Uber's Investment Potential: Risks And Rewards

Table of Contents

Understanding Uber's Business Model and Market Position

Uber's success stems from its innovative business model and its dominance within the transportation network. This section explores its market position and the strengths that underpin its potential for continued growth.

Dominant Market Share and Network Effects

Uber boasts a truly global reach, operating in numerous countries and cities worldwide. Its success is significantly amplified by network effects – the more riders and drivers using the platform, the more valuable it becomes for everyone. This creates a powerful barrier to entry for competitors. Moreover, Uber's diversification beyond ride-sharing, notably through Uber Eats (its food delivery service), Uber Freight (its logistics arm), and explorations into micromobility (e-scooters and bikes), further enhances its market resilience and growth prospects.

- Dominant player in ride-sharing globally. This market leadership provides a solid foundation for future expansion and profitability.

- Diversification into food delivery and other sectors. This strategic diversification reduces reliance on a single revenue stream and opens doors to new growth avenues.

- Strong brand recognition and customer loyalty. Uber's widespread brand recognition translates into a significant competitive advantage.

- Network effects create a significant barrier to entry for competitors. The scale of Uber's network makes it difficult for newcomers to challenge its market position.

Assessing the Growth Potential of Uber

Uber's growth trajectory isn't simply about maintaining its existing market share; it's about aggressive expansion and innovative leaps. This section details the exciting possibilities that fuel Uber's investment potential.

Expansion into New Markets and Services

Uber continues its aggressive push into new geographical territories, particularly in developing countries with burgeoning populations and increasing demand for transportation and delivery services. Furthermore, Uber is actively developing and integrating new services, such as autonomous vehicles and electric scooter rentals. These strategic expansions significantly increase its addressable market and enhance its long-term growth prospects.

Technological Innovation and Future Trends

Uber’s investment in advanced technologies, including AI and machine learning, is central to its future success. These technologies enhance operational efficiency, optimize pricing strategies, and improve the overall user experience. The potential for breakthroughs in autonomous driving technology holds enormous implications for the company's profitability and competitive edge, offering a potentially transformative aspect to the Uber investment narrative.

- Untapped markets in developing countries. These markets represent a vast pool of potential customers for Uber's services.

- Potential for significant growth in autonomous vehicle technology. Autonomous vehicles could revolutionize the ride-sharing industry, dramatically reducing operational costs and increasing efficiency.

- Expansion into new mobility solutions. Exploring alternative transportation options, such as e-bikes and scooters, broadens Uber's appeal and addresses diverse urban mobility needs.

- Opportunities in logistics and freight services. Uber Freight demonstrates Uber's ambition to move beyond passenger transportation and into a wider logistics market.

Evaluating the Risks Associated with Investing in Uber

While Uber's growth potential is enticing, it's crucial to acknowledge the significant risks inherent in an Uber investment.

Regulatory Hurdles and Legal Challenges

The ride-sharing industry faces a complex and ever-evolving regulatory landscape. Licensing requirements, insurance regulations, and labor disputes (concerning the classification of drivers as employees versus independent contractors) represent ongoing challenges and potential liabilities. Legal battles and substantial fines are possible outcomes of these regulatory uncertainties.

Intense Competition and Market Saturation

Uber operates in a fiercely competitive market. Lyft is a significant competitor, and numerous other players are vying for market share. In some established markets, the potential for market saturation exists, limiting future growth prospects.

Profitability and Financial Performance

Uber's historical financial performance has been marked by periods of losses, despite significant revenue generation. Achieving sustained profitability remains a major challenge, requiring careful management of operational costs and strategic pricing. High capital expenditures further contribute to financial complexities.

- Varying regulations across different jurisdictions. This regulatory complexity necessitates significant legal and compliance investments.

- Competition from established players and new entrants. This intense competition keeps pressure on pricing and profitability.

- Fluctuations in fuel prices and driver costs. These external factors directly impact Uber's operational expenses.

- Concerns about driver classification and worker rights. These legal challenges can lead to substantial financial liabilities.

- High capital expenditure requirements. Significant investments are needed to maintain and expand its technological infrastructure and global reach.

Strategies for Mitigating Investment Risks

Investing in Uber, or any high-growth company, requires a strategic approach to minimize risk.

Diversification of your Investment Portfolio

Never put all your eggs in one basket. Diversification is crucial to mitigating risk. Spread your investments across various asset classes and sectors to reduce the impact of any single investment's underperformance.

Thorough Due Diligence

Before investing in Uber stock or any other security, conduct thorough research. Analyze financial statements, industry reports, and news articles to gain a comprehensive understanding of the company's financial health, competitive landscape, and future prospects.

Long-Term Investment Approach

Uber’s stock price may experience short-term volatility. A long-term investment strategy is generally recommended for companies with substantial growth potential but also inherent risks. Focus on the company's long-term prospects rather than short-term market fluctuations.

- Don't put all your eggs in one basket. Diversify your portfolio to manage overall risk.

