Understanding The CoreWeave, Inc. (CRWV) Stock Increase On Thursday

Table of Contents

On Thursday, shares of CoreWeave, Inc. (CRWV) experienced a significant price increase, leaving many investors wondering about the reasons behind this sudden surge. This article delves into the potential factors contributing to the CRWV stock price jump, analyzing market conditions, company-specific news, and the broader trends in cloud computing and artificial intelligence (AI). We'll examine the interplay of these elements to understand this unexpected market movement.

Analyzing the CoreWeave (CRWV) Stock Price Jump

Market Sentiment and Investor Confidence

Thursday's overall market sentiment played a crucial role in the CRWV stock surge. While the broader market showed some positive indicators, the technology sector, in particular, experienced a boost. Increased investor confidence in the tech sector, fueled by positive earnings reports from other major players and a generally optimistic outlook, likely spilled over into related stocks like CRWV. Furthermore, the growing excitement surrounding AI-driven technologies significantly impacted investor perception.

- Increased investor interest in AI-related technologies: The rapid advancement and adoption of AI across various industries created a wave of optimism, benefiting companies positioned to capitalize on this trend, including CoreWeave.

- Positive analyst reports impacting CRWV valuation: Favorable analyst ratings and price target increases often significantly influence investor decisions, leading to increased buying pressure and pushing stock prices higher.

- Overall positive economic indicators influencing the market: Positive macroeconomic data, such as employment figures or consumer spending, can boost investor confidence and lead to increased investment across various sectors, including cloud computing.

CoreWeave's Business Performance and Recent Announcements

Beyond the general market trends, CoreWeave's own performance and news likely contributed significantly to the stock price increase. While specific announcements need to be referenced based on the actual events of that day, we can hypothetically explore potential scenarios:

- New contracts secured with major clients: Securing large contracts with significant clients in the technology or other data-intensive sectors would undoubtedly boost investor confidence, demonstrating market demand for CoreWeave's cloud computing and AI infrastructure solutions.

- Expansion into new geographic markets: Expanding CoreWeave's reach to new markets indicates a growing global demand for its services and highlights the company's scalability and potential for further growth.

- Technological advancements announced by CoreWeave: Any new technological advancements in cloud computing, AI, or data center infrastructure announced by CoreWeave would be viewed favorably by investors, signaling the company's commitment to innovation and its competitive advantage in the market.

The Role of AI and Cloud Computing in CRWV's Stock Performance

CoreWeave operates in a rapidly expanding sector: cloud computing and AI infrastructure. The ever-increasing demand for cloud-based services and AI solutions directly benefits CoreWeave's business. This growing reliance on cloud services and the expanding AI market are key drivers for the CRWV stock price surge.

- Increasing reliance on cloud services by businesses: Companies are increasingly adopting cloud-based solutions to improve efficiency, scalability, and cost-effectiveness, fueling the growth of cloud infrastructure providers like CoreWeave.

- Growth of the AI market and CoreWeave's role in it: CoreWeave's focus on providing high-performance computing resources specifically tailored for AI workloads positions them favorably within the rapidly expanding AI market. Any news indicating their successful support of major AI projects would significantly impact their stock price.

- CoreWeave's competitive advantages in the cloud computing space: Specific advantages, such as superior technology, pricing strategies, or customer service, give CoreWeave an edge over competitors and contribute to its market success and investor appeal.

Potential Risks and Future Outlook for CRWV Stock

While the recent stock surge is positive, understanding potential risks and future challenges is crucial for informed investment decisions.

Factors that Could Impact Future Stock Price

Several factors could influence the future CRWV stock price. It's vital to consider these potential headwinds:

- Increased competition in the cloud computing market: The cloud computing market is highly competitive, with established players and new entrants constantly vying for market share. Increased competition could put pressure on CoreWeave's margins and growth.

- Potential regulatory changes impacting the industry: Government regulations regarding data privacy, security, and antitrust issues could significantly impact the cloud computing industry, affecting CoreWeave's operations and profitability.

