Uber Stock's Recession Resilience: A Deep Dive Into Analyst Predictions

Table of Contents

Analyst Sentiment Towards Uber Stock in Recessionary Environments

The overall consensus among financial analysts regarding Uber's stock performance during economic slowdowns is cautiously optimistic, but with significant variations. While some believe Uber's diversified business model offers a degree of recession-proofing, others express concerns about the price sensitivity of its services.

- Goldman Sachs, for example, recently maintained a "buy" rating on Uber stock, citing its potential for growth in new markets and its cost-cutting initiatives. Their target price prediction reflects a significant upside potential. Conversely, Morgan Stanley has expressed a more conservative outlook, pointing to the potential for reduced consumer spending on ride-sharing and food delivery during an economic downturn. Their target price suggests a more limited upside.

- Differing opinions often stem from varying assessments of Uber's price elasticity of demand. Some analysts believe that even during a recession, Uber's services will remain relatively in-demand, especially its lower-cost options, while others anticipate a substantial drop in ridership and food delivery orders as consumers tighten their belts.

- The impact of interest rate hikes is another significant factor influencing Uber's valuation. Higher interest rates increase the cost of borrowing, potentially impacting Uber's expansion plans and profitability. This makes accurate prediction challenging.

- The potential for increased competition further clouds the forecast for Uber stock. New entrants into the ride-sharing and food delivery markets might intensify the price wars, squeezing Uber's margins during a recession.

Uber's Business Model and Recession-Proofing Strategies

Uber's diversified revenue streams – rides, Uber Eats, and Uber Freight – offer some protection against economic downturns. However, the resilience of each segment varies.

- Price Elasticity of Demand: While Uber Rides might see a decrease in demand during a recession, the price elasticity is expected to be less severe than some other discretionary spending categories. Consumers may reduce the frequency of their rides, but a baseline demand is likely to persist. Uber Eats, on the other hand, may face more significant challenges, as consumers may opt for home-cooking to save money. Uber Freight, benefiting from essential goods transportation, may experience less pronounced impacts.

- Cost-Cutting Measures: Uber has implemented various cost-cutting measures, including adjustments to driver incentives and operational streamlining, to improve its profitability and enhance its resilience during challenging economic times.

- Increased Demand for Cheaper Options: A recession could potentially boost demand for Uber's cheaper transportation options, potentially offsetting some of the overall decline in demand. This factor depends heavily on the severity and duration of the economic downturn.

- New Markets and Services: Uber's expansion into new markets and services, such as its growing presence in micromobility, provides additional diversification and potential avenues for growth even amidst economic uncertainty.

Key Financial Metrics to Watch for Assessing Uber Stock's Recession Resilience

Investors should closely monitor several key financial metrics to assess Uber stock's recession resilience:

- Revenue Growth: Tracking the growth rate of overall revenue, and importantly, the individual growth rates of rides, Eats, and Freight, offers a clear picture of the company's performance. A slowdown in revenue growth, especially in Eats, would be a significant warning sign.

- Profitability (EBITDA, Net Income): Monitoring EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income reveals Uber's profitability and its ability to generate profits even during challenging times. Declining profitability is a major red flag.

- Cash Flow Generation: Strong positive cash flow is crucial for a company's survival during a recession. Uber's ability to generate positive cash flow despite lower revenues indicates a healthy financial position.

- Debt Levels and Leverage: High levels of debt can be detrimental during an economic downturn, restricting the company's flexibility. Investors should monitor Uber's debt-to-equity ratio and its ability to service its debt.

- Customer Acquisition Costs and Retention Rates: High customer acquisition costs can strain profitability during a recession. Investors should pay close attention to the efficiency of Uber's marketing and the retention rate of its customers.

Comparing Uber's Recession Resilience to Competitors

Benchmarking Uber against its primary competitors like Lyft and DoorDash is vital for assessing its relative strength.

- Market Share Dynamics: Analyzing historical market share data during previous economic slowdowns can offer valuable insights into Uber's competitive resilience.

- Cost Structures and Profitability: A comparison of Uber's cost structure and profitability metrics with those of its competitors helps assess its efficiency and competitive advantage.

- Competitive Advantages and Disadvantages: Uber's diverse offerings and global reach give it some advantages, but it also faces challenges in areas like regulatory hurdles and fierce competition, which could impact its performance in a recession.