- Analyze financial statements and industry reports. Thorough due diligence is essential before making any investment decisions.

- Understand the company's strategy and management team. Evaluate the company's leadership and its long-term vision.

- Consider your risk tolerance. Only invest an amount you are comfortable potentially losing.

Conclusion

Uber presents a compelling investment opportunity, driven by its dominant market position, diversification efforts, and potential for technological breakthroughs. However, regulatory hurdles, intense competition, and the challenge of achieving sustained profitability pose significant risks. Considering an Uber investment? Weigh the risks and rewards carefully before making your decision. Thorough research and a long-term perspective are key to successful investment in the dynamic transportation network sector.

Featured Posts

-

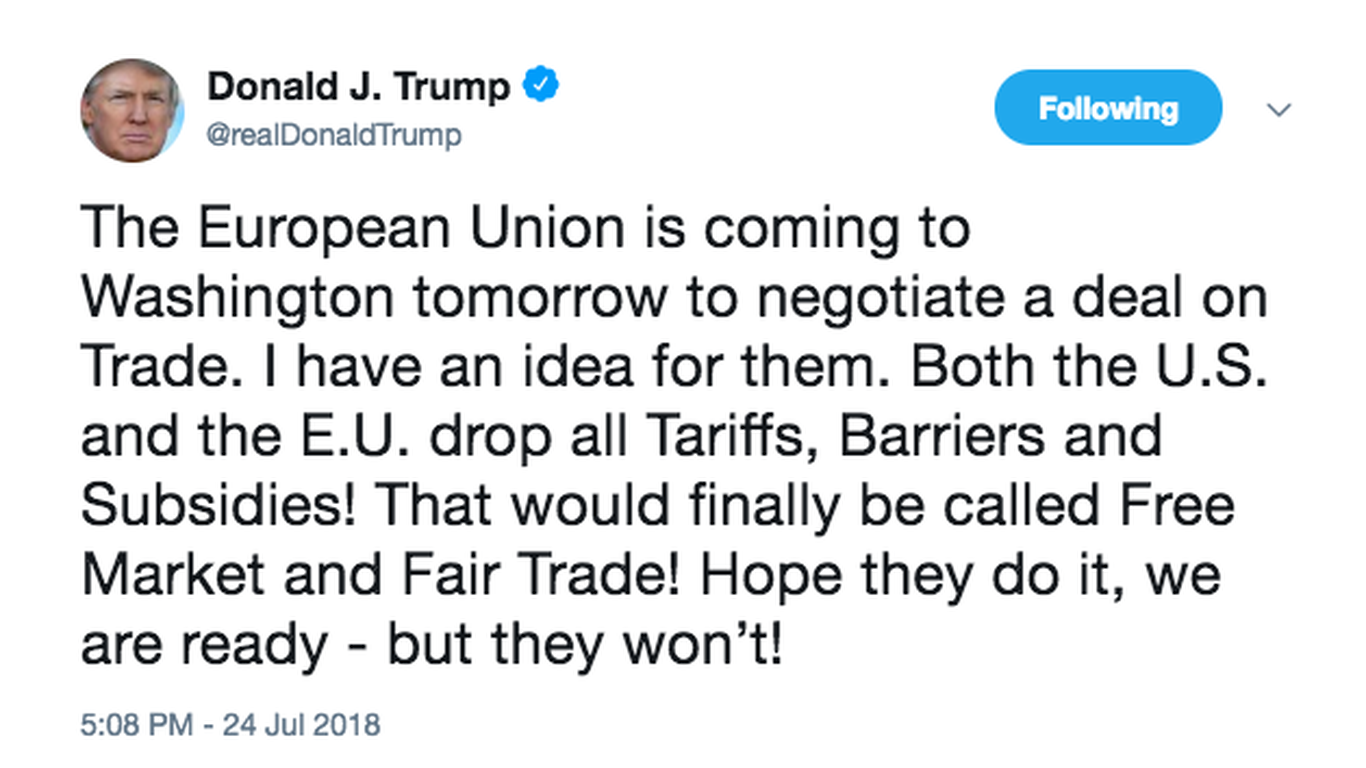

Dutch Public Against Eu Response To Trump Import Tariffs

May 18, 2025

Dutch Public Against Eu Response To Trump Import Tariffs

May 18, 2025 -

Moncada And Sorianos Strong Performances Lead Angels To 1 0 Victory Over White Sox

May 18, 2025

Moncada And Sorianos Strong Performances Lead Angels To 1 0 Victory Over White Sox

