Understanding Private Equity: Four Books Offering Critical Perspectives

Table of Contents

We'll examine these books to provide a multifaceted understanding of the private equity industry, revealing both its potential and its pitfalls.

Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist – Navigating the Deal-Making Process

Brad Feld and Jason Mendelson's "Venture Deals" offers an invaluable perspective from the entrepreneur's side of the table. This isn't a dry legal textbook; it's a practical guide filled with real-world examples and actionable advice.

Key Insights: A Founder's Guide to Private Equity Negotiation

The book excels at demystifying the complex process of venture capital deals. It empowers entrepreneurs to participate actively in shaping the terms that govern their company's future.

- Understanding term sheets and their implications: Feld and Mendelson break down the often-confusing language of term sheets, explaining the implications of each clause on valuation, equity, and control. Effective term sheet analysis is crucial for private equity negotiation.

- Negotiating valuation, equity stakes, and control: The authors provide strategies for negotiating favorable terms, emphasizing the importance of understanding your company's worth and protecting your long-term interests.

- Protecting founders' interests throughout the process: The book stresses the importance of proactive engagement in every stage of the deal, from initial discussions to final agreements.

- Importance of legal counsel, but also strategic thinking beyond the legal aspects: While highlighting the necessity of legal expertise in private equity negotiation, "Venture Deals" also emphasizes the importance of strategic thinking, going beyond the legal aspects to consider long-term business goals.

Private Equity: A Comprehensive Guide – A Broad Overview of the Industry

While a specific author wasn't provided, a comprehensive guide to private equity should cover the full spectrum of the industry. Such a book would provide a foundational understanding of its various aspects.

Key Insights: Understanding Private Equity Strategies and Operations

A robust overview book will delve into the mechanics of the private equity world, illuminating the different players and strategies involved.

- Different types of private equity funds: This includes an explanation of leveraged buyouts (LBOs), venture capital investments, growth equity, and other strategies.

- Investment strategies and due diligence processes: The book should outline the meticulous research and analysis private equity firms undertake before investing in a company. Understanding due diligence is crucial to understanding private equity performance.

- The role of limited partners (LPs) and general partners (GPs): This section would clarify the relationships and responsibilities of these key players in private equity fund management.

- Performance measurement and fund management: The book should discuss how private equity funds are managed, how their performance is measured, and how returns are generated for investors.

Private Equity: Predators in Suits – A Critical Analysis of Private Equity's Impact

Books like "Private Equity: Predators in Suits" (this title is used as an example, replace with an actual book title and author for accuracy) offer a counterpoint to the often-rosy portrayals of the industry.

Key Insights: Examining the Social and Economic Impact of Private Equity

These critical analyses examine the potential negative consequences of private equity investments.

- Potential negative consequences of private equity investments: This includes examining concerns about job losses, asset stripping, and the focus on short-term gains over long-term sustainability.

- Concerns about debt levels and financial engineering: The book likely analyzes the role of high levels of debt in leveraged buyouts and the potential risks involved.

- Ethical considerations related to profit maximization versus social responsibility: This section explores the ethical dilemmas faced by private equity firms, balancing profit maximization with broader social responsibilities.

- Regulatory challenges and oversight of the industry: The book may address the need for stronger regulation and oversight to mitigate potential negative impacts.

The Infrastructure Investor: A Specialized Perspective

Focusing on a specific niche, such as infrastructure investment, reveals unique aspects of private equity.

Key Insights: Understanding Niche Private Equity Strategies

This section might examine a book focusing on private equity investments in infrastructure projects.

- Unique characteristics of infrastructure investment: Infrastructure projects often involve long-term horizons, significant capital requirements, and complex regulatory frameworks.

- Investment strategies employed in this area: This will differ significantly from venture capital or leveraged buyout strategies.

- Market trends and future outlook: This will include analyzing the growth potential of the infrastructure sector and identifying emerging trends.

- Potential risks and opportunities: Investing in infrastructure presents unique risks and rewards related to regulatory changes, technological advancements, and economic cycles.

Gaining a Deeper Understanding of Private Equity

By exploring these four distinct perspectives—the entrepreneur's view, a broad industry overview, a critical examination of its impact, and a specialized niche—we gain a much richer understanding of the private equity landscape. Each book offers valuable insights, complementing the others to create a more holistic picture. The books collectively illuminate the complexities, the potential benefits, and the potential drawbacks of this significant economic force. To truly learn more about private equity, understanding private equity investments, and exploring private equity strategies, we encourage you to explore these crucial texts and conduct further research into this dynamic field. A critical analysis of private equity, encompassing all its facets, is key to informed participation in the global economy.

Featured Posts

-

Ghosts Season 4 Episode 16 St Hettys Day Brings Big Power Reveal Preview

May 27, 2025

Ghosts Season 4 Episode 16 St Hettys Day Brings Big Power Reveal Preview

May 27, 2025 -

Galatasarays Pursuit Of Osimhen Ends In Stalemate No Permanent Transfer

May 27, 2025

Galatasarays Pursuit Of Osimhen Ends In Stalemate No Permanent Transfer

May 27, 2025 -

404 Day Atlanta Decoding The Iconic Area Code

May 27, 2025

404 Day Atlanta Decoding The Iconic Area Code

May 27, 2025 -

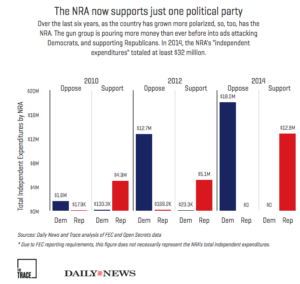

Nra Convention 2024 Reduced Political Presence In Atlanta

May 27, 2025

Nra Convention 2024 Reduced Political Presence In Atlanta

May 27, 2025 -

Nora Fatehi And Jason Derulos Snake A Number One Hit On Uk British Asian Charts

May 27, 2025

Nora Fatehi And Jason Derulos Snake A Number One Hit On Uk British Asian Charts

May 27, 2025

Latest Posts

-

Epcot International Flower And Garden Festival A Complete Guide

May 30, 2025

Epcot International Flower And Garden Festival A Complete Guide

May 30, 2025 -

Le Depute Rn Jacobelli Et La Question De L Impartialite Judiciaire Pour Marine Le Pen

May 30, 2025

Le Depute Rn Jacobelli Et La Question De L Impartialite Judiciaire Pour Marine Le Pen

May 30, 2025 -

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025 -

Hbo Announces Adaptation Of Gisele Pelicots Rape Survivor Memoir

May 30, 2025

Hbo Announces Adaptation Of Gisele Pelicots Rape Survivor Memoir

May 30, 2025 -

Marine Le Pen Et La Justice Jacobelli Defend Une Application Equitable De La Loi

May 30, 2025

Marine Le Pen Et La Justice Jacobelli Defend Une Application Equitable De La Loi

May 30, 2025