Ultra-Low Growth Forecast For Canada: Implications For The Economy

Table of Contents

Causes of the Ultra-Low Growth Forecast for Canada

Several interconnected factors contribute to the ultra-low growth forecast for the Canadian economy. Understanding these root causes is crucial for developing effective responses.

Global Economic Slowdown and its Impact on Canadian Exports

The global economy is grappling with significant headwinds, directly impacting Canada's export-oriented economy.

- Global inflation: Persistently high inflation rates in many countries are reducing consumer spending and dampening economic activity, leading to a Canadian export slowdown.

- Recessionary fears: The possibility of recession in major trading partners like the US and the EU is creating further uncertainty and reducing demand for Canadian goods and services, impacting Canadian GDP growth.

- Reduced global demand: Weakening global demand for commodities, a significant component of Canadian exports, is putting pressure on key sectors like energy and mining, exacerbating the impact on Canadian GDP. This global economic uncertainty necessitates a strategic reassessment of export markets and diversification efforts.

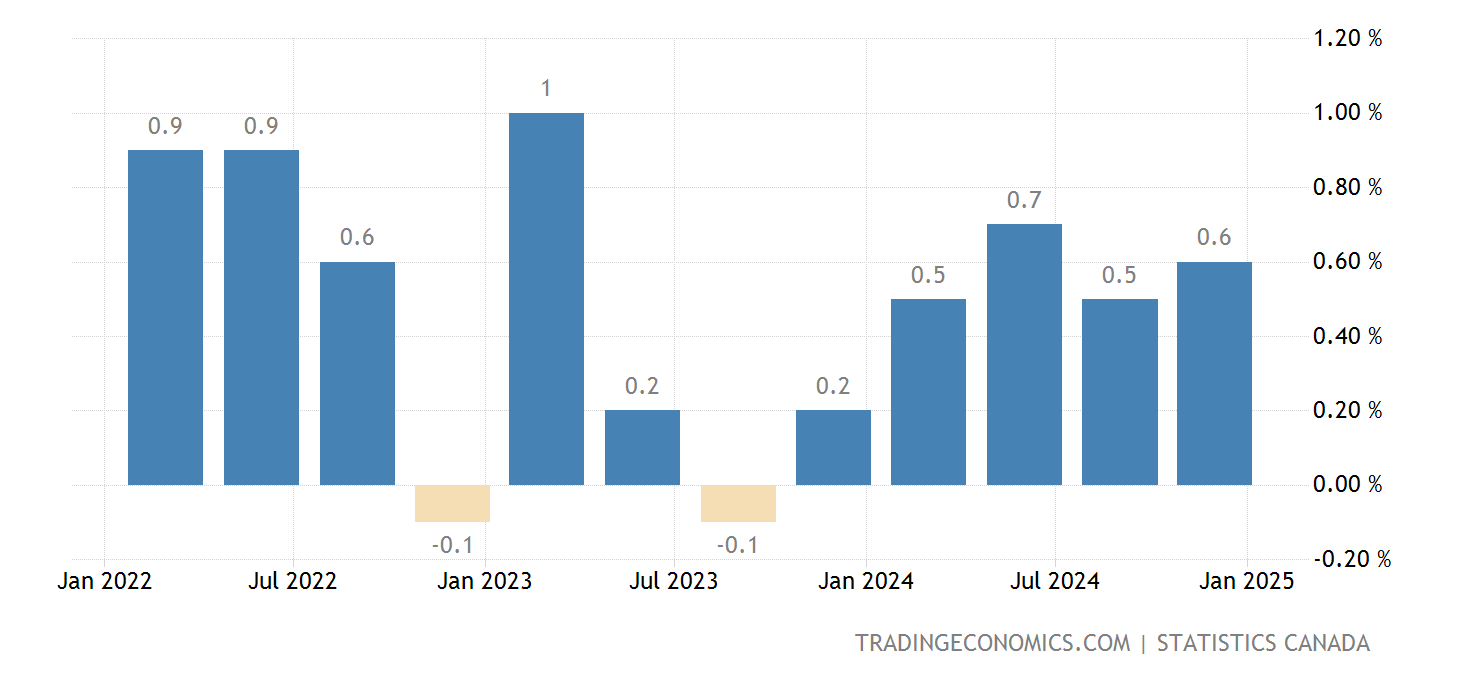

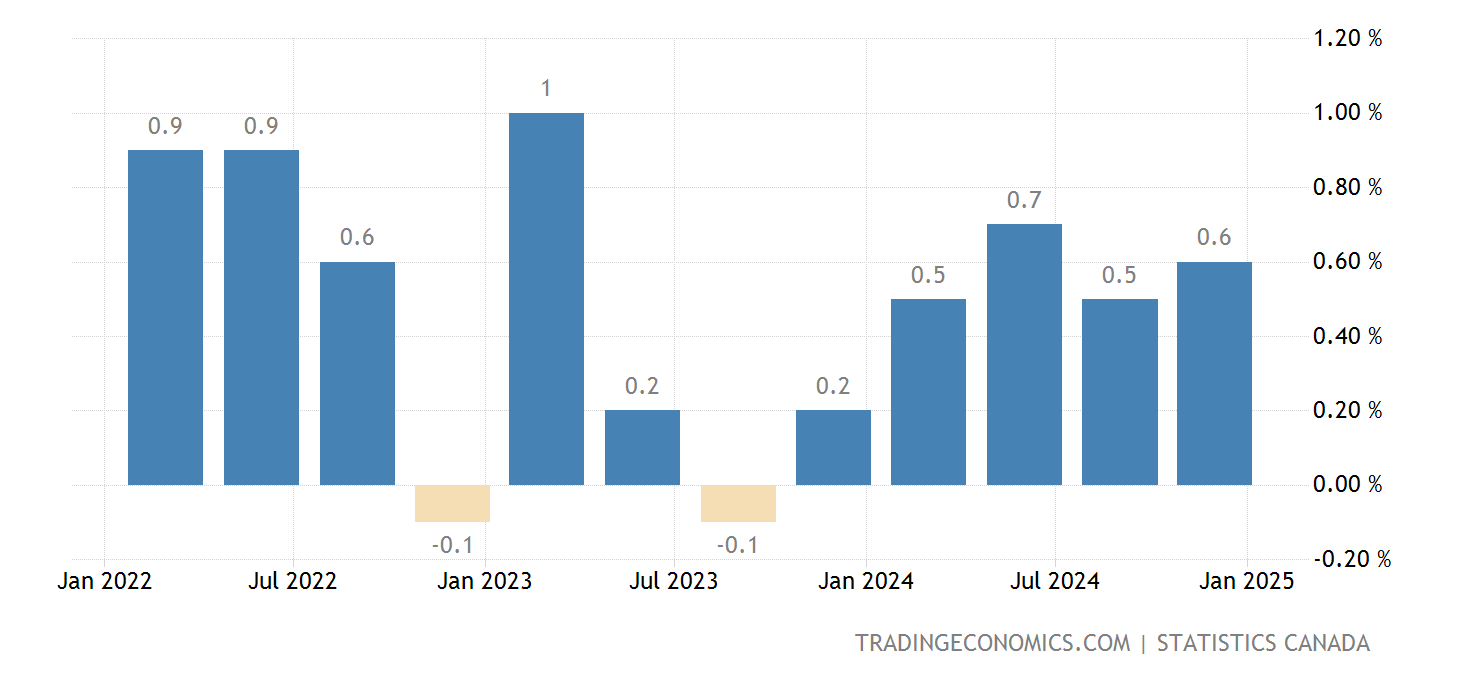

High Interest Rates and Their Dampening Effect on Investment and Consumer Spending

The Bank of Canada's efforts to combat inflation through increased interest rates are having a significant dampening effect on economic activity.

