Understanding High Stock Market Valuations: Why Investors Shouldn't Panic (According To BofA)

Table of Contents

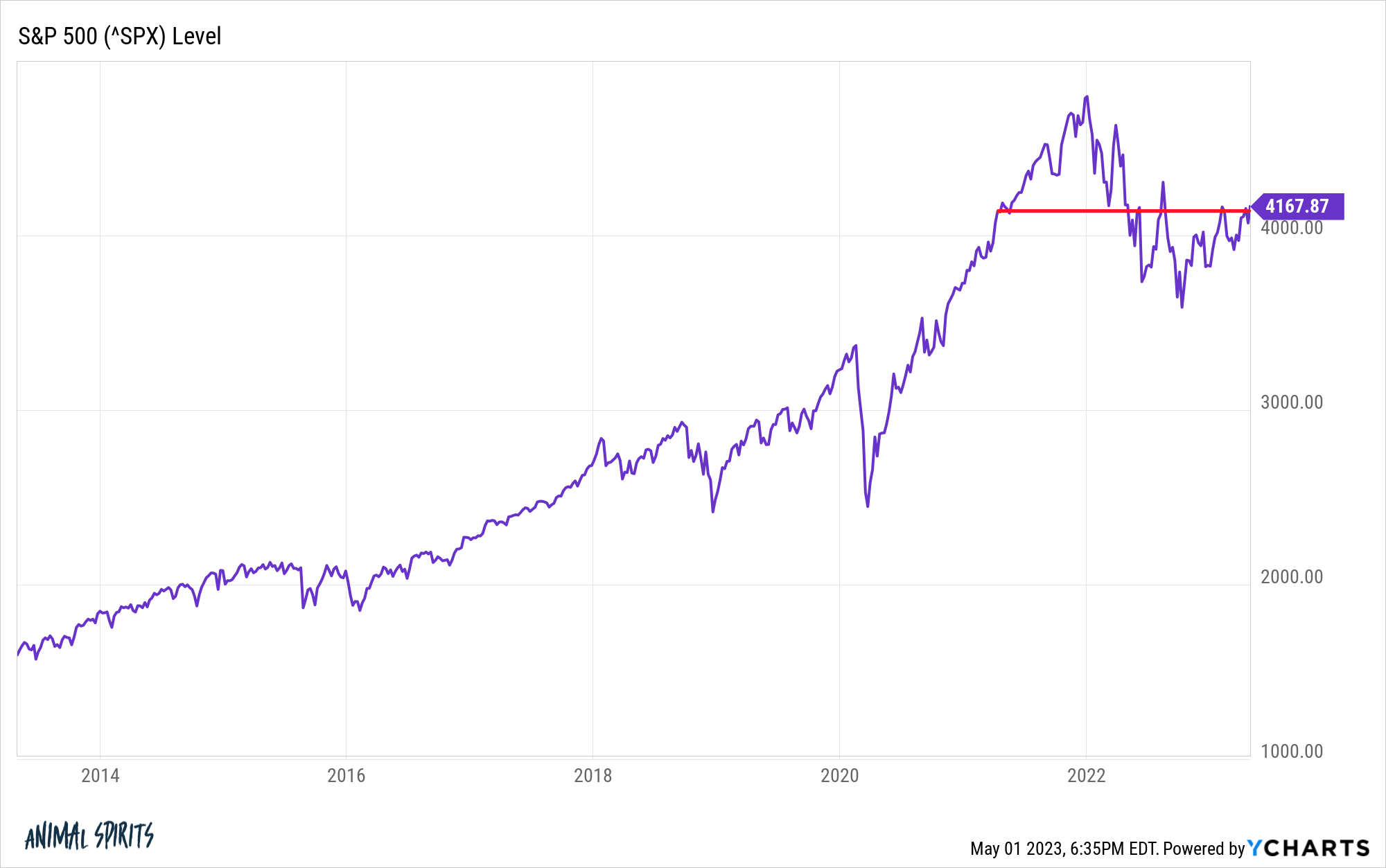

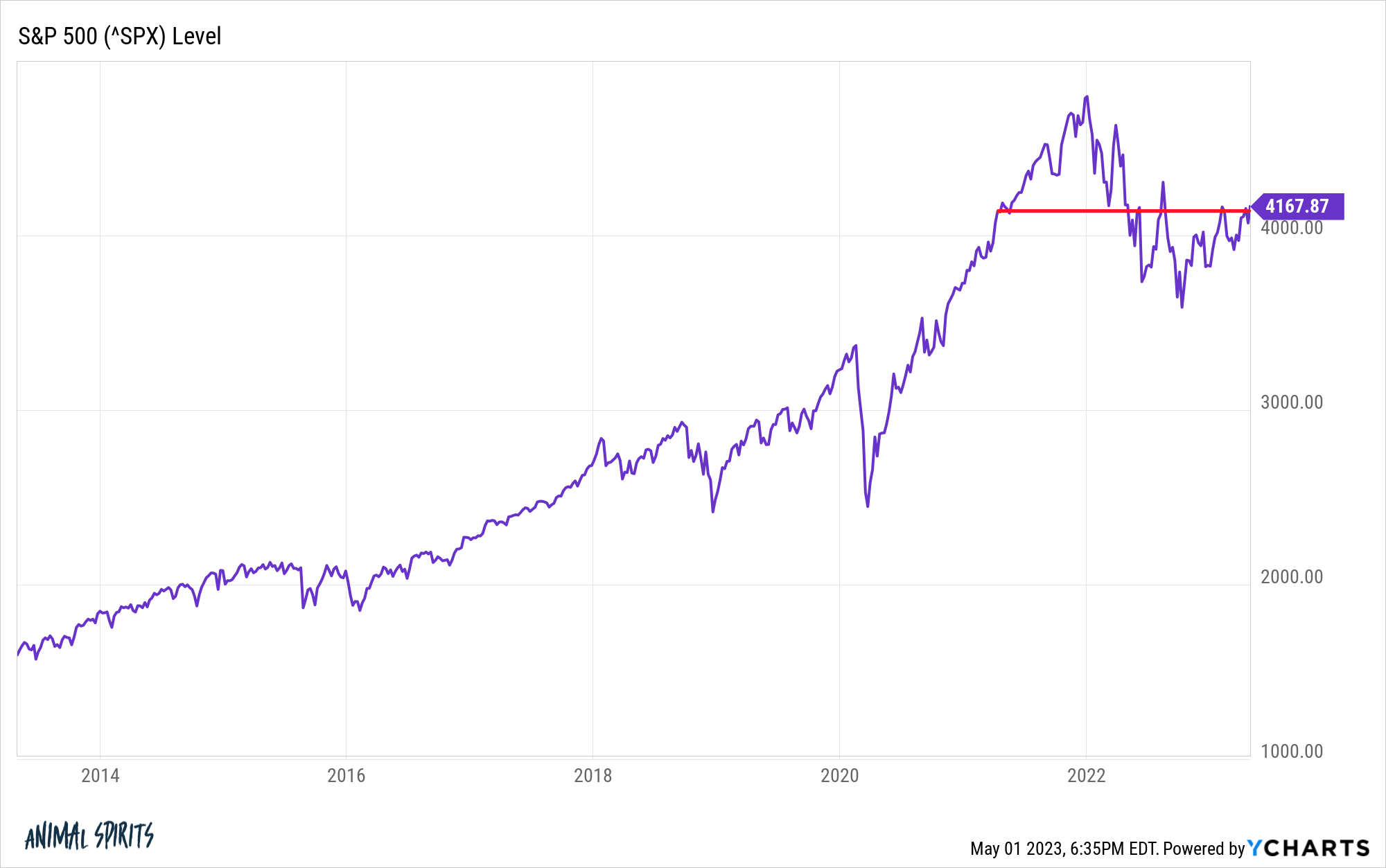

High stock valuations are a common source of stock market anxiety. Many investors feel uneasy when stock prices appear to be significantly above historical averages, sparking fears of an imminent market correction. However, Bank of America (BofA), a leading financial institution, offers a more nuanced perspective, suggesting that a blanket panic response might be unwarranted. This article will delve into BofA's reasoning, exploring the factors they consider when assessing high stock valuations and providing insights for investors navigating this complex landscape. We'll examine key indicators and explore how to approach investing in a potentially high-valuation market.

BofA's Rationale: Low Interest Rates and Strong Corporate Earnings

BofA's argument centers on the interplay between low interest rates and robust corporate earnings. They contend that the current high stock valuations are, to a significant extent, justified by these prevailing economic conditions.

- Low interest rates make borrowing cheaper for companies: This translates to increased investment in expansion, research and development, and talent acquisition. Lower borrowing costs directly boost profitability and fuel corporate growth.

- Lower discount rates lead to higher present values of future earnings: In valuation models, discount rates are crucial for determining the present value of future cash flows. Low interest rates imply lower discount rates, which, in turn, increase the calculated value of a company's future earnings, supporting higher stock prices.

