Understanding Congo's Cobalt Export Quota Plan: Market Implications

Table of Contents

The Details of Congo's Cobalt Export Quota Plan

Congo's cobalt export quota system represents a significant shift in the country's mining regulatory framework. The specifics of the quota system, including the exact percentage of production affected and the mechanism for allocation, are still evolving. However, the overarching goal of the DRC government is multifaceted: to increase government revenue from cobalt exports, promote the development of a robust domestic cobalt processing and refining industry, and ultimately, gain greater control over its vital mineral resources. Keywords like "Cobalt quota system," "DRC mining regulations," and "Cobalt export restrictions" are central to understanding this complex issue.

Potential Benefits for the DRC

The DRC government envisions several key benefits from implementing cobalt export quotas:

- Increased Government Revenue: Quotas can provide a more predictable and potentially higher stream of revenue for the government, funding crucial infrastructure projects and social programs.

- Promotion of Domestic Cobalt Processing and Refining: By limiting raw cobalt exports, the government aims to incentivize investment in domestic processing facilities, adding value to the mineral resource within the country.

- Creation of Jobs and Economic Growth: A thriving domestic cobalt processing sector has the potential to create numerous jobs and stimulate economic growth within the DRC, reducing reliance on raw material exports.

- Greater Control over the Cobalt Supply Chain: The quota system allows the DRC greater control over the flow of its cobalt, potentially leading to more favorable negotiations with international buyers.

Challenges and Risks Associated with the Quota System

While the potential benefits are significant, the quota system also presents considerable challenges and risks:

- Potential for Supply Shortages and Price Volatility: Restricting cobalt exports could lead to supply shortages in the global market, causing price volatility and potentially impacting the affordability and availability of EV batteries.

- Risk of Hindering the Growth of the EV Industry: Supply disruptions could delay the growth of the electric vehicle industry, a critical sector for addressing climate change.

- Concerns about Transparency and Fairness in the Quota Allocation Process: The lack of transparency in the allocation process could lead to concerns about fairness and favoritism, potentially harming investor confidence.

- Potential for Illegal Mining and Smuggling to Increase: Quotas can unintentionally incentivize illegal mining and smuggling activities as producers seek alternative ways to export their cobalt.

Impact on the Global Cobalt Market

The implementation of Congo's cobalt export quota plan will have far-reaching consequences for the global cobalt market. The potential impact on cobalt price forecast is a key area of concern. A reduction in supply could lead to short-term price increases, potentially impacting the affordability of electric vehicles. However, long-term effects are less clear, and depend on factors such as market response and the development of alternative cobalt sources. Keywords such as "Cobalt price forecast," "Cobalt supply chain disruption," "Alternative cobalt sources," and "Battery metal prices" are crucial in understanding this complex interplay.

Impact on Battery Manufacturers

Battery manufacturers face several challenges due to the quota system:

- Increased Costs of Raw Materials: Higher cobalt prices due to supply constraints will increase the cost of producing EV batteries, impacting profitability and potentially the price of electric vehicles.

- Supply Chain Vulnerabilities and Diversification Strategies: Battery manufacturers will need to diversify their sourcing strategies to reduce reliance on the DRC and mitigate supply chain risks.

- Potential for Delays in EV Production: Supply shortages could lead to delays in EV production, hindering the growth of the electric vehicle market.

Impact on Investors

Investors in the cobalt market will also experience significant impacts:

- Volatility in Cobalt-Related Stock Prices: The uncertainty surrounding the quota system's impact could lead to significant volatility in cobalt-related stock prices.

- Investment Opportunities in Alternative Battery Technologies: The challenges posed by the quota system may accelerate investment in research and development of alternative battery technologies that require less or no cobalt.

- Increased Scrutiny of Cobalt Sourcing Practices: Investors are likely to pay increased attention to the ethical and responsible sourcing of cobalt, increasing pressure on companies to implement robust supply chain traceability measures.

Strategies for Navigating the Changing Cobalt Landscape

Navigating the evolving cobalt market requires proactive strategies for all stakeholders:

- Diversification Strategies for Battery Manufacturers: Battery manufacturers must diversify their cobalt sourcing to reduce reliance on a single source and mitigate risks associated with the quota system. This includes exploring alternative cobalt sources and developing battery technologies that require less cobalt.

- Importance of Responsible Sourcing and Ethical Cobalt Mining: The focus on responsible cobalt sourcing and ethical cobalt mining practices is paramount. This involves ensuring that cobalt is mined and processed in a way that respects human rights, environmental regulations, and promotes sustainable development. Keywords such as "Responsible cobalt sourcing," "Cobalt supply chain traceability," and "Ethical cobalt mining" will increasingly define the industry landscape.