- Bank of Canada interest rates: Higher borrowing costs are making it more expensive for businesses to invest in expansion and for consumers to make large purchases, thus impacting business investment.

- Consumer spending slowdown: Increased mortgage rates and the higher cost of borrowing are leading to a consumer spending slowdown, impacting retail sales and overall economic growth.

- Impact on business investment: Businesses are delaying or scaling back investment plans due to the increased cost of capital, contributing to the overall ultra-low growth forecast for Canada. This necessitates businesses to carefully evaluate their investment strategies in the current environment.

Supply Chain Disruptions and Persistent Inflation

Lingering supply chain disruptions and persistent inflation continue to pose significant challenges to the Canadian economy.

- Supply chain bottlenecks: Although improving, supply chain disruptions continue to impact the availability and cost of goods and services, contributing to inflationary pressures.

- Inflationary pressures: High inflation erodes purchasing power, impacting consumer confidence and spending, further contributing to the ultra-low growth forecast for Canada.

- Cost of living crisis: The cost of living crisis is putting pressure on households, forcing them to cut back on discretionary spending, thereby adding to the economic slowdown. This situation requires both government intervention and individual adaptation strategies.

Implications of Ultra-Low Growth for Key Economic Sectors

The ultra-low growth forecast has significant implications across various sectors of the Canadian economy.

