Understanding The Canadian Preference Against 10-Year Mortgage Terms

Table of Contents

Higher Interest Rate Risk with Longer Terms

One primary reason for avoiding 10-year mortgage terms is the inherent risk associated with locking into a specific interest rate for an extended period. Interest rates are notoriously volatile, influenced by various economic factors. Committing to a 10-year term means accepting the rate offered at the time of application, leaving you vulnerable to potential increases throughout the term.

- Increased vulnerability to rate hikes: If interest rates rise during your 10-year term, you're stuck with the initial, potentially lower, rate for the entire duration, potentially missing out on lower rates available to those with shorter-term mortgages.

- Difficulty predicting long-term interest rate trends: Accurately forecasting interest rate movements over a decade is nearly impossible. Economic shifts, government policies, and global events can all significantly impact rates.

- Potential for higher overall interest paid: While a lower initial rate might seem appealing, a rise in rates could lead to paying significantly more interest over the life of the 10-year mortgage compared to someone who refinanced with a lower rate on a shorter-term mortgage.

Financial Uncertainty and Changing Life Circumstances

Life is unpredictable. Job loss, unexpected medical expenses, family changes, or even a simple career shift can dramatically alter your financial situation. A 10-year mortgage term offers minimal flexibility in adapting to such unforeseen circumstances.

- Job insecurity and its impact on mortgage payments: Losing your job can make fixed, long-term mortgage payments challenging to maintain, especially with a 10-year commitment.

- Unexpected expenses and their influence on financial stability: Unexpected major expenses – home repairs, medical bills, or supporting family members – can severely strain your finances, potentially leading to difficulties in meeting your mortgage obligations.

- Difficulty predicting future income and financial needs: Your income and expenses are likely to change over ten years. A 10-year mortgage leaves little room for adjusting your payments or refinancing to reflect these changes.

Preference for Shorter-Term Flexibility and Refinancing Options

Many Canadians prefer the flexibility offered by shorter-term mortgages, typically 5-year terms. This allows for rate adjustments every five years, providing opportunities to refinance at potentially lower rates. This approach offers greater control over your mortgage payments and financial planning.

- More frequent opportunities to secure lower interest rates: Refinancing every five years allows you to take advantage of market fluctuations and potentially secure a lower interest rate with each renewal.

- Greater control over mortgage payments and financial planning: Shorter terms provide more frequent opportunities to adjust your mortgage payments based on your changing financial situation.

- Alignment with shorter-term financial goals and life plans: Shorter terms often align better with shorter-term financial goals, such as saving for a down payment on a larger home or investing in other assets.

The Role of Mortgage Brokers and Lender Practices

Mortgage brokers and lenders can influence borrower choices, sometimes inadvertently steering clients toward shorter-term mortgages. This isn't always intentional, but several factors contribute to this trend.

- Commission structures favoring shorter-term mortgages: Some commission structures may incentivize brokers to recommend shorter-term mortgages, as they result in more frequent refinancing opportunities and thus higher commission earnings.

- Complexity of 10-year mortgage applications and underwriting: The process of applying for and obtaining approval for a 10-year mortgage might be perceived as more complex than for a shorter-term mortgage, leading to a preference for the simpler option.

- Higher upfront costs associated with longer-term locks: While potentially offset by lower long-term interest costs, the perceived higher upfront costs associated with securing a 10-year rate can discourage some borrowers.

Conclusion: Making Informed Decisions about Canadian Mortgage Terms

The Canadian preference against 10-year mortgage terms stems from a combination of factors: risk aversion to long-term interest rate commitments, uncertainty regarding future financial stability, and a preference for the flexibility of shorter-term mortgages and refinancing options. Choosing the right mortgage term is crucial. Before making a decision on a 10-year mortgage or any other long-term mortgage commitment, consult a financial professional to weigh the pros and cons based on your unique circumstances. Understanding the implications of Canadian mortgage term choices is paramount to making a financially sound decision.

Featured Posts

-

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents For Insightful Content

May 05, 2025

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents For Insightful Content

May 05, 2025 -

Verstappens First Interview Since Becoming A Father

May 05, 2025

Verstappens First Interview Since Becoming A Father

May 05, 2025 -

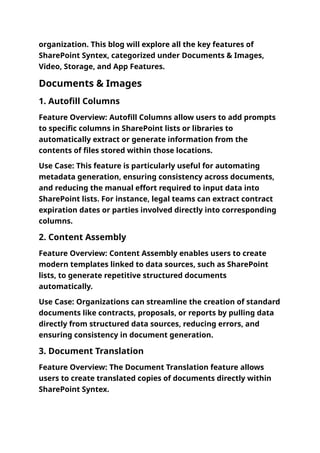

Heatwave Alert Stay Safe In South Bengals Affected Districts

May 05, 2025

Heatwave Alert Stay Safe In South Bengals Affected Districts

May 05, 2025 -

Impact Of Trump Tariffs On Aritzia Pricing Strategy And Adjustments

May 05, 2025

Impact Of Trump Tariffs On Aritzia Pricing Strategy And Adjustments

May 05, 2025 -

Paddy Pimblett Criticizes Dustin Poiriers Retirement Decision

May 05, 2025

Paddy Pimblett Criticizes Dustin Poiriers Retirement Decision

May 05, 2025

Latest Posts

-

The Dress That Broke The Internet Emma Stones Snl Appearance

May 05, 2025

The Dress That Broke The Internet Emma Stones Snl Appearance

May 05, 2025 -

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025 -

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025 -

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025 -

Cord Cutting Revolution Continues Fox And Espns Streaming Plans For 2025

May 05, 2025

Cord Cutting Revolution Continues Fox And Espns Streaming Plans For 2025

May 05, 2025