Understanding The Bitcoin Golden Cross: A Guide For Crypto Investors

Table of Contents

What is a Bitcoin Golden Cross?

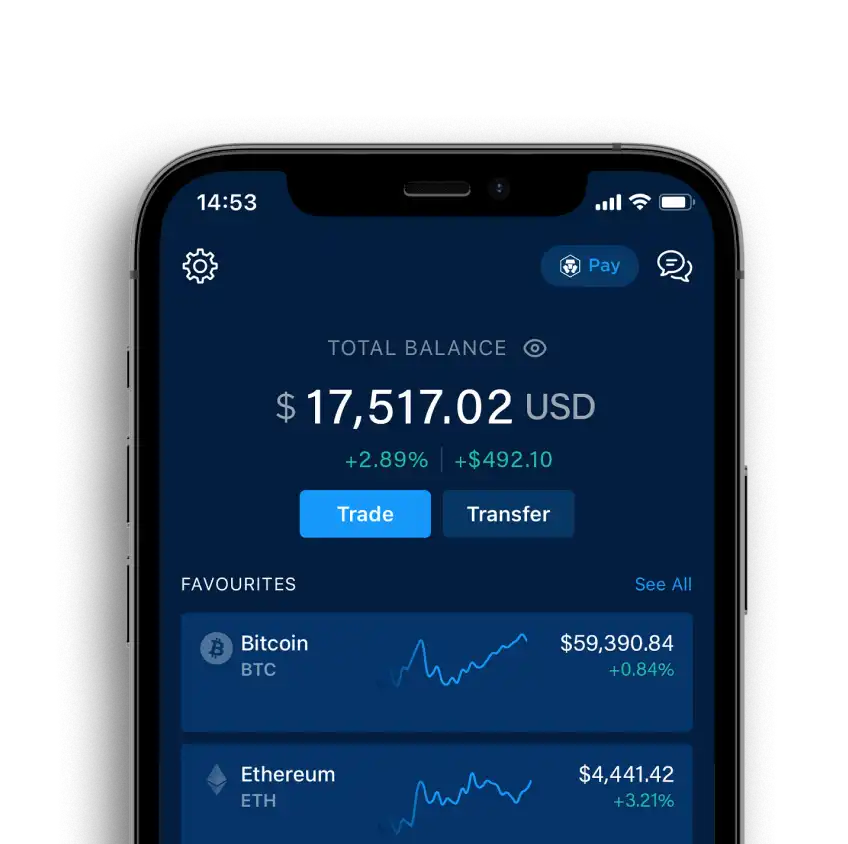

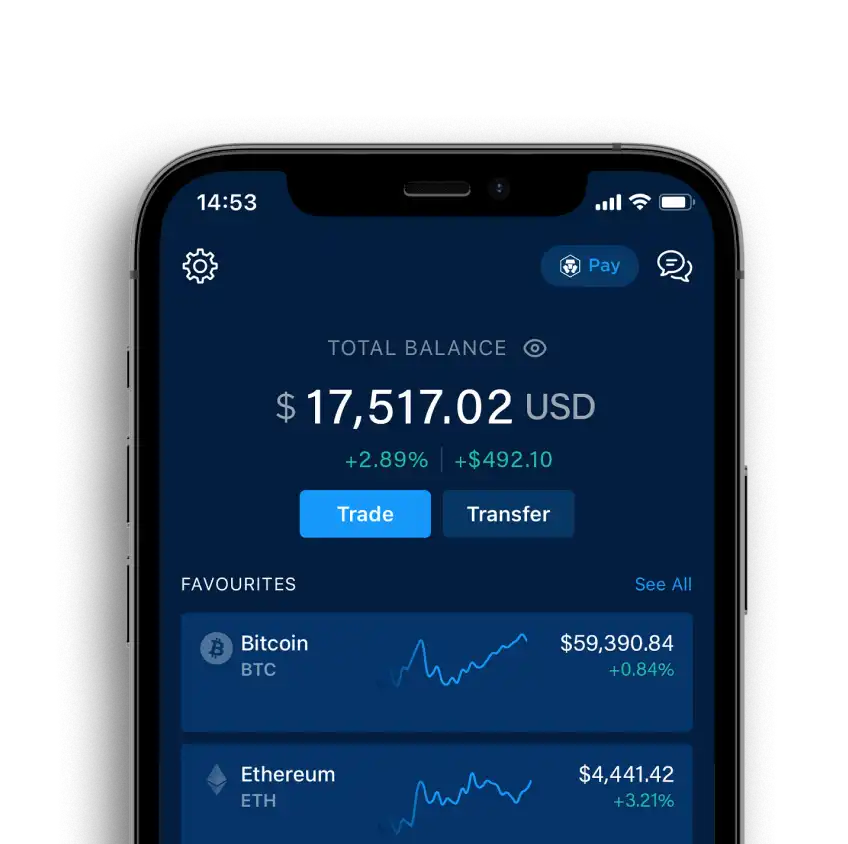

The Bitcoin Golden Cross is a bullish technical indicator formed when the 50-day moving average (MA) crosses above the 200-day MA. These moving averages smooth out price fluctuations, providing a clearer picture of the underlying trend. The 50-day MA represents short-term price momentum, while the 200-day MA reflects longer-term trends. When the shorter-term average crosses above the longer-term average, it suggests a potential shift from a bearish to a bullish market sentiment.

