Understanding High Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's analysis, while acknowledging the historically high valuations, doesn't necessarily paint a uniformly negative picture. Their assessment is nuanced, considering multiple factors and avoiding a simplistic "overvalued" or "undervalued" label. Instead, they focus on specific sectors and metrics to paint a more comprehensive picture of current market conditions and the potential risks and opportunities.

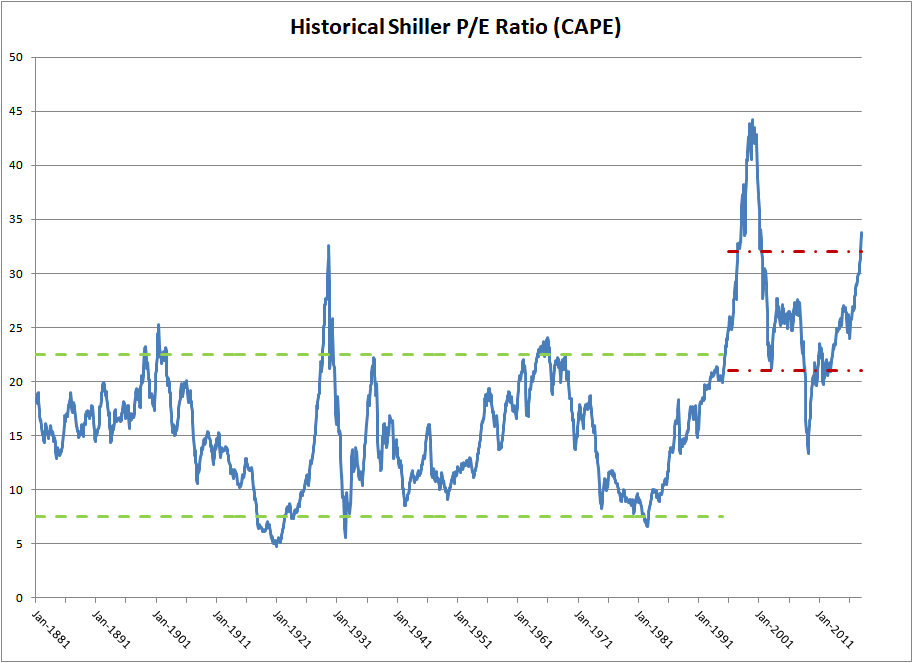

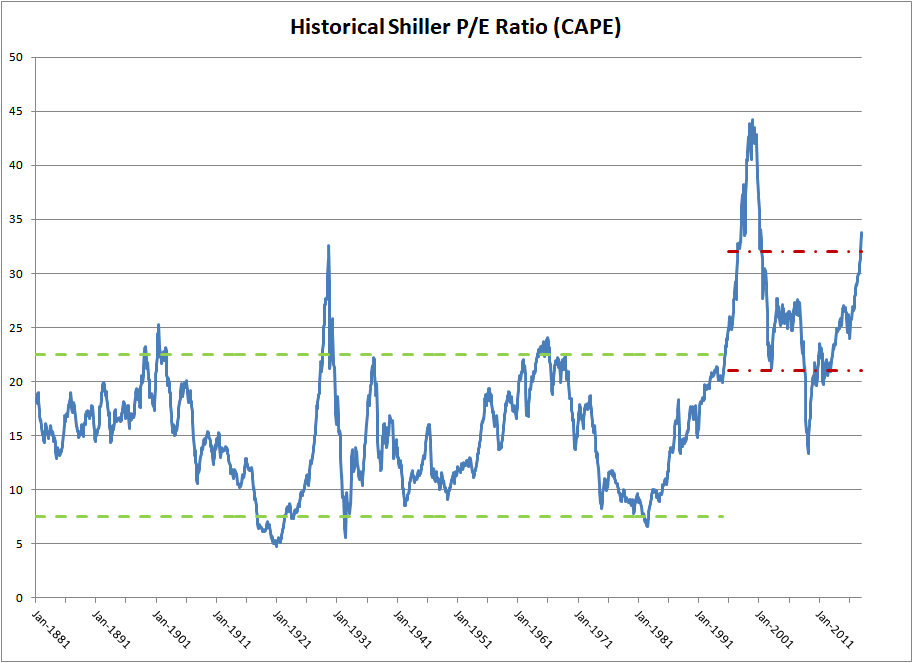

- Specific Metrics: BofA employs a range of metrics to assess market valuations, including the price-to-earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation ratios. They also incorporate fundamental analysis of corporate earnings and future growth projections.

- BofA's Assessment: While acknowledging elevated P/E ratios compared to historical averages, BofA often points to low interest rates and strong corporate earnings in specific sectors as potentially justifying, at least partially, the high valuations. However, they also highlight potential vulnerabilities within the market.

