Understanding High Stock Market Valuations: A BofA Viewpoint

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current environment of high stock market valuations. Understanding these dynamics is key to making informed investment decisions.

Low Interest Rates

Globally low interest rates, a result of central bank policies, have significantly impacted stock market valuations. This has several consequences:

- Lower bond yields make stocks comparatively more attractive. With lower returns on safer investments like bonds, investors seek higher yields in riskier assets such as equities. This increased demand pushes stock prices higher.

- Quantitative easing programs have injected liquidity into the market, fueling asset price inflation. The injection of large amounts of capital into the financial system increases the overall money supply, which can lead to inflated asset prices, including stocks.

- This effect is amplified when inflation remains low, further incentivizing equity investment. Low inflation allows central banks to maintain low interest rates for longer periods, reinforcing the attractiveness of equities relative to fixed-income investments. This creates a positive feedback loop driving high stock market valuations.

Strong Corporate Earnings

Robust corporate earnings, especially from large-cap technology companies, have provided substantial support for higher stock valuations.

- Sustained growth in sectors like technology has driven significant returns. The technology sector's consistent growth and innovation have fueled impressive returns, attracting substantial investor interest and driving up valuations across the board.

- Increased profitability and strong future growth projections boost investor confidence. Companies demonstrating strong profitability and promising future growth prospects command higher valuations due to increased investor confidence and expectations of future returns.

- Analysis of leading economic indicators and corporate performance data helps explain this trend. Examining data such as GDP growth, consumer spending, and corporate profit margins provides a clearer picture of the economic factors underpinning strong corporate earnings and high stock valuations.

Investor Sentiment and Market Psychology

Positive investor sentiment and speculative trading play a crucial role in driving stock prices, sometimes beyond what fundamental analysis would suggest.

- Fear of missing out (FOMO) can drive rapid price increases. When investors perceive rapid price appreciation in certain stocks, the fear of missing out can trigger a rush of buying, further inflating prices and potentially creating a bubble.

- Market bubbles can form when investor confidence becomes detached from underlying value. In periods of exuberance, market valuations can become detached from underlying fundamentals, leading to unsustainable price increases and an increased risk of a market correction.

- Understanding market sentiment and identifying potential bubbles is critical for risk management. Investors must carefully assess market sentiment and identify potential signs of overvaluation to effectively manage risk and avoid significant losses during market corrections.

Assessing the Risks of High Stock Market Valuations

While high valuations can lead to significant returns, it’s crucial to understand the associated risks.

