Understanding The Thursday Decline In CoreWeave Inc. (CRWV) Stock

Table of Contents

Market-Wide Factors Influencing CRWV Stock Performance

Several macroeconomic factors can significantly influence the performance of even the strongest stocks, and the Thursday CoreWeave stock decline was no exception. Understanding these broader market trends is crucial for interpreting the price movement.

Overall Market Sentiment

The overall market sentiment on that Thursday played a considerable role in the CRWV stock drop. A negative market mood often impacts even fundamentally strong companies.

- Negative market news: Reports of slowing economic growth in key sectors, coupled with concerns about rising inflation, created a generally pessimistic atmosphere.

- Indices performance: Major market indices like the NASDAQ and S&P 500 experienced significant drops, indicating a broader market downturn. The tech sector, where CRWV operates, was particularly hard hit.

- General investor sentiment: Investor confidence was low, leading to widespread selling across various sectors, including technology. This broader market correction undoubtedly contributed to the CoreWeave price drop. This negative sentiment, related to the tech stock correction, had a significant impact on CRWV.

Interest Rate Hikes and Their Impact

Interest rate hikes by central banks, like the Federal Reserve, directly impact growth stocks like CoreWeave. Higher interest rates increase borrowing costs and reduce the attractiveness of investing in companies projected for future growth.

- Specific interest rate changes: Any announcement of further interest rate increases or expectations of such increases on that Thursday would have negatively impacted investor confidence.

- Impact on investor confidence: Increased interest rates typically make bonds more attractive relative to stocks, diverting investment capital away from growth stocks.

- Effect on growth stocks like CRWV: CoreWeave, being a growth stock, is particularly vulnerable to interest rate hikes. Higher rates often lead to a decrease in valuation for companies whose future earnings are discounted more heavily. The interest rate impact on CRWV is a key element in understanding this Thursday's decline. The Fed rate hikes were certainly a factor.

Company-Specific News and Factors Affecting CRWV Stock Price

While market-wide factors played a role, company-specific news and events can significantly amplify or mitigate their impact. Let's explore potential internal factors contributing to the CoreWeave stock decline.

Absence of Positive News or Catalysts

The absence of positive news or catalysts can create a vacuum, leading to selling pressure, especially in a bearish market.

- Analysis of recent company news: A review of CoreWeave's recent announcements reveals no significant positive developments that could have offset the negative market sentiment.

- Earnings reports: Any missed earnings expectations or a less-than-stellar earnings report could have triggered the CRWV stock drop. A lack of strong guidance for future earnings further dampened investor enthusiasm.

- Potential missed opportunities: The absence of major contracts or partnerships could have contributed to the negative sentiment surrounding the CoreWeave stock.

Analyst Downgrades or Price Target Adjustments

Analyst opinions significantly influence investor sentiment and trading activity. Downgrades or reduced price targets often lead to sell-offs.

- Specific analyst reports: Any negative analyst reports released or leaked on that Thursday would have contributed to the decline.

- Changes in price targets: A reduction in price targets by major investment firms would have further exacerbated selling pressure.

- Rationale behind downgrades: Understanding the reasons behind analyst downgrades—whether it's concerns about future growth, increased competition, or other factors—is critical for a complete picture of the CoreWeave stock decline. The CRWV analyst rating changes are a crucial piece of this puzzle.

Potential Insider Trading or Unusual Volume

Unusual trading activity, including potential insider trading, can sometimes be an indicator of significant events.

- Data on trading volume: Analyzing the trading volume on that Thursday can reveal whether the sell-off was driven by unusually high volume, suggesting informed selling.

- Unusual trading patterns: Any unusual trading patterns, such as large block trades or significant short selling activity, should be investigated.

- Any disclosed insider trading activity: While not always readily apparent, any disclosed insider trading activity would require scrutiny and could contribute to the negative narrative around the CoreWeave stock. Investigating potential CRWV insider trading is essential.

