Understanding Personal Loan Interest Rates Today: A Simple Explanation

Table of Contents

1. Introduction:

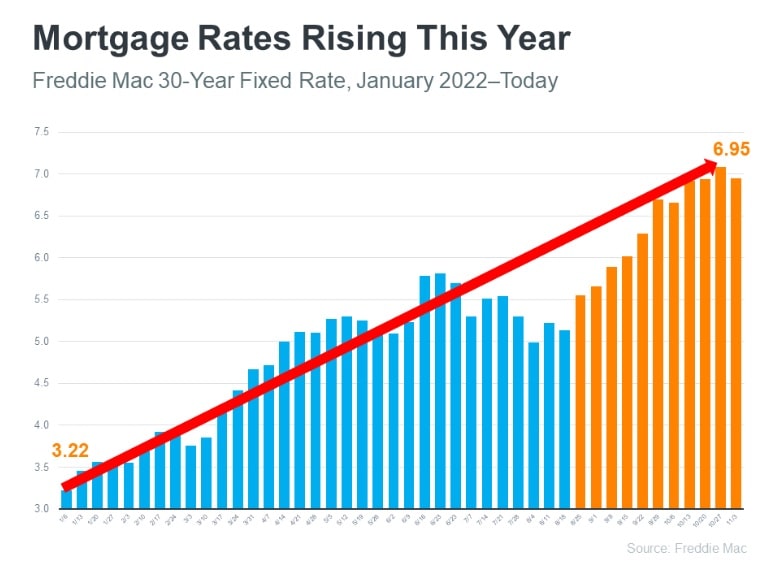

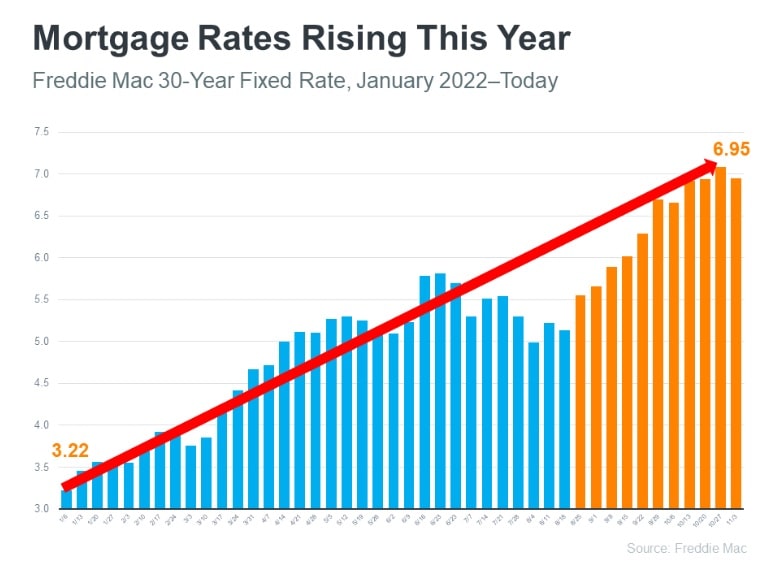

Personal loan interest rates represent the cost of borrowing money. They are expressed as a percentage of the loan amount and significantly impact the total amount you'll repay. A lower interest rate translates to lower overall borrowing costs, making it vital to understand the factors influencing these rates before applying for a loan.

2. Main Points:

H2: Factors Influencing Personal Loan Interest Rates

Several key factors determine the personal loan interest rates you'll qualify for. Lenders assess these factors to determine your creditworthiness and the risk involved in lending you money.

H3: Credit Score: Your credit score is a critical factor. Lenders use it to gauge your history of repaying debt. A higher credit score indicates a lower risk to the lender, resulting in more favorable interest rates.

- Excellent credit scores (750+) often qualify for the lowest rates, sometimes below 5% APR.

- Fair to poor credit scores (below 670) result in significantly higher rates, potentially exceeding 20% APR, and may even lead to loan application rejection.

- Regularly check your credit report from all three major bureaus (Equifax, Experian, and TransUnion) for errors and to monitor your score. Addressing any negative marks and building positive credit history can significantly improve your chances of securing a lower interest rate.

H3: Debt-to-Income Ratio (DTI): Your debt-to-income ratio (DTI) compares your monthly debt payments to your gross monthly income. A high DTI suggests you're already heavily burdened with debt, increasing the risk for lenders. A lower DTI indicates greater financial stability and typically results in better interest rates.

- Calculate your DTI by dividing your total monthly debt payments (excluding mortgage payments in some cases) by your gross monthly income.

- Strategies for lowering your DTI include paying down existing debt, increasing your income, or both.

- Responsible debt management is essential for securing favorable loan terms.

H3: Loan Amount and Term: The amount you borrow and the loan repayment term (the length of the loan) also affect your interest rate. Generally, larger loan amounts might attract slightly higher rates, reflecting a higher risk for the lender. Similarly, longer loan terms can lead to higher overall interest payments, even if the monthly payment is lower.

