Understanding High Stock Market Valuations: BofA's Advice To Investors

Table of Contents

What are High Stock Market Valuations?

High stock market valuations refer to a situation where the prices of stocks are considered expensive relative to their underlying fundamentals. This is often assessed using various valuation metrics, indicating that the market may be overvalued and potentially vulnerable to a correction. Common metrics include Price-to-Earnings (P/E) ratios, which compare a company's stock price to its earnings per share, and market capitalization to GDP, a broader measure comparing the total value of all stocks to the size of the economy.

High valuations imply that investors are paying a premium for stocks, potentially leading to lower future returns. This increased price also increases the risk of significant losses if the market experiences a downturn. The higher the valuation, the greater the potential for a correction.

- Common valuation metrics used to assess the market: P/E ratio, Price-to-Sales ratio (P/S), Price-to-Book ratio (P/B), Cyclically Adjusted Price-to-Earnings ratio (CAPE).

- Historical context: Comparing current valuations to past market cycles, such as the dot-com bubble or the 2008 financial crisis, provides valuable perspective on potential risks and opportunities. Analyzing historical data helps investors understand whether current valuations are truly extreme or within a typical range.

- Impact of interest rates and economic growth on valuations: Lower interest rates generally support higher stock valuations, as they reduce the cost of borrowing for companies and increase the attractiveness of stocks relative to bonds. Strong economic growth also tends to boost valuations, while economic slowdowns or recessions often lead to lower valuations.

BofA's Perspective on Current Market Valuations

BofA regularly publishes reports and analyses offering their perspective on current market valuations. (Note: For the most up-to-date information, please refer to BofA's official publications. Specific data points and quotes will need to be sourced from their current research.) Their analysis typically considers a wide range of factors to determine if current valuations are sustainable.

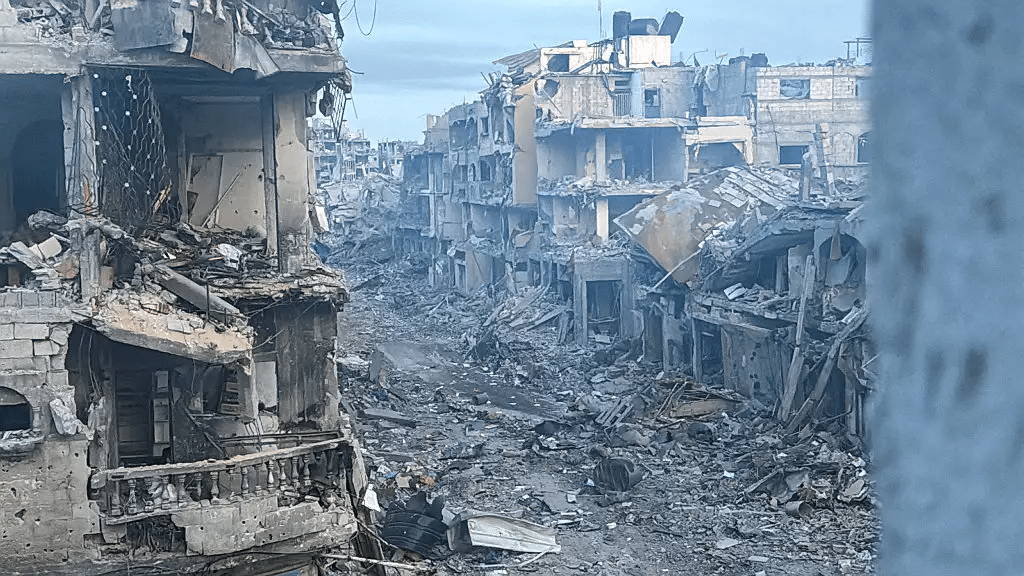

- Key factors influencing BofA's outlook: Inflation rates, economic growth forecasts, geopolitical events (such as trade wars or political instability), central bank policies (interest rate changes), and corporate earnings are key considerations for BofA's valuation assessments.

- BofA's predictions for future market performance: BofA’s predictions will vary depending on the specific report and time period, but generally include assessments of potential growth or contraction. They will often suggest potential scenarios depending on the evolution of the factors mentioned above.

- Specific sectors BofA recommends or cautions against: BofA may advise investors to favor certain sectors (e.g., those exhibiting strong earnings growth or less sensitivity to macroeconomic shocks) and to avoid others (e.g., highly valued sectors with questionable fundamentals). Their analysis may highlight particular stocks or sectors presenting attractive or concerning valuations.

