Understanding The Dynamics Between NNPC, Dangote Refinery, And Petrol Prices

Table of Contents

NNPC's Role in Petrol Price Determination

NNPC's Historical Dominance

Historically, NNPC enjoyed a near-monopoly on petrol importation and distribution in Nigeria. This control heavily influenced petrol pricing.

- Subsidies: The government implemented fuel subsidies, leading to artificially low prices at the pump but placing a huge burden on public finances.

- Importation: NNPC was the primary importer of refined petroleum products, making the nation vulnerable to global price fluctuations and supply chain disruptions.

- Price Controls: The government often imposed price controls, limiting NNPC's ability to adjust prices based on market realities.

- Challenges in Efficient Distribution: Inefficient distribution networks and logistical bottlenecks led to shortages and price hikes in certain regions.

NNPC's Current Position

Post-deregulation, NNPC's role has shifted. While it remains a significant player, the landscape is increasingly competitive.

- Competition with Private Importers: The deregulation has opened the door for private sector participation in petroleum importation, creating competition for NNPC.

- Impact of Deregulation: Deregulation aimed to create a more market-driven pricing system, reducing the government's financial burden from subsidies.

- Focus on Upstream Operations: NNPC is increasingly focusing on upstream operations (exploration and production) rather than solely on downstream activities (refining and distribution).

Government Policy and NNPC

Government policies directly influence NNPC's actions and, consequently, petrol prices.

- Subsidy Removal: The gradual removal of fuel subsidies has been a key policy shift, aiming to create a more sustainable pricing system.

- Price Deregulation: Price deregulation aims to allow market forces to determine prices, leading to theoretically more efficient allocation of resources.

- Impact of Exchange Rate Fluctuations: The Naira's exchange rate against the US dollar significantly impacts import costs and thus, petrol prices.

