Understanding Bitcoin's Rebound: Potential For Future Growth

Table of Contents

Analyzing the Factors Behind Bitcoin's Rebound

Several key factors have converged to fuel Bitcoin's recent price rebound. Understanding these elements is vital for predicting its future trajectory.

Institutional Adoption and Investment

The involvement of large financial institutions is significantly bolstering Bitcoin's legitimacy and price stability. This institutional adoption is a game-changer, shifting the narrative from a niche asset to a potentially mainstream investment.

- Examples of institutional investments: MicroStrategy's massive Bitcoin holdings, Tesla's Bitcoin purchase (and subsequent partial sale), and the growing interest from various pension funds and investment firms.

- The impact of Grayscale Bitcoin Trust (GBTC): GBTC, a publicly traded trust offering exposure to Bitcoin, provides institutional investors with a regulated and accessible entry point into the market. Its performance often mirrors, and even influences, Bitcoin's price.

- Growing acceptance among hedge funds: Many prominent hedge funds are increasingly allocating assets to Bitcoin, further driving demand and legitimizing it within traditional financial circles.

Institutional interest acts as a stabilizing force, attracting more conservative investors and reducing the impact of short-term market fluctuations. This influx of capital provides a solid foundation for sustained price growth.

Macroeconomic Factors Influencing Bitcoin's Price

Bitcoin's price is not immune to the broader economic environment. Global macroeconomic events and government policies significantly influence investor sentiment and, consequently, Bitcoin's value.

- Examples of global economic events impacting Bitcoin: Periods of high inflation, geopolitical instability, and concerns about fiat currency devaluation often lead to increased demand for Bitcoin as a hedge against risk.

- The "safe haven" asset narrative: Many investors view Bitcoin as a safe haven asset, similar to gold, providing a store of value during times of economic uncertainty.

- The impact of quantitative easing (QE): The massive injection of liquidity into global markets through QE programs can indirectly fuel Bitcoin's price, as investors seek alternative assets outside of traditional markets.

The correlation between traditional financial markets and the crypto market is becoming increasingly apparent. Macroeconomic instability often drives investors toward Bitcoin, seeing it as a decentralized and inflation-resistant alternative.

Technological Advancements and Network Upgrades

Significant technological advancements within the Bitcoin network are enhancing its scalability, efficiency, and usability, thereby broadening its appeal.

- Explanation of the Lightning Network: The Lightning Network is a second-layer scaling solution that allows for faster and cheaper Bitcoin transactions outside of the main blockchain.

- Improved transaction speeds: The Lightning Network and other upgrades have significantly reduced transaction times, making Bitcoin more practical for everyday use.

- Reduced fees: Lower transaction fees make Bitcoin a more attractive option for a wider range of users, particularly for smaller transactions.

- Impact on wider usage: These improvements are directly contributing to increased adoption and usage of Bitcoin, further fueling its price appreciation.

Addressing previous limitations through technological innovation is key to Bitcoin's long-term success and wider adoption as a mainstream payment system.

Assessing the Potential for Sustained Bitcoin Growth

While Bitcoin's rebound is promising, it's crucial to analyze both the potential for sustained growth and the inherent risks.

Long-Term Market Trends and Predictions

Numerous experts offer varying predictions regarding Bitcoin's long-term trajectory. While precise forecasting remains elusive, analyzing long-term trends provides valuable insights.

- Price predictions from reputable analysts: While predictions vary greatly, many analysts foresee continued growth for Bitcoin, albeit with considerable volatility.

- Considerations for long-term investment strategies: Long-term investors should adopt a strategy that accounts for both potential gains and significant price fluctuations.

- Potential challenges and risks: Factors such as regulatory uncertainty and technological disruption need to be considered.

Bitcoin's potential to become a mainstream asset class is undeniable, offering a unique value proposition in a rapidly evolving financial landscape.

Risks and Challenges Facing Bitcoin's Growth

It's important to acknowledge the inherent risks associated with Bitcoin investment.

- Regulatory hurdles: Government regulations concerning cryptocurrencies vary widely across the globe, presenting ongoing uncertainty.

- Potential for market manipulation: The relatively smaller market capitalization of Bitcoin compared to traditional markets makes it potentially more vulnerable to manipulation.

- Environmental concerns regarding Bitcoin mining: The energy consumption associated with Bitcoin mining is a legitimate concern and subject to ongoing debate and technological solutions.

A balanced perspective is essential; understanding both the potential rewards and associated risks is crucial for responsible investment.

Diversification and Risk Management in Bitcoin Investment

Responsible Bitcoin investment requires careful planning and diversification.

- Strategies for managing risk: Diversifying your portfolio, setting stop-loss orders, and avoiding impulsive investment decisions are crucial.

- Importance of thorough research: Thoroughly research the market before investing, understanding the underlying technology and potential risks.

- Avoiding impulsive decisions: Emotions should play no part in investment decisions; stick to your strategy and risk tolerance.

Conclusion

Bitcoin's rebound is fueled by a confluence of factors: institutional adoption, macroeconomic influences, and crucial technological advancements. While the potential for future growth is considerable, understanding the inherent risks—regulatory uncertainties, market manipulation, and environmental concerns—is paramount. Key takeaways include the importance of analyzing macroeconomic factors, appreciating technological improvements, and acknowledging the influence of institutional adoption. While understanding Bitcoin's rebound requires careful analysis of various factors, its potential for future growth remains a compelling area of study for savvy investors. Continue your research and make informed decisions about Bitcoin investment, considering Bitcoin's future and how to navigate the complexities of Bitcoin price rebounds.