- Quantitative easing (QE) and its impact: The implementation of QE policies by central banks has significantly lowered interest rates globally. This artificial lowering of borrowing costs has played a substantial role in supporting higher stock valuations across various markets. While the effects of QE are debated, its influence on interest rates and thus stock valuations is undeniable.

While BofA acknowledges the elevated valuations, they emphasize that these valuations are not solely based on speculation but are partially underpinned by the current low-interest-rate environment and the strength of corporate earnings. Accessing detailed BofA reports can provide further data and charts supporting this analysis.

Examining Key Valuation Metrics: Beyond the P/E Ratio

Relying solely on the Price-to-Earnings (P/E) ratio to assess market valuations can be misleading. A more comprehensive understanding requires considering a broader range of valuation metrics.

- Price-to-Sales (P/S) ratio: This metric compares a company's market capitalization to its revenue, offering a valuation perspective independent of profitability. It's particularly useful for assessing companies with high growth potential but currently low or negative earnings.

- Price-to-Book (P/B) ratio: This ratio compares a company's market value to its book value (assets minus liabilities), providing insights into the market's assessment of a company's net asset value.

- Dividend yield: The dividend yield indicates the annual dividend per share relative to the stock price. This metric is especially relevant for investors seeking income from their investments.

Different sectors often exhibit varying valuation multiples. A high P/E ratio in a high-growth technology sector might be justified by future earnings expectations, while a similar P/E ratio in a mature, slow-growth sector might signal overvaluation. Therefore, a diversified approach incorporating multiple valuation metrics provides a more nuanced and robust assessment of market conditions.

Long-Term Growth Potential and Technological Advancements

BofA's optimistic outlook also stems from its assessment of long-term economic growth potential fueled by technological advancements.

- Continued innovation: Technological breakthroughs in areas such as artificial intelligence, biotechnology, and renewable energy are expected to drive significant economic growth and create new investment opportunities.

- Beneficial sectors: Sectors poised to benefit from this technological revolution include technology, renewable energy, and healthcare. These sectors are likely to experience substantial growth in the coming years, potentially justifying higher valuations.

- Global economic trends and demographics: Favorable demographic trends in certain regions, coupled with the continued growth of emerging markets, further contribute to the long-term growth potential of the global economy.

These long-term growth prospects contribute to BofA's view that current valuations, while high, are not necessarily unsustainable, especially when considered within the context of continued innovation and expansion into new markets.

Managing Risk and Diversification in a High-Valuation Market

Even with a positive long-term outlook, managing risk remains crucial in a high-valuation market.

- Diversification: Spreading investments across different asset classes—stocks, bonds, real estate—is fundamental to risk mitigation. This reduces the impact of any single asset's underperformance.

- Focus on quality: Selecting companies with strong fundamentals, sustainable competitive advantages, and robust growth prospects is vital. Thorough fundamental analysis is essential for identifying such companies.

- Long-term perspective: Maintaining a long-term investment strategy and avoiding knee-jerk reactions to short-term market fluctuations is key to successful long-term investing.

Conclusion

BofA's analysis suggests that while high stock market valuations are a legitimate concern, they are not necessarily a cause for immediate panic. Factors such as low interest rates, strong corporate earnings, and the potential for continued long-term growth need to be considered. Relying solely on the P/E ratio is insufficient; a more comprehensive approach involving multiple valuation metrics is recommended. Investors should focus on managing risk through diversification, selecting high-quality companies, and adopting a long-term investment strategy. Understanding high stock market valuations requires a nuanced approach. By considering these factors and conducting thorough research, investors can make more informed decisions and navigate market volatility more effectively. For more in-depth analysis, refer to relevant BofA research [link to BofA research if available].

Featured Posts

-

Lvmh First Quarter Sales Below Forecast Shares Down 8 2

May 24, 2025

Lvmh First Quarter Sales Below Forecast Shares Down 8 2

May 24, 2025 -

The Role Of Green Spaces During The Pandemic A Seattle Case Study

May 24, 2025

The Role Of Green Spaces During The Pandemic A Seattle Case Study

May 24, 2025 -

Stemwede Unfall Mit Baum Verletzte Person Aus Bad Essen

May 24, 2025

Stemwede Unfall Mit Baum Verletzte Person Aus Bad Essen

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Property

May 24, 2025

Your Escape To The Country Choosing The Right Rural Property

May 24, 2025 -

254 Apple Stock Price Forecast A Wall Street Analysts Perspective And Investment Advice

May 24, 2025

254 Apple Stock Price Forecast A Wall Street Analysts Perspective And Investment Advice

May 24, 2025

Latest Posts

-

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025 -

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025