UK Wind Energy Future Uncertain: Vestas Highlights Auction Reform Risks

Table of Contents

Vestas' Concerns Regarding Auction Reform

Vestas, a global leader in wind turbine technology, has voiced significant apprehension regarding the proposed changes to the UK's Contracts for Difference (CfD) auction system. These reforms, while intended to improve efficiency, introduce elements of uncertainty that are detrimental to long-term investment in UK wind energy projects.

-

Increased uncertainty for investors: The revised auction rules create ambiguity around future returns, making it harder for investors to assess the risk profile of UK wind projects. This uncertainty can lead to decreased investment and a slowdown in project development.

-

Potential for reduced project pipeline: The lack of clarity surrounding the auction process may discourage developers from committing to new projects, leading to a shrinking pipeline of future wind energy capacity. This could significantly impact the UK's ability to meet its climate targets.

-

Impact on the UK's renewable energy targets: A reduction in wind energy projects directly undermines the UK's commitment to transitioning to a low-carbon economy. Delayed or cancelled projects will leave a gap in the renewable energy supply, potentially impacting energy security and the achievement of net-zero goals.

-

Concerns about the competitiveness of the UK market: Compared to other European countries with more stable and predictable renewable energy policies, the UK's proposed changes could make it a less attractive location for investment in wind energy, hindering its ability to compete in the global renewable energy market. This could result in a loss of skilled jobs and technological leadership.

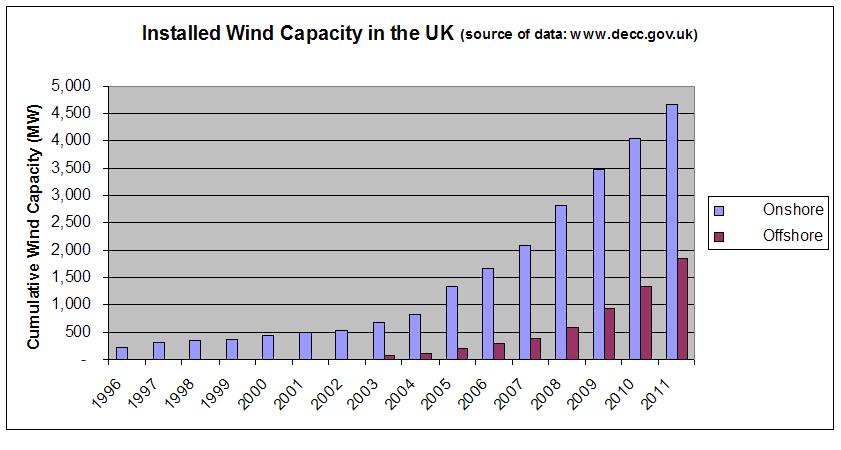

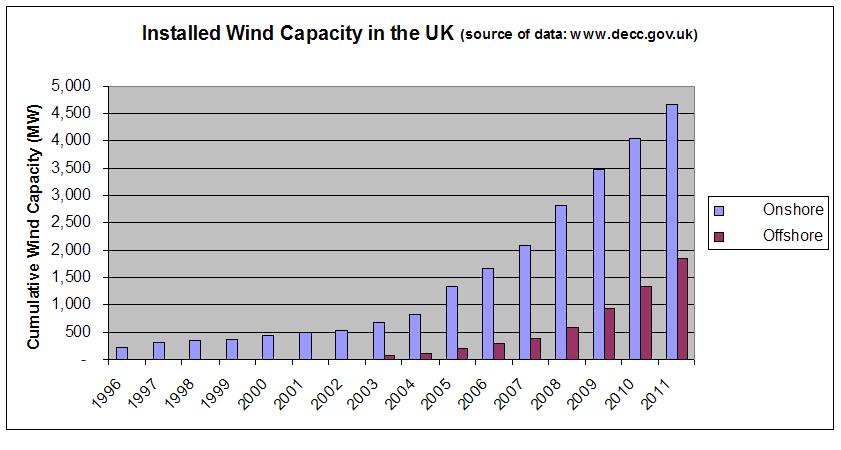

Impact on UK Offshore Wind Development

The implications of the auction reforms are particularly acute for the UK's burgeoning offshore wind sector. Offshore wind projects are significantly more complex and capital-intensive than onshore projects, making them particularly vulnerable to policy uncertainty.

-

Potential delays in large-scale offshore wind farm construction: Uncertainty surrounding CfD allocations can delay crucial project planning, permitting, and financing stages, leading to significant construction delays.

