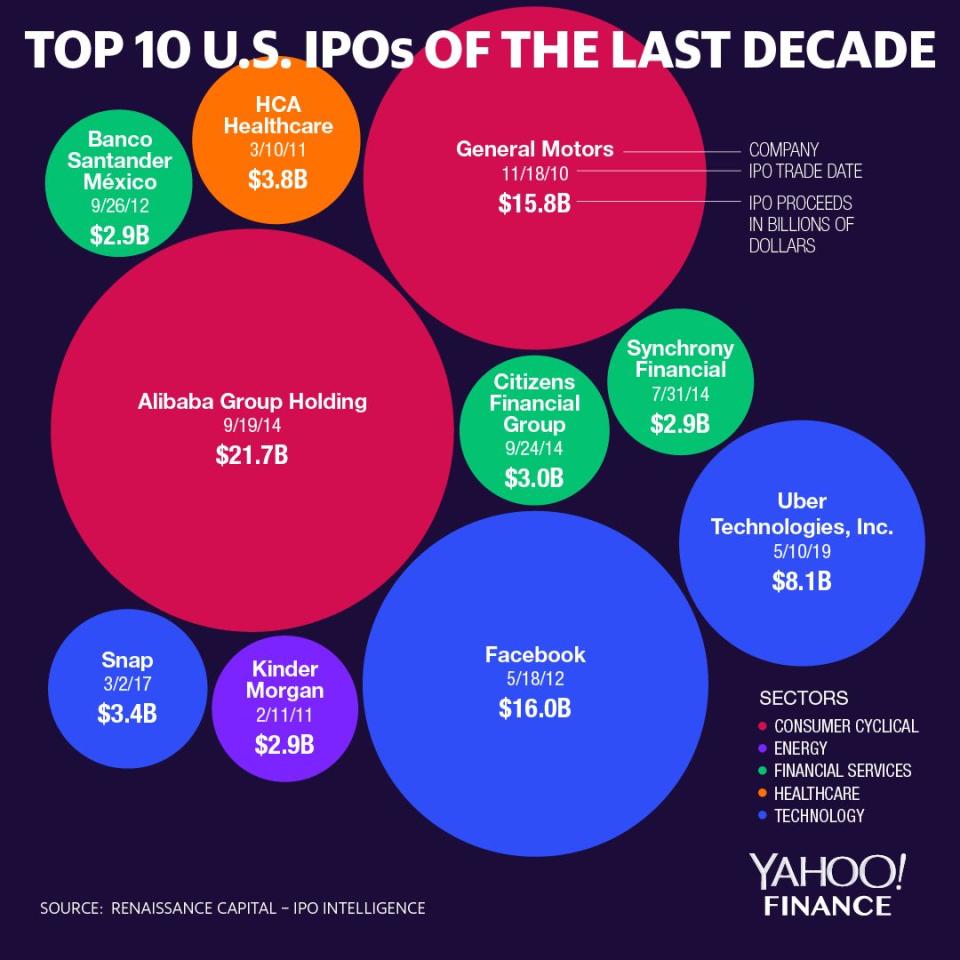

Understanding The Investment Potential Of Uber (UBER)

Table of Contents

Uber's Business Model and Revenue Streams

Uber's core business revolves around connecting riders with drivers through its technology platform. However, the company has diversified significantly beyond its original ridesharing service. Key revenue streams include:

- Ridesharing: This remains Uber's flagship service, connecting passengers with drivers for transportation. Revenue is generated through commissions on each ride.

- Uber Eats: This food delivery service competes with companies like DoorDash and Grubhub, generating revenue through commissions on food orders.

- Uber Freight: This segment connects shippers with trucking companies, providing a digital platform for freight transportation and generating revenue through brokerage fees.

- Subscription Services: Uber offers subscription plans, like Uber One, providing riders with benefits such as discounted rides and priority delivery, generating recurring revenue.

The growth potential of each segment varies.

- Ridesharing market share and growth trends: While dominant in many markets, competition and regulatory changes affect its growth trajectory.

- Uber Eats market penetration and competition: The food delivery market is highly competitive, requiring continuous innovation and marketing to maintain market share.

- Freight segment's contribution and future prospects: This is a relatively newer segment, but with the potential for substantial growth due to the increasing demand for efficient freight logistics.

- Subscription services and their impact on revenue: These recurring revenue streams offer a more predictable and stable source of income compared to transactional services.

The scalability and profitability of each segment are crucial considerations for investors. While ridesharing enjoys a large user base, profitability remains a challenge due to driver compensation and operational costs. Uber Eats and Uber Freight show more promise for long-term profitability.

Competitive Landscape and Market Dynamics

Uber faces intense competition in all its business segments. Key competitors include:

- Lyft: A direct competitor in the ridesharing market.

- Traditional taxi services: A persistent, though declining, competitor in many regions.

