Understanding The D-Wave Quantum (QBTS) Stock Dip On Monday

Table of Contents

Market-Wide Factors Influencing QBTS Stock Performance

Several macroeconomic and sector-specific trends likely contributed to the D-Wave Quantum (QBTS) stock dip. Understanding these broader influences is crucial for a complete analysis.

Overall Market Sentiment

Monday's market performance played a role in the QBTS stock dip. The overall sentiment heavily influenced the performance of many technology stocks.

- Market Indices Performance: The Nasdaq Composite and S&P 500 both experienced slight declines on Monday, indicating a broader market downturn that likely impacted growth stocks like QBTS. This general negative sentiment spilled over into the quantum computing sector.

- Investor Sentiment: Increased risk aversion and profit-taking among investors could have also contributed to the sell-off. Investors may have been reassessing their holdings in riskier assets, leading to a decrease in demand for QBTS shares.

Sector-Specific Trends

The quantum computing sector itself faces competitive pressures and evolving technological landscapes. These factors can impact investor confidence in individual companies.

- Competitor Activities: Increased activity from competitors, including announcements of new advancements or funding rounds, could have diverted investor attention and capital away from D-Wave Quantum. Keeping an eye on rivals like IBM and Google is crucial for understanding QBTS's market position.

- Technological Advancements: While quantum computing is advancing rapidly, setbacks or slower-than-expected progress in the field could impact investor sentiment. Any negative news related to broader quantum computing advancements might have affected QBTS's stock price.

D-Wave Quantum (QBTS)-Specific News and Developments

Company-specific news and analyst sentiment significantly impact a stock's performance. Let's examine potential internal factors influencing the QBTS stock dip.

Company Announcements or Press Releases

Any recent announcements from D-Wave Quantum could have triggered the stock price decline. A lack of positive news can be just as impactful as negative news.

- Earnings Reports and Partnerships: The absence of positive earnings reports or significant new partnerships could have disappointed investors, leading to selling pressure. Any missed expectations regarding revenue or growth targets could also have contributed to the dip.

- Market Reaction to Announcements: Investors closely scrutinize company communications. Even if there weren't explicit negative announcements, the market's reaction to any news (or lack thereof) directly affects the stock price.

Analyst Ratings and Predictions

Analyst opinions heavily influence investor sentiment and trading decisions. Let's analyze whether analyst activity contributed to the QBTS stock dip.

- Analyst Recommendations: Any downgrades or negative predictions from prominent financial analysts might have spurred selling. Investor confidence is often swayed by expert opinions.

- Impact on Investor Confidence: Negative analyst ratings can create a domino effect, prompting further selling and exacerbating the price decline. The weight given to analyst predictions varies, but their collective influence can be powerful.

Technical Analysis of the QBTS Stock Chart

Technical analysis provides a different perspective on the QBTS stock dip, looking at chart patterns and trading activity.

Chart Patterns and Indicators

Analyzing the QBTS stock chart for technical indicators can offer clues about the dip.

- Chart Patterns: The appearance of bearish chart patterns, such as a head and shoulders formation or a double top, might have signaled to traders that a price decline was imminent. Technical analysts look for visual cues in price movements to predict future trends.

- Technical Indicators: Indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) might have shown signs of oversold conditions or bearish momentum, prompting traders to sell. These quantifiable metrics provide additional insights into price trends.

Trading Volume and Volatility

Examining trading volume and volatility during the dip provides valuable context.

- Trading Volume Compared to Average: A significant increase in trading volume during the dip could indicate a large number of investors selling their shares, amplifying the price decrease. High volume often accompanies sharp price movements.

- Volatility Analysis: Analyzing volatility using metrics like standard deviation can reveal whether the dip was unusually sharp compared to the stock's historical volatility. Higher than normal volatility could indicate heightened uncertainty and risk aversion.

Conclusion

The Monday dip in D-Wave Quantum (QBTS) stock appears to be multifaceted, resulting from a confluence of market-wide sentiment, company-specific news, and technical trading patterns. While the absence of positive news and potentially bearish technical indicators played a role, a complete understanding necessitates considering all contributing elements. Investors interested in the future of QBTS should carefully monitor news related to D-Wave Quantum, market trends, and analyst predictions. Stay informed about the D-Wave Quantum (QBTS) stock and its performance to make sound investment decisions. Continue to follow our analysis for further updates on the D-Wave Quantum (QBTS) stock dip and its implications. Understanding the complexities of the D-Wave Quantum (QBTS) stock dip requires continuous monitoring of these various factors.

