Understanding Executive Compensation Disclosures In Proxy Statements (Form DEF 14A)

Table of Contents

Decoding the Components of Executive Compensation

Executive compensation is multifaceted, encompassing various elements designed to attract and retain top talent. Understanding each component is essential for a complete picture.

Salary and Bonuses

The foundation of executive compensation typically includes a base salary and short-term incentives (bonuses). The DEF 14A clearly outlines these figures.

- Base Salary: This is the fixed annual compensation paid to the executive. It's usually presented as a yearly amount in the DEF 14A.

- Short-Term Incentives (Bonuses): These are payments based on the company's performance during a specific period, often a year. The DEF 14A will detail the bonus structure, including the metrics used to determine the payout. Performance-based bonuses can be tied to various factors such as revenue growth, profitability, or market share.

Variations in bonus structures are common. Some companies use target bonuses, while others employ a more complex formula linking bonus payments to exceeding specific performance goals. Understanding the executive compensation structure, including the base salary and bonus plan, and the related performance metrics, is crucial for a thorough analysis.

Long-Term Incentives (LTIs)

Long-term incentives are designed to align executive interests with shareholder value creation over an extended period. These commonly include:

- Stock Options: These give executives the right, but not the obligation, to purchase company stock at a predetermined price (the exercise price) within a specified timeframe.

- Restricted Stock Units (RSUs): These are shares of company stock granted to executives, but they are subject to vesting requirements—meaning the executive must meet certain conditions (like continued employment) before they can own the shares.

- Performance-Based Stock Awards: These awards are contingent upon achieving pre-defined performance goals, often linked to long-term corporate objectives.

The DEF 14A will clearly outline the vesting period for each LTI, specifying the time it takes for the executive to fully own the stock or receive the payout. It’s crucial to understand the potential dilution effect that stock-based compensation can have on existing shareholders. Analyzing the value and potential payout of these stock options, RSUs, and stock awards is essential for a complete understanding of long-term incentives.

Other Compensation

Beyond salary, bonuses, and LTIs, executive compensation packages often include various perquisites, benefits, and additional compensation. This "other compensation" category in the DEF 14A might include:

- Retirement plan contributions

- Health insurance premiums

- Life insurance

- Company car

- Personal use of corporate aircraft

- Club memberships

Analyzing this section of the executive compensation package provides a comprehensive view of the total compensation received.

Analyzing the Summary Compensation Table (SCT)

The heart of executive compensation disclosure in the DEF 14A is the Summary Compensation Table (SCT).

Understanding the SCT Format

The SCT presents a concise overview of executive compensation for the named executive officers. The table typically includes columns for:

- Name and Principal Position: Identifying the executive.

- Year: The reporting year.

- Salary: The annual base salary.

- Bonus: Short-term incentive compensation.

- Stock Awards: Value of stock-based compensation.

- Option Awards: Value of stock options granted.

- All Other Compensation: The total of all other compensation elements.

- Total Compensation: The sum of all compensation elements.

Understanding the executive compensation disclosure in this structured Summary Compensation Table (SCT) is crucial. This SEC filing presents data in a readily comparable format.

Interpreting the Data

Effectively analyzing the SCT requires comparing data across different timeframes and benchmarks.

- Year-over-Year Comparison: Compare current year compensation to prior years' to identify trends.

- Industry Benchmarking: Compare the compensation levels to those of executives at similar companies in the same industry.

- Company Performance: Assess compensation in relation to the company's financial performance. Does executive compensation align with shareholder returns?

Effective compensation analysis involves comparing figures and identifying anomalies or discrepancies.

Identifying Potential Red Flags

Certain aspects of the SCT might raise concerns:

- Compensation significantly outpacing company performance.

- Excessive use of stock options or other LTIs that create significant risk for shareholders.

- Unusual or excessive "other compensation."

Analyzing the executive compensation disclosure for such red flags is critical for investors to identify potential issues with corporate governance and management accountability.

Beyond the Summary Compensation Table: Looking for Additional Context

The SCT provides a summary; however, crucial context is found elsewhere in the DEF 14A.

Narrative Disclosure

The DEF 14A includes a narrative section explaining the rationale behind compensation decisions. This narrative disclosure is vital for understanding the compensation committee's reasoning and the factors influencing compensation levels.

Compensation Committee Report

The compensation committee report details the committee's process and oversight of executive compensation. This provides insight into the committee's independence and its role in ensuring fair and reasonable compensation. This section highlights elements of corporate governance.

Peer Group Analysis

The DEF 14A often includes a discussion of the company's peer group analysis, which compares executive compensation to that of similar companies. This provides valuable context for assessing the competitiveness and reasonableness of executive pay. This benchmarking helps establish a context for comparing competitive compensation.

Conclusion: Mastering Executive Compensation Disclosures in Proxy Statements (Form DEF 14A)

Understanding executive compensation disclosures in DEF 14A filings is essential for any investor or stakeholder. This article has highlighted the key elements: the Summary Compensation Table (SCT), long-term incentives (LTIs), other compensation elements, and the importance of the narrative disclosure and compensation committee report. By critically analyzing the data presented, comparing it to industry benchmarks and considering the company's performance, you can identify potential red flags and make informed decisions. By understanding the nuances of executive compensation disclosures in proxy statements (Form DEF 14A), you can become a more informed investor and contribute to better corporate governance. Actively review the executive compensation sections of proxy statements (Form DEF 14A) for companies you invest in or are interested in to make well-informed decisions.

