquisition means Foodpanda will need to compete more aggressively and possibly invest more heavily in its Taiwanese operations to maintain its position.

Impact on the Taiwanese Food Delivery Market

The failed acquisition significantly impacts the competitive landscape of the Taiwanese food delivery market. While the market remains dynamic, the absence of the Uber-Foodpanda merger leaves the field open to other major players. Local competitors, now facing less immediate pressure from a merged entity, will likely adapt their strategies.

- Increased Competition: The continued presence of multiple players in the market suggests that competition will remain intense, potentially benefiting consumers through lower prices or enhanced services.

- Shifting Dynamics: The absence of the acquisition could lead to a more diverse market, where smaller local players may gain more prominence or new entrants might find opportunities.

- Future Consolidation: Despite the failure of this specific deal, the potential for future consolidation within the Taiwanese food delivery sector remains high, with other players possibly exploring mergers or acquisitions to gain a competitive edge.

The Future of Uber and Foodpanda in Taiwan After the Failed Acquisition

The decision by Uber to abandon the Foodpanda Taiwan acquisition highlights the substantial regulatory hurdles and financial risks associated with international business expansion in a rapidly evolving market. The failure underscores the importance of thorough due diligence and a comprehensive understanding of local regulatory landscapes. Both Uber and Foodpanda must now adapt their strategies, with Uber reassessing its Asian growth plans and Foodpanda focusing on strengthening its independent market position in Taiwan.

Stay updated on the latest developments in the Taiwanese food delivery market and the future strategies of Uber and Foodpanda by following [link to your website/blog/social media]. Learn more about the impact of regulatory challenges on international business acquisitions.

Featured Posts

-

Disturbing Brooklyn Attack Woman Groped Sex Act Simulated

May 18, 2025

Disturbing Brooklyn Attack Woman Groped Sex Act Simulated

May 18, 2025 -

How Much Are Resort Fees In Downtown Las Vegas Hotels

May 18, 2025

How Much Are Resort Fees In Downtown Las Vegas Hotels

May 18, 2025 -

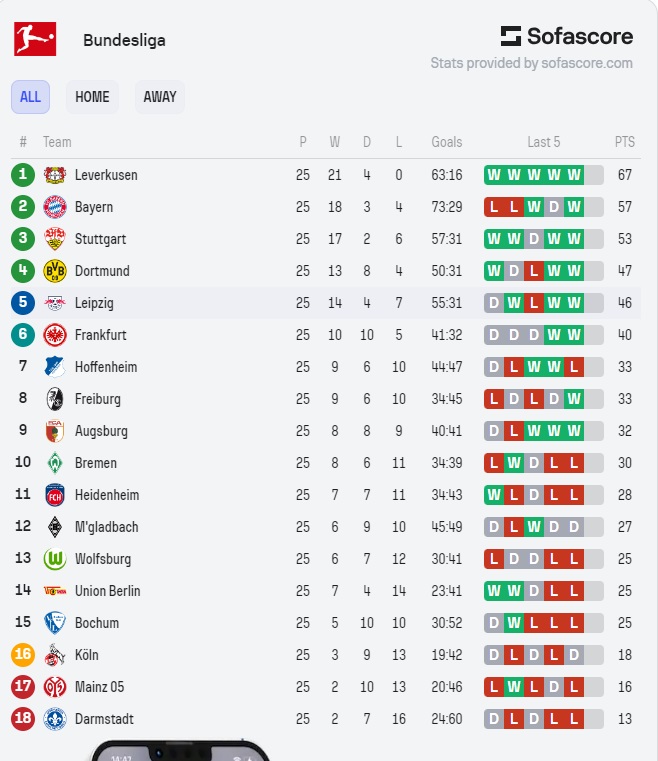

Statistikat E Pasimeve Te Granit Xhakes Ne Bundeslige

May 18, 2025

Statistikat E Pasimeve Te Granit Xhakes Ne Bundeslige

May 18, 2025 -

Eurovision 2025 Uk Entry Announced Amidst Controversys Shadow

May 18, 2025

Eurovision 2025 Uk Entry Announced Amidst Controversys Shadow

May 18, 2025 -

Treasury Futures Trading Landscape Transformed Fmxs Launch Signals Shift In Power

