Understanding High Stock Market Valuations: BofA's Analysis For Investors

Table of Contents

The stock market has experienced periods of significantly high valuations, leaving many investors questioning the future. This article delves into Bank of America's (BofA) analysis of current high stock market valuations, offering insights to help you navigate this complex landscape and make informed investment decisions. We'll explore the factors contributing to these elevated valuations and examine BofA's perspectives on potential risks and opportunities.

BofA's Key Findings on High Valuations

Keywords: BofA Market Outlook, Stock Market Forecasts, Valuation Metrics, Price-to-Earnings Ratio (P/E), Market Cap, Investment Returns

Bank of America's recent reports on market valuations provide crucial insights for investors. Their analysis typically employs several key valuation metrics to gauge the overall market health.

-

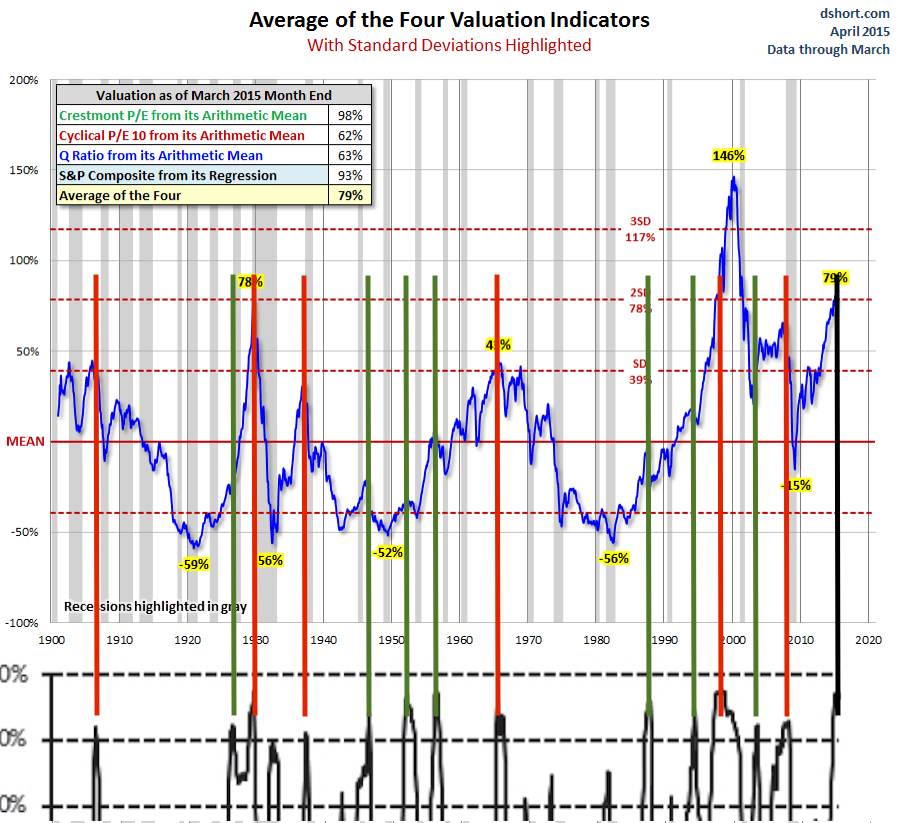

Price-to-Earnings Ratio (P/E): BofA closely monitors the P/E ratio, comparing current earnings to stock prices. A high P/E ratio generally suggests that the market is pricing in significant future growth. BofA's analysis often includes comparisons to historical P/E ratios to determine if the current level is unusually high.

-

Other Valuation Multiples: Beyond the P/E ratio, BofA likely uses other valuation multiples such as Price-to-Sales (P/S), Price-to-Book (P/B), and others to get a more comprehensive picture of market valuation. These offer different perspectives on company value and overall market health.

-

Assessment of Fundamentals: BofA assesses whether current valuations are justified by underlying fundamentals. This involves analyzing factors such as earnings growth, projected interest rate hikes, and overall economic growth projections. A disconnect between valuations and fundamentals often signals potential risk.

-

Sector-Specific Analysis: BofA's reports usually include a sector-specific analysis. This helps investors identify potentially overvalued or undervalued sectors, allowing for more targeted investment strategies. For example, they may highlight technology stocks as potentially overvalued given their high growth expectations, while pointing to undervalued sectors within the broader market.

