Uber Stock Rebound Hinges On Robotaxi Success

Table of Contents

The Current State of Uber's Robotaxi Program

Uber's foray into the autonomous vehicle market represents a pivotal moment in its history. The success or failure of its robotaxi initiative will significantly influence its future financial performance and, consequently, its stock price. Let's examine the key aspects of this ambitious undertaking:

Technological Challenges

Developing reliable and safe autonomous driving technology is incredibly complex. Uber, like its competitors, faces numerous hurdles:

- Software Glitches: Autonomous driving systems rely on complex software algorithms. Even minor glitches can have severe consequences, impacting safety and delaying progress.

- Unpredictable Weather Conditions: Adverse weather such as heavy rain, snow, or fog can severely limit the effectiveness of sensor technologies crucial for self-driving cars.

- Regulatory Hurdles: Navigating the regulatory landscape for autonomous vehicles varies significantly across jurisdictions, creating complexities and delays. Securing the necessary licenses and approvals is a significant undertaking.

- Ethical Considerations Surrounding Accidents: Accidents involving autonomous vehicles raise complex ethical questions about liability and decision-making algorithms. Addressing these concerns is vital for public acceptance.

Market Competition

Uber is not alone in the robotaxi race. The autonomous vehicle market is fiercely competitive, with several major players vying for dominance:

- Waymo: Google's self-driving subsidiary, Waymo, is a leading contender with extensive experience and a large fleet of autonomous vehicles.

- Cruise: General Motors' Cruise division is another major player, focusing on deploying robotaxis in urban environments.

- Tesla's Autopilot: While not fully autonomous, Tesla's Autopilot system represents a significant step towards self-driving technology and poses a competitive threat.

- Competitive Pricing Strategies: The pricing strategies employed by these competitors will play a vital role in determining market share and profitability.

Regulatory Landscape

Government regulations play a crucial role in shaping the future of robotaxis. Uber faces several regulatory challenges:

- Licensing Requirements: Obtaining the necessary licenses to operate robotaxis can be a time-consuming and complex process.

- Safety Testing Protocols: Rigorous safety testing protocols are essential to ensure the safety and reliability of autonomous vehicles before deployment.

- Public Acceptance and Perception: Public perception and trust in self-driving technology are vital factors influencing regulatory decisions and ultimately the success of robotaxis.

The Potential Impact of Robotaxi Success on Uber's Stock

If Uber successfully deploys its robotaxi technology, the impact on its stock could be transformative:

Cost Reduction and Efficiency

Autonomous vehicles have the potential to revolutionize Uber's operational model:

- Increased Vehicle Utilization: Robotaxis can operate 24/7, maximizing vehicle utilization and increasing revenue generation.

- Reduced Labor Costs: Eliminating the need for human drivers would dramatically reduce labor costs, a significant component of Uber's expenses.

- Potential for Higher Profit Margins: Lower operating costs and increased efficiency directly translate to higher profit margins, enhancing the attractiveness of Uber stock.

Revenue Generation and New Business Models

Successful robotaxi deployment opens up exciting new revenue streams:

- Subscription Models: Offering subscription-based access to robotaxi services could provide a stable and recurring revenue source.

- On-Demand Rides: Continuing to offer on-demand rides, but with autonomous vehicles, would improve efficiency and reduce costs.

- Partnerships with Other Businesses: Collaborations with other businesses, such as logistics companies, could create new avenues for revenue generation.

Investor Sentiment and Stock Valuation

A successful robotaxi rollout could significantly boost investor confidence:

- Increased Market Capitalization: Successful deployment would likely lead to a significant increase in Uber's market capitalization.

- Improved Credit Rating: Improved financial performance would likely improve Uber's credit rating, making it easier to secure financing.

- Higher Stock Price: Ultimately, positive financial results and improved investor sentiment would lead to a higher Uber stock price.

Risks and Challenges to a Successful Robotaxi Rollout

Despite the considerable potential, several significant risks and challenges could hinder Uber's robotaxi ambitions:

Technological Uncertainty

The inherent complexities of autonomous driving technology pose significant challenges:

- Unexpected Technical Failures: Unforeseen technical failures could lead to accidents, delays, and damage to reputation.

- Unforeseen Challenges in Various Operating Environments: Autonomous vehicles must perform reliably in diverse and unpredictable environments, which poses significant technical challenges.

Public Acceptance and Trust

Public acceptance and trust are critical for the successful adoption of robotaxis:

- Addressing Safety Concerns: Effectively addressing public safety concerns through rigorous testing and transparent communication is crucial.

- Promoting Transparency and Building Confidence: Building public trust requires proactive communication about the technology and its safety features.

