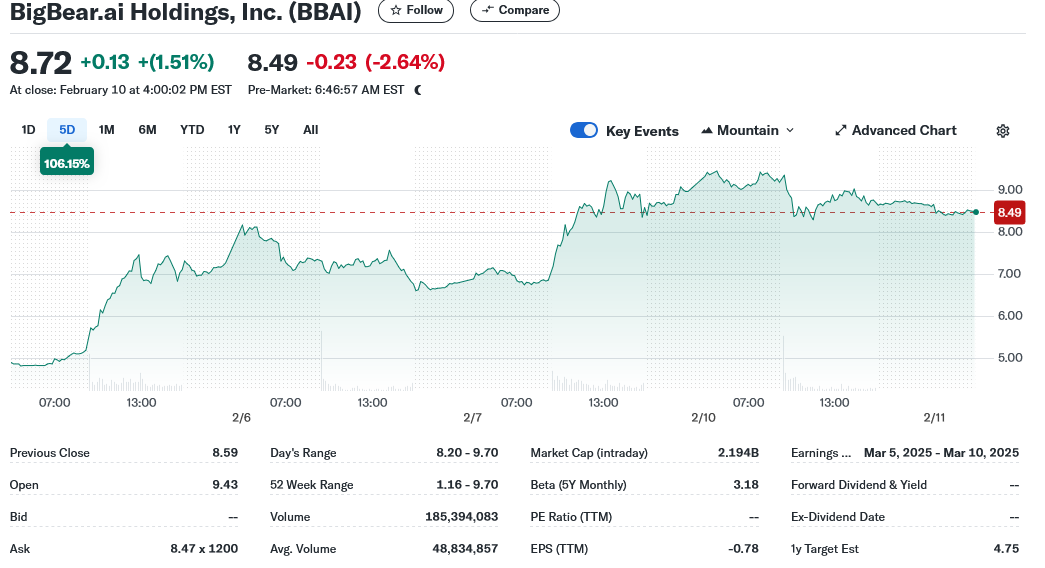

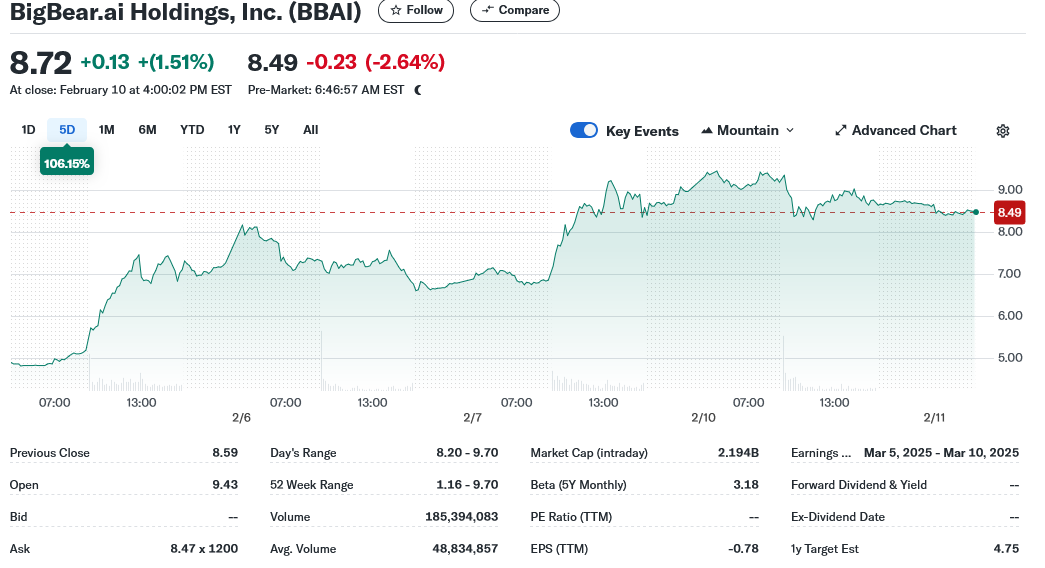

Understanding The BigBear.ai (BBAI) Stock Drop In 2025

Table of Contents

Macroeconomic Factors Influencing BBAI Stock Performance in 2025

Several macroeconomic factors contributed to the overall market volatility in 2025, significantly impacting growth stocks like BBAI.

Interest Rate Hikes and Inflation

Rising interest rates and persistent inflation played a crucial role in the BBAI stock drop. These factors negatively impacted investor risk appetite.

- Increased borrowing costs for businesses: Higher interest rates made it more expensive for companies like BBAI to borrow money, hindering expansion and potentially impacting profitability. This increased financial pressure reduced the appeal of investing in growth stocks.

- Reduced investor confidence in high-growth, yet unprofitable, companies: Investors often shift their focus to more stable investments during periods of high inflation and rising interest rates. Companies like BBAI, which may prioritize growth over immediate profitability, become less attractive during such times.

- Shift in investor preference towards more stable, dividend-paying stocks: In uncertain economic environments, investors tend to favor companies offering consistent dividend payouts, prioritizing stability over growth potential. This led to a rotation out of growth stocks, including BBAI.

Geopolitical Uncertainty and Market Volatility

Geopolitical instability and overall market volatility further exacerbated the situation.