Featured Posts

-

Andors First Look Everything We Ve Been Waiting For

May 17, 2025

Andors First Look Everything We Ve Been Waiting For

May 17, 2025 -

Erdogan In Birlesik Arap Emirlikleri Devlet Baskani Ile Telefon Goeruesmesi

May 17, 2025

Erdogan In Birlesik Arap Emirlikleri Devlet Baskani Ile Telefon Goeruesmesi

May 17, 2025 -

Tvs Jupiter Cng

May 17, 2025

Tvs Jupiter Cng

May 17, 2025 -

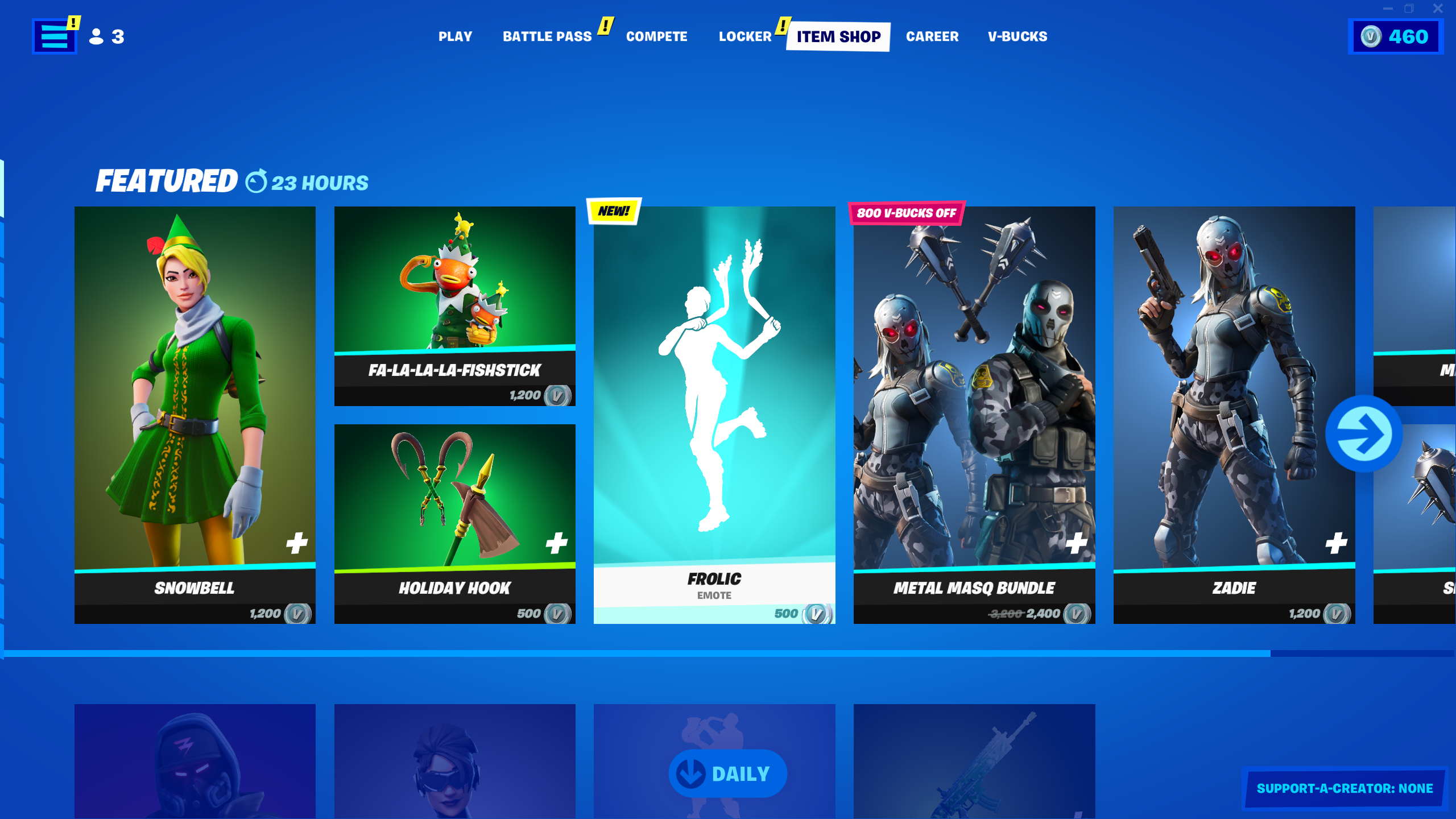

New Fortnite Item Shop Feature Easier Navigation And Purchases

May 17, 2025

New Fortnite Item Shop Feature Easier Navigation And Purchases

May 17, 2025 -

Latest On Angelo Stiller Arsenals Pursuit Gains Momentum

May 17, 2025

Latest On Angelo Stiller Arsenals Pursuit Gains Momentum

May 17, 2025