- Sectoral Analysis: BofA’s reports often delve into specific sectors. Some sectors might be deemed overvalued based on their P/E ratios relative to expected growth, while others, particularly those exhibiting strong earnings and resilient growth prospects, may be viewed more favorably, despite high valuations. This granular approach is crucial for investors seeking to understand which parts of the market present the highest risks and the greatest opportunities.

Factors Contributing to High Stock Market Valuations (According to BofA)

BofA attributes the current high stock market valuations to a confluence of factors, each contributing to a complex interplay influencing market behavior. Understanding these factors is key to interpreting their overall assessment and formulating an effective investment strategy.

- Low Interest Rates: Historically low interest rates globally have pushed investors towards higher-yielding assets, including stocks. This increased demand has driven up prices, contributing significantly to high valuations.

- Quantitative Easing (QE): Central banks' QE programs have injected massive liquidity into the financial system, further fueling asset price inflation.

- Strong Corporate Earnings (in select sectors): Although some sectors have struggled, others have reported strong earnings, supporting the elevated stock prices in those areas. BofA's analysis highlights the discrepancies between sectors, offering a more nuanced perspective on high valuations.

- Investor Sentiment: Market psychology plays a crucial role. Optimism and risk appetite among investors can lead to higher valuations, even in the face of potential risks. Conversely, shifts in sentiment can lead to rapid corrections.

- Geopolitical Factors: Global events, including trade wars, political instability, and pandemics, influence investor confidence and market volatility, impacting valuations.

BofA's Predictions and Recommendations for Investors

BofA's predictions are not static pronouncements; they are dynamic assessments based on ongoing economic and market data. Their advice to investors reflects their understanding of high stock market valuations and potential future scenarios.

- Market Forecasts: BofA regularly publishes short-term and long-term market forecasts, providing guidance on potential market movements and risk assessments. These forecasts are often conditioned on various economic scenarios.

- Asset Allocation: Their recommendations often involve diversified asset allocation strategies, balancing investments across stocks, bonds, and cash, depending on the perceived level of risk and potential returns. The specific allocations suggested will shift depending on the overall market assessment.

- Risk Mitigation: BofA emphasizes risk mitigation strategies, encouraging investors to be mindful of the potential for market corrections and to implement strategies to protect their portfolios. This might include hedging techniques or a more conservative approach to certain investments.

- Investment Opportunities: Despite cautionary notes about high valuations, BofA often identifies specific sectors or investment opportunities that they consider potentially promising, even within a generally overvalued market. These might include companies demonstrating exceptional growth or those operating in resilient sectors.

Alternative Perspectives on High Stock Market Valuations

It's crucial to acknowledge that BofA's perspective is not the only one. Other financial institutions and analysts offer varying opinions on high stock market valuations. Considering these diverse viewpoints enriches the understanding of the market's complexity.

- Differing Viewpoints: Some analysts might argue that the current valuations are unsustainable and predict a significant correction, while others may believe that low interest rates and technological advancements justify the high prices.

- Key Arguments: These differing opinions often stem from different interpretations of economic data, varying assessments of risk, and differing forecasting methodologies.

- Areas of Consensus & Disagreement: While there might be disagreements on the extent of overvaluation, there is often a consensus on the need for investors to be cautious and to diversify their portfolios, acknowledging the inherent uncertainty within the market.

Conclusion: Understanding High Stock Market Valuations – Key Takeaways and Next Steps

BofA's analysis of high stock market valuations emphasizes the importance of a nuanced approach, recognizing that not all sectors are equally overvalued. Their assessment considers the interplay of factors such as low interest rates, quantitative easing, corporate earnings, investor sentiment, and geopolitical events. While acknowledging the elevated valuation metrics, BofA’s strategies emphasize diversification and risk mitigation, guiding investors towards a cautious yet opportunistic approach.

Understanding high stock market valuations is crucial for navigating the current market. Use BofA's insights, coupled with your own research and consultation with a financial advisor, to inform your investment decisions and build a robust portfolio strategy today. Remember to regularly review your investment strategy and adapt it to changing market conditions. Staying informed about high stock market valuations and their potential impact is vital for long-term investment success.

Featured Posts

-

Eminems Influence Could He Bring A Wnba Team Back To Detroit

May 17, 2025

Eminems Influence Could He Bring A Wnba Team Back To Detroit

May 17, 2025 -

New Ev Launch Ultraviolette Tesseract Electric Scooter Price Range And Design

May 17, 2025

New Ev Launch Ultraviolette Tesseract Electric Scooter Price Range And Design

May 17, 2025 -

Nba Hornets Vs Celtics Prediction And Betting Odds

May 17, 2025

Nba Hornets Vs Celtics Prediction And Betting Odds

May 17, 2025 -

Star Wars Andor Planned Book Axed Over Ai Technology Worries

May 17, 2025

Star Wars Andor Planned Book Axed Over Ai Technology Worries

May 17, 2025 -

Piston Vs Knicks A Season Success Analysis

May 17, 2025

Piston Vs Knicks A Season Success Analysis

May 17, 2025