-

Increased costs for offshore wind energy projects: Delays and increased risk translate directly into higher costs for offshore wind projects, potentially increasing the final price of energy for consumers.

-

Reduced competitiveness of UK offshore wind compared to other European markets: Countries with more stable policies are attracting significant investment in offshore wind, leaving the UK at a competitive disadvantage. This could lead to a loss of market share and potential jobs.

-

Impact on job creation in the offshore wind sector: The offshore wind sector is a major job creator, employing thousands of people across the UK supply chain. Policy uncertainty threatens this growth and the associated economic benefits.

Alternative Energy Sources and the Energy Transition

The uncertainty surrounding UK wind energy might trigger a shift in investment towards other renewable energy sources. This could have both positive and negative consequences for the UK's overall energy transition.

-

Increased focus on solar power or other renewables: Investors might divert funds from wind energy to other renewable technologies, such as solar power, which may have less regulatory risk.

-

Potential for energy diversification strategies: While a shift away from wind energy might seem negative, it could lead to a more diversified renewable energy mix, improving energy security and resilience.

-

Impacts on energy security and price stability: A lack of investment in wind energy could potentially lead to higher energy prices and increased reliance on fossil fuels, impacting both energy security and the UK's environmental goals.

-

The role of government policy in shaping energy transition: Government policy plays a crucial role in directing investment and shaping the energy transition pathway. Clear, consistent, and supportive policies are essential for attracting investment in all renewable energy sectors.

Calls for Policy Clarity and Investor Confidence

To secure a sustainable future for UK wind energy, the government must provide clear and stable policies that encourage investment and foster investor confidence.

-

Importance of long-term policy stability: Long-term policy stability is crucial for planning and securing long-term financing for wind energy projects. Short-term changes create significant risks and uncertainty for investors.

-

Need for transparent and predictable auction processes: A transparent and predictable auction system is essential for ensuring fair competition and attracting investment. The current ambiguity needs to be addressed.

-

Addressing investor concerns regarding the return on investment: The government needs to actively engage with investors to understand and address their concerns. This includes providing clear assurances about the long-term support for the wind energy sector.

-

Engaging with industry stakeholders to develop effective policies: Collaboration between the government, industry stakeholders, and investors is vital for developing effective policies that promote sustainable growth in the UK wind energy sector.

Conclusion

The proposed auction reforms pose significant risks to the future of UK wind energy, potentially hindering investment, delaying projects, and impacting the nation's renewable energy goals. Vestas' concerns highlight the urgent need for policy clarity and a stable regulatory environment. The UK government must act swiftly to address these concerns and ensure a sustainable future for the UK wind energy sector, including offshore wind farm development and the broader energy transition. Failure to do so could significantly impact the UK's ability to meet its climate change commitments.

Call to Action: Learn more about the challenges facing UK wind energy and how you can support a sustainable energy future by researching relevant policy initiatives and advocating for responsible energy policy changes affecting UK wind energy and the overall energy transition.

Featured Posts

-

A Tough Road Ahead The Next Federal Reserve Chairs Inheritance From The Trump Administration

Apr 26, 2025

A Tough Road Ahead The Next Federal Reserve Chairs Inheritance From The Trump Administration

