Uber Stock Forecast: Will Autonomous Vehicles Drive Growth?

Table of Contents

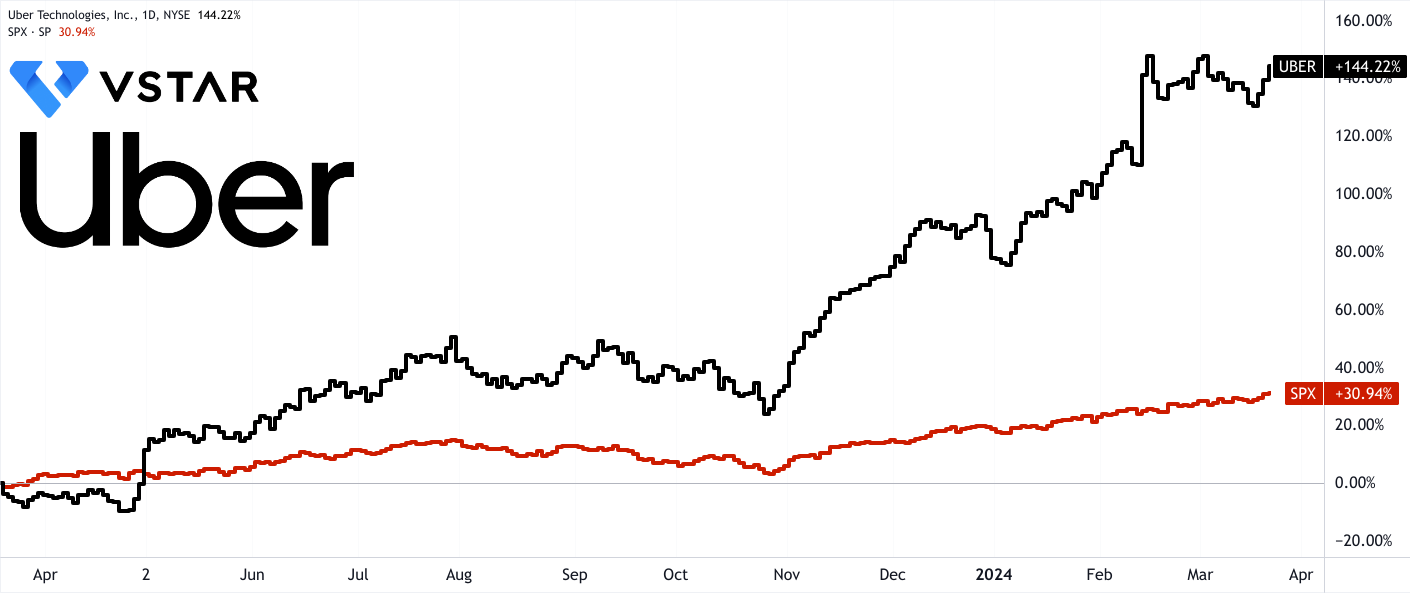

Current State of Uber and its Stock Performance

Uber Technologies, Inc. (UBER) currently holds a significant position in the global ride-sharing market, but its journey hasn't been without its bumps. Understanding its current financial health is crucial for any Uber stock forecast. Let's look at the key indicators:

-

Current Uber stock price and market capitalization: (Insert current stock price and market cap from a reputable financial source, e.g., Google Finance, Yahoo Finance, with a hyperlink). Fluctuations are common, so always check the most up-to-date information.

-

Recent quarterly earnings and revenue growth: (Insert data on recent quarterly earnings and revenue growth, citing the source, ideally with a hyperlink to the official Uber investor relations page). Analyzing trends in revenue growth helps to understand the company's underlying strength.

-

Key financial challenges and successes: Uber has faced challenges like intense competition, regulatory hurdles, and fluctuating driver costs. However, successes include expansion into new markets and the diversification of its services beyond ride-sharing (e.g., Uber Eats). (Include specific examples with data points if available).

-

Investor sentiment towards Uber stock: (Summarize current investor sentiment – bullish, bearish, or neutral – based on reputable financial news sources. Cite these sources with hyperlinks). Analyzing analyst ratings and news sentiment can provide insights into market expectations.

The Promise of Autonomous Vehicles for Uber

The integration of autonomous vehicles (AVs) holds immense promise for revolutionizing Uber's business model and driving significant growth. The potential benefits are substantial:

-

Reduced driver costs: Eliminating the need for human drivers could drastically cut operational expenses, a major component of Uber's cost structure. This would directly impact profitability.

-

Increased operational efficiency through optimized routing: AVs can optimize routes, reduce idle time, and improve overall efficiency, leading to cost savings and increased ride volume.

-

Expansion into new markets and services (autonomous delivery): AVs open doors to new revenue streams, such as autonomous delivery services (Uber Eats expansion) and potentially even robotaxi fleets operating in underserved areas.

-

Potential for higher profit margins: Lower operational costs combined with increased revenue streams from new services translate into potentially much higher profit margins.

