Understanding Market Corrections: Professional Selling And Individual Buying

Table of Contents

Professional Selling During Market Corrections

Professional sellers often view market corrections as opportunities, rather than threats. Their strategies involve a sophisticated blend of analysis, risk management, and a deep understanding of market psychology.

Identifying Opportunities for Strategic Selling

Identifying undervalued assets ripe for selling during a market correction requires a keen eye and advanced analytical skills. Professionals look beyond the short-term volatility and focus on underlying value. This involves:

- Analyzing market trends and predicting potential rebounds: Sophisticated models and predictive analytics are used to identify sectors or individual assets poised for a recovery.

- Diversifying holdings to mitigate risk: Professionals rarely hold concentrated positions. Diversification across asset classes helps to buffer against losses in any single sector.

- Employing sophisticated quantitative analysis: This includes using complex algorithms and data analysis to identify assets that are temporarily undervalued due to market sentiment rather than inherent flaws. This might involve discounted cash flow analysis or other valuation models. Understanding the difference between a temporary dip and a long-term decline is key. Tax implications and strategic timing are carefully considered to minimize tax burdens while maximizing profits.

Managing Risk and Volatility

Market corrections bring increased volatility. Professional sellers employ robust risk management strategies to protect their portfolios, including:

- Utilizing stop-loss orders to limit potential losses: These orders automatically sell an asset when it reaches a predetermined price, limiting potential downside.

- Employing portfolio diversification techniques: Diversification across different asset classes, geographies, and sectors helps to reduce overall portfolio risk.

- Monitoring market indicators closely (e.g., VIX): The VIX (Volatility Index) and other market indicators provide valuable insights into market sentiment and potential volatility. Understanding these indicators is crucial for adjusting selling strategies. Hedging strategies, such as using options or futures contracts, can also be employed to mitigate risk.

The Psychology of Selling During Corrections

Selling during a market correction can be emotionally challenging, even for professionals. Overcoming fear and panic selling is critical:

- Maintaining a long-term investment strategy: Sticking to a well-defined, long-term strategy helps to avoid impulsive decisions based on short-term market fluctuations.

- Relying on data and analysis rather than emotions: Objective data and analytical models should guide selling decisions, rather than fear or speculation.

- Seeking expert advice when needed: Consulting with financial advisors or other experts can provide valuable insights and support during periods of market uncertainty.

Individual Buying During Market Corrections

Market corrections present opportunities for individual investors to acquire assets at potentially lower prices. However, a careful, strategic approach is essential.

Identifying Undervalued Assets

For individual investors, identifying undervalued assets involves a combination of fundamental and technical analysis, and thorough due diligence. This includes:

- Researching companies and their financial health: Analyzing financial statements, assessing management quality, and understanding the company's competitive landscape are critical.

- Looking for companies with strong fundamentals despite market downturn: Focus on companies with strong balance sheets, consistent earnings, and a history of weathering economic storms.

- Utilizing discounted cash flow analysis: This valuation method helps to determine a company's intrinsic value, which can be compared to its current market price to identify potential bargains.

Managing Risk and Volatility for Individual Investors

Risk management is paramount for individual investors during market corrections. Strategies include:

- Avoid impulsive buying decisions: Thorough research and analysis are essential before committing funds.

- Invest only what you can afford to lose: Never invest money that you need for essential expenses or short-term goals.

- Consider a long-term investment horizon: Market corrections are temporary. A long-term perspective helps to weather the short-term volatility.

- Employing dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the market price. This helps to reduce the risk of buying high and selling low.

The Psychology of Buying During Corrections

Buying during a market downturn can be emotionally challenging. Overcoming fear is crucial for capitalizing on opportunities:

- Overcome fear of missing out (FOMO) and focus on long-term growth: Avoid chasing short-term gains. Focus on building a portfolio for long-term growth.

- Develop a robust investment plan and stick to it: Having a clear plan helps to maintain discipline and avoid impulsive decisions.

- Consider seeking financial advice from a qualified professional: A financial advisor can provide personalized guidance and support.