May 18, 2025 -

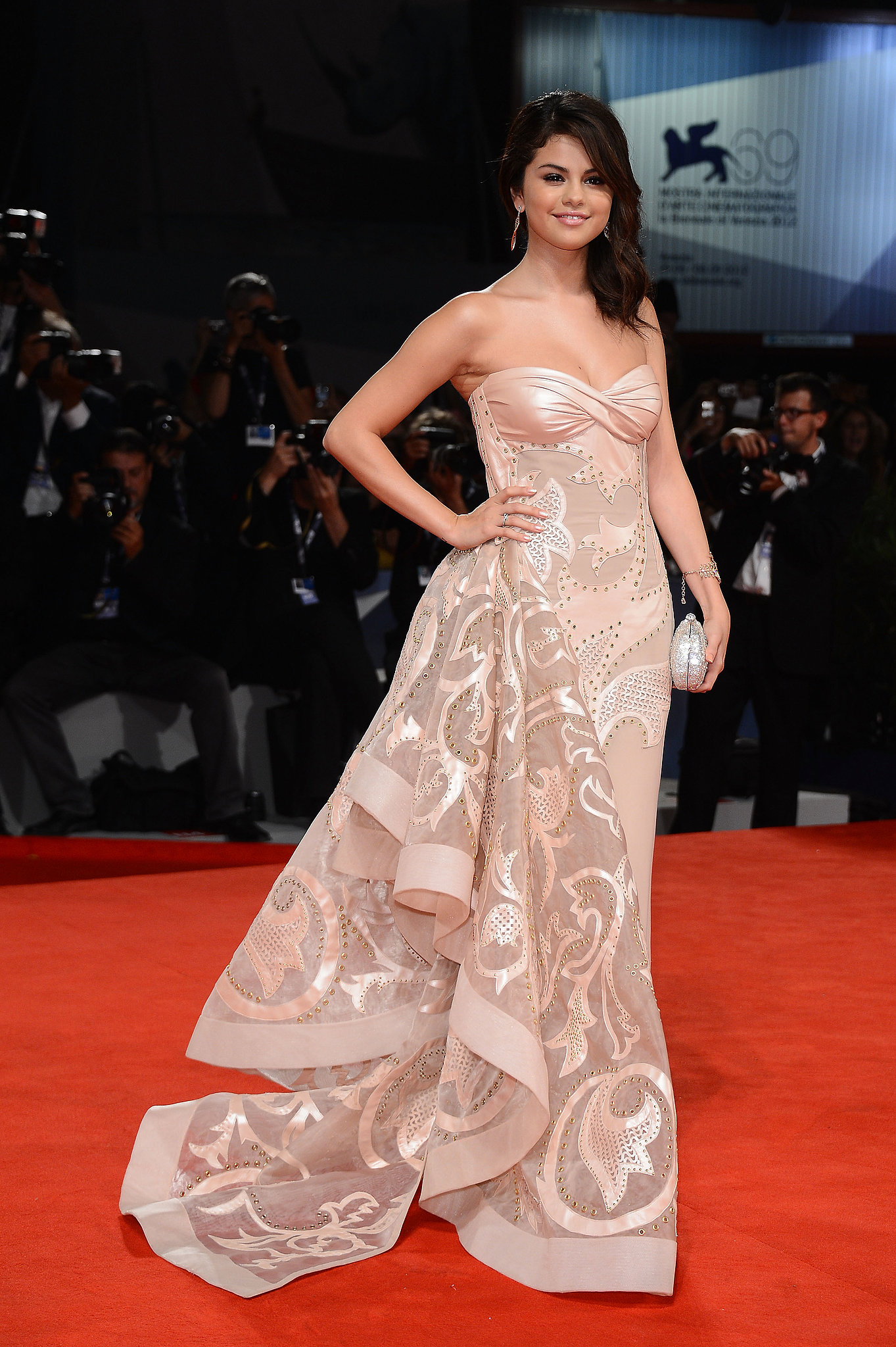

The Red Carpet And Its Rule Breakers A Cnn Perspective

May 18, 2025

The Red Carpet And Its Rule Breakers A Cnn Perspective

May 18, 2025 -

Podcast Stan Wyjatkowy Onetu I Newsweeka Informacje I Analiza Dwa Razy W Tygodniu

May 18, 2025

Podcast Stan Wyjatkowy Onetu I Newsweeka Informacje I Analiza Dwa Razy W Tygodniu

May 18, 2025 -

Reddit Strengthens Moderation A Crackdown On Violent Content Upvotes

May 18, 2025

Reddit Strengthens Moderation A Crackdown On Violent Content Upvotes

May 18, 2025

Latest Posts

-

Next Week Pedro Pascals 2025 Conquest Begins

May 18, 2025

Next Week Pedro Pascals 2025 Conquest Begins

May 18, 2025 -

Asaduddin Owaisis Eid Eve Post A Ghibli Esque Stand For Palestine Opposing The Waqf Bill

May 18, 2025

Asaduddin Owaisis Eid Eve Post A Ghibli Esque Stand For Palestine Opposing The Waqf Bill

May 18, 2025 -

Pedro Pascals 2025 Domination It Starts Next Week

May 18, 2025

Pedro Pascals 2025 Domination It Starts Next Week

May 18, 2025 -

Jennifer Aniston And Pedro Pascal Birthday Greetings And Relationship Clarification

May 18, 2025

Jennifer Aniston And Pedro Pascal Birthday Greetings And Relationship Clarification

May 18, 2025 -

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025