Understanding The Scale Of The Current Bond Crisis

Table of Contents

Rising Interest Rates and Their Impact

The current bond crisis is significantly fueled by the aggressive monetary policy actions taken by central banks worldwide.

The Fed's Aggressive Rate Hikes:

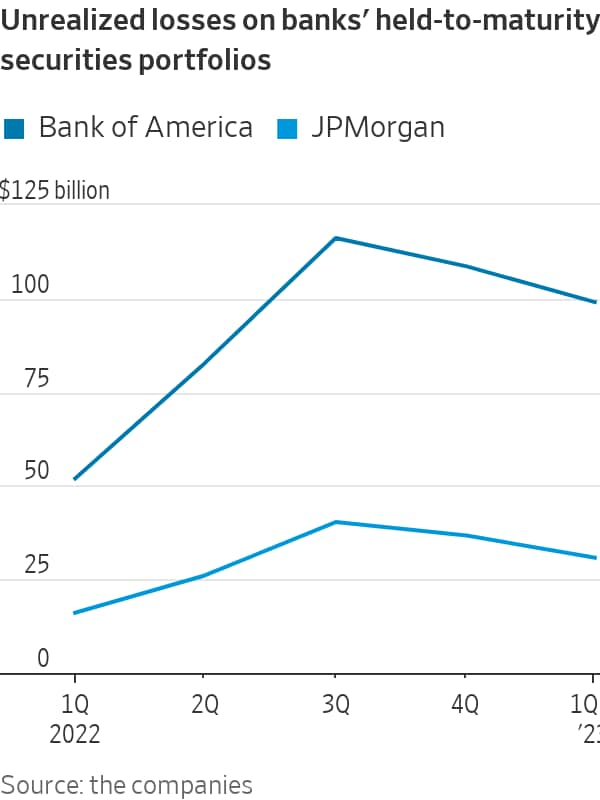

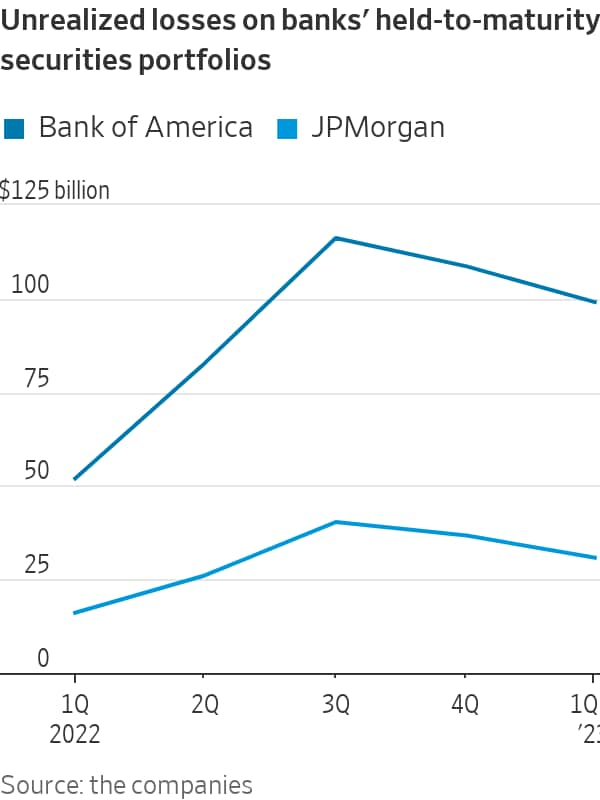

The Federal Reserve's (Fed) series of interest rate hikes represents a cornerstone of the current bond market turmoil. These increases, aimed at curbing rampant inflation, have had a profound impact on bond yields and prices.

- Inverse Relationship: Higher interest rates lead to lower bond prices. This is because newly issued bonds offer higher yields, making existing bonds with lower yields less attractive.

- Increased Borrowing Costs: Higher rates increase borrowing costs for governments and corporations, making it more expensive to service existing debt and potentially hindering economic growth. This increased cost of borrowing directly impacts the ability to issue new bonds and affects the overall stability of the bond market. The Federal Reserve's actions have been particularly impactful on the US Treasury bond market, considered a benchmark for global debt.

- Inflationary Pressures: While designed to combat inflation, the initial impact of rate hikes can exacerbate inflationary pressures in the short term by increasing the cost of goods and services. The delicate balance the Fed must achieve between fighting inflation and avoiding a recession has been a critical element in the unfolding bond crisis.

For example, the Fed Funds rate has increased by X percentage points since [Start Date], representing the most aggressive tightening cycle in decades. This can be visually represented by a chart showing the rate increases over time.

Global Central Bank Policies:

The Fed's actions are not in isolation. Central banks globally, including the European Central Bank (ECB) and the Bank of England (BoE), have also implemented interest rate hikes, albeit at varying paces and magnitudes.