May 18, 2025

Treasury Futures Trading Landscape Transformed Fmxs Launch Signals Shift In Power

May 18, 2025

Latest Posts

-

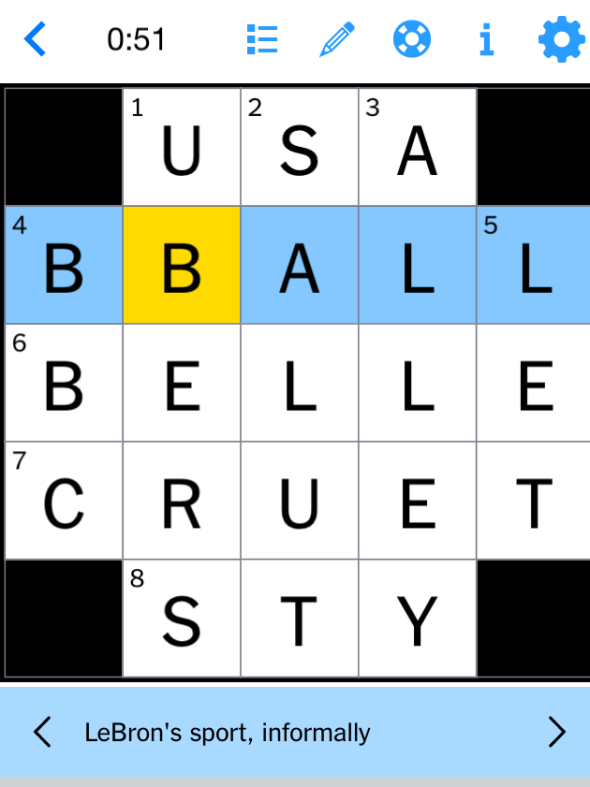

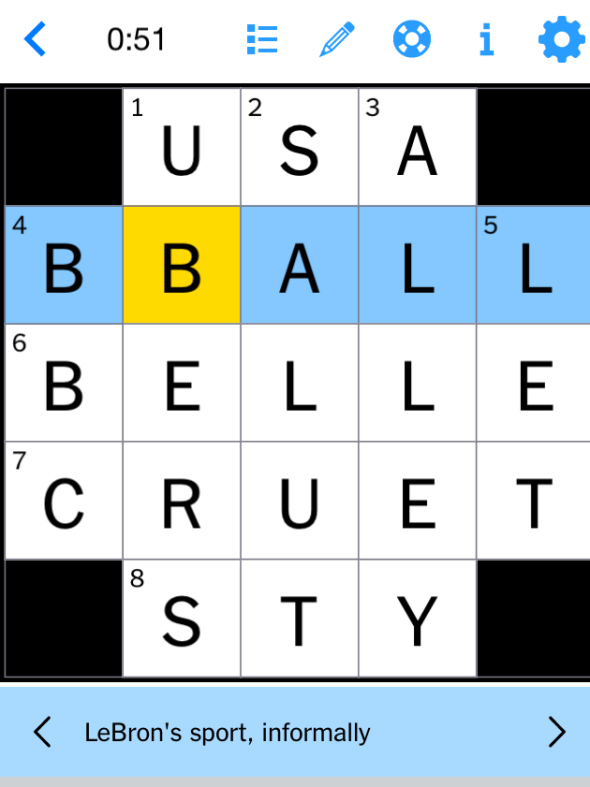

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 19, 2025 -

Nyt Mini Crossword Clues March 5 2025

May 19, 2025

Nyt Mini Crossword Clues March 5 2025

May 19, 2025 -

Nyt Mini Crossword Hints Clues And Answers For April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Hints Clues And Answers For April 8 2025 Tuesday

May 19, 2025 -

Get The Answers Nyt Mini Crossword March 5 2025

May 19, 2025

Get The Answers Nyt Mini Crossword March 5 2025

May 19, 2025 -

Nyt Mini Crossword March 5 2025 Help And Solutions

May 19, 2025

Nyt Mini Crossword March 5 2025 Help And Solutions

May 19, 2025