Impact on the Housing Market

The Canadian housing market is particularly vulnerable to the current economic climate.

- Canadian housing market: Higher interest rates are leading to a cooling of the housing market, with potential for housing price declines in some regions.

- Housing price declines: Decreased affordability and reduced buyer demand could lead to a correction in housing prices and a slowdown in construction activity.

- Mortgage rates: The increase in mortgage rates is making homeownership less accessible for many Canadians, further impacting the housing market's health.

Effects on Employment and the Labor Market

The ultra-low growth forecast poses challenges to the Canadian labor market.

- Canadian unemployment rate: Slower economic growth could lead to a rise in the Canadian unemployment rate or at least slower job creation.

- Job creation: Businesses may delay hiring or even implement layoffs in response to reduced demand and economic uncertainty.

- Labor market outlook: The labor market outlook remains uncertain, with the potential for increased unemployment in certain sectors, particularly those sensitive to economic downturns.

Consequences for Government Revenue and Fiscal Policy

The economic slowdown will significantly impact government finances.

- Government spending: Reduced economic activity will lead to lower tax revenues, creating challenges for government spending and potentially increasing the budget deficit.

- Fiscal policy: The government will need to carefully manage its fiscal policy to balance the need for economic stimulus with the need for fiscal responsibility.

- Budget deficit: The budget deficit may widen, potentially necessitating difficult choices regarding government programs and spending priorities.

Strategies for Mitigating the Impact of Ultra-Low Growth

Addressing the challenges posed by the ultra-low growth forecast requires a multi-pronged approach.

Government Policy Responses

The government can play a crucial role in mitigating the negative impacts.

- Government stimulus: Fiscal stimulus packages, targeted at vulnerable sectors and aimed at boosting economic activity, could be considered.

- Fiscal policy response: A well-designed fiscal policy response can help cushion the impact of the slowdown on individuals and businesses.

- Economic diversification: Investing in economic diversification strategies can reduce reliance on vulnerable sectors and enhance resilience to future shocks.

Business Strategies for Navigating Slow Growth

Businesses need to adapt to the challenging economic environment.

- Business resilience: Implementing robust business resilience strategies, including cost-cutting measures and operational efficiency improvements, is vital.

- Economic downturn strategies: Developing proactive economic downturn strategies to manage risks and maintain profitability during a period of slower growth is crucial.

- Risk management: Effective risk management is paramount in navigating uncertainties and adapting to a changing market landscape.

Conclusion: Understanding and Addressing the Ultra-Low Growth Forecast for Canada

The ultra-low growth forecast for Canada presents significant challenges, stemming from global economic slowdown, high interest rates, and persistent inflationary pressures. These factors have implications for the housing market, employment, and government finances. Mitigation strategies involve government policy responses, such as fiscal stimulus and investments in economic diversification, alongside business adaptation strategies focused on resilience and risk management. Staying informed about the evolving economic landscape is key to navigating these challenges effectively. Stay informed about the evolving economic landscape and explore strategies to navigate the challenges of Canada's ultra-low growth forecast. Visit [link to relevant resource, e.g., Statistics Canada website] for more insights.

