Understanding The Volatility Of Riot Platforms Stock (RIOT)

Table of Contents

Factors Contributing to RIOT Volatility

Several interconnected factors contribute to the significant volatility observed in RIOT's stock price. Understanding these elements is key to navigating the inherent risks and potential rewards associated with investing in this company.

Cryptocurrency Market Fluctuations

The price of Bitcoin (BTC) and other cryptocurrencies is the most significant driver of RIOT's stock price. As a Bitcoin mining company, RIOT's revenue and profitability are directly tied to the value of Bitcoin. A rising BTC price generally translates to increased profitability for Riot, boosting investor confidence and driving up the RIOT stock price. Conversely, a falling BTC price negatively impacts profitability, leading to a decline in the stock price. Other factors further complicate this relationship:

- Impact of Bitcoin halving events: Halving events, which reduce the rate of new Bitcoin creation, historically affect both BTC price and mining profitability, influencing RIOT's stock price.

- Regulatory changes affecting cryptocurrency markets: Government regulations and policies regarding cryptocurrencies significantly influence market sentiment and, consequently, BTC price and RIOT's performance.

- Market sentiment and its influence on BTC price: Investor confidence and overall market sentiment towards cryptocurrencies directly impact BTC price volatility, creating ripple effects on RIOT’s stock.

- The role of major cryptocurrency exchanges: The activities of major cryptocurrency exchanges, including trading volume and price manipulation, can significantly impact BTC price and, by extension, RIOT's stock.

Energy Costs and Regulatory Scrutiny

The cost of electricity is a massive operating expense for Bitcoin mining companies like Riot Platforms. Fluctuations in energy prices directly affect RIOT's profitability and, therefore, its stock price. Furthermore, environmental regulations play a crucial role:

- Impact of renewable energy adoption: RIOT's commitment to renewable energy sources influences its operating costs and environmental impact, potentially affecting investor perception and stock price.

- Geographic location of mining facilities and their energy costs: The location of mining facilities significantly impacts energy costs. Regions with cheaper electricity offer a competitive advantage, affecting profitability and stock performance.

- Government regulations on energy consumption: Stringent environmental regulations impacting energy consumption can increase operating costs and negatively influence RIOT's stock price.

- The potential for carbon tax implications: The introduction or increase of carbon taxes could significantly impact RIOT's profitability, adding another layer of volatility to its stock.

Competition in the Cryptocurrency Mining Industry

RIOT operates in a competitive landscape. The actions of other major cryptocurrency mining companies influence RIOT's market share and, ultimately, its stock performance. Key competitive factors include:

- Market share analysis of major players: Analyzing the market share of competing miners provides insights into RIOT's competitive position and its potential for future growth.

- Technological advancements in mining hardware: Advancements in mining hardware can impact efficiency and profitability, influencing RIOT’s competitive edge and stock performance.

- The impact of mergers and acquisitions in the industry: Consolidation within the mining industry can reshape the competitive landscape, impacting RIOT's market position and stock valuation.

Macroeconomic Factors

Broader economic conditions also play a significant role in influencing investor sentiment towards riskier assets, including RIOT stock.

- Impact of inflation on investor behavior: High inflation often prompts investors to move away from riskier assets like RIOT stock, leading to price declines.

- The relationship between interest rate hikes and stock market performance: Interest rate hikes by central banks tend to negatively impact the performance of growth stocks like RIOT.

- General economic uncertainty affecting risk appetite: Periods of economic uncertainty typically lead to decreased risk appetite among investors, negatively impacting volatile stocks like RIOT.

Analyzing RIOT Stock Performance

Understanding the volatility of Riot Platforms stock (RIOT) necessitates analyzing its past performance and underlying financial health.

Historical Price Trends

Analyzing historical price data reveals significant volatility. (Include charts and graphs here visually representing price fluctuations over time). Note key periods of substantial price increases and decreases, trying to identify any recurring patterns. Comparing RIOT's performance against other mining stocks or the overall cryptocurrency market provides valuable context.