-

Market Forecasts: BofA often incorporates market forecasts in their analysis, predicting future market performance based on their valuation analysis and other macroeconomic factors. These forecasts, however, should always be considered with caution, as market performance can be volatile and unpredictable.

Factors Contributing to High Stock Market Valuations

Keywords: Low Interest Rates, Monetary Policy, Inflation, Economic Growth, Investor Sentiment, Quantitative Easing

Several factors contribute to periods of high stock market valuations. Understanding these factors is critical for navigating the market effectively.

-

Low Interest Rates and Quantitative Easing: Historically low interest rates and the implementation of quantitative easing (QE) policies by central banks have pushed investors toward riskier assets like stocks, increasing demand and driving up prices. Lower borrowing costs also stimulate corporate investment and growth, boosting stock prices further.

-

Strong Corporate Earnings and Economic Growth: Periods of robust corporate earnings growth and positive economic forecasts contribute significantly to high valuations. Investors are willing to pay higher prices for stocks when they expect future profits to grow strongly.

-

Investor Sentiment and Speculation: Positive investor sentiment and speculative trading behavior can push stock prices beyond what might be justified by underlying fundamentals. Market psychology plays a significant role in driving valuations, especially during periods of high optimism.

-

Inflation's Impact: Inflation can impact stock valuations in several ways. While higher inflation might lead to higher earnings for some companies, it also increases interest rates and potentially reduces future earnings growth expectations, creating pressure on valuations. BofA's analysis likely considers the complex interplay between inflation, interest rates, and stock prices.

Risks Associated with High Valuations

Keywords: Market Corrections, Stock Market Volatility, Recession Risk, Investment Risk Management, Portfolio Diversification

High stock market valuations inherently carry increased risk.

-

Market Corrections and Crashes: Historically, periods of high valuations have often been followed by significant market corrections or even crashes. This is because overvalued markets are more susceptible to sharp price declines when investor sentiment shifts.

-

Recession Risk: High valuations can coincide with increased risk of an economic downturn. If economic growth slows or reverses, the high prices paid for stocks may not be justified, leading to substantial losses. BofA's analysis often includes assessments of recession probabilities and their potential impact on stock prices.

-

Lower Future Returns: Investing in a highly valued market generally translates to lower future returns compared to investing in a more reasonably valued market. The potential for price appreciation is significantly reduced when starting at already high valuations.

-

Importance of Risk Management: Effective risk management strategies become crucial in high-valuation environments. This includes diversification across asset classes, setting realistic return expectations, and establishing clear risk tolerance levels.

Investment Strategies for High Valuation Environments

Keywords: Defensive Investing, Value Investing, Growth Investing, Portfolio Strategy, Risk Tolerance, Asset Allocation

Navigating a market with high valuations requires a thoughtful investment strategy.

-

Defensive Investing: BofA may suggest increasing exposure to defensive sectors, such as consumer staples and utilities, which are generally less sensitive to economic downturns. These sectors often offer more stability during periods of market uncertainty.

-

Value Investing: Identifying undervalued companies becomes increasingly important in a high-valuation market. Value investing involves finding companies whose stock prices are below their intrinsic value, potentially offering higher returns.

-

Growth Investing with Caution: Growth investing remains a possibility, but careful selection of companies with strong future growth potential and reasonable valuations is essential. Avoiding speculative growth stocks is crucial in a high-valuation environment.

-

Portfolio Diversification and Asset Allocation: Diversifying across asset classes (stocks, bonds, real estate, etc.) and carefully adjusting asset allocation based on individual risk tolerance remains paramount. This helps to reduce overall portfolio risk and minimize losses during potential market corrections.

Conclusion

Understanding high stock market valuations requires careful consideration of various factors, as highlighted in BofA's analysis. By comprehending the contributing elements, associated risks, and potential investment strategies, investors can make more informed decisions. BofA's insights provide a valuable framework for navigating this complex market environment.

Call to Action: Stay informed about market trends and consult with financial advisors to develop a robust investment strategy tailored to your risk tolerance and financial goals. Continue your research into understanding high stock market valuations and leverage BofA's analysis to make smart investment choices. Don't underestimate the importance of understanding these high stock market valuations to effectively manage your investment portfolio.

