Understanding Canadian Mortgage Preferences: The 10-Year Term Question

Table of Contents

Canadians face a significant financial decision when purchasing a home: choosing the right mortgage term. While terms range from short-term options to longer commitments, the 10-year mortgage term has become increasingly popular. This article explores the advantages and disadvantages of a 10-year term within the Canadian mortgage market, empowering you to make a well-informed decision.

Advantages of a 10-Year Mortgage Term in Canada

A 10-year mortgage term offers several compelling benefits for Canadian homeowners:

Predictable Monthly Payments

- Financial Stability: A fixed-rate 10-year mortgage provides predictable monthly payments for a full decade. This stability is crucial for budgeting and financial planning, allowing you to allocate funds confidently for other expenses.

- Simplified Budgeting: Knowing your exact mortgage payment for ten years simplifies your monthly budget significantly, reducing financial stress and promoting responsible financial management.

- Interest Rate Certainty: Unlike variable-rate mortgages, a 10-year fixed-rate mortgage shields you from interest rate fluctuations during this period, providing peace of mind.

Potentially Lower Interest Rates

- Longer-Term Incentives: Lenders sometimes offer slightly lower interest rates for longer mortgage terms like 10 years, incentivizing borrowers to commit to a longer period.

- Cumulative Savings: The slightly lower interest rate, even if marginal, can result in significant savings over the ten-year period, leading to substantial long-term cost reductions.

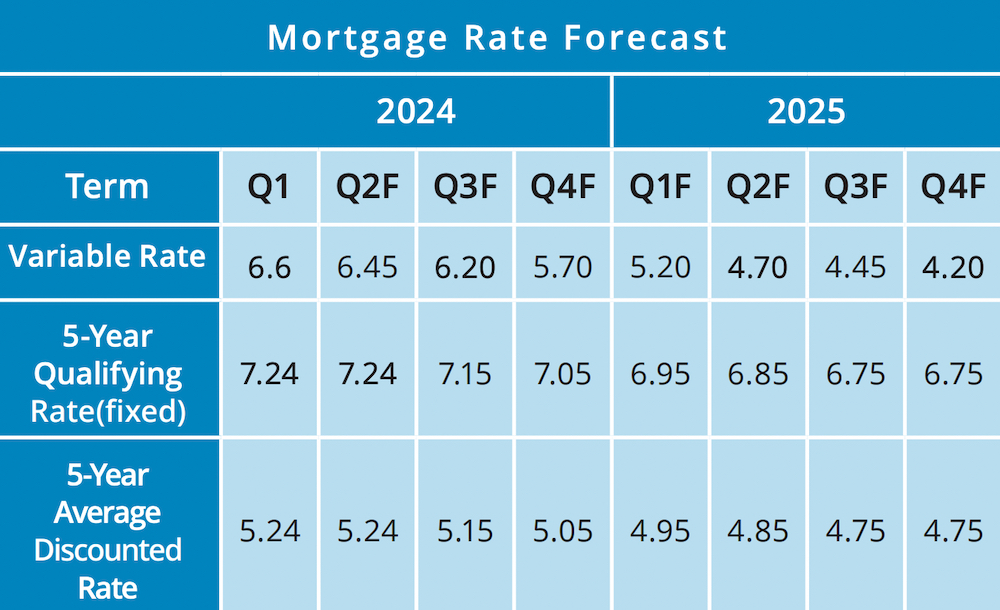

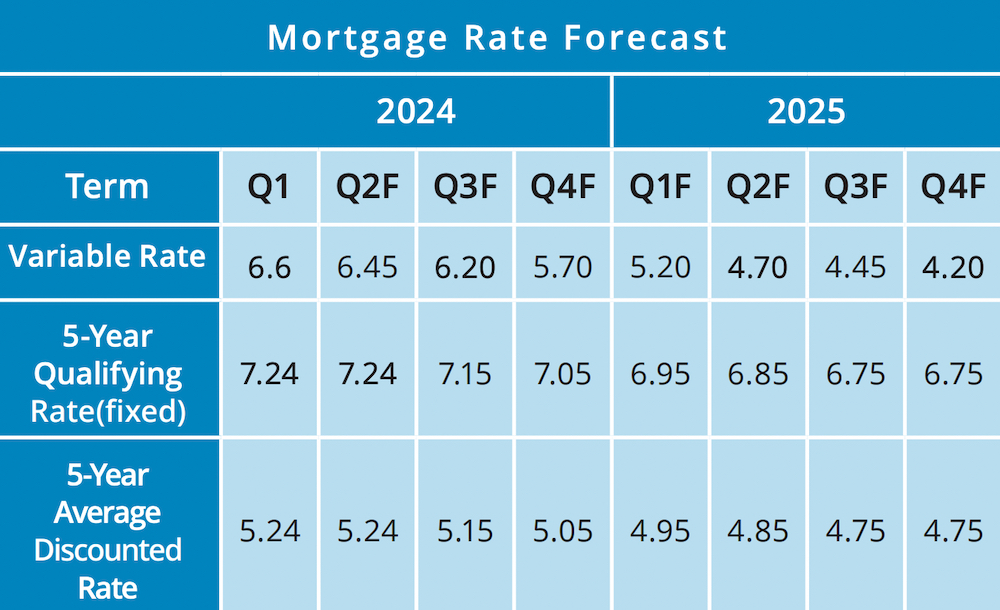

- Rate Comparison: It's crucial to compare the total interest paid over the amortization period for different mortgage terms (5-year, 10-year, etc.) to determine the most cost-effective option.