Ethical Considerations

The ethical implications of autonomous vehicles require careful consideration:

- Algorithmic Biases: Ensuring fairness and eliminating biases in the algorithms governing decision-making in autonomous vehicles is vital.

- Decision-Making Processes in Critical Situations: Defining clear ethical guidelines for decision-making in critical situations, such as unavoidable accidents, is a crucial challenge.

Conclusion

Uber's stock rebound is heavily reliant on the successful implementation of its robotaxi program. While the potential benefits – cost reduction, new revenue streams, and improved investor sentiment – are significant, the technological, regulatory, and ethical challenges are considerable. The autonomous vehicle market is highly competitive, and unexpected setbacks could easily impact Uber's progress. Keep a close eye on Uber's robotaxi developments to gauge the potential for a significant Uber stock rebound in the coming years. Monitoring Uber's autonomous vehicle strategy and its progress in navigating the complex regulatory landscape is essential for any investor considering Uber's stock. For more in-depth analysis, visit Uber's investor relations page and stay updated on financial news related to the autonomous vehicle sector. Understanding the interplay between Uber's robotaxi future and its stock price is crucial for informed investment decisions.

Featured Posts

-

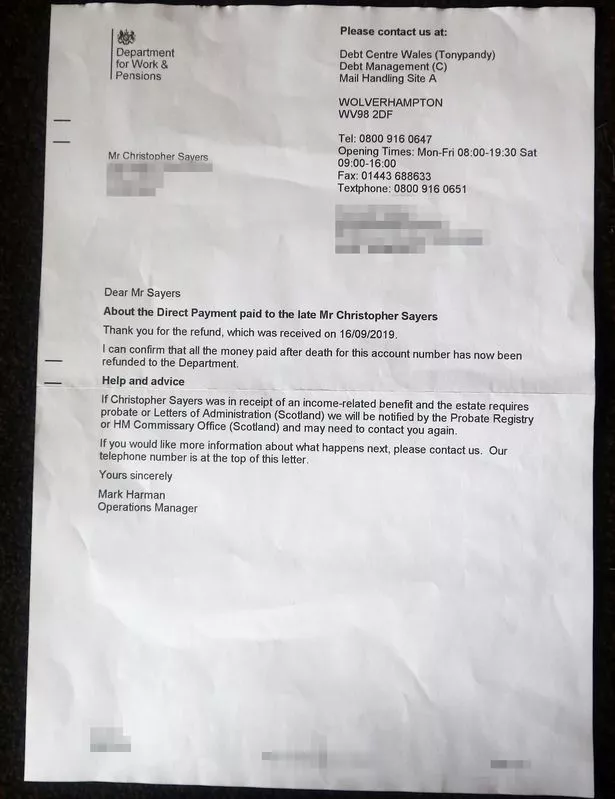

Is Your Dwp Letter Missing Act Now To Avoid Financial Loss

May 08, 2025

Is Your Dwp Letter Missing Act Now To Avoid Financial Loss

May 08, 2025 -

Dystopian Horror Movie Based On Stephen King Novel First Trailer Drops

May 08, 2025

Dystopian Horror Movie Based On Stephen King Novel First Trailer Drops

May 08, 2025 -

The Rise Of Deadly Fungi A Looming Superbug Crisis

May 08, 2025

The Rise Of Deadly Fungi A Looming Superbug Crisis

May 08, 2025 -

Shkelje E Rregullave Te Uefa S Nga Arsenali Detajet E Akuzave Kunder Klubit Anglez

May 08, 2025

Shkelje E Rregullave Te Uefa S Nga Arsenali Detajet E Akuzave Kunder Klubit Anglez

May 08, 2025 -

March 29th Thunder Vs Pacers Key Injuries To Watch

May 08, 2025

March 29th Thunder Vs Pacers Key Injuries To Watch

May 08, 2025

Latest Posts

-

Bao Mau Danh Tre Em O Tien Giang He Luy Va Giai Phap Cho Tuong Lai

May 09, 2025

Bao Mau Danh Tre Em O Tien Giang He Luy Va Giai Phap Cho Tuong Lai

May 09, 2025 -

Bao Mau Tien Giang Tat Tre Noi Dung Loi Khai Toan Bo Su Viec

May 09, 2025

Bao Mau Tien Giang Tat Tre Noi Dung Loi Khai Toan Bo Su Viec

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Analyse En Perspectieven

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Analyse En Perspectieven

May 09, 2025 -

Air India Denies Lisa Rays Claims Bollywood Actresss Complaint Investigated

May 09, 2025

Air India Denies Lisa Rays Claims Bollywood Actresss Complaint Investigated

May 09, 2025 -

Loi Khai Gay Soc Cua Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025

Loi Khai Gay Soc Cua Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025