Featured Posts

-

Nba Sixth Man Of The Year Payton Pritchard Honored Va Hero Spotlight

May 12, 2025

Nba Sixth Man Of The Year Payton Pritchard Honored Va Hero Spotlight

May 12, 2025 -

The Juan Soto Michael Kay Controversy And Its Effect On Sotos Bat

May 12, 2025

The Juan Soto Michael Kay Controversy And Its Effect On Sotos Bat

May 12, 2025 -

Rahal To Launch Scholarship For Aspiring Racing Drivers

May 12, 2025

Rahal To Launch Scholarship For Aspiring Racing Drivers

May 12, 2025 -

Updated Ufc 315 Fight Card Impact Of Jose Aldos Weight Cut

May 12, 2025

Updated Ufc 315 Fight Card Impact Of Jose Aldos Weight Cut

May 12, 2025 -

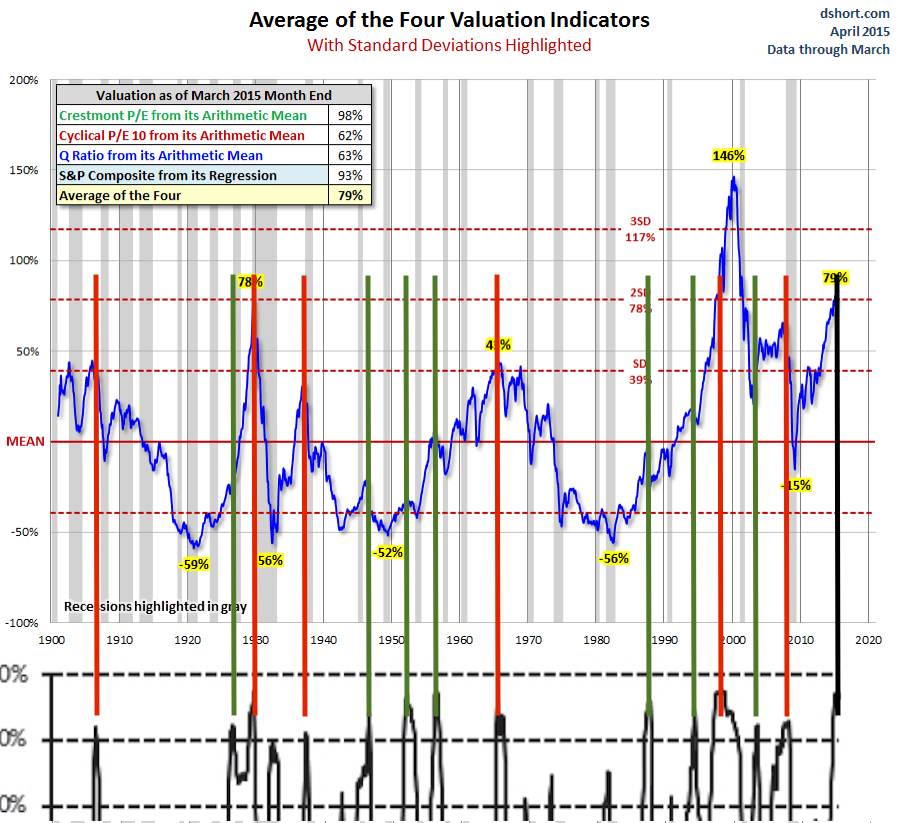

Indy Car 2025 5 Drivers At Risk Of Missing The Indy 500

May 12, 2025

Indy Car 2025 5 Drivers At Risk Of Missing The Indy 500

May 12, 2025

Latest Posts

-

I Serie A Stin Tv Odigos Gia Athlitikes Metadoseis

May 13, 2025

I Serie A Stin Tv Odigos Gia Athlitikes Metadoseis

May 13, 2025 -

Prekmurski Romi Muzikalna Zgodovina In Sodobnost

May 13, 2025

Prekmurski Romi Muzikalna Zgodovina In Sodobnost

May 13, 2025 -

Athlitikes Metadoseis Deite Tin Serie A Online And Live

May 13, 2025

Athlitikes Metadoseis Deite Tin Serie A Online And Live

May 13, 2025 -

Romska Muzikalna Tradicija Prekmurje

May 13, 2025

Romska Muzikalna Tradicija Prekmurje

May 13, 2025 -

Kultura Romskih Muzikantov V Prekmurju

May 13, 2025

Kultura Romskih Muzikantov V Prekmurju

May 13, 2025