Reduced Number of Renewals

- Fewer Renewal Cycles: Opting for a 10-year term means you only need to renew your mortgage once a decade, reducing the administrative burden and time spent shopping for new mortgage rates.

- Streamlined Process: Less frequent renewals streamline the mortgage process, minimizing the stress and time commitment associated with rate comparisons and mortgage applications.

- Rate Risk Mitigation (but not elimination): While not completely eliminating rate risk, it does reduce the frequency of facing potential rate increases at renewal.

Disadvantages of a 10-Year Mortgage Term in Canada

Despite its advantages, a 10-year mortgage term also presents certain drawbacks:

Interest Rate Risk

- Rate Lock-in: You're locked into your initial interest rate for ten years. If interest rates fall significantly during this period, you miss out on the opportunity to secure a lower rate.

- Market Volatility: Unexpected changes in the Canadian mortgage market and interest rate hikes can negatively impact your financial situation, particularly if your fixed rate was set at a relatively high point.

- Economic Forecasting: Careful monitoring of economic forecasts and interest rate predictions is crucial before committing to a long-term mortgage like a 10-year term.

Limited Flexibility

- Mid-Term Changes: Making significant changes to your mortgage mid-term can be challenging and may involve penalties.

- Refinancing Challenges: Refinancing or breaking a 10-year mortgage early usually incurs penalties, limiting your flexibility in response to changing circumstances.

- Life Changes: Unforeseen life events (job loss, relocation, etc.) can make a long-term mortgage difficult to manage.

Higher Initial Payments (Potentially)

- Total Interest: While the initial interest rate might be lower, the total interest paid over the 10-year term might be higher compared to a shorter-term mortgage with a slightly higher initial rate.

- Amortization Comparison: It's essential to calculate the total interest payable across different mortgage terms to make an informed decision based on your overall financial goals and risk tolerance.

Alternatives to a 10-Year Term

Canadian homeowners have other mortgage term options:

Shorter-Term Mortgages (e.g., 5-year)

- Increased Flexibility: Shorter terms, like 5-year mortgages, offer greater flexibility, allowing you to adapt to market changes by renegotiating your interest rate every five years.

- Rate Adjustments: You can adjust your mortgage strategy based on prevailing interest rates at each renewal.

- More Frequent Renewals: Be prepared for more frequent mortgage renewals, which require more time and effort in comparing rates and mortgage options.

Variable-Rate Mortgages

- Potentially Lower Rates: Variable-rate mortgages often offer lower initial interest rates compared to fixed-rate options.

- Payment Fluctuations: However, your monthly payments will fluctuate based on changes in the Bank of Canada's prime rate.

- Risk Tolerance: Variable-rate mortgages are suitable only for individuals comfortable with the risk associated with fluctuating payments.

Factors to Consider Before Choosing a 10-Year Term

Before deciding on a 10-year mortgage term, consider these crucial factors:

- Risk Tolerance: Assess your comfort level with interest rate fluctuations and the potential for higher payments over the long term.

- Economic Outlook: Analyze current economic conditions and interest rate predictions to gauge the potential risks and rewards.

- Financial Goals: Align your mortgage choice with your long-term financial goals, considering factors like retirement planning and investment strategies.

- Flexibility Needs: Evaluate your need for flexibility in adapting your mortgage to potential life changes or unforeseen circumstances.

- Professional Advice: Consult with a qualified mortgage broker or financial advisor to get personalized advice and explore the best options for your situation.

Conclusion

Choosing a 10-year mortgage term in Canada involves carefully weighing its advantages and disadvantages. The stability of predictable payments and potentially lower interest rates are attractive, but the reduced flexibility and increased interest rate risk should be carefully considered. Understanding your personal financial circumstances, risk tolerance, and long-term financial goals is paramount. Seeking expert advice from a mortgage professional is highly recommended to ensure you make the best decision for your specific needs. Begin exploring your Canadian mortgage options today and start planning your long-term financial strategy. Don't hesitate to discuss your options for a 10-year mortgage term with a qualified professional.

Featured Posts

-

How To Watch Fox Without Cable Live Sports News And Tv Shows

May 04, 2025

How To Watch Fox Without Cable Live Sports News And Tv Shows

May 04, 2025 -

Bianca Censori And Kanye West Back Together After Weeks Apart

May 04, 2025

Bianca Censori And Kanye West Back Together After Weeks Apart

May 04, 2025 -

The Rumours Are True Fleetwood Macs Pioneering Supergroup Status

May 04, 2025

The Rumours Are True Fleetwood Macs Pioneering Supergroup Status

May 04, 2025 -

Crawford Vs Canelo Is Benavidez Avoidance Due To Disrespect Or Skill

May 04, 2025

Crawford Vs Canelo Is Benavidez Avoidance Due To Disrespect Or Skill

May 04, 2025 -

Todays Mma Fights Best Bets Odds And Predictions For Ufc Des Moines

May 04, 2025

Todays Mma Fights Best Bets Odds And Predictions For Ufc Des Moines

May 04, 2025