Conclusion

Assessing Uber stock's resilience during a potential recession requires a nuanced analysis. While its diversified business model and cost-cutting measures offer some protection, the price sensitivity of its services and potential increased competition represent significant challenges. Analyst predictions vary, reflecting the complexity of the situation. Investors should carefully analyze Uber's revenue growth, profitability, cash flow, debt levels, and customer metrics, comparing them with its competitors.

Call to Action: Investors should carefully consider these factors and conduct their own thorough due diligence before making investment decisions regarding Uber stock. Further research into the company's financial statements and future strategic plans is crucial for assessing the long-term potential of this investment during periods of economic uncertainty. Remember to monitor key financial metrics and analyst sentiment surrounding Uber stock to make informed investment choices.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details Of The Jan 6th Case

May 18, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details Of The Jan 6th Case

May 18, 2025 -

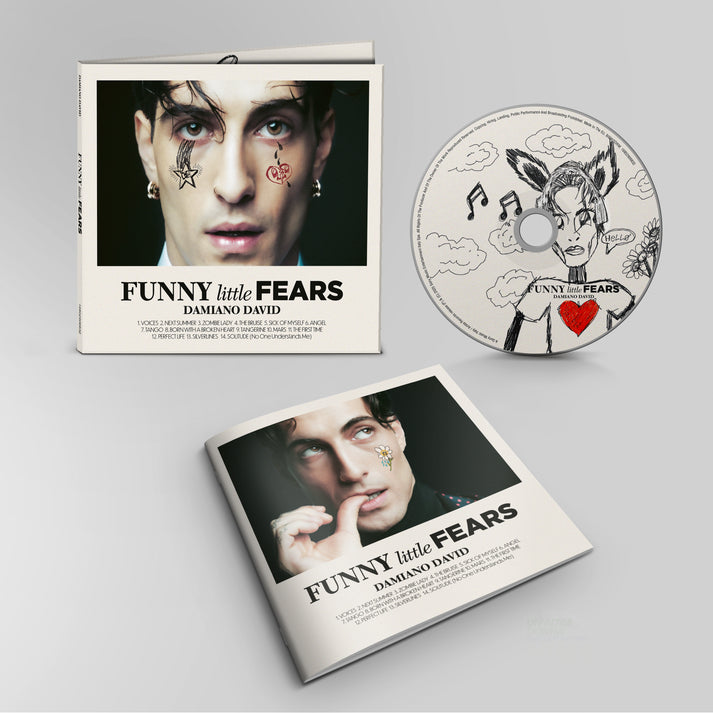

Maneskins Damiano David Funny Little Fears Debut Solo Album Released

May 18, 2025

Maneskins Damiano David Funny Little Fears Debut Solo Album Released

May 18, 2025 -

Are Downtown Las Vegas Resort Fees Worth It A Cost Analysis

May 18, 2025

Are Downtown Las Vegas Resort Fees Worth It A Cost Analysis

May 18, 2025 -

Shane Gillis Snl Firing Bowen Yangs Statement And The Fallout

May 18, 2025

Shane Gillis Snl Firing Bowen Yangs Statement And The Fallout

May 18, 2025 -

Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025

Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025

Latest Posts

-

Negosiasi Rumit Pertukaran Satu Tentara Israel Dengan 1 027 Tahanan Palestina

May 18, 2025

Negosiasi Rumit Pertukaran Satu Tentara Israel Dengan 1 027 Tahanan Palestina

May 18, 2025 -

Pertukaran Tahanan Israel Palestina 1 027 Nyawa Untuk Satu Tentara

May 18, 2025

Pertukaran Tahanan Israel Palestina 1 027 Nyawa Untuk Satu Tentara

May 18, 2025 -

Kisah Pertukaran 1 027 Tahanan Palestina Dengan Satu Tentara Israel Negosiasi Panjang Lima Tahun

May 18, 2025

Kisah Pertukaran 1 027 Tahanan Palestina Dengan Satu Tentara Israel Negosiasi Panjang Lima Tahun

May 18, 2025 -

Jusuf Kalla Momen Ulang Tahun Dan Harapan Perdamaian Israel Palestina Dari Gaza

May 18, 2025

Jusuf Kalla Momen Ulang Tahun Dan Harapan Perdamaian Israel Palestina Dari Gaza

May 18, 2025 -

Israel Dan Paus Fransiskus Konflik Dan Dampaknya Pada Hubungan Diplomatik

May 18, 2025

Israel Dan Paus Fransiskus Konflik Dan Dampaknya Pada Hubungan Diplomatik

May 18, 2025