- Differing Approaches: While the goal – curbing inflation – is shared, the approaches and the speed at which these central banks are moving differ, leading to varying impacts on their respective bond markets. The ECB, for example, faced unique challenges due to the energy crisis in Europe.

- Global Impact: These coordinated yet independent actions have created a complex and volatile global bond market, with ripple effects across different sovereign bond markets and asset classes. For instance, the impact on emerging market economies is particularly noteworthy, with many facing currency depreciations and increased borrowing costs.

Soaring Inflation and its Role in the Bond Market Turmoil

Inflation plays a pivotal role in the current bond crisis. High inflation erodes the purchasing power of fixed-income investments, like bonds.

Inflation's Impact on Bond Yields:

High inflation leads to lower demand for bonds, driving up their yields to compensate investors for the erosion of their purchasing power.

- Inflation Expectations: The market's expectation of future inflation heavily influences current bond yields. If inflation is anticipated to remain high, investors will demand higher yields to offset the risk of their returns being eroded.

- Country-Specific Impacts: Countries with significantly high inflation rates, such as [Country A] and [Country B], have witnessed a sharp increase in their bond yields, reflecting investor concerns about the sustainability of their debt.

A chart showcasing inflation rates alongside corresponding bond yields in select countries would effectively illustrate this correlation.

The Impact of Supply Chain Issues and Energy Prices:

Global supply chain disruptions and soaring energy prices have significantly contributed to inflationary pressures and destabilized the bond market.

- Cost-Push Inflation: These factors have led to cost-push inflation, as businesses struggle to absorb rising input costs, leading to higher prices for consumers.

- Government Debt: Governments have also faced increased spending pressures, further contributing to higher debt levels, ultimately impacting their ability to service bond obligations and exacerbating the bond crisis. For example, government interventions to mitigate the energy crisis have added to fiscal burdens in many countries.

Debt Levels and Sovereign Risk

High levels of government debt and increased credit spreads are further amplifying the bond market crisis.

High Government Debt Levels:

Many governments entered the pandemic with already high levels of debt, a situation exacerbated by increased spending during the crisis.

- Debt-to-GDP Ratio: High debt-to-GDP ratios increase the risk of sovereign debt defaults, causing investors to demand higher yields on government bonds to compensate for the increased risk.

- Examples of High Debt: Countries with high debt-to-GDP ratios are particularly vulnerable during periods of rising interest rates, as their borrowing costs increase dramatically. Examples include [Country C] and [Country D].

Increased Credit Spreads:

Credit spreads, which represent the difference in yield between a government bond and a corporate bond of similar maturity, have widened considerably, reflecting the increased risk aversion in the market.

- Borrowing Costs: Wider credit spreads increase the borrowing costs for corporations, potentially hindering investment and economic growth.

- Market Sentiment: The widening of credit spreads reflects investors' diminished confidence in the ability of borrowers to repay their debts, thus signaling increased risk in the bond market. For instance, the spread between US Treasury bonds and corporate bonds widened significantly [Date], reflecting market apprehension.

Conclusion

The current bond crisis is a complex phenomenon driven by the interconnectedness of rising interest rates, soaring inflation, and high levels of debt. These factors have created a perfect storm, impacting investor confidence and increasing the risk of defaults. Understanding the scale of this current bond crisis requires recognizing these intertwined challenges and their cascading effects. The significant implications for investors, governments, and the global economy cannot be overstated. This bond market crisis necessitates prudent financial planning and a proactive approach to investment management.

Understanding the scale of this current bond crisis is crucial for making informed investment decisions. Stay informed, consult with financial professionals, and develop a robust strategy to navigate this challenging market environment. Consider diversifying your portfolio to mitigate risk and seek professional advice to tailor a strategy appropriate to your individual financial situation and risk tolerance. The evolving nature of this bond crisis demands continuous monitoring and adaptation.

Featured Posts

-

Offre Limitee Samsung Galaxy S25 256 Go A 862 42 E

May 28, 2025

Offre Limitee Samsung Galaxy S25 256 Go A 862 42 E

May 28, 2025 -

Welcome To Wrexham A Comprehensive Guide

May 28, 2025

Welcome To Wrexham A Comprehensive Guide

May 28, 2025 -

Nba Lifts Ban John Haliburton Returns To Pacers Games

May 28, 2025

Nba Lifts Ban John Haliburton Returns To Pacers Games

May 28, 2025 -

Hugh Jackman Takes A Cheeky Swipe At Ryan Reynolds His Biggest Gripe

May 28, 2025

Hugh Jackman Takes A Cheeky Swipe At Ryan Reynolds His Biggest Gripe

May 28, 2025 -

Analyzing The Miami Marlins 2025 Opening Day Roster Competition

May 28, 2025

Analyzing The Miami Marlins 2025 Opening Day Roster Competition

May 28, 2025