Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

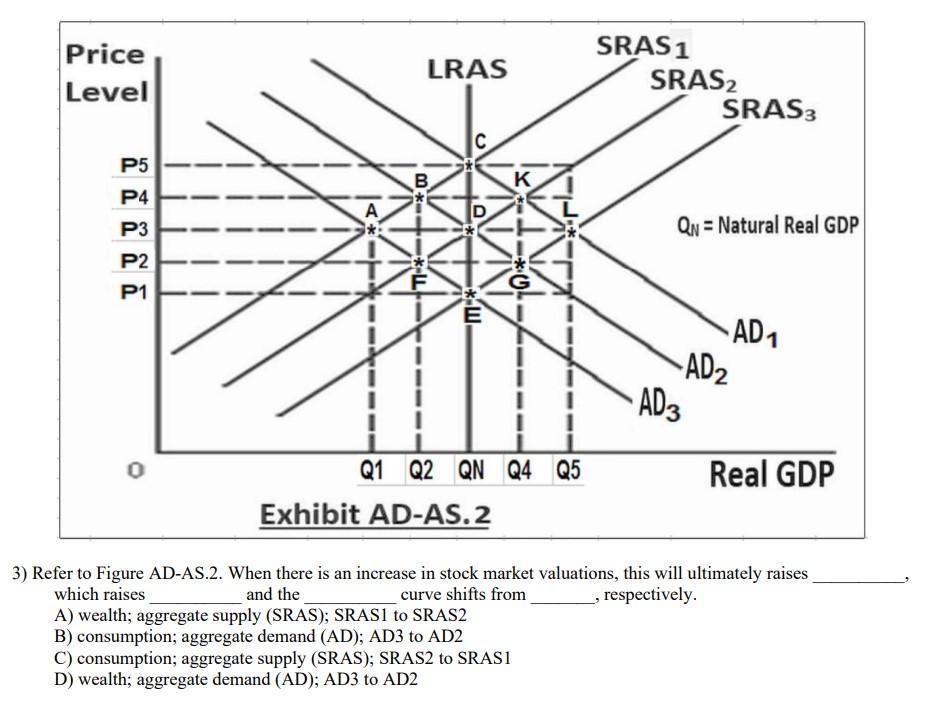

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook often shifts, so it's crucial to consult their most recent reports for the most up-to-date information. However, generally, BofA tends to take a nuanced approach, acknowledging both the potential for further growth and the significant risks associated with high valuations. Their analysis incorporates a variety of factors, making a simple "bullish," "bearish," or "neutral" label insufficient.

Key Valuation Ratios Analyzed by BofA:

BofA utilizes a comprehensive suite of valuation ratios to assess market conditions. These include:

-

Price-to-Earnings ratio (P/E): This ratio compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or overvaluation. BofA analysts analyze P/E ratios across sectors and compare them to historical averages to gauge potential overvaluation.

-

Price-to-Sales ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's often used for companies with negative earnings, offering a broader valuation perspective. BofA's interpretation considers the industry context and growth trajectory.

-

Cyclically Adjusted Price-to-Earnings ratio (CAPE): Also known as the Shiller P/E ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a longer-term valuation perspective. BofA uses CAPE to assess whether valuations are historically high or low compared to previous economic cycles.

While precise data points from BofA reports change frequently, their analysis generally involves comparing current levels of these ratios to historical averages and industry benchmarks to determine if valuations are justified by underlying fundamentals or represent potential risk.

Impact of Interest Rates on Stock Valuations (BofA perspective):

BofA's analysis highlights the inverse relationship between interest rates and stock valuations. Rising interest rates typically lead to lower stock valuations as investors shift towards higher-yielding bonds. Conversely, falling interest rates can boost stock valuations as investors seek higher returns in the equity market. BofA's forecasts on interest rates and their impact on the market are key components of their overall valuation assessments, factoring in monetary policy decisions and economic projections. For example, a predicted increase in interest rates might lead BofA to advise caution regarding current market valuations.