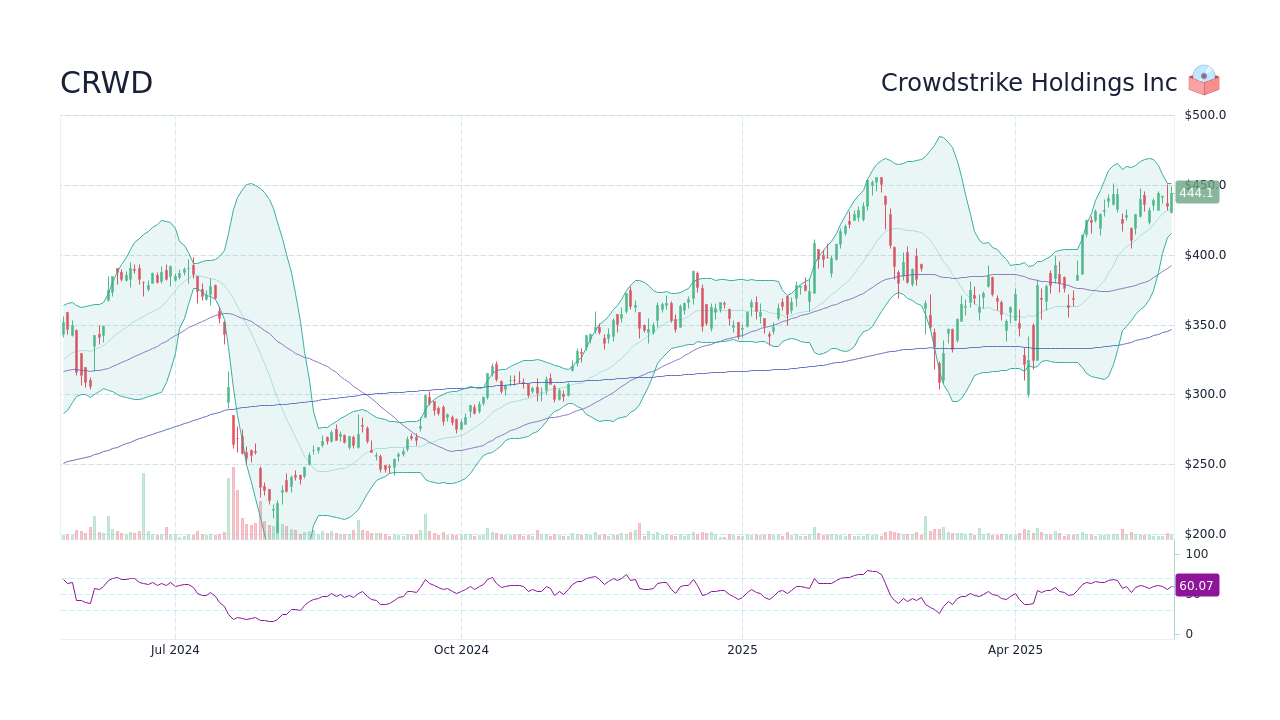

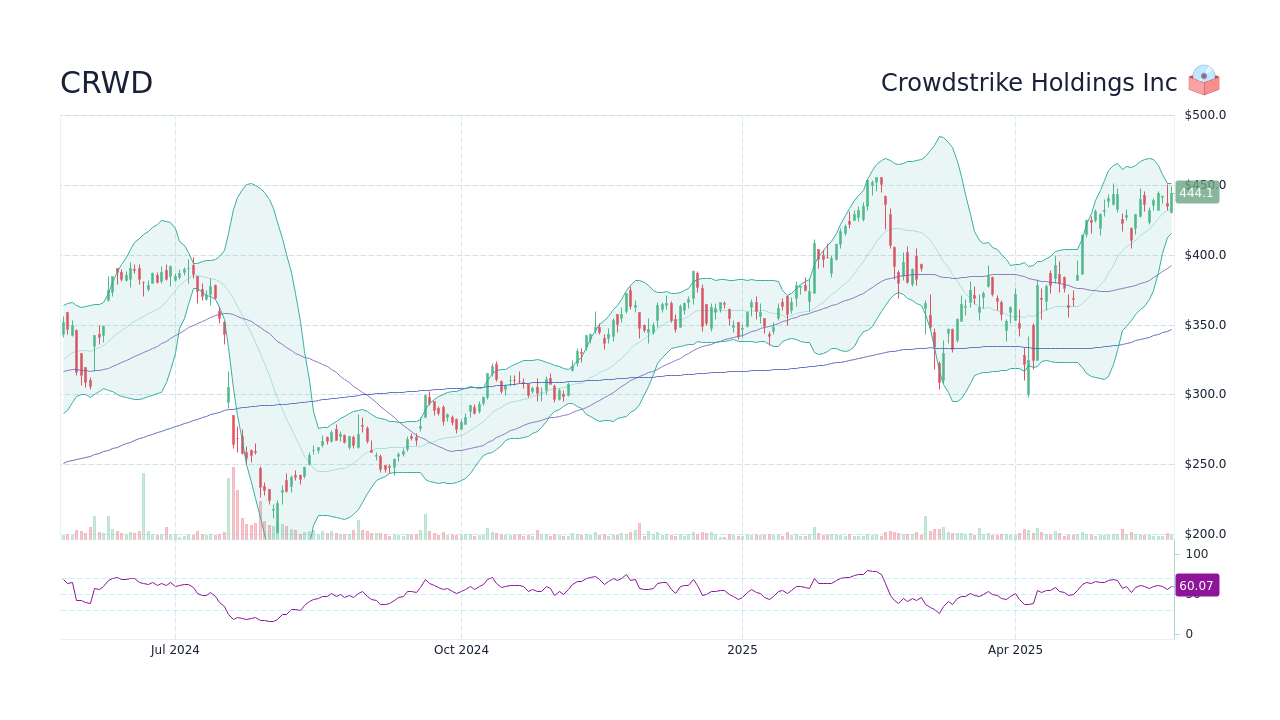

Technical Analysis of the CRWV Stock Drop

Technical analysis provides insights into price movements based on chart patterns and trading volume.

Chart Patterns and Support/Resistance Levels

Examining the CRWV stock chart reveals key technical elements that contributed to the decline.

- Specific chart patterns observed: Identifying chart patterns such as a "head and shoulders" or a breakdown below a key support level can provide valuable insights.

- Breakdown of support levels: The breach of key support levels often triggers further selling, accelerating the downward trend. CRWV technical analysis requires understanding these support and resistance points.

- Technical indicators pointing towards a price drop: Technical indicators such as Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) could have provided signals of an impending decline before the Thursday drop.

Trading Volume and Volatility

High trading volume accompanying a price drop suggests strong selling pressure, while low volume might indicate a less significant event.

- Data on trading volume: Comparing the trading volume on that Thursday to the average trading volume can help determine the significance of the sell-off.

- Volatility metrics: Measuring volatility using metrics like the Average True Range (ATR) can highlight the intensity of price fluctuations.

- Market liquidity: Low market liquidity can exacerbate price swings, making it harder to buy or sell shares, potentially contributing to the sharp CoreWeave price drop. The CRWV trading volume and volatility data are essential for complete analysis.

Conclusion