Fundamental Analysis of RIOT

A fundamental analysis of RIOT's financial statements provides a deeper understanding of the company's health. Key metrics to consider include:

- Revenue growth: Assessing the trend in RIOT's revenue reveals the company's growth trajectory and its ability to generate income.

- Profitability margins: Examining profit margins helps understand the efficiency of RIOT's operations and its ability to translate revenue into profit.

- Debt levels: High debt levels indicate financial risk and can negatively impact stock performance.

- Cash flow: Strong cash flow demonstrates the company’s ability to meet its financial obligations and invest in future growth.

Technical Analysis of RIOT (Optional)

Technical analysis uses chart patterns and indicators to predict future price movements. (This section should clearly state that this is speculative and not financial advice). Examples of technical indicators include moving averages, RSI, and others. However, it's crucial to remember that technical analysis has limitations and should not be relied upon solely for investment decisions.

Conclusion

The volatility of Riot Platforms stock (RIOT) stems from a confluence of factors, including cryptocurrency market fluctuations, energy costs, industry competition, and macroeconomic conditions. While RIOT offers potential for high returns, the inherent volatility associated with the cryptocurrency market and these other factors presents significant risks. Understanding the volatility of Riot Platforms stock (RIOT) is essential for informed investment choices.

Call to Action: Before investing in Riot Platforms stock (RIOT), conduct thorough due diligence, review financial statements, understand the risks associated with cryptocurrency mining, and consider consulting with a qualified financial advisor to align your investments with your risk tolerance and financial goals. Thoroughly understanding the volatility of Riot Platforms stock (RIOT) is crucial for making well-informed investment decisions.

Featured Posts

-

Brtanyh Myn Kshmyr Ke Msyle Pr Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 02, 2025

Brtanyh Myn Kshmyr Ke Msyle Pr Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 02, 2025 -

