Understanding Sovereign Bond Markets With Swissquote Bank

Table of Contents

What are Sovereign Bonds?

Definition and Characteristics

Sovereign bonds, also known as government bonds, are debt securities issued by national governments to finance their spending. These bonds represent a loan from an investor to a government, with the government promising to repay the principal amount (the face value of the bond) plus interest at a specified future date (the maturity date). Governments issue various types of sovereign bonds, including Treasury bills (short-term), Treasury notes (medium-term), and Treasury bonds (long-term), each with a different maturity period. Investing in sovereign bonds is considered by many to be a relatively low-risk strategy compared to equities, although risks still exist.

- Sovereign Risk: This refers to the risk that a government might default on its debt obligations. The creditworthiness of the issuing government significantly influences the bond's yield and price. Countries with strong economies and stable political systems generally issue bonds with lower yields, reflecting lower perceived risk.

- Maturities: Sovereign bonds come with a range of maturities, from a few months (Treasury bills) to several decades (long-term bonds). The maturity influences the bond's price sensitivity to interest rate changes; longer-maturity bonds are generally more sensitive.

- Yield and Interest Rates: Sovereign bond yields are inversely related to their prices. When interest rates rise, existing bond yields become less attractive, causing bond prices to fall. Conversely, when interest rates fall, bond prices rise.

- Credit Rating Agencies: Agencies like Moody's, S&P, and Fitch rate sovereign bonds based on the issuing government's creditworthiness. These ratings are crucial indicators of risk and influence investor demand.

Investing in Sovereign Bonds with Swissquote Bank

Accessing the Market

Swissquote Bank provides a convenient and secure platform for accessing the global sovereign bond market. Their user-friendly interface allows investors of all experience levels to explore diverse opportunities, manage their portfolios effectively, and benefit from competitive pricing. Their services are designed to streamline the process of trading government bonds, making it accessible even to those new to the market.

- Bond Selection: Swissquote Bank offers a wide variety of sovereign bonds from various countries, providing opportunities for diversification across geographies and currencies.

- Trading Process: The trading process is typically straightforward, involving placing orders through the Swissquote Bank platform. Fees and commissions associated with trading are clearly outlined, allowing investors to budget accordingly.

- Research & Analytics: Swissquote Bank provides various research tools and analytical resources, including market reports, economic indicators, and charting capabilities, to aid investors in their decision-making process.

- Security: Swissquote Bank implements robust security measures to protect investor assets and ensure the integrity of the trading platform, adhering to the highest industry standards.

Understanding Sovereign Bond Risks and Returns

Risk Assessment

While sovereign bonds are generally considered lower risk than equities, they are not without risk. Understanding these risks is crucial for making informed investment decisions.

- Interest Rate Risk: Changes in interest rates significantly impact bond prices. Rising interest rates generally lead to falling bond prices, while falling interest rates lead to rising bond prices.

- Inflation Risk: Inflation erodes the purchasing power of future interest payments and the principal repayment. Investors need to carefully consider the impact of inflation on the real return of their sovereign bond investments.

- Currency Risk: Investing in foreign sovereign bonds exposes investors to currency fluctuations. Changes in exchange rates can affect the overall return in the investor's domestic currency.

- Diversification: Diversifying across different sovereign bonds with varying maturities, issuers, and currencies can effectively mitigate some of these risks.

- Political and Economic Events: Geopolitical events and economic instability in the issuing country can negatively impact sovereign bond prices. Careful monitoring of global events is important.

- Yield Curve: The yield curve, which plots the yields of bonds with different maturities, provides insights into future interest rate expectations and can help investors assess risk.

- Bond Duration: Duration measures the sensitivity of a bond's price to interest rate changes. Longer-duration bonds are generally more sensitive to interest rate fluctuations.

Strategic Considerations for Sovereign Bond Investing

Building a Diversified Portfolio

A well-diversified portfolio is crucial for managing risk and maximizing returns. This applies to sovereign bonds as well.

- Investment Goals: Investors should select sovereign bonds that align with their specific investment goals, such as capital preservation, income generation, or a combination of both.

- Risk Tolerance: The choice of sovereign bonds should reflect the investor's risk tolerance. Conservative investors may prefer higher-rated bonds with shorter maturities, while more aggressive investors might consider lower-rated bonds with longer maturities.

- Yield Curve Analysis: Analyzing the yield curve can provide valuable insights into future interest rate movements and inform investment decisions.

- Income Generation: Sovereign bonds provide a regular stream of income through interest payments. This makes them attractive for investors seeking a stable income stream.

- Capital Preservation: Sovereign bonds can help preserve capital during periods of market uncertainty, particularly higher-rated bonds from stable economies.

- Hedging Strategies: Sovereign bonds can be used as a component of hedging strategies to reduce overall portfolio risk.