Featured Posts

-

Finding Strength In Adversity A Guide To Resilience And Mental Health

May 21, 2025

Finding Strength In Adversity A Guide To Resilience And Mental Health

May 21, 2025 -

The Allure Of Cassis Blackcurrant From Liqueur To Culinary Delights

May 21, 2025

The Allure Of Cassis Blackcurrant From Liqueur To Culinary Delights

May 21, 2025 -

Protomagia Sto Oropedio Evdomos Idees Gia Ekdromi

May 21, 2025

Protomagia Sto Oropedio Evdomos Idees Gia Ekdromi

May 21, 2025 -

Love Monster And The Development Of Empathy In Children

May 21, 2025

Love Monster And The Development Of Empathy In Children

May 21, 2025 -

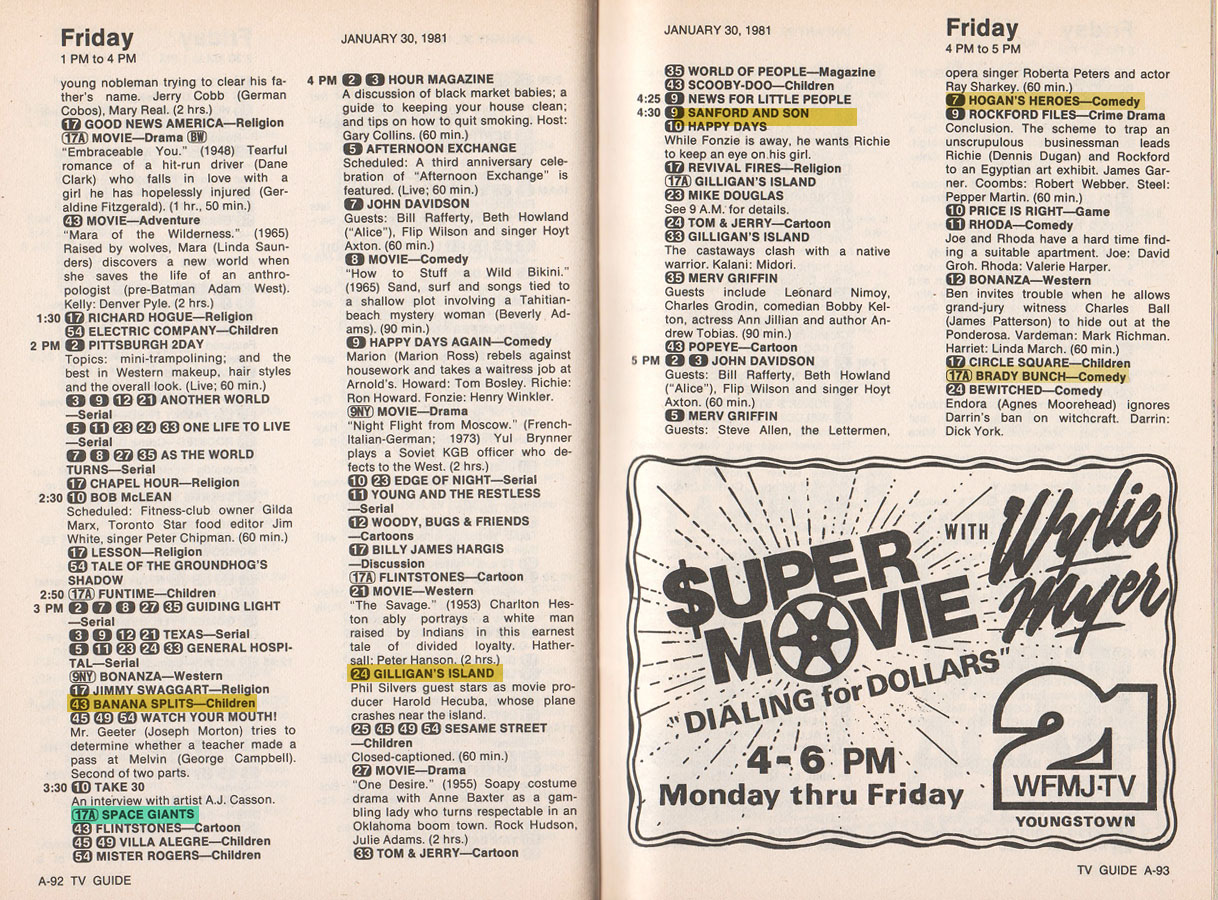

Your Guide To Sandylands U Tv Showtimes And Channels

May 21, 2025

Your Guide To Sandylands U Tv Showtimes And Channels

May 21, 2025