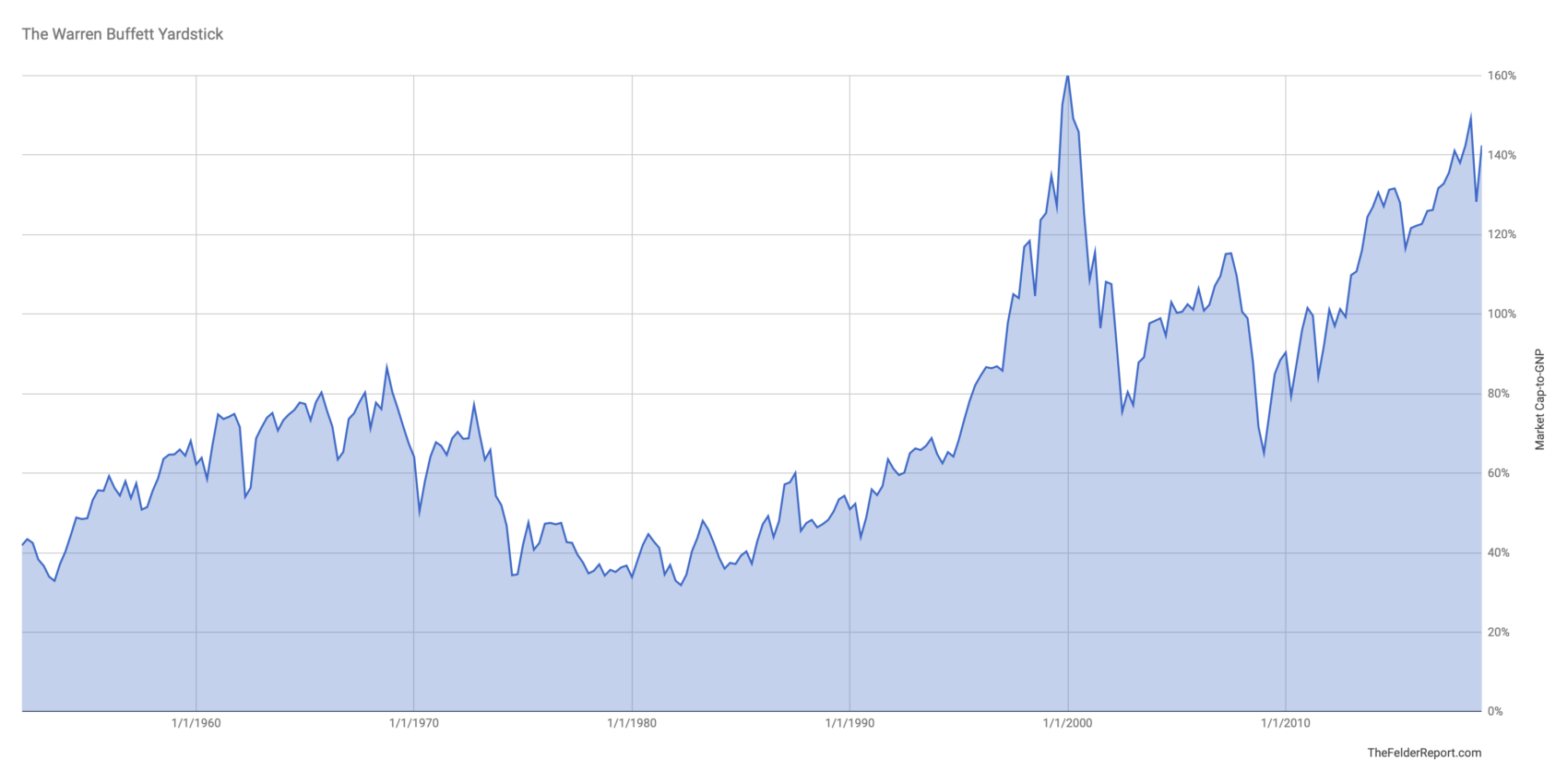

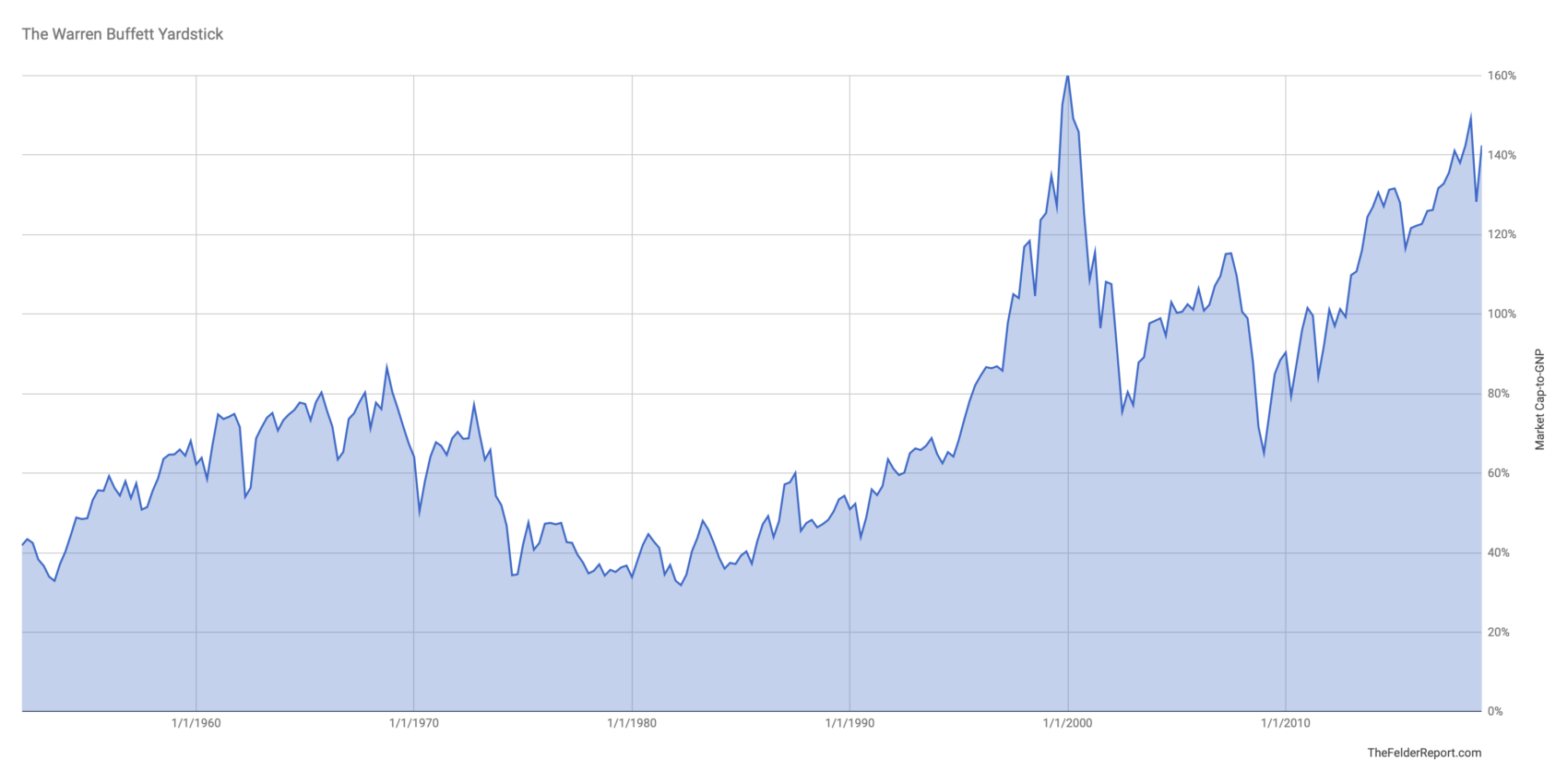

Valuation Metrics

Traditional valuation metrics offer insights into whether current stock prices are justified.

- High P/E ratios may suggest that stocks are overpriced relative to earnings. A high Price-to-Earnings ratio indicates that investors are paying a premium for each dollar of earnings, suggesting potential overvaluation.

- CAPE ratio considers long-term average earnings, providing a longer-term perspective on valuation. The Cyclically Adjusted Price-to-Earnings (CAPE) ratio smooths out short-term earnings fluctuations, offering a more stable measure of valuation over time.

- P/S ratio can be useful for valuing companies with high growth potential but limited or negative earnings. The Price-to-Sales ratio is a useful metric for valuing companies with high growth but limited or negative current earnings.

Potential for Correction

High valuations inherently increase the risk of a market correction or a more significant downturn.

- A sudden change in investor sentiment can trigger a sharp sell-off. A shift in investor sentiment, perhaps triggered by unexpected economic news or geopolitical events, can lead to rapid selling and a sharp decline in market prices.

- Geopolitical events, unexpected economic data, or changes in monetary policy can negatively impact market valuations. External factors can significantly influence market valuations, creating volatility and uncertainty.

- Understanding potential downside risks is crucial for portfolio diversification and risk mitigation. Investors should carefully consider potential downside risks and implement strategies to diversify their portfolios and mitigate potential losses.

BofA's Strategic Recommendations for Navigating High Valuations

Navigating high stock market valuations requires a strategic approach. BofA Securities recommends the following:

Diversification

A diversified portfolio across various asset classes reduces the overall risk.

- Spreading investments across stocks, bonds, real estate, and other asset classes can lessen the impact of any single asset class underperforming. This helps to balance risk and return.