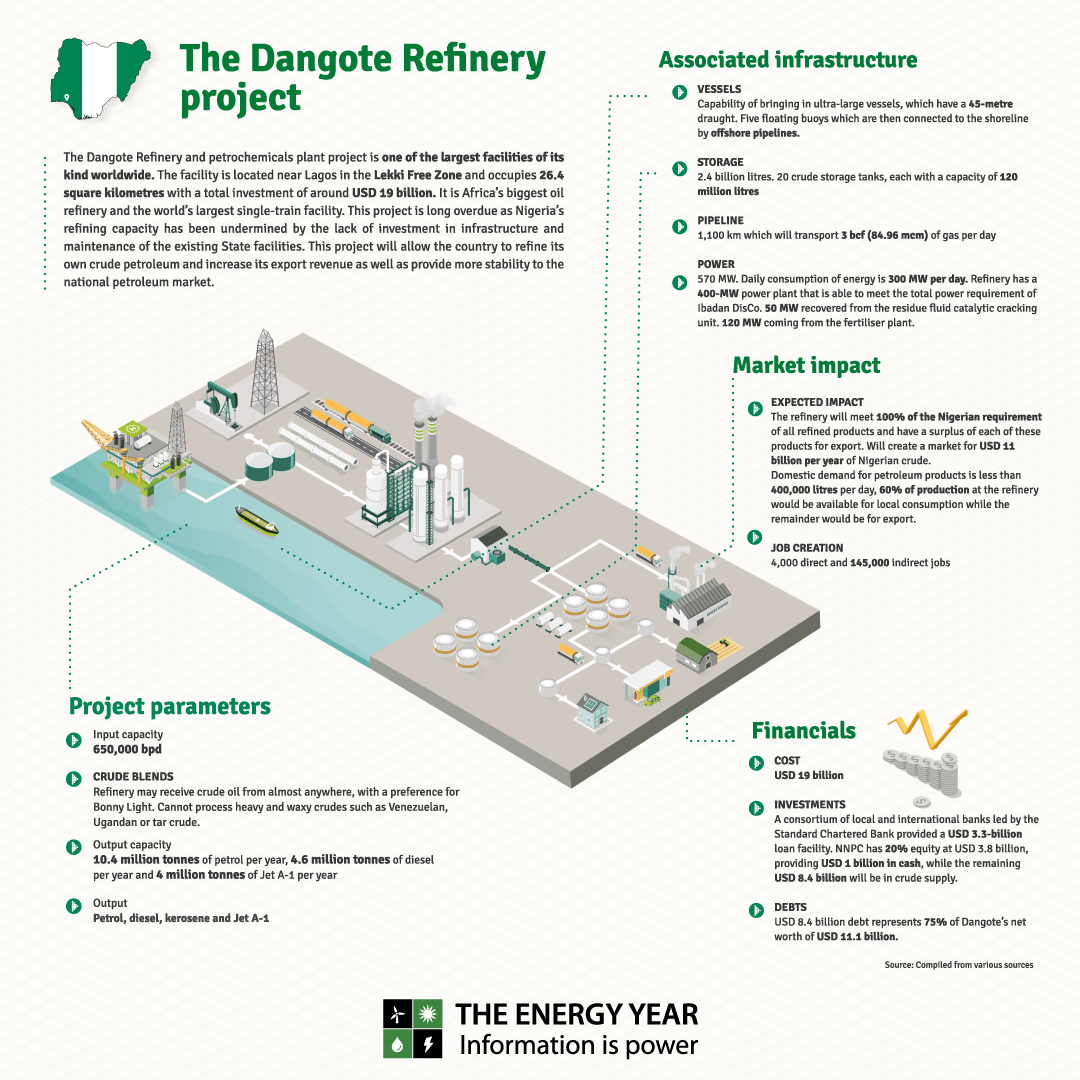

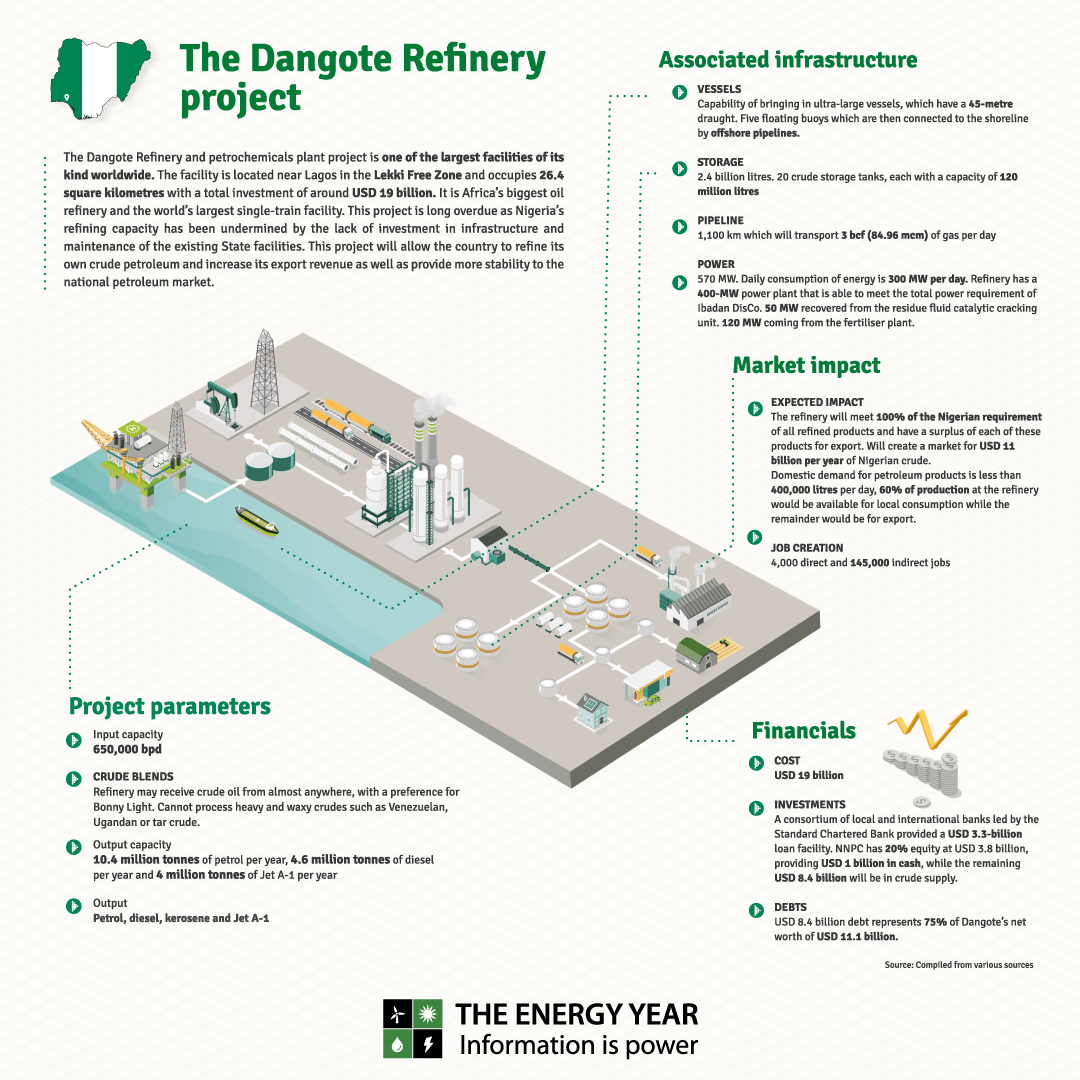

The Dangote Refinery's Potential Impact

Increased Refining Capacity

The Dangote Refinery boasts a massive refining capacity, representing a significant shift in Nigeria's energy landscape.

- Reduced Reliance on Imports: Domestic refining will significantly reduce Nigeria's reliance on imported petroleum products.

- Potential for Lower Prices: Increased local supply and competition could lead to lower petrol prices for consumers.

- Impact on NNPC's Market Share: NNPC's market dominance is likely to decrease as the Dangote Refinery captures a substantial share of the market.

Price Competition

The entry of the Dangote Refinery is expected to intensify competition within the Nigerian petroleum market.

- Price Wars: Competition could trigger price wars, potentially benefiting consumers through lower prices.

- Potential for Lower Consumer Costs: Increased competition should ideally lead to more affordable fuel for Nigerian consumers.

- Market Share Dynamics: The market share dynamics between NNPC and Dangote Refinery will be a key determinant of petrol price fluctuations.

Challenges and Uncertainties

Despite its potential, the Dangote Refinery faces several challenges that could influence price dynamics.

- Operational Efficiency: Maintaining consistent and efficient operations is crucial to meeting projected output and impacting prices.

- Feedstock Availability: Securing a reliable supply of crude oil to feed the refinery is essential for its long-term success.

- Regulatory Hurdles: Navigating regulatory frameworks and obtaining necessary permits can impact the refinery's operations.

- Market Acceptance: Gaining consumer trust and market acceptance for its products is crucial for the refinery's success.

The Interplay Between NNPC and the Dangote Refinery

Competitive Landscape

A new competitive landscape is emerging between NNPC and the Dangote Refinery.

- Market Share Competition: Both entities will compete for market share, influencing price strategies and distribution networks.