Strategies for Navigating High Valuations: BofA's Recommendations

Navigating high valuations requires a strategic approach. BofA generally recommends a cautious yet opportunistic approach, focusing on risk management and diversification.

- Diversification across asset classes: Spreading investments across different asset classes (stocks, bonds, real estate, commodities) reduces overall portfolio risk. This diversification helps cushion potential losses in one asset class with gains in another.

- Focus on quality companies with strong fundamentals: During periods of high valuations, focusing on companies with a proven track record of profitability, strong balance sheets, and sustainable competitive advantages can be beneficial.

- Consider defensive sectors less sensitive to market fluctuations: Sectors like consumer staples and utilities often display more stability during market downturns. These sectors can provide a degree of protection during periods of high valuation uncertainty.

- Importance of long-term investing strategies: Maintaining a long-term investment horizon is critical. Short-term market fluctuations should be viewed within the broader context of long-term investment goals.

Risk Management in a High-Valuation Market

High valuations inherently increase the risk of significant market corrections. Effective risk management is paramount.

- Understanding your risk tolerance: Knowing your personal risk tolerance helps in choosing the appropriate investment strategy. Conservative investors may prefer lower-risk investments, while more aggressive investors might accept higher risks for potentially higher returns.

- Importance of diversification: Diversification across asset classes, sectors, and geographies reduces exposure to any single risk factor. A well-diversified portfolio is better equipped to withstand market volatility.

- Potential impact of market corrections: Investors should be prepared for potential market corrections, where valuations decline sharply. Having a plan in place for managing potential losses is vital.

- The role of portfolio rebalancing: Periodically rebalancing your portfolio back to your target asset allocation helps maintain discipline and manage risk. This may involve selling some assets that have appreciated significantly and buying assets that have underperformed.

Conclusion

This article explored BofA's insights into understanding and navigating high stock market valuations. We examined what constitutes high valuations, BofA’s current outlook (remember to consult their latest reports for the most up-to-date information), and strategies for managing risk and potentially capitalizing on opportunities. Remember, understanding the market environment is crucial for effective investment decision-making.

Call to Action: Stay informed about market conditions and continue learning about how to best navigate high stock market valuations. Consult with a financial advisor to create a personalized investment strategy tailored to your individual risk tolerance and financial goals. Further research into BofA's market analysis and investment recommendations, along with other reputable financial sources, can provide valuable additional insights. Don't hesitate to seek professional guidance when making investment decisions related to high stock market valuations.

Featured Posts

-

Australias Election Results Interpreting The Global Political Landscape

May 05, 2025

Australias Election Results Interpreting The Global Political Landscape

May 05, 2025 -

Enhancements To Spotify I Phone App Expanded Payment Choices

May 05, 2025

Enhancements To Spotify I Phone App Expanded Payment Choices

May 05, 2025 -

Updated Spotify I Phone App Multiple Payment Methods Supported

May 05, 2025

Updated Spotify I Phone App Multiple Payment Methods Supported

May 05, 2025 -

Stepfather Faces Murder Charges In Stepsons Death Allegations Of Torture Starvation And Assault

May 05, 2025

Stepfather Faces Murder Charges In Stepsons Death Allegations Of Torture Starvation And Assault

May 05, 2025 -

Shopify Developers Lifetime Revenue Share Model Explained

May 05, 2025

Shopify Developers Lifetime Revenue Share Model Explained

May 05, 2025

Latest Posts

-

16 Year Old Stepsons Death Stepfather Arrested On Murder Charges

May 05, 2025

16 Year Old Stepsons Death Stepfather Arrested On Murder Charges

May 05, 2025 -

Dr Ethan Choi Returns In Chicago Med Season 10 Episode 14

May 05, 2025

Dr Ethan Choi Returns In Chicago Med Season 10 Episode 14

May 05, 2025 -

Tragedy Strikes Raiwaqa One Woman Dead In House Fire

May 05, 2025

Tragedy Strikes Raiwaqa One Woman Dead In House Fire

May 05, 2025 -

Chicago Med Season 10 Episode 14 Dr Chois Comeback

May 05, 2025

Chicago Med Season 10 Episode 14 Dr Chois Comeback

May 05, 2025 -

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 05, 2025

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 05, 2025