Challenges and Risks Associated with Autonomous Vehicle Implementation

Despite the promise, the path to widespread AV adoption presents significant challenges and risks for Uber:

-

High initial investment costs for autonomous vehicle technology: The development, testing, and deployment of AV technology require substantial upfront investments, potentially impacting short-term profitability.

-

Regulatory approvals and legal complexities: Navigating the complex regulatory landscape and obtaining necessary approvals for autonomous vehicle operation varies significantly across different jurisdictions, posing a considerable hurdle.

-

Public perception and safety concerns about self-driving cars: Public trust and acceptance are vital for the success of AVs. Negative incidents or public safety concerns could severely hinder adoption.

-

Competition from other tech giants and startups: Uber faces intense competition from other tech companies and startups also investing heavily in autonomous vehicle technology.

Analyzing the Uber Stock Forecast Considering Autonomous Vehicle Development

Predicting the impact of autonomous vehicles on Uber's stock price requires careful consideration of various scenarios:

-

Short-term vs. long-term impact on stock price: In the short term, investment in AV technology may negatively impact profits. However, the long-term potential for increased efficiency and new revenue streams could significantly boost the stock price.

-

Potential catalysts for stock price increases (successful autonomous vehicle deployment): Successful and safe deployment of AVs in a significant market could be a major catalyst for stock price appreciation.

-

Risks that could negatively affect the stock price (delays, accidents, regulatory setbacks): Delays in AV development, accidents involving autonomous vehicles, or regulatory setbacks could negatively impact investor confidence and the stock price.

-

Comparison to other companies investing in autonomous technology: Comparing Uber's progress and strategy in AV development to competitors (e.g., Waymo, Cruise) is crucial for a comprehensive forecast.

Key Factors Influencing the Forecast

Several key factors will heavily influence the Uber stock forecast:

-

Technological advancements: The pace of technological progress in AV technology will directly impact the timeline for deployment and its overall success.

-

Regulatory landscape: The regulatory environment and the speed of obtaining necessary approvals will significantly affect the feasibility and timing of AV integration.

-

Market competition: The competitive landscape, including the actions of other companies investing in AV technology, will play a crucial role in Uber's success in this space.

-

Consumer adoption: Public acceptance and demand for autonomous ride-sharing services will determine the market size and revenue potential.

Conclusion

The potential of autonomous vehicles to drive Uber's future growth is undeniable. However, significant challenges and uncertainties remain. While a cautiously optimistic outlook is warranted in the long term, the short-term impact on the stock price is likely to be volatile, influenced by technological advancements, regulatory hurdles, and competitive pressures. Stay informed about the developments in autonomous vehicle technology and Uber's progress in this area to make informed decisions regarding your Uber stock investment. Keep an eye on our future articles for further updates on the Uber stock forecast and the impact of autonomous vehicles on its future.

Featured Posts

-

Andor Season 2 Rebels Cameos A Look At The Timelines Potential

May 08, 2025

Andor Season 2 Rebels Cameos A Look At The Timelines Potential

May 08, 2025 -

Dwp Doubles Home Visits For Benefit Recipients

May 08, 2025

Dwp Doubles Home Visits For Benefit Recipients

May 08, 2025 -

Bayern Munich Stunned By Inter Milan In Champions League Clash

May 08, 2025

Bayern Munich Stunned By Inter Milan In Champions League Clash

May 08, 2025 -

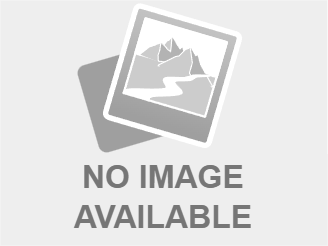

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025 -

Vse Rezultaty Matchey Arsenal Ps Zh Evropeyskie Kubki

May 08, 2025

Vse Rezultaty Matchey Arsenal Ps Zh Evropeyskie Kubki

May 08, 2025

Latest Posts

-

Exploring The Post Space Journey Of Rakesh Sharma Indias First Astronaut

May 09, 2025

Exploring The Post Space Journey Of Rakesh Sharma Indias First Astronaut

May 09, 2025 -

The High Cost Of Childcare A Mans Experience With Babysitting And Daycare

May 09, 2025

The High Cost Of Childcare A Mans Experience With Babysitting And Daycare

May 09, 2025 -

Unexpected Daycare Costs After Paying 3 000 For Babysitting

May 09, 2025

Unexpected Daycare Costs After Paying 3 000 For Babysitting

May 09, 2025 -

Su Viec Bao Hanh Tre O Tien Giang Hau Qua Va Giai Phap Cho Tuong Lai

May 09, 2025

Su Viec Bao Hanh Tre O Tien Giang Hau Qua Va Giai Phap Cho Tuong Lai

May 09, 2025 -

Dads 3 000 Babysitting Expense Turns Into 3 600 Daycare Bill

May 09, 2025

Dads 3 000 Babysitting Expense Turns Into 3 600 Daycare Bill

May 09, 2025