- Economic downturn influencing investor behavior: An economic downturn could reduce corporate spending on cloud services and AI projects, potentially negatively affecting CoreWeave's revenue and stock price.

Predicting Future CRWV Stock Movement

Predicting future stock movement is inherently challenging. While the current situation appears promising, it's essential to approach any investment in CRWV cautiously. Thorough due diligence, considering personal risk tolerance, and staying informed about the company's progress are crucial.

- Short-term and long-term outlook for CRWV stock: The short-term outlook might be volatile, influenced by market sentiment and news events. The long-term outlook depends on CoreWeave's ability to execute its strategy and maintain its competitive edge in a dynamic market.

- Factors to watch for in determining future performance: Keep an eye on CoreWeave's financial reports, new partnerships, technological advancements, and competitive landscape developments.

- Disclaimer regarding investment advice: This analysis is for informational purposes only and does not constitute investment advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion

The Thursday increase in CoreWeave (CRWV) stock price resulted from a confluence of positive factors, including favorable market sentiment, strong company performance and positioning within the booming AI and cloud computing sectors. While the future is inherently uncertain, CoreWeave's position in a rapidly expanding market offers considerable potential for future growth.

Call to Action: Understanding the factors influencing the CoreWeave (CRWV) stock price is crucial for investors. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to CRWV or other cloud computing stocks. Stay informed about CoreWeave's future developments to track its performance and make informed choices regarding this potentially lucrative investment opportunity.