- Shorter loan terms generally mean higher monthly payments but lower overall interest paid.

- Larger loan amounts may come with slightly higher interest rates due to increased risk.

- APR (Annual Percentage Rate) is the total cost of your loan, including the interest rate and any additional fees. Always compare APRs when shopping for a personal loan.

H3: Lender Type: Different lenders offer varying interest rates. Banks, credit unions, and online lenders each have their own criteria and pricing structures.

- Banks often offer competitive rates for borrowers with good credit.

- Credit unions may provide more favorable terms for members, often with lower rates and fees.

- Online lenders offer convenience but may have higher or lower rates depending on the borrower's profile and the specific loan product.

H2: How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rate involves careful planning and comparison shopping.

H3: Shop Around: Don't settle for the first offer you receive. Comparing offers from multiple lenders is essential to finding the best rates.

- Use online comparison tools to quickly compare interest rates from various lenders.

- Contact multiple lenders directly to discuss your needs and get personalized quotes.

- Check for pre-qualification offers to get a sense of your potential interest rate without impacting your credit score.

H3: Negotiate: Once you've identified a lender offering a competitive rate, don't hesitate to negotiate.

- Highlight your strong credit history and stable financial situation.

- Consider bundling financial products (e.g., checking and savings accounts) to potentially secure a lower rate.

- Show you've shopped around and have received other offers.

H3: Read the Fine Print: Before signing any loan agreement, thoroughly review all terms and conditions.

- Pay close attention to fees (origination, late payment, prepayment penalties).

- Understand the repayment schedule and the total cost of the loan, including all fees and interest.

- Review all documents carefully before committing to a loan.

H2: Understanding APR and Other Fees

The APR (Annual Percentage Rate) represents the total annual cost of borrowing, including interest and all fees. It differs from the interest rate alone, as it accounts for other charges. Be aware of additional fees, such as origination fees, late payment fees, and prepayment penalties. These fees directly impact the total cost of your loan.

3. Conclusion:

Securing a favorable personal loan interest rate hinges on several factors, including your credit score, DTI, loan amount, loan term, and the type of lender you choose. By carefully comparing offers, negotiating effectively, and understanding the fine print, you can significantly reduce the overall cost of borrowing. Don't let high personal loan interest rates derail your financial goals. Start comparing rates today and find the perfect loan to suit your needs! Use online loan comparison tools to begin your search and secure the best personal loan interest rates for your situation.

Featured Posts

-

Erik Ten Hag His Journey To Bayer Leverkusen And What To Expect

May 28, 2025

Erik Ten Hag His Journey To Bayer Leverkusen And What To Expect

May 28, 2025 -

Jennifer Lopez To Host The 2024 American Music Awards In May

May 28, 2025

Jennifer Lopez To Host The 2024 American Music Awards In May

May 28, 2025 -

Key Arsenal Transfer Target Gunners Beat Real Madrid And Manchester United To Signing

May 28, 2025

Key Arsenal Transfer Target Gunners Beat Real Madrid And Manchester United To Signing

May 28, 2025 -

A Complete Guide To Finance Loans Application Interest Rates Emis And Tenure

May 28, 2025

A Complete Guide To Finance Loans Application Interest Rates Emis And Tenure

May 28, 2025 -

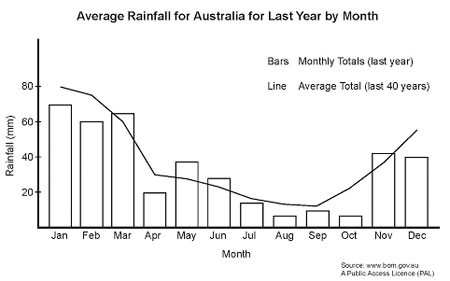

Analyzing Aprils Rainfall Above Average Or Below

May 28, 2025

Analyzing Aprils Rainfall Above Average Or Below

May 28, 2025

Latest Posts

-

Le 9 Mai 2025 Arcelor Mittal La Russie Et Les Consequences Geopolitiques Franceinfo

May 30, 2025

Le 9 Mai 2025 Arcelor Mittal La Russie Et Les Consequences Geopolitiques Franceinfo

May 30, 2025 -

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025 -

Presidentielle 2027 Marine Le Pen Empechee De Se Presenter Jacobelli Denonce Un Diktat

May 30, 2025

Presidentielle 2027 Marine Le Pen Empechee De Se Presenter Jacobelli Denonce Un Diktat

May 30, 2025 -

Arcelor Mittal Face Aux Sanctions L Emission De Laurent Jacobelli Du 9 Mai 2025

May 30, 2025

Arcelor Mittal Face Aux Sanctions L Emission De Laurent Jacobelli Du 9 Mai 2025

May 30, 2025 -

Le Proces Rn En Appel Une Decision En 2026 Selon Jacobelli

May 30, 2025

Le Proces Rn En Appel Une Decision En 2026 Selon Jacobelli

May 30, 2025