- Collaboration Possibilities: There's potential for collaboration between NNPC and the Dangote Refinery, perhaps in areas like crude oil supply or distribution.

- Potential for Partnerships: Strategic partnerships could emerge to improve efficiency and ensure stable fuel supply.

Impact on Petrol Price Volatility

The interaction between NNPC and the Dangote Refinery will affect petrol price stability.

- Price Fluctuations: The balance between competition and cooperation will influence price fluctuations in the market.

- Seasonal Variations: Seasonal demand variations could impact price levels and create opportunities for price manipulation.

- Impact of Global Oil Prices: Global crude oil prices will still influence domestic petrol prices, but the level of influence could decrease.

Long-Term Implications

This dynamic will have long-term consequences for Nigeria's energy sector.

- Energy Security: Increased domestic refining capacity strengthens Nigeria's energy security, reducing reliance on imports.

- Economic Growth: Lower fuel prices can stimulate economic growth by reducing production costs across various sectors.

- Job Creation: The refinery's operations and associated industries will create numerous job opportunities.

- Consumer Welfare: Lower and more stable petrol prices ultimately improve consumer welfare.

Conclusion: Navigating the Future of Petrol Prices in Nigeria

The relationship between NNPC, the Dangote Refinery, and petrol prices in Nigeria is complex and evolving. The Dangote Refinery's substantial refining capacity has the potential to significantly reduce reliance on imports and introduce increased competition, leading to lower prices for consumers. However, challenges remain, including operational efficiency, feedstock availability, and the overall impact of global oil prices. The interplay between NNPC and the Dangote Refinery will be crucial in shaping the future of petrol pricing. Understanding the dynamics between NNPC, Dangote Refinery, and petrol prices is crucial for navigating the Nigerian fuel market. Continue monitoring the interplay between NNPC, the Dangote Refinery, and petrol prices for informed decision-making.