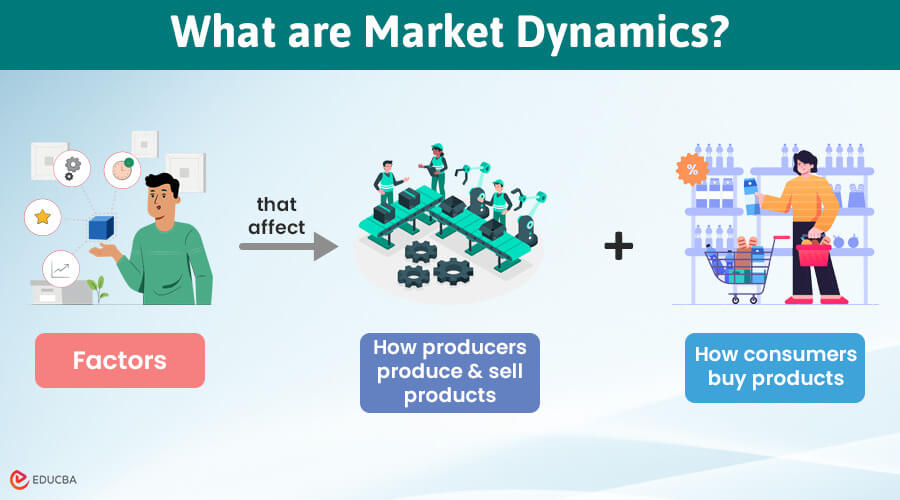

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current elevated stock market valuations, as analyzed by BofA:

Low Interest Rates and Quantitative Easing:

Historically low interest rates and quantitative easing (QE) programs have played a significant role. These policies increased the money supply, lowering borrowing costs and encouraging investors to seek higher returns in the equity market. This boosted risk appetite and pushed valuations higher. BofA's research likely points out this as a significant factor driving higher P/E and other valuation metrics.

Strong Corporate Earnings and Growth Prospects:

Robust corporate earnings and positive growth expectations in various sectors have also supported high valuations. BofA's sector-specific analyses often reveal which industries are demonstrating exceptional earnings growth, thereby justifying higher valuations within those segments. This aspect is crucial in understanding why some sectors might be overvalued while others remain relatively fairly priced.

Technological Advancements and Disruptive Innovation:

Technological breakthroughs and disruptive innovations have propelled valuations in certain sectors, particularly in technology stocks. BofA's reports likely identify specific companies benefiting from these trends, highlighting the role of innovation in driving high valuations for certain growth stocks. This justifies higher P/E ratios in high-growth tech firms, for instance.

Risks Associated with High Stock Market Valuations

Despite the positive factors, BofA acknowledges significant risks associated with high stock market valuations:

Potential for Market Correction or Crash:

Given the elevated valuations, BofA's analysis likely explores the risk of a market correction or even a more significant crash. They assess the probability and potential severity of such an event, considering various economic indicators and market sentiment. This often involves stress testing various scenarios and considering potential triggers.

Inflation and Its Impact on Valuations:

Inflation significantly impacts stock valuations. Rising inflation erodes corporate earnings and increases investor uncertainty, potentially leading to lower valuations. BofA's assessments include analyzing the potential impact of inflation on corporate profitability and investor behavior. Their forecasts incorporate various inflation scenarios and their effect on stock prices.

Geopolitical Uncertainty and its Influence:

Geopolitical events introduce volatility into the market, impacting investor sentiment and valuations. BofA's analysis considers potential geopolitical risks and their possible influence on market stability and stock prices. These assessments often involve analyzing global events and their potential ramifications on specific sectors or the market as a whole.

Conclusion

Understanding high stock market valuations requires a nuanced approach, considering multiple interacting factors. BofA's analysis highlights both the potential for continued growth and the inherent risks associated with current market levels. By carefully analyzing key valuation metrics like the Price-to-Earnings ratio, Price-to-Sales ratio, and CAPE ratio, considering macroeconomic trends such as interest rates and inflation, and assessing potential risks from geopolitical uncertainty and market corrections, investors can make more informed decisions. Remember to consult with a financial advisor for personalized advice before making any investment decisions based on high stock market valuations. Stay informed on the latest BofA research and insights to better navigate this dynamic market and understand high stock market valuations more effectively.

Featured Posts

-

In The Easy Chair With Karli Kane Hendrickson Exploring Topic Of Conversation

Apr 26, 2025

In The Easy Chair With Karli Kane Hendrickson Exploring Topic Of Conversation

Apr 26, 2025 -

Lando Norris Injured After Night Out With Famous Dj

Apr 26, 2025

Lando Norris Injured After Night Out With Famous Dj

Apr 26, 2025 -

Chelsea Handlers Oscars Afterparty Drug Allegations Surface

Apr 26, 2025

Chelsea Handlers Oscars Afterparty Drug Allegations Surface

Apr 26, 2025 -

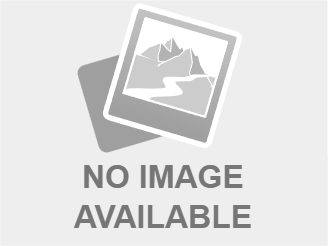

Benson Boone And Harry Styles A Style Comparison

Apr 26, 2025

Benson Boone And Harry Styles A Style Comparison

Apr 26, 2025 -

Trumps Economic Policies And The Difficulties Facing The Next Fed Chair

Apr 26, 2025

Trumps Economic Policies And The Difficulties Facing The Next Fed Chair

Apr 26, 2025

Latest Posts

-

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025 -

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025 -

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025 -

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025 -

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025