Resources and Further Learning

Swissquote Bank Support and Educational Materials

Swissquote Bank offers various resources to enhance your understanding of sovereign bond investing.

- Website Resources: Visit the Swissquote Bank website for detailed information on their sovereign bond offerings, trading platforms, and research tools. [Insert Link to relevant Swissquote page here]

- Educational Webinars: Swissquote Bank frequently hosts webinars and online seminars providing valuable insights into the sovereign bond market. [Insert Link to webinars page here, if available]

- Market Analysis Reports: Access insightful market analysis reports and commentary from Swissquote Bank’s experts. [Insert Link to market analysis page here, if available]

- Dedicated Support: Swissquote Bank provides dedicated support to assist clients with their investment needs.

Conclusion

Understanding sovereign bond markets is essential for building a robust and diversified investment portfolio. Sovereign bonds offer a potentially attractive means of generating income and managing risk, but it's crucial to understand the inherent risks involved, including interest rate risk, inflation risk, and currency risk. Swissquote Bank provides a user-friendly platform and valuable resources to help investors navigate this complex market. By leveraging the platform’s features and educational materials, investors can make informed decisions, build diversified portfolios, and explore the opportunities available in the world of sovereign bonds. Explore sovereign bond opportunities with Swissquote Bank today and embark on a journey towards smarter, more strategic investing. Visit the Swissquote Bank website to learn more and start investing in sovereign bonds.

Featured Posts

-

Remembering The Fsu Shooting Victims Unveiling Untold Stories

May 19, 2025

Remembering The Fsu Shooting Victims Unveiling Untold Stories

May 19, 2025 -

Getting To Universal Epic Universe From Sun Rail And Brightline A Practical Guide

May 19, 2025

Getting To Universal Epic Universe From Sun Rail And Brightline A Practical Guide