Conclusion

Understanding market corrections is vital for both professional sellers and individual buyers. Professionals can leverage corrections for strategic selling, managing risk through diversification and sophisticated analysis. Individual investors can capitalize on these periods by carefully identifying undervalued assets, mitigating risk through dollar-cost averaging, and employing a long-term perspective. Successfully navigating market corrections requires a combination of knowledge, discipline, and a well-defined investment strategy. Don't let fear dictate your decisions; learn to understand and utilize market corrections to your advantage. By actively learning about market corrections, and understanding how they affect both buying and selling strategies, you can build a more resilient and profitable investment portfolio.

Featured Posts

-

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

Apr 28, 2025

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

Apr 28, 2025 -

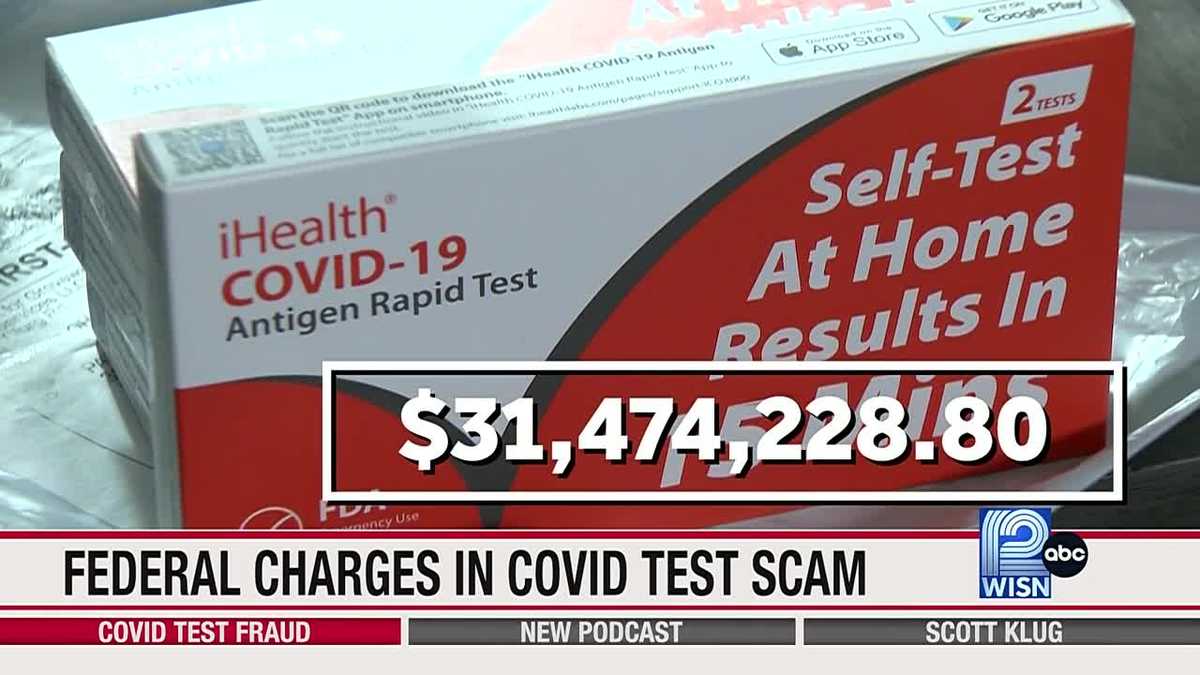

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 28, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 28, 2025 -

Assessing The Economic Fallout The Canadian Travel Boycott And The Us

Apr 28, 2025

Assessing The Economic Fallout The Canadian Travel Boycott And The Us

Apr 28, 2025 -

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

Apr 28, 2025

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

Apr 28, 2025 -

Luigi Mangione A Look At His Supporters Perspectives

Apr 28, 2025

Luigi Mangione A Look At His Supporters Perspectives

Apr 28, 2025

Latest Posts

-

Hudsons Bay Store Closing Sale Find Amazing Deals Now

Apr 28, 2025

Hudsons Bay Store Closing Sale Find Amazing Deals Now

Apr 28, 2025 -

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025 -

Final Days Of Hudsons Bay 70 Off Liquidation Event

Apr 28, 2025

Final Days Of Hudsons Bay 70 Off Liquidation Event

Apr 28, 2025 -

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025 -

Hudsons Bay Liquidation Up To 70 Off At Final Stores

Apr 28, 2025

Hudsons Bay Liquidation Up To 70 Off At Final Stores

Apr 28, 2025