Featured Posts

-

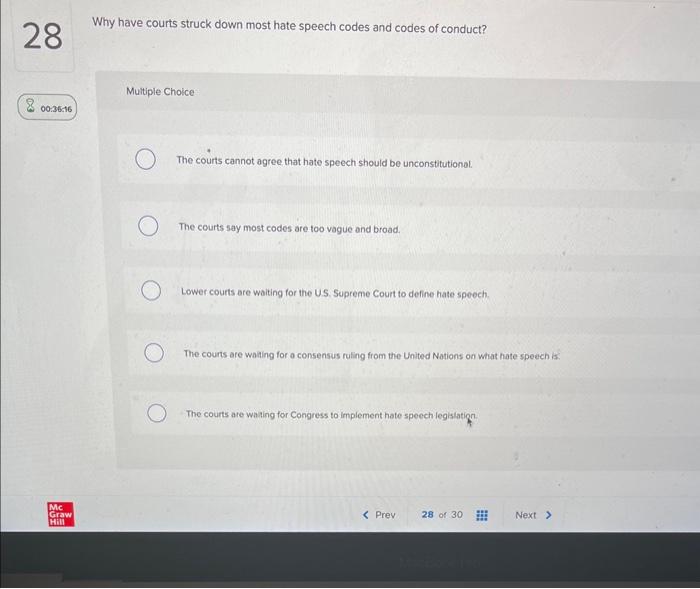

Court Upholds Sentence Against Lucy Connolly For Hate Speech

May 22, 2025

Court Upholds Sentence Against Lucy Connolly For Hate Speech

May 22, 2025 -

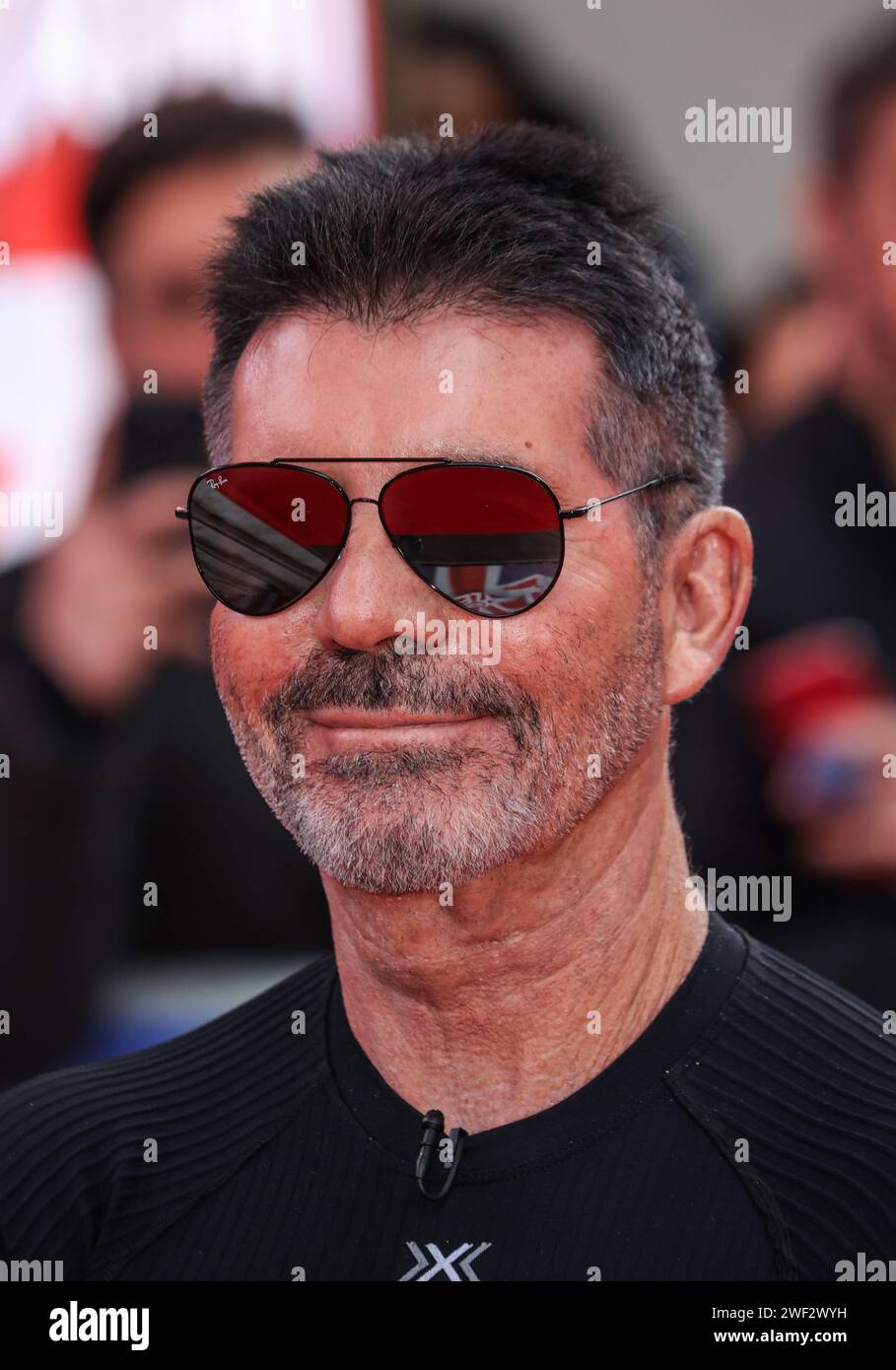

David Walliams Vs Simon Cowell The Britains Got Talent Rift Deepens

May 22, 2025

David Walliams Vs Simon Cowell The Britains Got Talent Rift Deepens

May 22, 2025 -

Home Depots Financial Performance Disappointment Despite Tariff Guidance

May 22, 2025

Home Depots Financial Performance Disappointment Despite Tariff Guidance

May 22, 2025 -

Is The Love Monster Right For Your Child A Parents Guide

May 22, 2025

Is The Love Monster Right For Your Child A Parents Guide

May 22, 2025 -

Cwd Found In Jackson Hole Elk Understanding The Risks

May 22, 2025

Cwd Found In Jackson Hole Elk Understanding The Risks

May 22, 2025