May 19, 2025 -

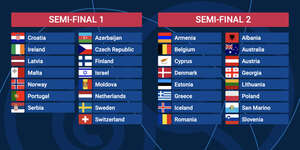

The United Kingdom At Eurovision 2025 A 19th Place Result

May 19, 2025

The United Kingdom At Eurovision 2025 A 19th Place Result

May 19, 2025 -

Parcay Sur Vienne La Fete De La Marche Reunit Une Centaine De Personnes

May 19, 2025

Parcay Sur Vienne La Fete De La Marche Reunit Une Centaine De Personnes

May 19, 2025 -

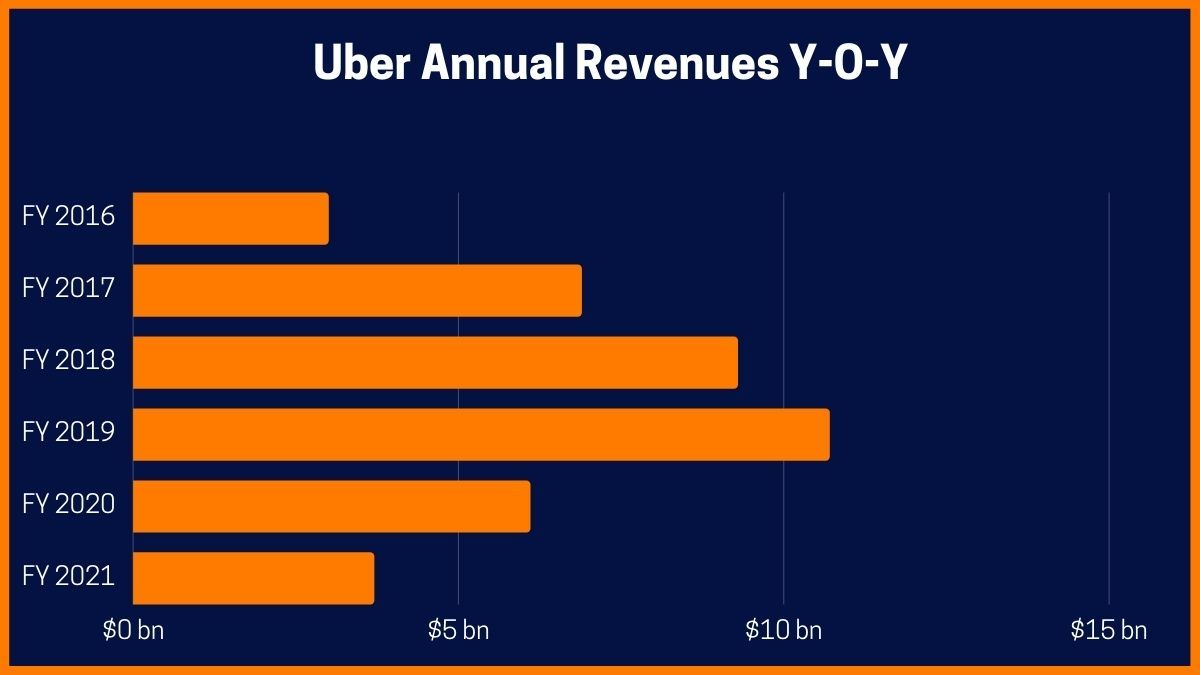

Understanding The Reasons Behind Ubers April Double Digit Increase

May 19, 2025

Understanding The Reasons Behind Ubers April Double Digit Increase

May 19, 2025

Latest Posts

-

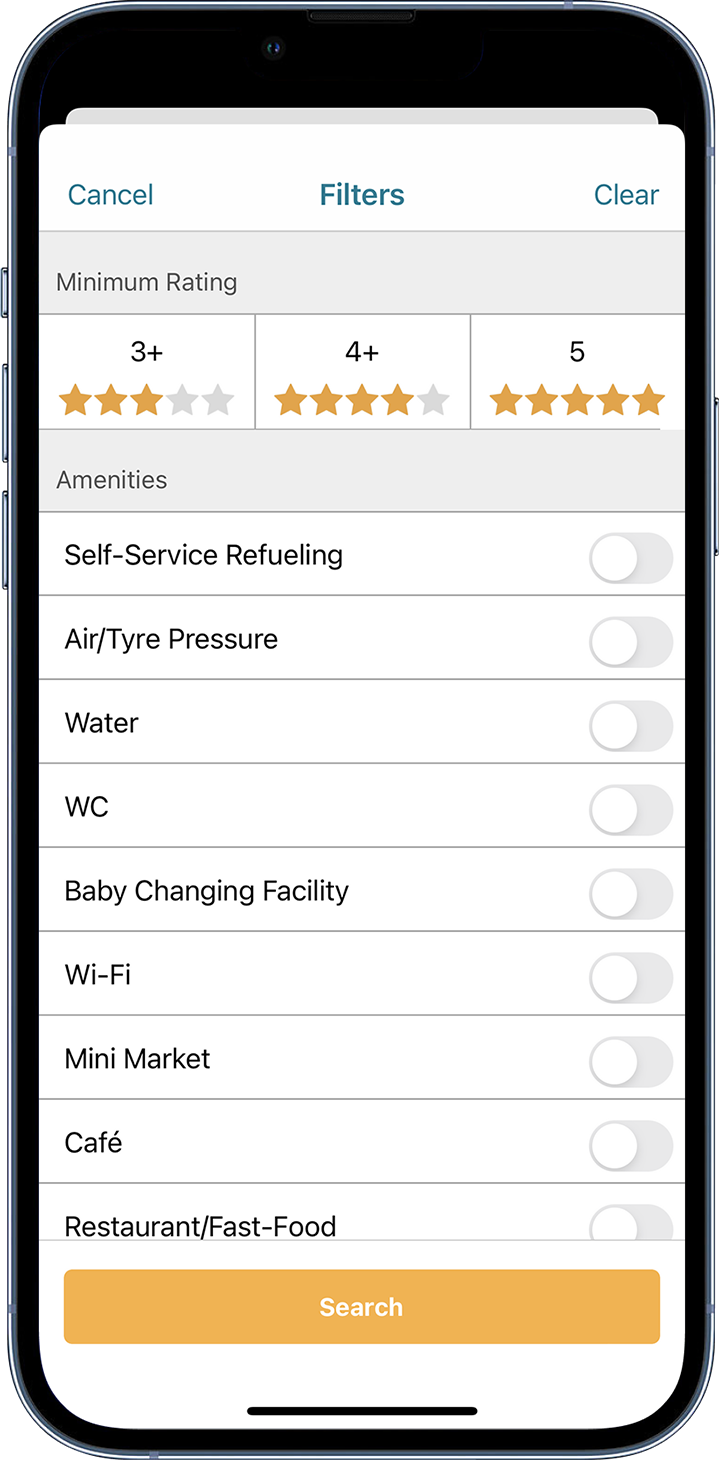

Kaysima Pos Na Eksoikonomisete Xrimata Stin Kypro

May 19, 2025

Kaysima Pos Na Eksoikonomisete Xrimata Stin Kypro

May 19, 2025 -

Poy Na Breite Ta Fthinotera Kaysima Stin Kypro

May 19, 2025

Poy Na Breite Ta Fthinotera Kaysima Stin Kypro

May 19, 2025 -

Odigos Gia Tin Eyresi Fthinon Kaysimon Stin Kypro

May 19, 2025

Odigos Gia Tin Eyresi Fthinon Kaysimon Stin Kypro

May 19, 2025 -

Eyresi Ton Xamiloteron Timon Se Kaysima Stin Kypro

May 19, 2025

Eyresi Ton Xamiloteron Timon Se Kaysima Stin Kypro

May 19, 2025 -

Akrivotera Kai Fthinotera Pratiria Kaysimon Stin Kypro

May 19, 2025

Akrivotera Kai Fthinotera Pratiria Kaysimon Stin Kypro

May 19, 2025