- Impact of global conflicts on investor sentiment: Global conflicts created uncertainty in the market, causing investors to become risk-averse and sell off stocks perceived as riskier, including BBAI.

- Increased uncertainty leading to risk aversion: The uncertainty surrounding geopolitical events led to a general increase in risk aversion among investors, further driving down the price of BBAI stock.

- Correlation between market volatility and BBAI stock price fluctuations: BBAI's stock price showed a strong correlation with overall market volatility, reflecting its sensitivity to broader economic and geopolitical events.

BigBear.ai (BBAI) Company-Specific Factors

Beyond macroeconomic influences, several company-specific factors contributed to the BBAI stock drop in 2025.

Financial Performance and Earnings Reports

BBAI's financial performance in 2025 played a significant role. A thorough analysis of the company's earnings reports reveals key issues.

- Analysis of quarterly earnings reports: Disappointing quarterly earnings reports, potentially showing slower-than-expected revenue growth or widening losses, likely triggered sell-offs.

- Comparison to industry benchmarks and competitor performance: Underperformance relative to industry benchmarks and competitors further eroded investor confidence in BBAI's future prospects. A comparative analysis highlighting this underperformance would have been crucial for investors.

- Examination of revenue streams and their growth trajectory: A decline in certain revenue streams or slower-than-anticipated growth in key areas may have signaled underlying weaknesses to investors.

Competition and Market Share

The competitive landscape also played a part in the BBAI stock decline.

- Identification of key competitors and their market strategies: Aggressive strategies from competitors might have eroded BBAI's market share, leading to concerns about its long-term viability.

- Assessment of BBAI's market share and growth potential: A shrinking market share and a less promising growth outlook fueled negative investor sentiment.

- Analysis of competitive advantages and disadvantages: A lack of strong competitive advantages compared to rivals could have undermined investor confidence in BBAI's ability to sustain its position in the market.

Strategic Decisions and Management Changes

Strategic decisions and potential management changes within BBAI also impacted the stock price.

- Evaluation of the effectiveness of implemented strategies: Poorly executed or ineffective strategies could have contributed to the financial underperformance and the subsequent stock price decline.

- Analysis of the impact of management changes (if any): Management changes, especially if perceived negatively by investors, could have shaken confidence in the company's leadership and future direction.

- Assessment of strategic alliances and partnerships: Failure to secure beneficial strategic alliances or partnerships could have limited BBAI's growth opportunities and impacted investor sentiment.

Investor Sentiment and Market Reactions

Investor sentiment and market reactions amplified the BBAI stock drop.

Analyst Ratings and Price Target Revisions

Analyst opinions played a significant role.

- Review of analyst reports and ratings changes: Negative analyst ratings and downgrades contributed to the negative sentiment surrounding BBAI. A decline in average analyst ratings would be a clear indication of this.

- Analysis of the impact of price target revisions on investor confidence: Lowered price targets by analysts further reduced investor confidence and likely prompted selling.

- Comparison to historical analyst ratings and price targets: Comparing 2025 analyst ratings to prior years helps establish the magnitude of the shift in sentiment.

Media Coverage and Public Perception

Media coverage and public perception significantly influenced investor behavior.

- Analysis of news articles and media reports: Negative news coverage about BBAI's performance or strategic challenges fueled the sell-off.

- Examination of social media sentiment and online discussions: Negative social media sentiment and online discussions could have further amplified the negative perception of BBAI.

- Assessment of the impact of public perception on investor behavior: Public perception, shaped by media and social media, directly influenced investor decisions.

Conclusion

The 2025 decline in BigBear.ai (BBAI) stock price resulted from a confluence of macroeconomic headwinds and company-specific challenges. Understanding the interplay between interest rate hikes, geopolitical uncertainty, company performance, competition, and investor sentiment is crucial for navigating future investments in BBAI. By carefully analyzing these factors, investors can make more informed decisions. Keep a close eye on future BBAI earnings reports and market developments to better understand the ongoing evolution of this technology company and its stock performance. Further research into the BigBear.ai (BBAI) stock is highly recommended before making any investment decisions. Careful analysis of the BBAI stock is essential for any potential investor.

Featured Posts

-

D Wave Quantum Inc Qbts Investigating The 2025 Market Drop

May 21, 2025

D Wave Quantum Inc Qbts Investigating The 2025 Market Drop

May 21, 2025 -

I Krisi Ton Sidirodromon Istoriki Anadromi Kai Prooptikes

May 21, 2025

I Krisi Ton Sidirodromon Istoriki Anadromi Kai Prooptikes

May 21, 2025 -

Freepoint Eco Systems Announces Ing Project Finance Facility

May 21, 2025

Freepoint Eco Systems Announces Ing Project Finance Facility

May 21, 2025 -

Arne Slot Did Liverpool Get Lucky Against Psg Goalkeeper Debate Reignites

May 21, 2025

Arne Slot Did Liverpool Get Lucky Against Psg Goalkeeper Debate Reignites

May 21, 2025 -

Vodacom Vod Exceeds Earnings Expectations With Strong Payout

May 21, 2025

Vodacom Vod Exceeds Earnings Expectations With Strong Payout

May 21, 2025