The Thursday decline in CoreWeave Inc. (CRWV) stock resulted from a combination of market-wide factors and company-specific events. The broader market downturn, fueled by interest rate hikes and negative economic news, created a challenging environment. Simultaneously, the absence of positive catalysts for CoreWeave, coupled with potential analyst downgrades and unusual trading activity, exacerbated the sell-off. Analyzing the CRWV stock decline through technical indicators, such as chart patterns and trading volume, further supports the narrative of a significant negative shift in sentiment. Understanding the interplay of these factors is crucial for navigating future investments.

By understanding the potential reasons behind the Thursday CoreWeave stock decline and consistently monitoring market trends and company news, investors can make more informed decisions about their CRWV holdings. Remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions. Stay informed about future CoreWeave stock price fluctuations to make sound investment choices.

Featured Posts

-

Controversa Fratilor Tate Bataie De Multime In Centrul Bucurestiului

May 22, 2025

Controversa Fratilor Tate Bataie De Multime In Centrul Bucurestiului

May 22, 2025 -

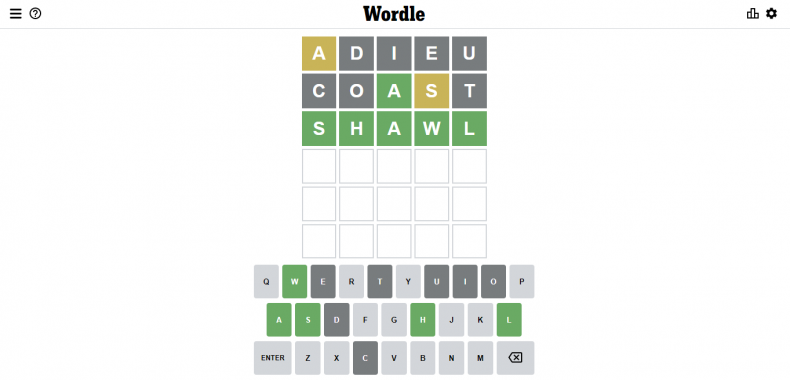

Todays Nyt Wordle Hints Answer And Help April 8 1389

May 22, 2025

Todays Nyt Wordle Hints Answer And Help April 8 1389

May 22, 2025 -

Abn Amro Opslag Handleiding Voor Offline Betalingen

May 22, 2025

Abn Amro Opslag Handleiding Voor Offline Betalingen

May 22, 2025 -

Dropout Kings Singer Adam Ramey Passes Away At 32

May 22, 2025

Dropout Kings Singer Adam Ramey Passes Away At 32

May 22, 2025 -

5 Podcasts Imprescindibles Para Amantes Del Misterio El Suspenso Y El Terror

May 22, 2025

5 Podcasts Imprescindibles Para Amantes Del Misterio El Suspenso Y El Terror

May 22, 2025