- Definition: Intersection of the 50-day and 200-day moving averages, where the 50-day MA crosses above the 200-day MA.

- Significance: Often (but not always) signals a potential bullish trend reversal, indicating a possible upward price movement for Bitcoin.

- Visual Representation: [Insert a simple chart or graph here illustrating the 50-day and 200-day MAs crossing, clearly showing the Golden Cross.] This visual representation makes it easy to identify the Bitcoin Golden Cross on a price chart.

This simple yet powerful indicator helps Bitcoin traders and investors gauge the potential direction of the market. However, it's crucial to remember that the Golden Cross is not a guarantee of future price increases.

Historical Significance of the Bitcoin Golden Cross

Analyzing past occurrences of the Bitcoin Golden Cross reveals a mixed bag. While many instances have been followed by periods of upward price movement, it's not a consistently accurate predictor. The magnitude and duration of these price increases have varied significantly. Some Golden Cross events have resulted in substantial rallies, while others have shown only modest gains or even subsequent declines.

- Examples of past Golden Cross events and their subsequent price action: Researching historical data on Bitcoin price charts, identifying past Golden Cross events, and documenting the subsequent price movements is crucial for a comprehensive understanding.

- Analysis of the accuracy of the signal in predicting long-term price increases: The success rate of the Bitcoin Golden Cross as a predictor is not 100%. Many factors influence the outcome.

- Discussion of factors that can influence the outcome: External market forces, regulatory changes, and overall investor sentiment can all impact the accuracy of the Golden Cross signal.

Understanding these historical nuances is key to interpreting the signal effectively within the broader market context.

Interpreting the Bitcoin Golden Cross: Factors to Consider

It is vital to understand that the Golden Cross is not a standalone investment strategy. Relying solely on this indicator can be extremely risky. A successful approach requires a holistic view that incorporates various factors:

- Importance of considering overall market conditions: Macroeconomic factors, regulatory announcements, and general market sentiment play a significant role in Bitcoin's price.

- Role of other technical indicators (e.g., RSI, MACD): Combining the Golden Cross with other indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) provides a more comprehensive analysis.

- The need for a comprehensive investment strategy: A robust strategy should involve diversification across multiple asset classes and risk management techniques.

- Risk management strategies for Bitcoin investments: Setting stop-loss orders and diversifying your portfolio are essential to mitigating potential losses.

False Signals and Avoiding Pitfalls

The Bitcoin Golden Cross is not infallible. False signals can and do occur.

- Examples of false Golden Cross signals: Identifying instances where the Golden Cross appeared but wasn't followed by a sustained bullish trend helps illustrate the indicator's limitations.

- Reasons for inaccurate predictions (market manipulation, unexpected news): External events such as regulatory changes, unexpected news, or market manipulation can invalidate the signal.

- Strategies to avoid relying solely on the Golden Cross: Always cross-reference the Golden Cross with other indicators and fundamental analysis before making any investment decisions.

By recognizing these pitfalls, investors can refine their strategies and reduce risks associated with the Bitcoin Golden Cross.

Conclusion

Understanding the Bitcoin Golden Cross is a crucial step in navigating the complex world of cryptocurrency investing. While it serves as a valuable technical indicator, it's essential to remember its limitations. The Golden Cross should be viewed as one piece of a larger puzzle, used in conjunction with other indicators and a thorough understanding of market conditions. Relying solely on the Bitcoin Golden Cross for investment decisions can be highly risky. Always conduct thorough research, consider consulting with a financial advisor, and develop a comprehensive investment strategy that includes robust risk management techniques before making any investment decisions. Learn more about utilizing the Bitcoin Golden Cross and other technical indicators to make smarter investment choices. Start your research today and take control of your crypto portfolio!

Featured Posts

-

Ps 5 Pros Ray Tracing Capabilities A Visual Comparison In Assassins Creed Shadows Of Mordor

May 08, 2025

Ps 5 Pros Ray Tracing Capabilities A Visual Comparison In Assassins Creed Shadows Of Mordor

May 08, 2025 -

Denver Nuggets Player Addresses Russell Westbrook Speculation

May 08, 2025

Denver Nuggets Player Addresses Russell Westbrook Speculation

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025 -

Shifting Trade Winds Canadas Unified Approach Wins Favor In Washington

May 08, 2025

Shifting Trade Winds Canadas Unified Approach Wins Favor In Washington

May 08, 2025 -

Arsenal Manager Arteta Under Fire Latest News And Analysis

May 08, 2025

Arsenal Manager Arteta Under Fire Latest News And Analysis

May 08, 2025

Latest Posts

-

Kripto Para Yatirimlarinda Duesues Riskler Ve Oenlemler

May 08, 2025

Kripto Para Yatirimlarinda Duesues Riskler Ve Oenlemler

May 08, 2025 -

Yatirimcilarin Kripto Paralardan Cekilmesinin Nedenleri Ve Sonuclari

May 08, 2025

Yatirimcilarin Kripto Paralardan Cekilmesinin Nedenleri Ve Sonuclari

May 08, 2025 -

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025 -

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025