Featured Posts

-

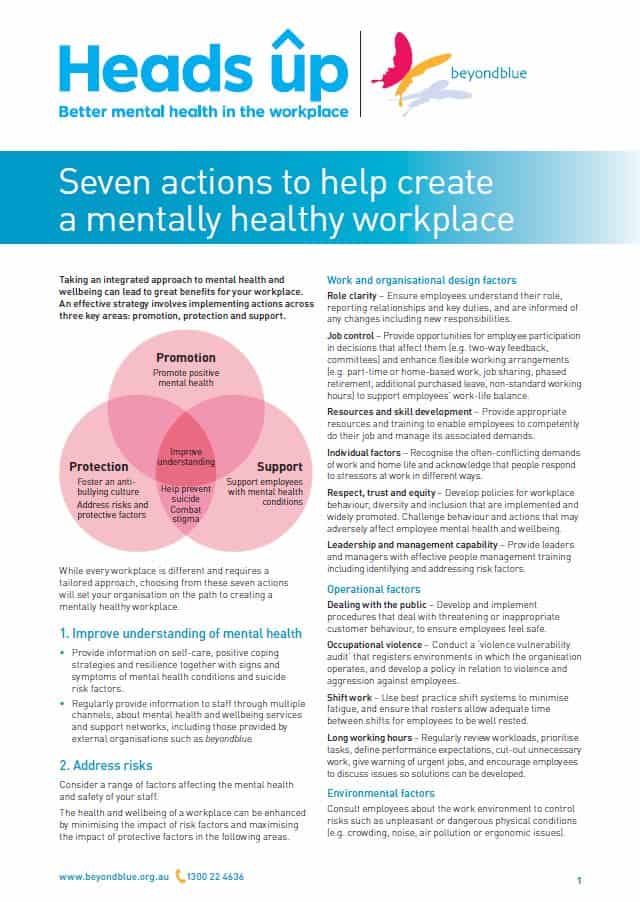

Improving Workplace Productivity Through Effective Mental Health Policies

May 03, 2025

Improving Workplace Productivity Through Effective Mental Health Policies

May 03, 2025 -

Christina Aguilera Unrecognizable In Recent Photos Due To Heavy Photo Editing

May 03, 2025

Christina Aguilera Unrecognizable In Recent Photos Due To Heavy Photo Editing

May 03, 2025 -

1 T

May 03, 2025

1 T

May 03, 2025 -

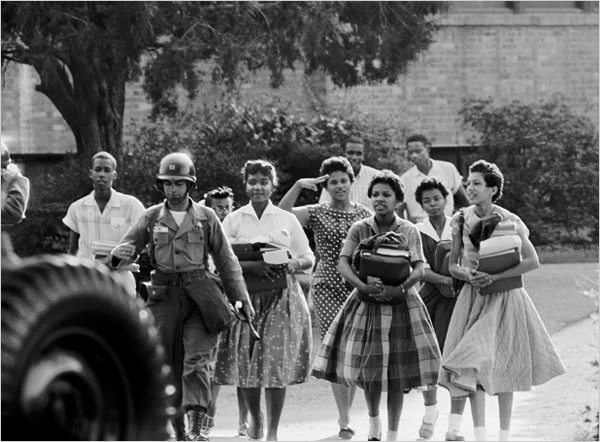

School Desegregation The Justice Departments Decision And Future Of Integration Efforts

May 03, 2025

School Desegregation The Justice Departments Decision And Future Of Integration Efforts

May 03, 2025 -

Reform Uks Internal Row Causes And Consequences

May 03, 2025

Reform Uks Internal Row Causes And Consequences

May 03, 2025

Latest Posts

-

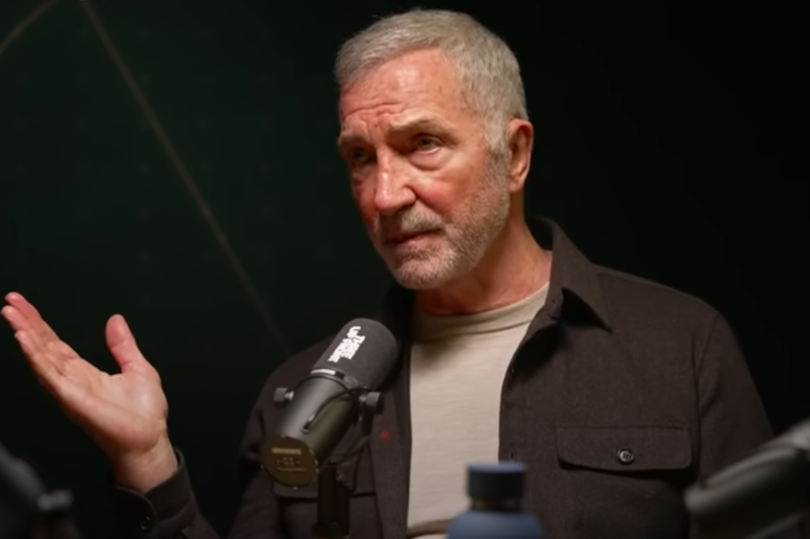

Graeme Souness On Lewis Skelly The Attitude That Impresses

May 03, 2025

Graeme Souness On Lewis Skelly The Attitude That Impresses

May 03, 2025 -

Rsalt Thdhyryt Ila Slah Twqf En Almghamrat Wdek Hsas

May 03, 2025

Rsalt Thdhyryt Ila Slah Twqf En Almghamrat Wdek Hsas

May 03, 2025 -

Liverpool And Mo Salah Contract Negotiations And The Road Ahead

May 03, 2025

Liverpool And Mo Salah Contract Negotiations And The Road Ahead

May 03, 2025 -

Souness Urges Aston Villa To Sign Marcus Rashford

May 03, 2025

Souness Urges Aston Villa To Sign Marcus Rashford

May 03, 2025 -

Jw 24 Thdhyr Eajl Lslah Bshan Mghamrath Alkhtyrt

May 03, 2025

Jw 24 Thdhyr Eajl Lslah Bshan Mghamrath Alkhtyrt

May 03, 2025