- Other ride-sharing services: Numerous regional and international players compete with Uber.

- Food delivery platforms: DoorDash, Grubhub, and others fiercely compete with Uber Eats.

Uber's competitive advantages include:

- Brand recognition and market leadership: Uber benefits from widespread brand awareness and extensive market presence.

- Technological innovation and app features: Continuous improvements to its app and technology give it an edge over some competitors.

- Pricing strategies and market share: Uber's pricing models and promotions play a crucial role in attracting and retaining users.

However, Uber also faces disadvantages:

- Regulatory hurdles and legal challenges: Navigating regulations related to labor laws, licensing, and data privacy is a continuous challenge.

The overall market growth varies across segments. The ridesharing market may be approaching saturation in some developed regions, while the food delivery and freight segments hold significant future growth potential.

Financial Performance and Growth Projections

Uber's historical financial performance reveals a complex picture. While revenue has grown steadily, profitability has been elusive for some time. Analyzing key financial ratios such as debt-to-equity and P/E ratios provides insight into the company's financial health.

- Year-over-year revenue growth: Examining revenue trends reveals the pace of growth across different segments.

- Profitability trends and projections: Uber's path to consistent profitability is a key factor to watch for investors.

- Cash flow and capital expenditure: Understanding cash flow dynamics helps assess the company's ability to reinvest in growth and manage its debt.

- Debt levels and financial health: High debt levels can pose risks, impacting the company's financial flexibility.

Future growth projections vary depending on economic conditions, regulatory changes, and competitive pressures. Analyzing these factors is crucial for evaluating the potential for long-term profitability.

Risks and Challenges Facing Uber

Several significant risks threaten Uber's future performance:

- Competition: The intense competition across all business segments poses a constant challenge.

- Regulatory changes: Changes in regulations regarding ride-sharing, food delivery, and labor laws can significantly impact operations and profitability.

- Economic downturns: Recessions can lead to reduced demand for ride-sharing and food delivery services.

- Driver relations: Maintaining positive relationships with drivers is crucial for operational efficiency and brand image.

- Cybersecurity risks and data breaches: Protecting user data and preventing security breaches is paramount for maintaining trust and reputation.

Uber is employing strategies to mitigate these risks, including investing in technology, diversifying its business segments, and engaging with regulators and drivers. However, investors need to carefully assess these risks and their potential impact on the stock price.

Valuation and Investment Strategies

Uber's current valuation should be analyzed in comparison to its peers and historical performance. Various valuation methods, such as:

- Price-to-earnings ratio (P/E) analysis: Comparing Uber's P/E ratio to industry peers provides insights into its relative valuation.

- Discounted cash flow (DCF) valuation: This method predicts future cash flows to determine the present value of the company.

- Comparison with competitor valuations: Benchmarking Uber's valuation against competitors helps assess its relative attractiveness.

Different investment strategies are suitable for different investors:

- Long-term holding: This strategy is suitable for investors with a longer time horizon and higher risk tolerance.

- Short-term trading: This strategy involves frequent buying and selling based on short-term price movements and is generally considered riskier.

Determining an appropriate entry and exit strategy requires considering your risk tolerance and investment time horizon.

Conclusion: Making Informed Decisions about Investing in Uber (UBER)

Investing in UBER requires careful consideration of its diverse business model, intense competitive landscape, historical and projected financial performance, and the inherent risks involved. While Uber's innovative approach and global reach are attractive, factors such as regulatory uncertainty, competitive pressures, and profitability challenges need thorough evaluation. By carefully analyzing these factors and conducting thorough due diligence, you can make a well-informed decision about the investment potential of UBER. Before investing in UBER, consider your risk tolerance and perform comprehensive research to assess whether this stock aligns with your investment goals.

Featured Posts

-

Bahia Derrota Al Paysandu 0 1 Resumen Completo Y Goles

May 17, 2025

Bahia Derrota Al Paysandu 0 1 Resumen Completo Y Goles

May 17, 2025 -

Victoria De Talleres 2 0 Ante Alianza Lima Resumen Y Goles

May 17, 2025

Victoria De Talleres 2 0 Ante Alianza Lima Resumen Y Goles

May 17, 2025 -

Nba Acknowledges Controversial No Call Impacting Pistons In Game 4

May 17, 2025

Nba Acknowledges Controversial No Call Impacting Pistons In Game 4

May 17, 2025 -

Preocupacion Por Prestamos Estudiantiles El Impacto De Una Segunda Presidencia De Trump

May 17, 2025

Preocupacion Por Prestamos Estudiantiles El Impacto De Una Segunda Presidencia De Trump

May 17, 2025 -

12 Essential Sci Fi Shows To Watch Right Now

May 17, 2025

12 Essential Sci Fi Shows To Watch Right Now

May 17, 2025