Value Investing

Focus on companies undervalued relative to their intrinsic value.

- Identifying undervalued companies with strong fundamentals can provide opportunities for long-term growth, even in a market with high overall valuations.

Strategic Asset Allocation

Adjusting your portfolio based on market conditions and your risk tolerance is essential.

- Regularly reviewing and adjusting your asset allocation strategy in response to changing market conditions and your own risk tolerance is a vital part of managing investments during periods of high valuations.

Conclusion

Understanding high stock market valuations necessitates a thorough analysis of interest rates, corporate earnings, and investor sentiment. While strong corporate earnings and low interest rates contribute to the current market environment, BofA Securities emphasizes the importance of carefully considering valuation metrics and potential risks. Diversification, value investing, and strategic asset allocation are crucial strategies for navigating this environment. By carefully assessing these factors and implementing a well-defined investment strategy, investors can better manage the risks and opportunities presented by high stock market valuations. Contact your BofA advisor to discuss your specific investment strategy and how to manage your portfolio in light of these high stock market valuations.

Featured Posts

-

Amber Heards Twins The Elon Musk Fatherhood Rumors Explained

May 16, 2025

Amber Heards Twins The Elon Musk Fatherhood Rumors Explained

May 16, 2025 -

How To Watch Barcelona Vs Girona La Liga Match Free Live Stream Tv Guide And Kick Off Time

May 16, 2025

How To Watch Barcelona Vs Girona La Liga Match Free Live Stream Tv Guide And Kick Off Time

May 16, 2025 -

Chinas Top Advisors Finalize Significant Us Agreement

May 16, 2025

Chinas Top Advisors Finalize Significant Us Agreement

May 16, 2025 -

Paysandu Vs Bahia Goles Resumen Y Resultado Final 0 1

May 16, 2025

Paysandu Vs Bahia Goles Resumen Y Resultado Final 0 1

May 16, 2025 -

San Jose Earthquakes Match Preview Insights From Quakes Epicenter

May 16, 2025

San Jose Earthquakes Match Preview Insights From Quakes Epicenter

May 16, 2025