Apr 26, 2025 -

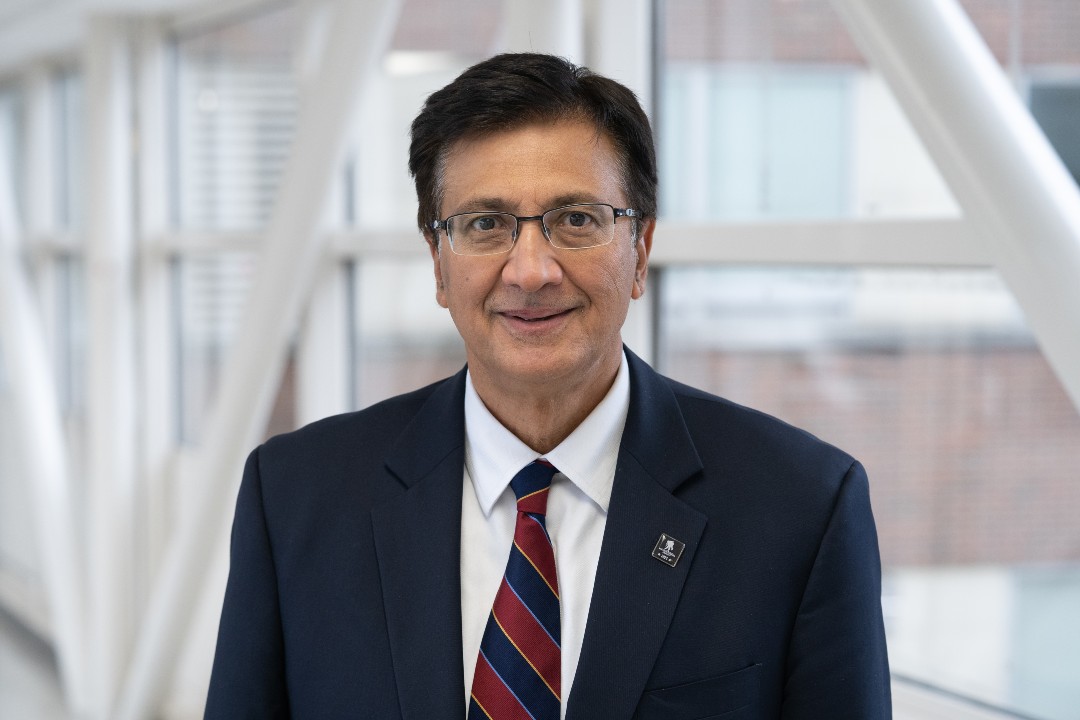

The Future Of Food Dyes A Conversation With Dr Sanjay Gupta

Apr 26, 2025

The Future Of Food Dyes A Conversation With Dr Sanjay Gupta

Apr 26, 2025 -

Benson Boone Antes Do Lollapalooza O Sucesso Mundial Da Musica

Apr 26, 2025

Benson Boone Antes Do Lollapalooza O Sucesso Mundial Da Musica

Apr 26, 2025 -

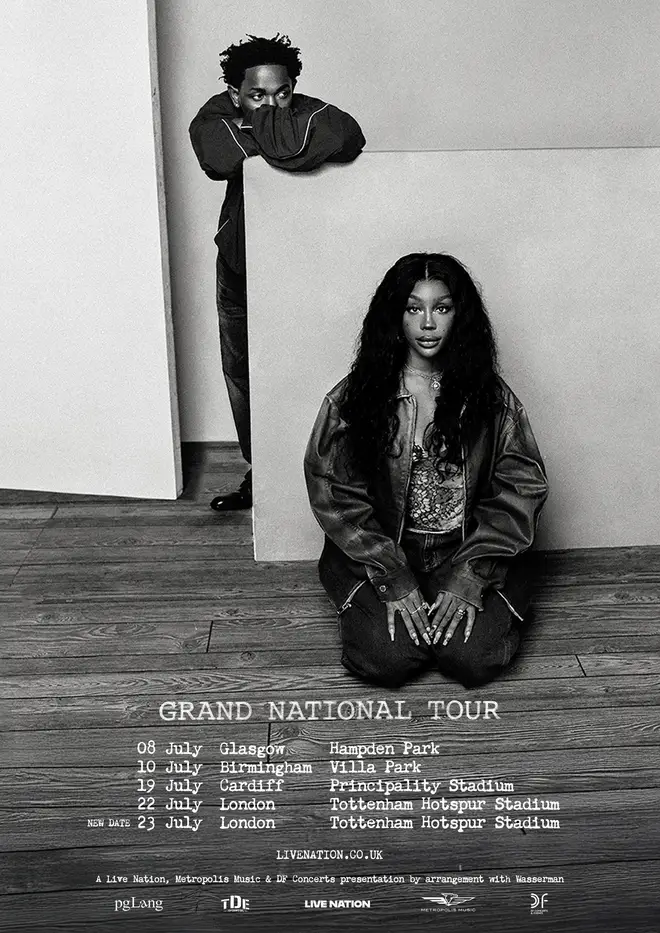

Kendrick Lamar And Sza Uk Tour Everything You Need To Know

Apr 26, 2025

Kendrick Lamar And Sza Uk Tour Everything You Need To Know

Apr 26, 2025 -

Fusion Portfolio Welcomes Dong Duong Hotel In Hue

Apr 26, 2025

Fusion Portfolio Welcomes Dong Duong Hotel In Hue

Apr 26, 2025

Latest Posts

-

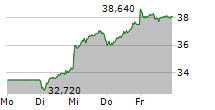

Eqs Pvr Pne Ag Veroeffentlicht Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlicht Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025 -

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025