Featured Posts

-

Darkseids Legion A Devastating Attack On Superman In Dcs July 2025 Comics

May 08, 2025

Darkseids Legion A Devastating Attack On Superman In Dcs July 2025 Comics

May 08, 2025 -

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

Futbollisti I Psg Largohet Nga Skuadra Pas Vendimit Te Luis Enriques

May 08, 2025

Futbollisti I Psg Largohet Nga Skuadra Pas Vendimit Te Luis Enriques

May 08, 2025 -

Saturday Night Live The Night Counting Crows Took Off

May 08, 2025

Saturday Night Live The Night Counting Crows Took Off

May 08, 2025 -

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Latest Posts

-

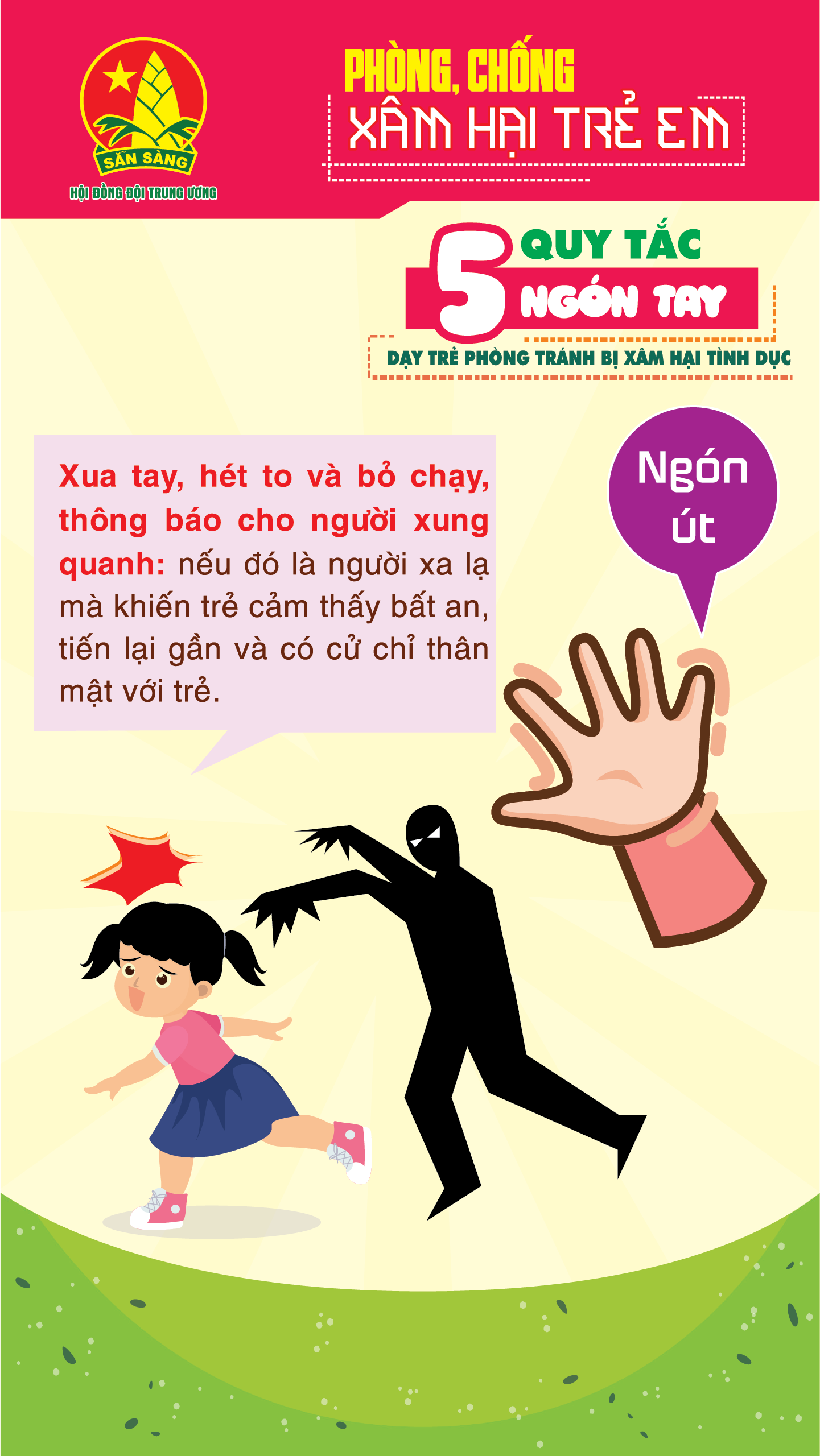

Bao Hanh Tre Em Tien Giang De Nghi Xu Ly Nghiem Khac Va Cai Thien An Toan Giu Tre

May 09, 2025

Bao Hanh Tre Em Tien Giang De Nghi Xu Ly Nghiem Khac Va Cai Thien An Toan Giu Tre

May 09, 2025 -

State Suspends Nc Daycare License Impact On Children And Families

May 09, 2025

State Suspends Nc Daycare License Impact On Children And Families

May 09, 2025 -

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025 -

Nc Daycare License Suspended Details On The States Decision

May 09, 2025

Nc Daycare License Suspended Details On The States Decision

May 09, 2025 -

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025