Loyle Carners New Album Everything We Know So Far

May 02, 2025

Loyle Carners New Album Everything We Know So Far

May 02, 2025 -

Section 230 And Banned Chemicals New Legal Precedent Set By E Bay Case

May 02, 2025

Section 230 And Banned Chemicals New Legal Precedent Set By E Bay Case

May 02, 2025 -

When Will Trust Care Health Offer Mental Health Treatment A Look At The Timeline

May 02, 2025

When Will Trust Care Health Offer Mental Health Treatment A Look At The Timeline

May 02, 2025 -

Tesla Board Denies Plans To Replace Elon Musk

May 02, 2025

Tesla Board Denies Plans To Replace Elon Musk

May 02, 2025

Latest Posts

-

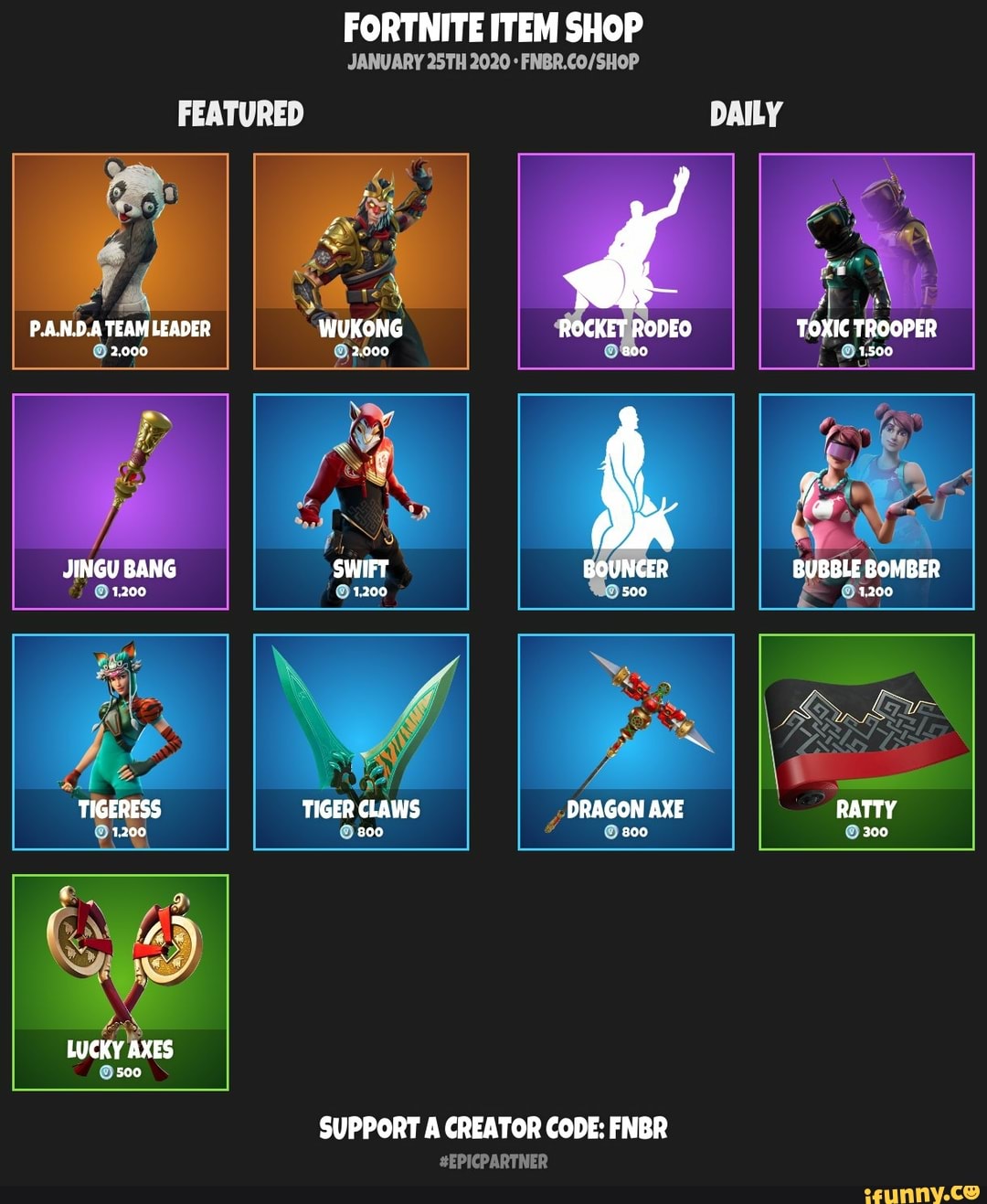

Get Free Captain America Items In The Fortnite Item Shop Limited Time

May 03, 2025

Get Free Captain America Items In The Fortnite Item Shop Limited Time

May 03, 2025 -

Fortnite Community Outraged Over Recent Music Change Details Inside

May 03, 2025

Fortnite Community Outraged Over Recent Music Change Details Inside

May 03, 2025 -

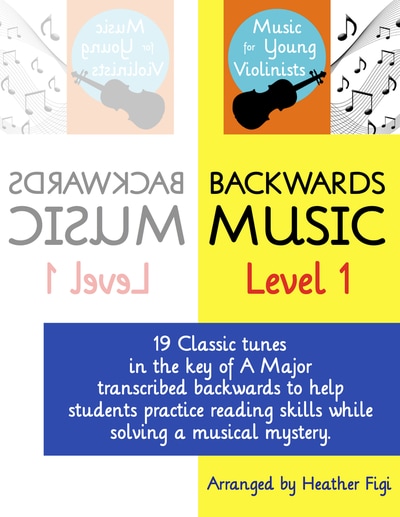

Backwards Music In Fortnite Players React Negatively To The Change

May 03, 2025

Backwards Music In Fortnite Players React Negatively To The Change

May 03, 2025 -

Fortnites Controversial Music Update Player Backlash Explained

May 03, 2025

Fortnites Controversial Music Update Player Backlash Explained

May 03, 2025 -

Fortnite Players Revolt The Backwards Music Controversy

May 03, 2025

Fortnite Players Revolt The Backwards Music Controversy

May 03, 2025