- Risk Mitigation Strategies for Investors: Investors should develop robust risk mitigation strategies to account for the potential volatility in the cobalt market. This includes diversifying their investments and carefully evaluating the ethical and environmental impact of the companies they invest in.

Conclusion: Understanding the Future of Congo's Cobalt Export Quota Plan

Congo's cobalt export quota plan presents a complex challenge with significant implications for both the DRC and the global cobalt market. While the plan aims to benefit the DRC through increased revenue and the development of a domestic processing industry, it also carries risks such as supply chain disruptions and price volatility. Transparency, responsible sourcing, and collaboration among stakeholders are crucial to ensuring a stable and sustainable cobalt market. The future of cobalt supply chains hinges on successfully navigating these complexities. Stay updated on the latest changes in Congo's cobalt export quota, understand the evolving dynamics of the DRC cobalt market, and learn more about the impact of cobalt export quotas on the global supply chain.

Featured Posts

-

Investasi Giant Sea Wall Kerjasama Pemerintah Dan Swasta Untuk Perlindungan Pesisir

May 16, 2025

Investasi Giant Sea Wall Kerjasama Pemerintah Dan Swasta Untuk Perlindungan Pesisir

May 16, 2025 -

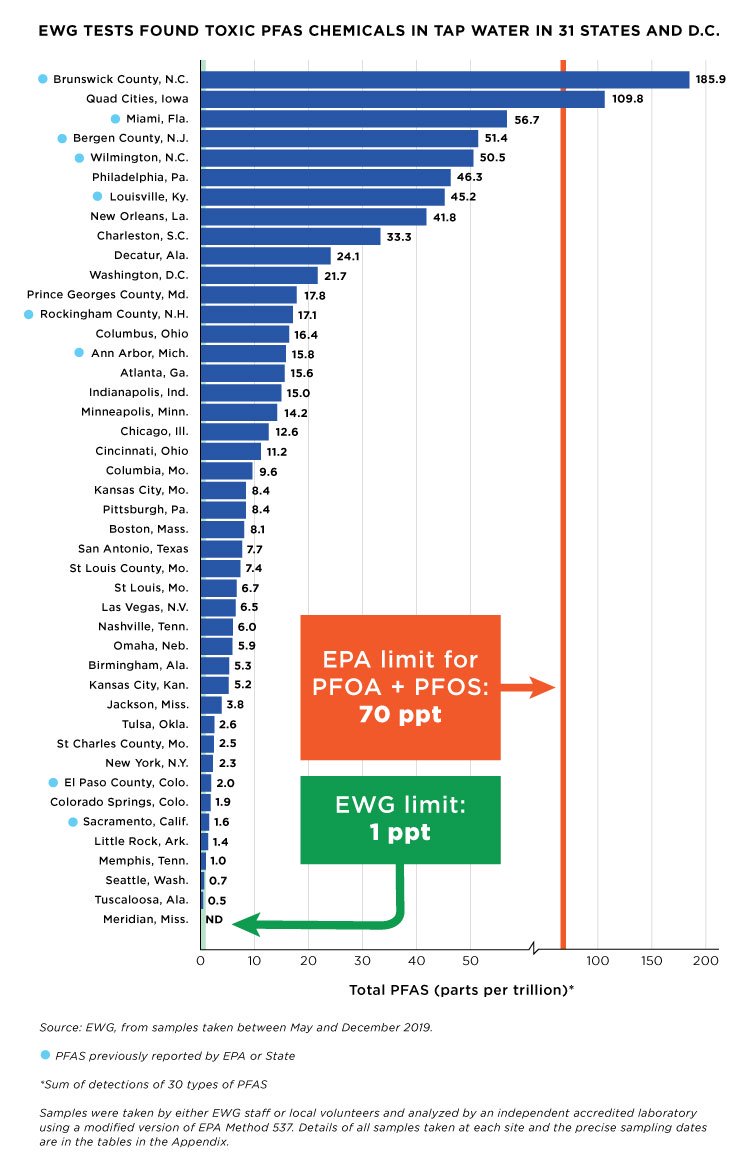

Blue Mountains Water Contaminated Pfas Levels Nine Times Higher Than Safe Limit

May 16, 2025

Blue Mountains Water Contaminated Pfas Levels Nine Times Higher Than Safe Limit

May 16, 2025 -

Rekord Leme Pobit Ovechkin I Ego Goly V Pley Off N Kh L

May 16, 2025

Rekord Leme Pobit Ovechkin I Ego Goly V Pley Off N Kh L

May 16, 2025 -

Gorklon Rust Decoding Elon Musks X Name Change

May 16, 2025

Gorklon Rust Decoding Elon Musks X Name Change

May 16, 2025 -

Tom Cruise And Ana De Armas Spotted Together Again Are They Dating

May 16, 2025

Tom Cruise And Ana De Armas Spotted Together Again Are They Dating

May 16, 2025