Featured Posts

-

Palantir Plunges 30 Time To Invest

May 10, 2025

Palantir Plunges 30 Time To Invest

May 10, 2025 -

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 10, 2025

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 10, 2025 -

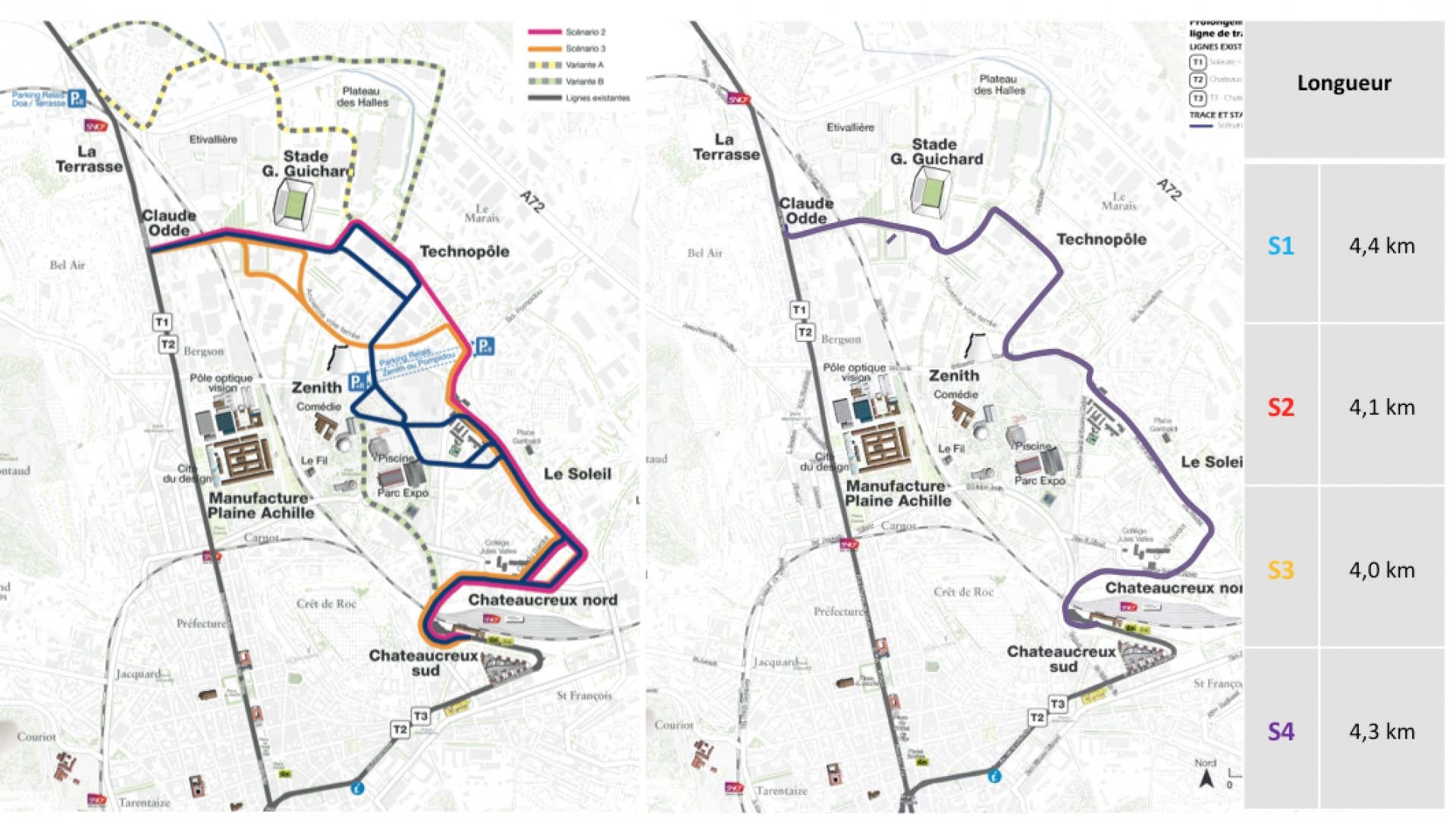

Dijon Concertation Achevee Pour La 3e Ligne De Tramway

May 10, 2025

Dijon Concertation Achevee Pour La 3e Ligne De Tramway

May 10, 2025 -

The 25m Financial Predicament Facing West Ham United

May 10, 2025

The 25m Financial Predicament Facing West Ham United

May 10, 2025 -

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 10, 2025

Sharp Decline In Indonesias Reserves Two Year Low Amidst Rupiah Volatility

May 10, 2025